Here’s what we found this week:

MongoDB is leading the transition to a new model for managing data. It’s cloud-based and on-site database management platforms are surging in popularity, adding high-profile clients, and generating rapid gains in revenue. MongoDB is emerging as a leader in the struggle to dominate the next-generation database software market.

Big 5 Sporting Goods is a traditional brick-and-mortar business with solid fundamentals, an attractive dividend, and solid recent growth. It’s also a stock with a small 20 million share float and over 40% short interest. Reddit buzz has the company setting up for a short squeeze, and unlike many short squeeze candidates the Company is not distressed and presents limited downside risk.

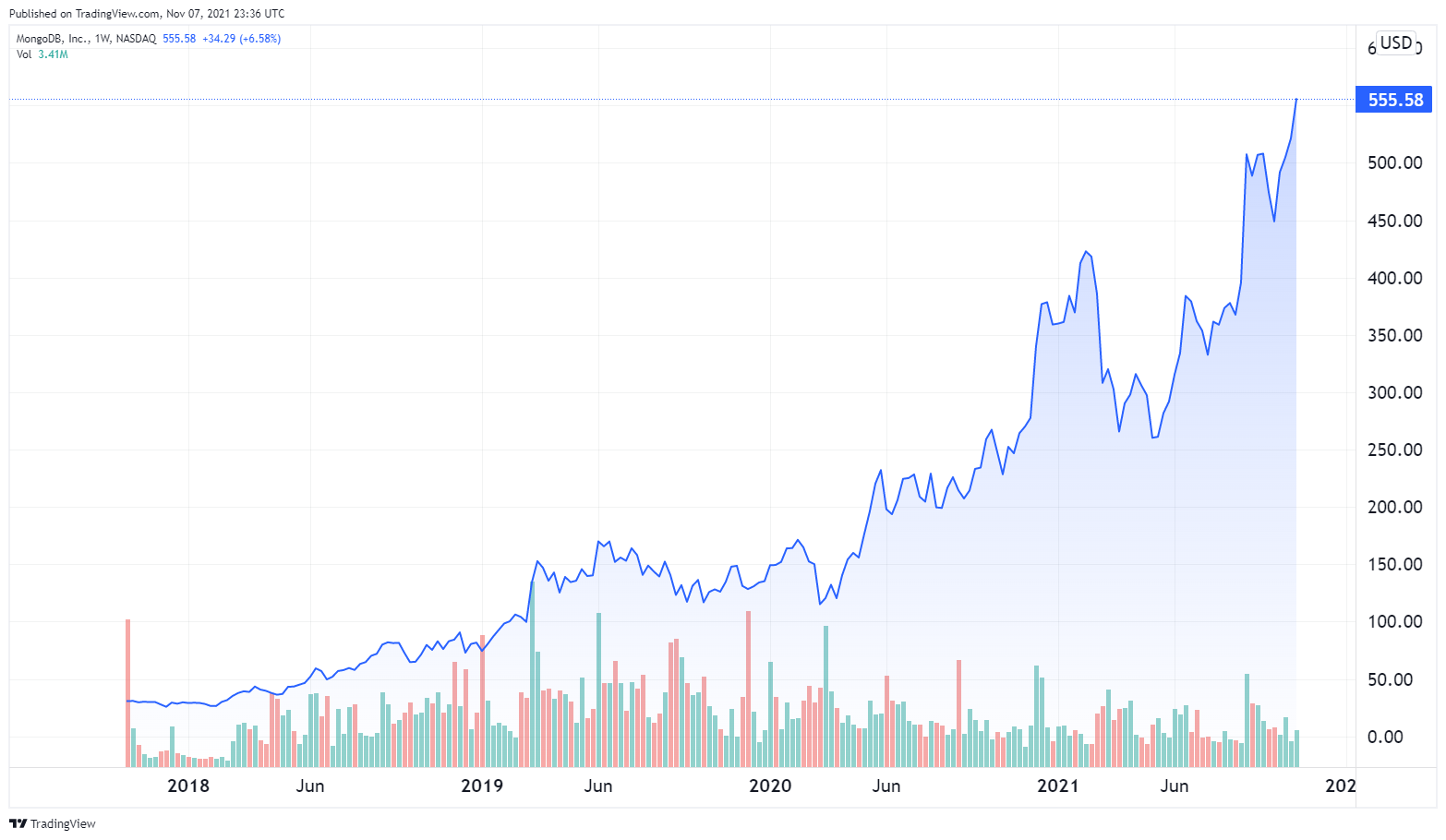

MongoDB, Inc. ($MDB)

$555.58 – Share price at time of writing

Source: tradingview.com

Summary:

- MongoDB is a modern general purpose database platform that has achieved a huge level of market penetration.

- MongoDB brought an entirely new and disruptive approach to database architecture, which has followed a similar pattern since the 70s.

- Every software application requires database servers. MongoDB serves developers with both cloud and on-site database services.

- The Company has achieved dramatic growth since its first product launch in 2009. It is consistently rated as the database most wanted by developers.

What they do:

MongoDB was founded in 2007 by the team of developers behind Internet advertising firm DoubleClick, now owned by Google. Frustrated by the lack of scalability and agility in the available databases, they set out to build an entirely new database system.

Database management has been dominated since the 70s by relational databases. While these systems have improved dramatically, they eventually encountered limits set by their basic structures.

MongoDB’s system, completely unproven at the time of introduction, is “built on a document-oriented data model and layered onto an elastic and distributed systems foundation”. The Company introduced at least one update annually since 2014.

To be completely honest, you don’t need to know what “an elastic and distributed systems foundation” is. MongoDB products are designed for and sold to developers, and the product descriptions and marketing materials are not fully (or sometimes even partially) comprehensible to people outside that field. Think of it as a better way to manage data.

