Summary

GigaCloud Technology operates a global B2B e-commerce business. While initially focusing on furniture, it has expanded its offerings to home appliances and fitness equipment. Since 2019, it has consistently grown revenues and net income, contributing to its robust balance sheet and cash flow statement. Its industry is set to grow tremendously in the coming years, opening opportunities for GigaCloud.

Lantheus is a healthcare company that creates and sells medical products for various purposes. With a rich background in the industry, some of its products have become market leaders in their fields. Lantheus has steadily grown its financial position but sees room for further growth. The consensus analyst price target implies a significant potential upside to Lantheus.

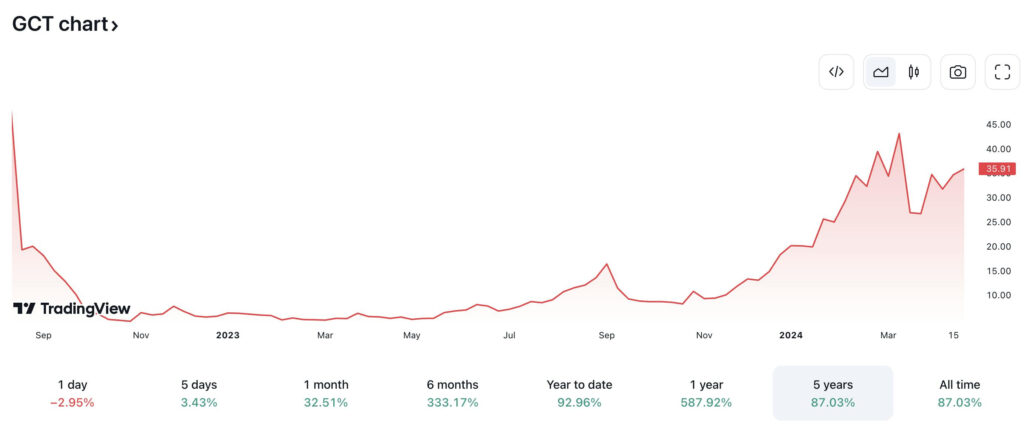

Gigacloud Technology ($GCT)

$37.09 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $37.09

- GigaCloud Technology operates a B2B e-commerce business that integrates everything from product discovery to logistics into one platform.

- It has shown consistent revenue and net income growth in the last few years. Its robust balance sheets and cash flow showcases strong fundamentals.

- It operates in an industry poised for tremendous growth, opening further opportunities for the company.

- $GCT has also rallied by over 80% this year alone. The consensus analyst price target shows it may still have potential to grow.

What they do

GigaCloud Technology ($GCT) operates an end-to-end B2B e-commerce business that integrates everything from product discovery, purchase, payments and logistics into one platform. Founded in 2006, GigaCloud has rapidly grown to having almost $800m in total transaction volume in 2023. The company started with just the furniture market, but now includes other categories such as home appliances and fitness equipment. It currently operates in the US, Japan, the UK, Germany and Canada.

GigaCloud segments its revenues into products and services:

- Product revenues: consists of revenue earned from the sale of GigaCloud’s own inventory (categorized as “GigaCloud 1P”) in its marketplace, and revenue earned from inventory sales through third-party e-commerce websites.

- Service revenues: revenues earned from platform commission and services including warehousing, last-mile delivery, packaging, ocean transportation and more.

GigaCloud generally makes the majority of its revenue from its products, with only about 23% of total revenues in 2023 coming from services.

Last year, GigaCloud acquired both Noble House Home Furnishings, a B2B distributor of indoor and outdoor home furnishings, and Apexis Inc., a cloud-based digital signage and e-catalog management company. The acquisitions totaled $87.6m and were funded by GigaCloud’s cash balance. Noble House's acquisition added six warehouses to GigaCloud's network, while Apexis enhances user experience and platform functionality.

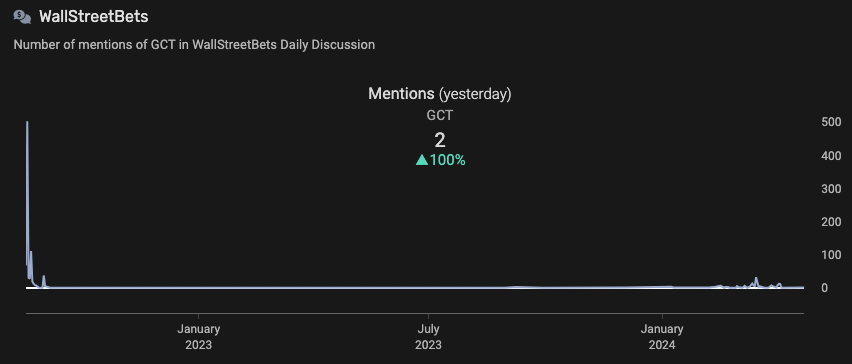

What the market is saying

GigaCloud generated a lot of buzz when it IPO’d in 2022, and continues to be discussed on public forums. Based on posts created in the last few months, the general topic around $GCT is whether its fundamentals show it’s undervalued or not. Some seem to believe it has good potential, while others seem to think that its numbers are too good to be true.

