Summary

Allegro MicroSystems, Inc. (NASDAQ:ALGM) designs, develops, and manufactures high-performance semiconductors, including integrated circuit (IC) solutions that incorporate its proprietary magnetic sensor and power IC technologies.

Cardinal Health Inc. (NYSE: $CAH) is a leading global healthcare services and products company, providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, and physician offices worldwide.

Allegro MicroSystems, Inc ($ALGM)

Source: tradingview.com

???? Summary:

- Share price at the time of writing: $49.55

- Allegro MicroSystems designs and manufactures high-performance semiconductors, with a focus on the automotive and industrial sectors

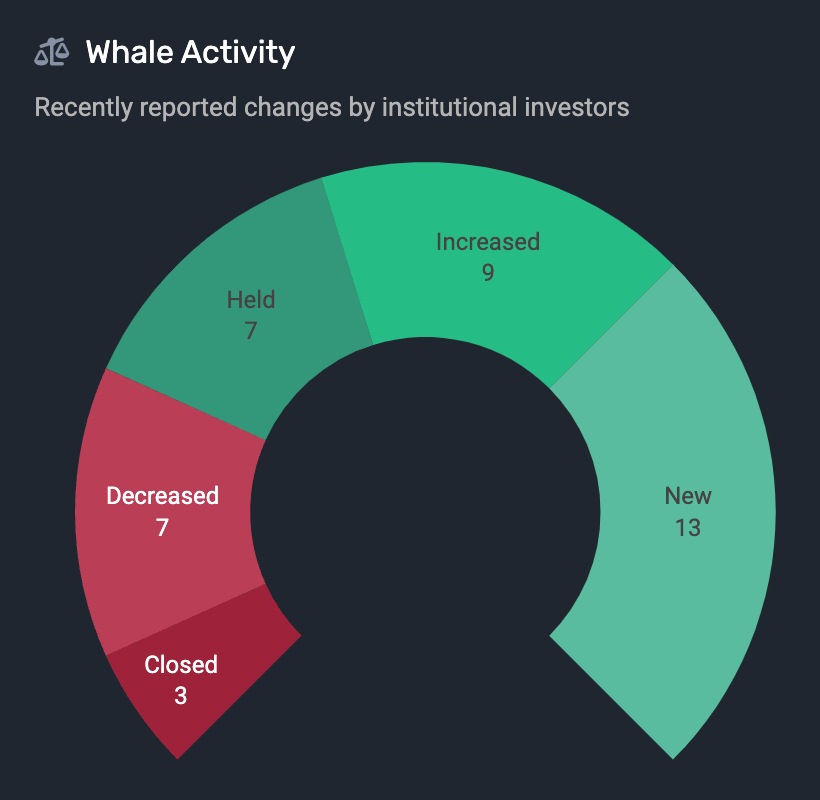

- Despite low retail investor interest, institutional investors have shown significant interest in Allegro, with thirteen new institutional investors opening positions and nine increasing their positions in the company.

- While Allegro has strong fundamentals and growth potential, it faces risks including intense competition in the semiconductor industry, heavy reliance on the Chinese market, and exposure to foreign exchange risk.

???? What they do:

Allegro MicroSystems designs, develops, and manufactures high-performance semiconductors, including integrated circuit (IC) solutions that incorporate proprietary magnetic sensor and power IC technologies.

Allegro's products are used in a wide array of applications within the automotive, industrial, and consumer/communications markets. The company's automotive solutions include technologies for electric and hybrid vehicles, advanced driver assistance systems (ADAS), and powertrain systems. These solutions are designed to improve safety, efficiency, and comfort, making Allegro a key player in the ongoing shift towards electric vehicles and more automated driving systems.

In the industrial sector, Allegro's solutions are used in a variety of applications, including factory automation, power and energy systems, and HVAC systems. The company's products help improve efficiency, reduce energy consumption, and enhance system performance in these applications.

Allegro's growth strategy is centered around its key growth segments:

- e-Mobility (including xEV and ADAS)

- Clean Energy & Automation

The company is targeting a 25% compound annual growth rate (CAGR) for its eMobility segment and an 18% CAGR for its Clean Energy & Automation segment from FY23-FY28.

These segments are expected to benefit from several long-term trends, including the global shift towards electric vehicles, the increasing adoption of automation technologies, and the growing focus on clean energy solutions.

???? What we learned from social media and institutional investment patterns:

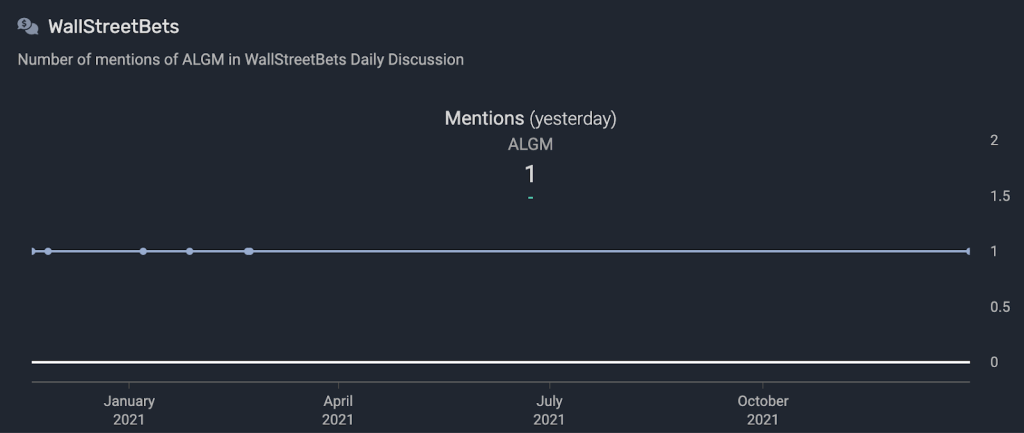

$ALGM flies completely under the radar when it comes to retail investors. The stock has only ever been mentioned once on Wall Street Bets.

