Dynatrace helps businesses monitor their digital operations, ensuring lightning-fast performance, and seamless user experiences – table stakes in today’s market. The company has shown solid growth and offers exposure to the AI and cloud computing sectors.

Zscaler a leading cybersecurity firm, is revolutionizing digital safety with its AI-powered Zero Trust Network, serving a hefty portion of Fortune 500 and Global 2000 companies. Zscaler operates in a rapidly growing sector, presenting a robust balance sheet and substantial revenue projections, despite facing challenges like a high valuation and increasing expenses.

Dynatrace, Inc. ($DT)

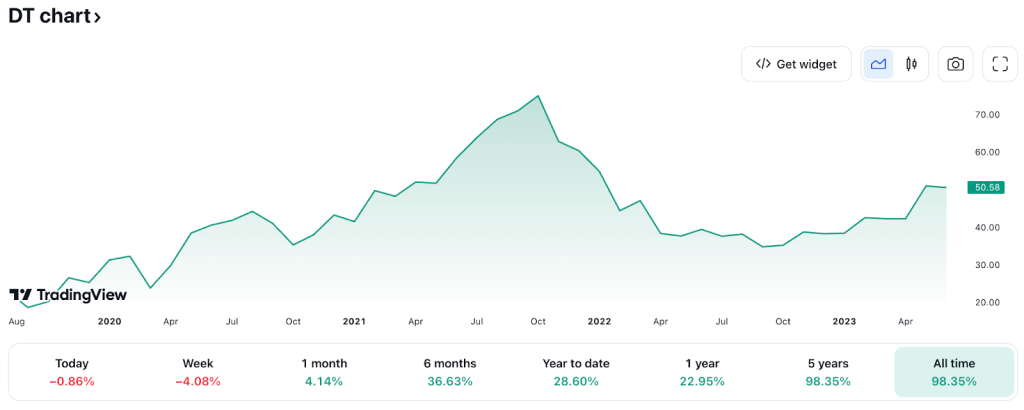

Source: Tradingview

- Share price at the time of writing: $50.58

- Dynatrace provides an AI-driven software platform for businesses to monitor and optimize their digital systems, with a total ARR of $1.25 billion for FY2023.

- The company has a high level of institutional investment. Renaissance Technologies significantly increased its position in Dynatrace in Q1 2023.

- Dynatrace caters to a wide customer base globally, and despite certain challenges, the ongoing digitalization of businesses presents numerous growth opportunities.

- Risks include foreign exchange rate fluctuations and intense competition from key industry players like New Relic, AppDynamics, and Datadog.

What they do:

Founded in 2005 and publicly traded since 2019, Dynatrace is a tech company that offers a software platform to help businesses monitor and improve their digital systems. Their software, powered by a form of AI called Davis, can keep track of applications and IT infrastructure, making it easier for businesses to use cloud technology.

Dynatrace's software intelligence platform includes infrastructure monitoring, application security, digital experience, business analytics, and cloud automation capabilities.

In terms of market strategy, Dynatrace focuses on innovation to meet evolving customer needs. It has partnerships with service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform, and contributes to open-source initiatives like the Cloud Native Computing Foundation and OpenTelemetry.

Dynatrace's financial performance has been strong, with total annual recurring revenue (ARR) of $1.25 billion and total revenue of $1.16 billion for FY2023. It was recognized as a “Leader” in the 2023 GigaOm Radar for Cloud Observability Solutions and was praised at the 2023 RSA Conference.

???? What we learned from social media and institutional investment patterns:

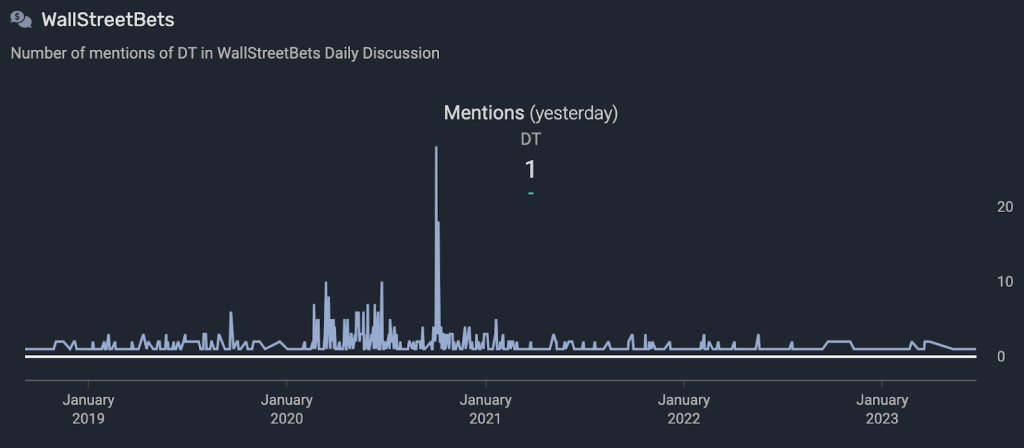

Dynatrace ($DT) experiences occasional chatter on r/WallStreetBets. The average daily number of mentions is not very high, but they tend to increase when there's news about the Company or about SaaS stocks in general.