Source: quiverquant.com

Notable comments from Reddit:

“GCT is an easily misunderstood business (hence the short squeeze last year) due to its B2B model, cross-border nature, and management’s inclination to keep a low profile. As a result, the market has applied a China discount to the business. Additionally, the US furniture market is coming off a peak, which has also hit GCT’s share price. ”

- thealphaexponent

“Is like an Amazon or Alibaba but removes the consumer and does B2B ecommerce, no debt, strong cash flow, P/E ratio still reasonable for massive YoY growth. Already up a lot on this company and earning's coming up Q4 which expecting big beat.”

- breakyourteethnow

Why $GCT could be valuable

Industry

GigaCloud operates in the consumer discretionary sector, more specifically within the B2B (business to business) e-commerce industry. Often likened to Alibaba ($BABA), GigaCloud’s B2B online marketplace connects suppliers and buyers from all over the world. What sets GigaCloud apart from others is that it also handles the logistics needed to deliver products from one end to the other.

Similar to its B2C (business to consumer) counterpart, the B2B e-commerce industry has grown exponentially in the last few years as companies look to take advantage of the scale that e-commerce offers. The pace especially quickened due to the COVID-19 pandemic. The majority of B2B buyers now use online stores to find suppliers and make orders. Accordingly, the percentage of all B2B sellers selling via e-commerce platforms have increased tremendously.

Unsurprisingly, the outlook for the industry is optimistic. B2B e-commerce sales are expected to grow all over the world. Double-digit growth for the industry is forecasted across the majority of regions, to reach a total market size of $18.8 trillion in the next three years. Asia Pacific in particular, is set to see a 25% CAGR of B2B e-commerce sales from present to 2030. This puts GigaCloud in a strong position in terms of growth opportunities.

Financials

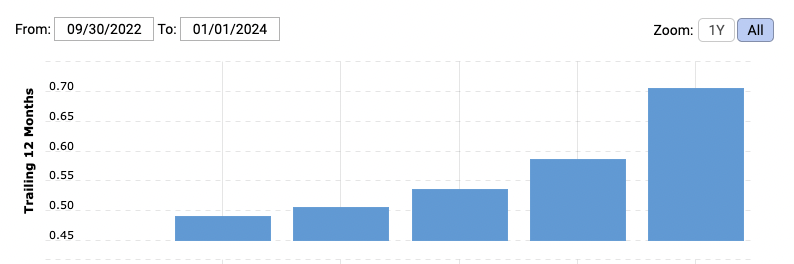

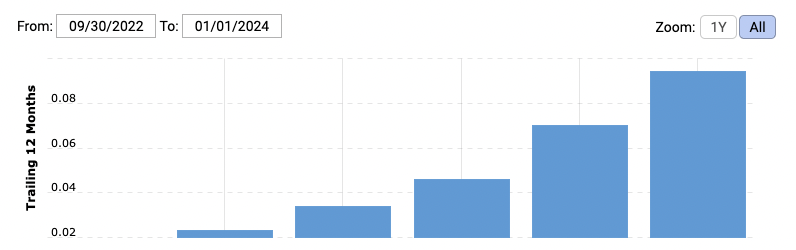

Since 2019, $GCT has been recording double-digit revenue growth that brought its revenue from $122m then to $703m last year. During the pandemic that brought in global supply chain issues and inflation, $GCT was even able to continue generating net income. Last year, it grew net income by 292% year-on-year – signaling what it can continue to do, now that the world has moved on from the pandemic.

$GCT TTM revenues per quarter from 2022 to Q4 2023:

Source: macrotrends.com

$GCT TTM net income per quarter from 2022 to Q4 2023:

Source: macrotrends.net

In terms of profitability metrics, GigaCloud has recorded an average gross profit margin of about 20% – characteristic of companies that hold and sell physical inventory. Its net profit margin increased substantially between 2022 and 2023, where it recorded 4.9% and 13.3% respectively. GigaCloud notes that this is mainly due to it being able to keep SG&A and R&D expenses relatively low compared to its growth in revenues. Over the long term, the ability to do this could allow GigaCloud an efficient expansion.

GigaCloud has posted robust balance sheets and cash flow statements in the last few years. As at the end of last year, its balance sheet shows that its short-term assets would more than cover its short-term liability. Similarly, its total assets can comfortably cover total liabilities. Cash flow wise, GigaCloud has recorded positive free cash flows since 2019, which means that its cash earned from operations can cover all investment expenses.

Its consistently growing revenue and net income, strong balance sheet and positive cash flow numbers, GigaCloud looks to have strong fundamentals that can allow it to benefit from the industry’s growth opportunities.

Price action

GigaCloud has recorded an impressive 85% share price growth year-to-date. Despite that, its stock price remains a distance from its all-time high. The consensus analyst price target is set at $40.50, representing further potential upside at its current price.