It appears to work. Stack Overflow’s annual developer survey, which most recently surveyed 65,000 developers in 186 countries, has rated MongoDB the most wanted database for four consecutive years.

Specific products include:

- Atlas, a multi-cloud database platform.

- Enterprise Advanced, an enterprise software and support package.

- Realm, a data service package for web and mobile use.

- Community Edition, a widely used free package.

$MDB sells these products (other than the free Community Edition) on a SaaS subscription model.

MongoDB’s client list includes Toyota, Morgan Stanley, AT&T, Google, Adobe, eBay, and the US Government. The Company offers specific solution packages for Financial Services, Telecom, Healthcare, Retail, Gaming, Government, and others.

What we learned from social media patterns:

$MDB is a high-flying growth tech company bringing entirely new technology to a service that’s used by almost every industry on the planet. You’d expect that to translate into a huge social media following.

That isn’t what we see.

There’s a peak in interest immediately after the early-September release of Q2 results for FY2022, but even that peak is 30-35 mentions a day. Some ground-breaking tech companies see that many mentions in an hour on a busy day.

There are several possible reasons for this. MongoDB may be well known in the developer community, but it is virtually unknown in the broader community. Very few individuals use the product or even fully understand what it does. It is anything but a household name.

We still think it’s strange that a stock that’s up almost 345% in two years is being overlooked by retail investors, but predicting retail investor behavior is always risky.

The current investment discussion of $MDB on Reddit seems dominated by short-term options traders discussing technical indicators, which change on a daily basis and have little relation to the fundamental investment thesis.

???? Signal: 96% of the $MDB float is held by 685 institutions, led by Capital World Investors with 7.65 million shares and T. Rowe Price with 5.77 million shares.

Why $MDB could be valuable:

The total global market for database software is expected to maintain a CAGR of 11.3% through 2025.

MongoDB is focused on the smaller market for non-relational (NoSQL) database software, which reached a total addressable market of $4.9 billion in 2020 but which is expected to grow to $21.6 billion by 2026, a CAGR of roughly 30%.