Source: quiverquant.com

Mentions across Reddit are more sporadic, but most of them are in the broader context of discussions about cloud computing stocks or AI technology stocks in general.

This is expected, as stock discussion has been generally muted since the start of the bear market and AI technology stocks in general are currently not the hot topic.

The largest holder of $DT shares is its founder Bernd Greifeneder, who holds a significant portion of the Company. Greifeneder is an Austria-educated technologist and entrepreneur with a solid background in software and AI.

Private equity firm Thoma Bravo, which took the company private in 2014, holds a significant stake. Additionally, a portion of Dynatrace's shares are held by Compuware, the company that acquired Dynatrace in 2011, placing majority ownership firmly in the hands of seasoned industry players.

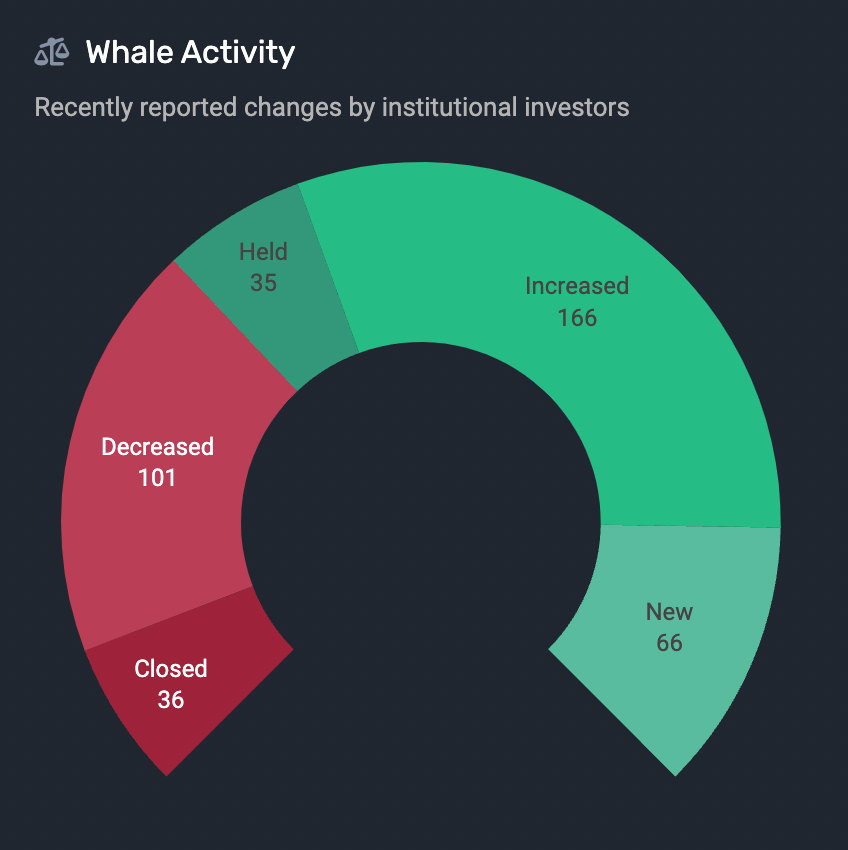

Of the shares trading on the NYSE, a considerable portion is held by institutions. While this figure might not be very high, institutional owners appear to have a generally positive outlook on the stock’s prospects.

Source: quiverquant.com

???? Smart Money Signal: In Q1 2023, Renaissance Technologies who are led by Jim Simons increased its position in Dynatrace by 743% acquiring over 325,000 shares.

???? Why $DT could be valuable:

Dynatrace has grown by 29% over the last year. Their 392,932 customers are globally distributed with a concentration in the United States. They cater to enterprises, small and medium businesses, and government organizations, focusing on IT operations, DevOps, and digital business management teams.