What the risks are

Bottom line: GigaCloud Technology operates a B2B e-commerce platform that focuses on furniture, home appliances and fitness equipment. It provides end-to-end service experience, which starts from product discovery and goes all the way to product delivery. Since 2019, $GCT has consistently grown revenue and net income, and continues to see strong potential for growth within its industry. Despite a tremendous share price gain year-to-date, the consensus analyst price target implies it may still have room to grow.

Lantheus Holdings ($LNTH)

$63.07 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $63.07

- Lantheus Holdings has a long history of developing successful medical products. Some of its product lines currently lead the market, with one of them holding a significant 80% market share.

- Lantheus has consistently grown revenues and has been profitable outside of the pandemic years. Its balance sheet and cash flow statements can be considered to be impressive, with its cash balance alone enough to pay off the majority of liabilities.

- Despite this, $LNTH is down 30% over the last year.

- The consensus analyst price target shows significant upside potential for $LNTH.

What they do

Lantheus Holdings, Inc. is a company that creates and sells products to help doctors diagnose and treat heart, cancer, and other diseases all over the world. The company was founded in 1956 and filed for an IPO in 2015. Lantheus offers a large portfolio of products. The ones that have contributed to at least 10% of revenues in the last few years include: DEFINITY, which improves ultrasound images for heart exams, TechneLite for nuclear medicine and PYLARIFY for prostate cancer imaging.

Lantheus recognizes revenue using two segments:

- Product revenue: revenues from the sales of its products to hospitals, independent facilities and radiopharmacies. Lantheus further breaks this segment down to products within Radiopharmaceutical Oncology, Precision Diagnostics and any strategic partnerships.

- License and royalty revenues: revenues from its licensing agreements, where it licenses certain rights to third parties.

Despite its current suite of highly-demanded products, Lantheus continues to invest in research and development. This has extended its realm into software and AI. Some of its latest projects include the creation of aBSI, an FDA-approved software-as-a-medical device that calculates the level of prostate cancer in a patient. Another example is PYLARIFY AI, an AI-powered medical device that can provide accurate quantitative assessment of medical images.

What the market is saying

While $LNTH does not get many mentions on trading forums, it has seen some discussion on its fundamentals on long-term investing forums. It has even got a dedicated Reddit community, albeit with only a few members. Many seem to think that $LNTH currently provides good value and has great potential for growth.

Source: quiverquant.com

Notable comments from Reddit:

“This company could be a good find. One reason it is undervalued is because the market cap is only $4B, so it is too small to attract institutions and other large investors.

If it proves itself, the attention will come eventually.”

– Poured_Courage

“LNTH (Lantheus) trades at 10% FCF/EV yield with 33% growth. For comparison, LLY trades at .5%(half a percent) FCF/EV yield with 36% growth.”

– lvskhoily

Why $LNTH could be valuable

Industry

Lantheus operates in the healthcare sector. With its numerous product lines, Lantheus has a presence in several sub-industries, but considers itself to be most present in the medical imaging and radiopharmaceuticals industries. Focusing on the industries where its three key products operate can be more insightful.

DEFINITY and Technelite are both used within the medical imaging industry. Lantheus has boasted a leading market share of over 80% for DEFINITY in this industry but still believes that it can continue to grow. Its own research has shown that DEFINITY has only penetrated about half of the existing U.S. market, and believes it can grow its total addressable market (TAM) from $290m to over $600m.

PYLARIFY on the other hand, operates within the radiopharmaceutical industry as part of the treatment for prostate cancer. Lantheus estimates that the industry’s TAM is about $1.6 billion, with an estimated annual growth of 2-3% due to the increasing incidence of prostate cancer. With PYLARIFY contributing about $850 million in revenue last year, Lantheus believes this can continue to grow. This is especially given its development of PYLARIFY AI. As at the end of last year, PYLARIFY was the country’s most used PET imaging agent.

Financials

Lantheus boasts consistently growing revenues since 2017. Last year, it grew revenues by 38.6%. Save for 2020 and 2021, Lantheus has also reported positive net income. Its net income in the last quarter of 2023 was particularly noteworthy.

Lantheus’ TTM revenue per quarter from 2014 to Q4 2023:

Source: macrotrends.net

Modine’s TTM net income per quarter from 2014 to Q4 2023:

Source: macrotrends.net

Despite its growth, Lantheus estimates that it can continue to grow revenues by almost 10% and net income by almost 50% in 2024.

Balance sheet wise, Lantheus boasted a hefty cash balance of $713 million at the end of 2023. This balance alone was enough to cover its current liabilities several times over, and even completely pay off its long-term debt balance of $561 million. Just based on its cash balance, it would take a lot for Lantheus to face liquidity and/or solvency issues. Similarly, its cash flow statement showed strong free cash flow levels. Last year, Lantheus recorded free cash flows of approximately $310 million.

What the risks are

Bottom line: Lantheus is a healthcare company that creates and sells medical products for various purposes. It has a long history of being in the field, and some of its products have become the market leaders in their respective industries. Despite that, Lantheus continues to invest heavily in research and development. It also sees further room for growth. Its share price is currently down about 30% in the last year, and analyst price targets imply it has significant room for growth.