Here’s what we found this week:

Jabil is a company that everybody uses and nobody knows. It’s a leading global manufacturer that supplies components to scores of household-name brands across the tech, electronics, and consumer goods spectrum. Management is strong, growth is solid, and the valuation is appealing.

Bunge Limited is a global agribusiness firm producing some of the most basic food ingredients and agricultural inputs. Earnings are growing fast and the Company trades at a very reasonable valuation.

Jabil Inc. ($JBL)

$62.25 – Share price at time of writing

Source: tradingview.com

Summary:

- Jabil is a leading provider of electronics design, manufacturing, and product management, along with other manufacturing services.

- Jabil’s customers include many of the world’s most recognizable brands.

- $JBL is diversifying its product portfolio through both acquisitions and internal development.

- The Company is producing strong earnings growth and trades at a very reasonable valuation.

What they do:

Jabil provides worldwide manufacturing and supply chain management services. They maintain manufacturing facilities in the US, Mexico, China, Malaysia, Vietnam. Customers can have identical products manufactured in multiple locations to simplify logistics.

Jabil’s largest customers are Amazon, Apple, Cisco Systems, Hewlett-Packard, Ingenico Group, Johnson & Johnson, LM Ericsson, NetApp, SolarEdge Technologies, and Tesla. They supply hundreds of other Companies, many of them household names.

Jabil has two reporting business segments.

Electronics manufacturing focuses on manufacturing and supply chain engineering for printed circuit boards and other electronic components for customers in the automotive, capital equipment, computer, communications, defense & aerospace, industrial & energy, and other industries.

Diversified Manufacturing Servicers provides engineering services using advanced materials science to provide solutions for the connected devices, healthcare, mobility, and packaging industries.

In Jan. 2021 Jabil acquired Ecologic Brands, a leading producer of sustainable packaging solutions, positioning the Company to exploit the move toward environmentally sound packaging.

What we learned from social media patterns:

$JBL is another stock that’s generally overlooked by retail investors, with a total of five social media mentions in three months.

Jabil is not seen as a cutting edge tech company, even though the components it makes are part of products all up and down the tech, communications, aerospace, and defense industries. It’s also not a household name, even though almost every household in the country uses its products without knowing it.

Brand visibility is a major factor in retail investor attention and Jabil doesn’t have it. That keeps the stock under the radar, but it can also create opportunity.

Notable comments from Reddit:

“Jabil also is recognized for its strong corporate culture, which promotes the concept of lean manufacturing, the idea of driving improvement and innovation by reducing waste and increasing process speed. This kind of focus is a very forward thinking and futuristic one, and will pay dividends as Jabil is able to adapt overtime to regulations that will cripple other companies.”

– Ideaambiguousawhole

???? Signal: 95.36% of the JBL float is held by institutions, with FMR, Vanguard, and Blackrock holding a combined total of almost 50 million shares.

Why $JBL could be valuable:

The electronic components manufacturing industry is expected to show a CAGR of 4.9% through 2026. Jabil is also engaged in numerous other industries, and is a leading supplier to multiple high-growth firms.

JBL revenues come from a diverse mix of industries, reducing dependence on any single market sector.

Source: Jabil

Jabil may not be a household name, but its customers include many of the biggest names in the world.

Source: Jabil

$JBL is positioned to benefit from numerous manufacturing trends, from the rise of electric vehicles to the move toward environment-friendly packaging.

Cash flow from operations has consistently increased, and $JBL has maintained a consistent level of spending on new facilities and development needed to maintain its competitive position.

Source: Jabil

$JBL has a clear commitment to improving shareholder value. In the past 8 years the Company has returned $3 billion to shareholders through dividends and through a stock buyback plan that has reduced the Company’s outstanding share base by 29%.

FY2021 earnings jumped to $5.61/share from $2.90 in FY 20, a gain of 93.5%. Free cash flow rose almost 39%. Jabil has beaten analyst earnings estimates for four consecutive quarters.

Despite these impressive growth figures, $JBL trades at a very modest valuation. The forward P/E is 10.12 and the Company trades at only .33x TTM sales.

13 analysts cover Jabil, with an average recommendation between “Buy” and “Strong Buy”. The average price target is $73, 17% above the current price.

What the risks are:

Many of Jabil’s customers rely on semiconductors to build their products. The global semiconductor shortage is fading, but if it continues, or if other events (like conflict over Taiwan) constrain semiconductor supplies Jabil’s business could be affected.