The company's competitive edge lies in its AI and automation-driven software intelligence solutions that deliver real-time insights, helping businesses optimize software applications and services. Dynatrace's customer-centric approach, strategic partnerships with cloud providers, and diversified revenue channels contribute to their strong market position. They also focus on continuous innovation and maintaining strong customer relationships.

However, Dynatrace faces challenges in catering to emerging technologies like IoT and edge computing, and the pressure to innovate can impact profitability. Despite this, the growing adoption of cloud platforms and digitalization offers numerous growth opportunities.

In terms of financial performance, Dynatrace reported total revenue of $1,159 million for the fiscal year 2023, up 29% on a constant currency basis. The GAAP operating income was $93 million, and the GAAP EPS was $0.37. The company's financial report also highlights a GAAP operating cash flow of $355 million and a free cash flow of $333 million.

In the fourth quarter of fiscal 2023, Dynatrace had total revenue of $314 million, up 27% on a constant currency basis, with a GAAP operating income of $19 million and a GAAP EPS of $0.27.

As for the broader market context, the Federal Reserve has been committed to getting inflation under control through higher rates, leading to periodic market drops. Dynatrace isn’t immune to these potential drops. Despite this, the financial markets have shown surprising strength, with longer-term interest rates remaining constrained and the trend of the stock market being higher since about last October. Current market signals suggest that the Fed is achieving a soft economic landing even as inflation continues to decline.

⚠️ What the risks are:

1️⃣ Country-specific Risks: Dynatrace is a global company with a significant presence in the United States, as evidenced by 8,254 websites using Dynatrace in the US. However, the company has been impacted by foreign exchange rate fluctuations. For example, in fiscal 2023, there was a strengthening of the U.S. dollar which resulted in a foreign exchange (“FX”) headwind. The total FY23 FX impact on a constant currency basis was expected to be approximately $30 million on ARR.

2️⃣ Corporate Structure Risks: Dynatrace's key resources include its talented workforce, intellectual property, patented AI technologies, and strong brand reputation. Its strategic partnerships with value-added resellers, system integrators, managed service providers, and leading cloud providers also extend its reach to potential customers. However, any disruptions in these partnerships or internal structures could pose potential risks. Additionally, as the company caters to a wide range of customer segments, it is crucial for them to continuously innovate and cater to the changing needs of its customers.

3️⃣ Competition: Dynatrace faces competition from key players in the industry such as New Relic, AppDynamics (acquired by Cisco Systems), Datadog, Splunk, SolarWinds, and Sysdig, who offer similar software solutions targeting application performance and IT operations management. The high level of competition may lead to reduced profitability margins due to the constant pressure to innovate and invest in new solutions.

Bottom line: Dynatrace is a tech firm with robust financials generating an impressive $1.25 billion in ARR. Consistent growth, solid partnerships, and a diversified customer base offer potential value. However, the company faces risks including exchange rate fluctuations, disruption of partnerships, and fierce competition. Dynatrace is suited to investors interested in the cloud computing and AI technology sectors and are comfortable with the associated risks.

Zscaler, Inc. ($ZS)

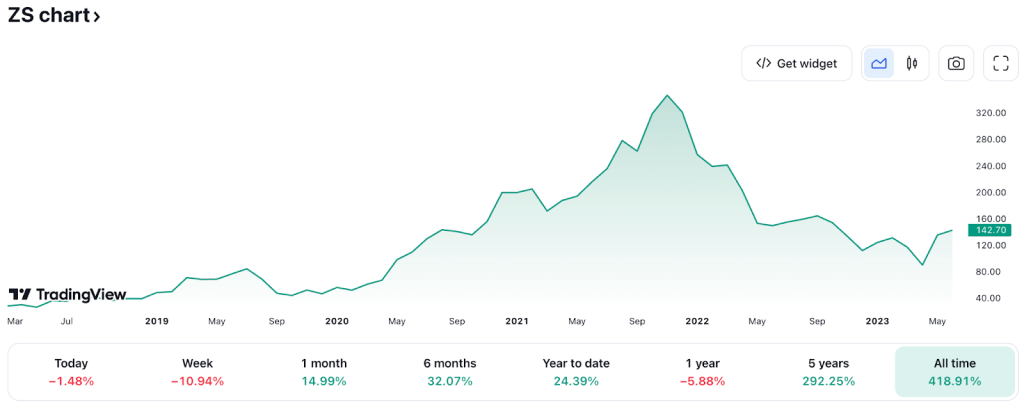

- Share price at the time of writing: $142.70

- Zscaler, a leading cybersecurity company, uses advanced AI and machine learning for risk assessment and anomaly detection.