MongoDB’s unique competitive position is illustrated by two charts from the recent Stack Overflow survey of developers. First, lets’s look at the software that developers use most.

Source: Stack Overflow

Many developers use more than one package, so the totals add up to more than 100%. We can see that MongoDB has established a solid market share, especially for such a new company.

Now let’s look at the packages that developers most want to use:

Source: Stack Overflow

In this category MongoDB leads the pack by a significant margin. That indicates that MongoDB is widely used, but also that it has enormous medium to long term growth potential.

MongoDB reported FY 2021 results on March 3, 2021. Total revenue was up 44%, while revenue from the Atlas product, which comprises 49% of total revenue, was up 66%.

Results for the 2nd quarter of FY 2022, released on September 2, showed continuing strong growth. Revenue was up 44% from the equivalent quarter last year. Atlas revenue was up 83% and made up 56% of the total.

MongoDB has had 75 million downloads in the last 12 months, more than the cumulative total of its first 11 years, another indication of how rapidly the platform’s use is growing.

MongoDB had over 29,000 customers as of July 31, adding 4,200 new customers since March.

$MDB has raised its FY2022 guidance substantially, with the revenue prediction rising from a range of $745 million to $765 million in March to a range of $805 million to $811 million in Sept. That would be an increase of 36% to 37% over FY 2021.

What the risks are:

MongoDB competes with large, well-established forms that have extensive resources to commit to R&D, such as Microsoft, Oracle, and IBM. The database market is evolving rapidly and these companies could introduce new products with features that MongoDB can’t match.

$MDB has never been profitable. Right now the focus is on growth, but the Company may not succeed in achieving profitability.

$MDB software is open source but operates under SSPL and AGPL licences that control its use. Inability to enforce intellectual property rights could erode the Company’s competitive position.

MongoDB’s valuation is only justifiable if the Company continues to show strong growth and adoption by high-profile customers. If growth slows the stock value could be substantially affected.

Bottom line: $MDB trades at over 26x TTM sales and is by no means a cheap stock. It’s not a play on current value, but it’s a high-growth company with the potential to dominate a tech sector that is used by virtually every type of business in the world.

Big 5 Sporting Goods ($BGFV)

$30.39 – Share price at time of writing

Source: tradingview.com

Summary:

- Big 5 Sporting goods is a sporting goods retailer with 430 brick-and-mortar stores in the US.

- $BGFV sells a wide range of athletic, fitness, outdoor, and recreation-related products, both name brand and private label.

- 40.3% of the float is currently short sold. The float is just over 20 million shares, small enough to support a targeted short squeeze.

- $BGFV is not distressed. It is profitable and pays a sustainable dividend. Fundamentals support the current valuation and potentially a higher one.

What they do:

Big 5 Sporting Goods has been in business for 66 years. They operate 430 stores in the western US, with an average size of 11,000 square feet.

The product mix in Big 5 stores includes a large selection of equipment for team sports, fitness, camping, hunting, fishing, home recreation, tennis, golf, and winter and summer recreation.

Brands include adidas, Coleman, Columbia, Everlast, New Balance, Nike, Rawlings, Skechers, Spalding, Under Armour and Wilson, along with a range of private label merchandise.

Big 5 focuses on providing high value for quality merchandise and carries items primarily in the low-to-mid-range price bracket.

Big 5 management has extensive experience in operating sporting goods stores, enabling them to optimize product mix to meet specific-store needs. The Company is consistently profitable and enjoys an operating margin of over 11%, unusually high for a retail business.

Management reports that while the Company has felt some impact from the current supply chain crunch, they have sufficient stock to support strong holiday sales.

What we learned from social media discussion:

$BGFV has seen a sharp spike in social media mentions in the last month.

The volume comes from discussion of the stock as a potential short squeeze candidate. Reddit is not as obsessed with short squeezes as it was in early 2021, when the GME and AMC squeezes were the talk of the town, but the possibility of a squeeze tends to get attention.