Jabil faces strong competition across many product lines. Sustaining the Company’s competitive position will require continued large investments in new plants and technologies.

Supply chain issues could interfere with acquisition of key components and raw materials.

Sales to Apple accounted for 20% of revenue in FY 2020 and sales to Amazon were 11%. Any serious issue affecting these or other major customers could affect $JBL results.

Bottom line: $JBL is a dominant player in a resilient, growing range of businesses. The Company has been largely overlooked and is trading at a highly competitive valuation.

Bunge Limited ($BG)

$94.11 – Share price at time of writing

Source: tradingview.com

Summary:

- Bunge Limited is a global agribusiness company that purchases, processes, and sells agricultural commodity products.

- Bunge products include edible oils, oilseeds, grains, animal feed ingredients, fertilizers, and biofuel feedstocks.

- $BG is entering a joint venture with Chevron to produce renewable fuels and lower the carbon intensity of the feedstocks.

- Earnings in the most recent quarterly report beat analyst estimates by almost 162%, and the company has boosted full-year guidance.

What they do:

Bunge Limited was founded by John Bunge in Amsterdam in 1818. The Company is now incorporated in Bermuda and headquartered in St. Louis, MO.

Bunge Limited operates in five business segments.

- Agribusiness. This segment processes oilseeds and grains into vegetable oils, animal feeds, grains, and biofuel feedstocks.

- Edible Oil Products include cooking oils, margarine, mayonnaise, and other products derived from the vegetable oil refining process. These products are sold worldwide under a range of brand names.

- Milling Products include flours, bakery mixes, and corn-based products made from grain supplied by the Agribusiness division.

- The Fertilizer Segment manufactures liquid and dry fertilizers in facilities in Argentina, Uruguay, and Paraguay. Many of these products are sold to the same farmers that supply grain to the Agribusiness segment.

- Corporate and Other. This segment is managed directly by the Company’s executives, notably captive insurance and securitization activities.

The Sugar and Bioenergy segment is considered a non-core business. It is built largely around BP Bunge Bioenergia, a joint venture with BP based in Brazil. The venture uses sugar cane to produce sugar, ethanol, and electricity at 11 mills in Brazil.

In Sept 2021 Bunge and Chevron announced a joint venture that will expand Bunge’s soybean processing facilities in Louisiana and Illinois to produce next-generation renewable fuels. Chevron will have first purchase rights to the output, which it will process into diesel and jet fuel.

Bunge Limited has a global presence, particularly in its agribusiness sector, which has processing capacity in multiple regions:

- 34% in South America.

- 27% in North America.

- 26% in Europe.

- 13% in Asia-Pacific.

This widespread footprint allows the Company to supply users all over the world, and insulates against changing economic conditions in any single market.

What we learned from social media discussion:

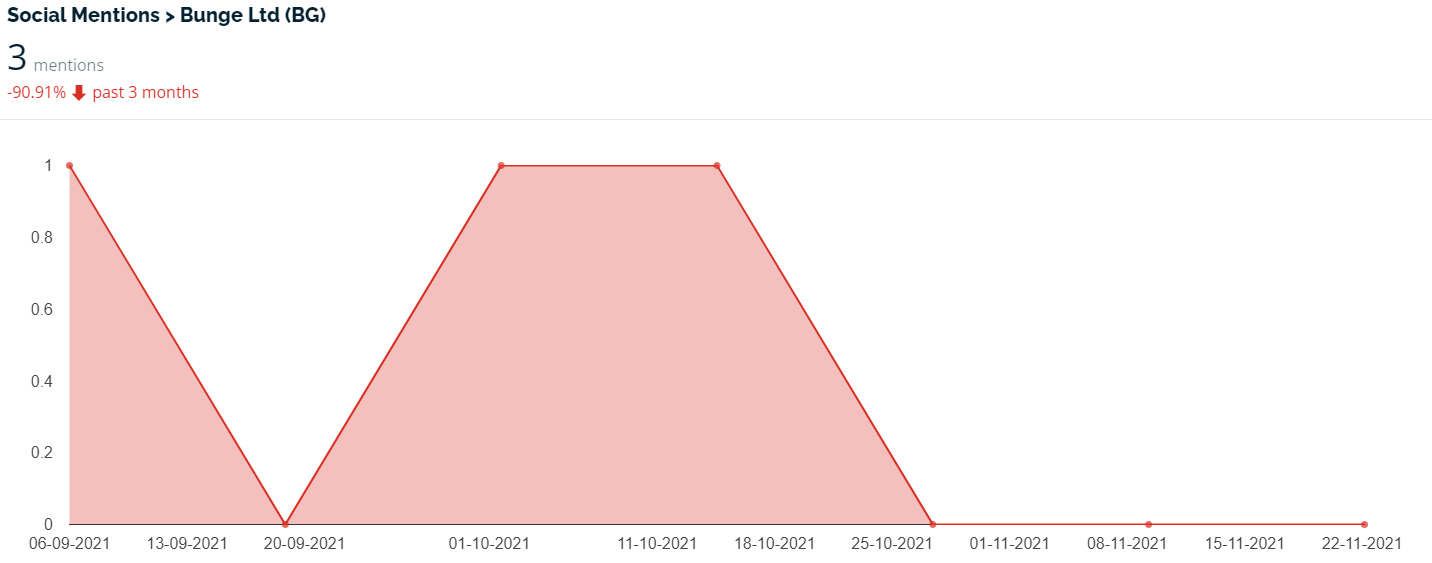

$BG is essentially invisible on social media, with three mentions in the last three months. Even a spectacular earnings beat on Oct 27 failed to register any interest.

That’s expected. $BG is the quintessential boring stock. It operates in a business that everybody uses but nobody notices, and it’s anything but a household name. It’s not surprising that institutions hold over 90% of the float.

Notable comments from Reddit:

“BG is a big agro business, which is obviously not the “trending” stuff of the day, probably explaining why it's so undervalued. However, BG has already started paying a dividend and it's also a solid business overall. A lot of regular investors will be comfortable buying it as a long-term asset – but it's also a big YOLO play because the current market environment makes undervalued stocks like this super likely to explode.”

– jkl2117

“The Forward P/E looks very lucrative, also half decent dividend in worst case.

Also looks like a nice increase in profits, management may have idea what they are doing…

Agri is boring though, what are “normal” P/E for Agri in US?”

– Professional-Poem-18

???? Signal: Ken Griffin of Citadel purchased 859,000 shares of $BG in August 2021.

Why $BG could be valuable:

Bunge sits at the interface of multiple growth trends in stable, recession-resistant core businesses.

- The global oilseeds market is expected to grow at a CAGR of 5.17% through 2026.

- The global packaged foods market is expected to maintain a CAGR of 5.2% through 2030. $BG oilseed and milled products are key ingredients in many packaged foods.

- The global specialty fertilizer market is expected to maintain a CAGR of 6.8% through 2027.

- The global animal feed market is expected to grow at a CAGR of 4.5% through 2027.

- The Brazilian biofuels market is expected to show a CAGR of over 4% through 2025.

- The US biofuels market is expected to maintain a CAGR of 8.3% through 2030.

These growth rates are lower than those we find in high-profile emerging tech markets, but they are sufficient to open up a solid growth opportunity in multiple business lines.

Bunge’s global presence positions the company to exploit the rising demand for basic food products in emerging markets.

Bunge’s Chevron joint venture will be ideally placed to exploit the expanding US biofuels market.

Bunge Limited’s Q3 2021 report completely blew away analyst expectations. EPS jumped to $4.27 from $1.84 in the equivalent quarter last year. Net sales for the first nine months of the year were up 52%. $BG repurchased $100 million worth of shares and authorized a new $500 million repurchase.

Management raised the full-year earnings guidance to at least $11.50/share, up 49% from 2020.

$BG has now beaten analyst earnings estimates by wide margins for four consecutive quarters.

In August 2021 $BG began paying a quarterly cash dividend. The dividend yield currently sits at 2.13%, with a very sustainable 12.78% payout ratio.

Bunge has a trailing P/E ratio of 6.03, a PEG ratio of 1.71, and a price/sales ratio of only 0.26. With a quarterly revenue growth rate of 39% and a quarterly earnings growth rate of 149.2%, this is an attractive valuation.

What the risks are:

$BG results were significantly affected by the COVID-19 pandemic. A resurgence could affect results.

Climate change and weather events can affect agricultural production.This may affect both demand for $BG products and raw material availability for finished products.

Bunge faces significant competition in each of its product lines.

Because Bunge Limited is a global business, it is exposed to risks related to regulation from multiple governments, protectionism and trade policy, and exchange rate fluctuations.

$BG is carrying a significant debt load. While the Company has had no problems managing its debt to date, any cash flow interruption could create serious debt payment problems that could affect share prices.

Bottom line: $BG is an under-the-radar stock in a highly resilient business, showing a remarkable growth trend and trading at an attractive valuation.