- The company has an impressive customer base, serving 40% of the Fortune 500 and 30% of the Global 2000, with a high gross margin of ~81%.

- Zscaler has a robust balance sheet with $1.7 billion in cash and short-term investments and is projected to generate around $1.5 billion in revenue in 2023.

What they do:

Zscaler is a leading cybersecurity company that focuses on securing the modern enterprise. Established in 2007, it helps organizations secure digital transformations with its cloud native Zero Trust Exchange platform. This platform connects users, devices, and applications securely, protecting them from cyberattacks and data loss.

Zscaler operates a Zero Trust Network, which only gives users access to the applications they need, thereby preventing attackers from moving within the network. It uses advanced machine learning and AI to assess risk and detect anomalies to prevent attacks. Zscaler can also inspect encrypted SSL/TLS traffic, a feature that sets it apart from most firewalls.

Zscaler's revenue comes from its cybersecurity services and the company has a significant customer base, serving 40% of the Fortune 500 and 30% of the Global 2000. It generated strong financial results for Q4 2022, beating revenue and earnings expectations. The company has a high gross margin of ~81% and generated solid cash flow from its operations.

Recently, Zscaler announced new features like Posture Control and Zero Trust for Workloads with AWS. It has a robust balance sheet with cash and short-term investments of $1.7 billion. For the full year of 2023, the company is projected to generate a revenue of approximately $1.49 billion to $1.50 billion, marking an increase of ~50% year over year.

???? What we learned from social media and institutional investment patterns:

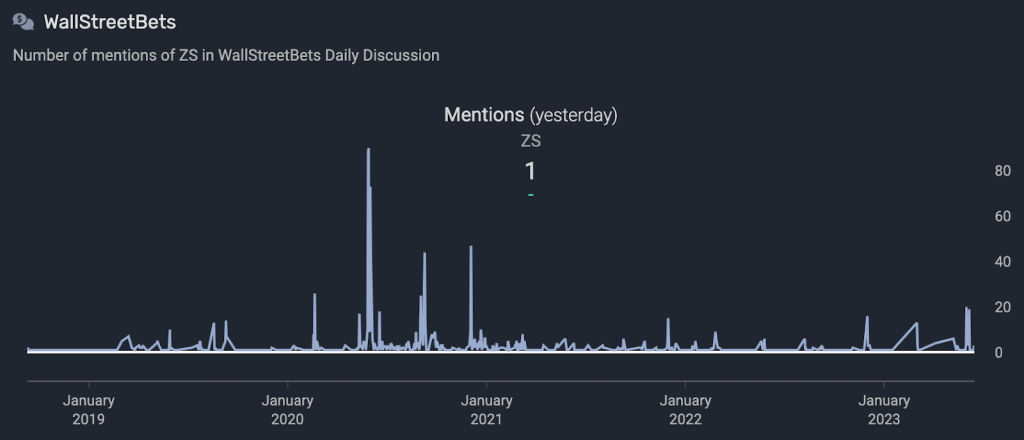

Despite generating over a billion dollars in annual revenue, Zscaler isn’t exactly a household name. Most non-technical people outside of the cybersecurity industry wouldn’t be familiar with the company. Which is why it’s not surprising most investors aren’t discussing the company on forums like Reddit.