Retail stocks have traditionally been favorites with Reddit-driven investors, largely because they are visible, well-known, and easily understood. The combination of a short squeeze and a well-known retail store is irresistible.

Notable comments from Reddit:

“I have bought BGFV shares multiple times over the last 2 years without selling a single share. This is such an unbelievably strong small cap company with so much potential.”

– dodgerdan1977

“The secret with this is.. It is a dividend paying stock.. So no naked shorts.

This thing can hit 100$ with just a little push

I hold calls and I hold 6000 shares from last September

Almost a year to date. This thing is a beast and keeps going up and up

This will squeeze just as hard if not harder when everything else will squeeze”

– Ayej4y

???? Signal: Ken Griffin of Citadel LLC has purchased 79,000 shares of $BGFV in 2021.

Why $BGFV could be valuable:

There are two investment theses that can be applied to $BGFV at this time: the short squeeze thesis and a fundamental thesis.

These parallel drivers of potential are complementary. Many short squeeze candidates are heavily distressed companies that have attracted short interest because they are at risk of failure. That makes an early-stage squeeze play risky, because if the squeeze fails to materialize you’re left holding shares in a failing company. If you wait for the squeeze to be confirmed you risk buying in too late and missing the profit.

$BGFV’s fundamental strength and decent dividend yield make it unlikely that the Company will fade away completely. Short-term losses are possible (as they are with any stock), but if a squeeze does not develop you’re not left holding shares with little or no fundamental value.

$BGFV is one of the most shorted stocks on the market today, with short interest composing over 40% of the float. This is not necessarily a high-volume short position: because the float is only around 20 million shares, a single short position can occupy a significant percentage.

Source: YCharts

Because the float is relatively small, an effective squeeze is possible without a really large volume of buyers. That short interest has been in play since Oct. 15, and the stock is up 27% in that time, so a squeeze may already be in progress. Covering an 8.48 million-share short position in a stock with a 20 million share float requires a lot of buying.

If a short squeeze does not develop, what’s the fundamental thesis for Big 5?

Year-to-date 2021 same-store sales were up 18.9% over 2020 and 19.7% over 2019. TTM earnings per share are currently $4.80, up from EPS of $2.58 in FY 2020.

That solid growth rate is matched by equally solid valuation metrics. Despite the recent stock price surge, the P/E ratio is only 6.6, the lowest in over a decade. ROE is 37%. The Price/Sales ratio is only 0.58. The forward dividend yield is 3.29%, with a sustainable payout ratio of 14.75%. The Company has declared a $1 per share special dividend to be paid December 1.

Brick-and-mortar retail is not an explosive high-growth business, but in this case there’s a solid growth trend and a set of fundamentals that just doesn’t support a bearish position.

What the risks are:

Big 5 operates in a highly competitive industry. The company relies almost entirely on in-store sales and is subject to competition from online retailers. This competition could affect results.

If the current supply-chain disruptions continue or escalate the Company’s ability to restock after the holidays could be affected, which could drive lower sales going forward.

A resurgence in the COVID-19 pandemic could force store closures.

The Company’s stores are concentrated in the western US, with a large presence in California. Regional factors can present risks. Summer wildfires in popular recreation areas have cut substantially into outdoor equipment sales in the last 2 years, and this could be repeated.

Some product sales are affected by regional weather conditions: a warm winter can cut sales of winter sports equipment or a rainy summer can cut sales of summer sports equipment.

Big 5 sells firearms, and is subject to numerous regulations governing firearms sales. Any compliance failure could result in regulatory action and damage to the company’s reputation.

Bottom line: Big 5 has the potential to emerge as a significant short squeeze. That situation has driven dramatic (though transient) increases in the prices of other stocks. If a short squeeze fails to emerge, the Company’s fundamentals and growth trend are sufficient to sustain and potentially increase its value.