Source: quiverquant.com

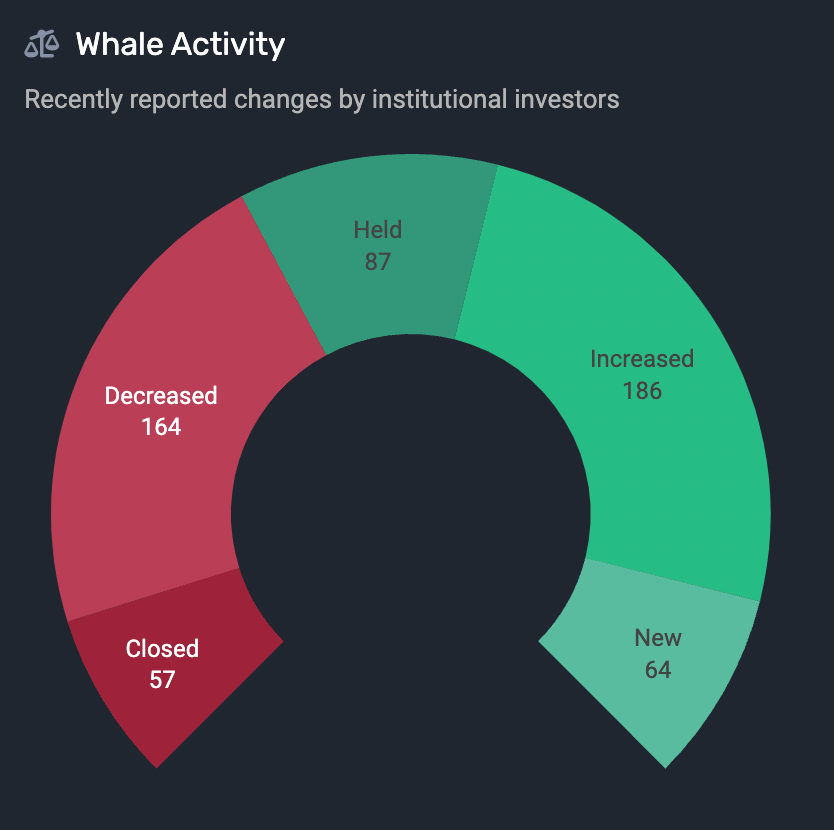

The largest holder of Zscaler shares is not a single individual or entity, but rather a diverse group of institutional investors, including BlackRock, The Vanguard Group and Goldman Sachs.

Individual investors make up a significant portion of ownership in the company, sitting at 42.65%.

Two legendary hedge funds – Renaissance Technologies and Citadel Advisors significantly increased their positions in Zscaler in Q1 2023. Increasing their positions by 40.7% and 82.3% respectively.

Source: quiverquant.com

???? Why $ZS could be valuable:

Zscaler operates in the cybersecurity space, a sector that is expected to grow rapidly over the coming years. With digital transformation taking place across industries, the need for cloud security is increasing and Zscaler is well-positioned to capitalize on this trend. By 2026, the market value of cloud security is predicted to reach $77 billion, growing at a compound annual growth rate (CAGR) of 13.7%.

Zscaler's innovative “Zero Trust Network” approach to cybersecurity is resonating with many businesses. This approach only allows users access to the applications they need, which helps prevent hackers from spreading within a network1. This system is beneficial for today's businesses that use a variety of cloud applications and have remote workers.

For Q4 2022, the company reported revenue of $318.1 million, beating analyst estimates by $15.34 million, and showing a significant 61% growth year over year. This strong growth rate reflects increasing demand for Zscaler's services, suggesting it is gaining more customers or increasing sales to existing customers, both of which are positive signs.

Another important metric is calculated billings, which grew by 57% year over year to $520.4 million. Calculated billings is a metric that includes revenue recognized during a period plus the change in deferred revenue. This increase shows that Zscaler is signing more contracts and generating more future revenue, demonstrating the strength and momentum of its business.

Zscaler also has a high gross margin of around 81%. This tell us that the company's cost of providing its services is relatively low, leaving a large portion of revenue available to cover other costs and contribute to profit.

It's also worth noting that while the company reported a GAAP loss from operations, this loss was a smaller percentage of revenue than in the previous year, indicating improving operational efficiency. On a Non-GAAP basis, income from operations was $38.1 million, or 12% of total revenue, which signals that the company is making progress towards profitability.

Zscaler's balance sheet is also robust, with $1.7 billion in cash, cash equivalents and short-term investments, and total debt of just over $1 billion, the majority of which is long-term. Having a significant amount of cash and equivalents can help the company invest in growth opportunities, weather potential financial downturns, and service its debt.

⚠️ What the risks are:

1️⃣High Valuation: Zscaler's stock is currently highly valued, which may require careful consideration. The company's shares are trading at 74 times their trailing 12-month free cash flow and 50 times the expected free cash flow for next year. This high valuation could lead to a price correction if investors believe it's overpriced.

2️⃣Slow Revenue Growth: As Zscaler continues to grow, its revenue expansion is expected to slow down. This is a normal part of a business's growth cycle, but it can negatively impact the stock price if the slowdown is more than what investors anticipate.

3️⃣Increasing Expenses: In the past, Zscaler has seen high growth in expenses, including stock-based compensation (SBC), which has limited its ability to generate a healthier profit margin. While the company is working on this issue, if it doesn't improve as expected, it could put pressure on the stock price.

Bottom line: Zscaler's strong financials, high gross margins, and innovative cybersecurity approach make it a promising investment. It has a robust balance sheet and is popular among institutional investors. However, its high valuation, anticipated slowdown in revenue growth, and increasing expenses pose risks. The stock is suitable for investors seeking growth in the cybersecurity sector, who understand tech stocks and are willing to navigate potential volatility.