Source: quiverquant

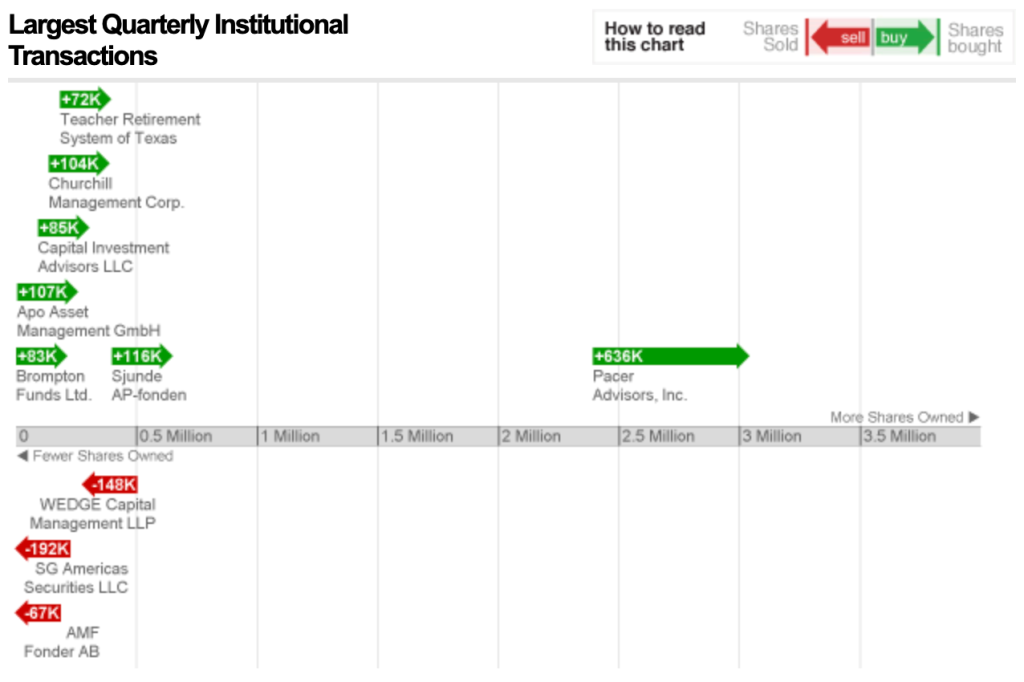

But if we look at institutional investors, the stock appears to be quite popular.

According to Quiver Quant, thirteen new institutional investors have opened positions in $ALGM while nine institutional investors increased their positions in the company.

Source: Quiverquant

???? Smart Money Signal ????: Renaissance Technologies, Point72 Asset Management and Citadel Advisors invested $39.2 million into $ALGM in Q1 2023.

???? Why $ALGM could be valuable:

Allegro MicroSystems (NASDAQ:ALGM) has several factors behind it that could drive share price growth in the future.

Firstly, the company operates in the high-growth semiconductor industry, where its sensor integrated circuits (ICs) and application-specific analog power ICs are used in a range of applications within the automotive, industrial, and consumer/communications markets. The company's focus on electric vehicles (EVs) and clean energy markets, both of which are expected to grow significantly in the coming years, positions it well for future growth.

Allegro's financial performance has been strong, with a 31% year-to-date rally in its stock price and a 34.5% YoY growth in its Q4 2022 earnings. The company's revenue has been growing at a modest 6.1% CAGR over the last five years, and it has consistently delivered positive levered free cash flow (FCF), indicating its financial strength.

Allegro is focused on innovation, as evidenced by its stable R&D expenses at about 15% of revenue, which could help it maintain its technological advantage in the rapidly evolving semiconductor industry. This could enable the company to sustain its revenue growth trajectory in the long term.

It's also important to note that Allegro's stock price might appear overvalued as it is currently sitting at a forward P/E ratio of 34.34. But when compared to the average forward P/E ratio of the semiconductor industry (which sits at 92.62) $ALGM’s valuation appears to be reasonable.

⚠️ What the risks are:

Competition: The company operates in the highly competitive and rapidly evolving semiconductor industry. Maintaining a technological advantage in this industry is crucial, and any failure to innovate or keep up with technological advancements could adversely affect the company's market position and financial performance.

Chinese market: Allegro's business is heavily concentrated in the Chinese market, which accounts for more than a quarter of the company's sales. This exposes the company to geopolitical risks, including changes in international trade policies and potential trade wars. Any adverse changes in the political or economic environment in China could have a significant impact on the company's revenues and profitability.

Foreign exchange: The company is exposed to foreign exchange risk, as only 13% of its sales are generated within the U.S. Fluctuations in foreign exchange rates could affect the company's revenues and earnings, and any unfavorable changes could have a material adverse effect on its financial performance.

Bottom line: Allegro MicroSystems demonstrates strong momentum in sales and an impressive ability to expand profitability metrics. However, the company's high concentration in the Chinese market and the broader economic environment pose significant risks. While Allegro has potential, investors should exercise caution and consider these factors before investing.

Cardinal Health Inc. ($CAH)

Source: tradingview.com

???? Summary:

- Share price at the time of writing: $93.19

- Cardinal Health is a global healthcare services and products company with a strong market position and financial strength.

- Despite being relatively unknown among retail investors, Cardinal Health has attracted significant institutional investment, with notable hedge funds investing heavily in Q1 2023.

- It faces risks including intense competition, customer concentration, and ongoing opioid litigation. These factors could impact its future performance and growth trajectory.

???? What they do:

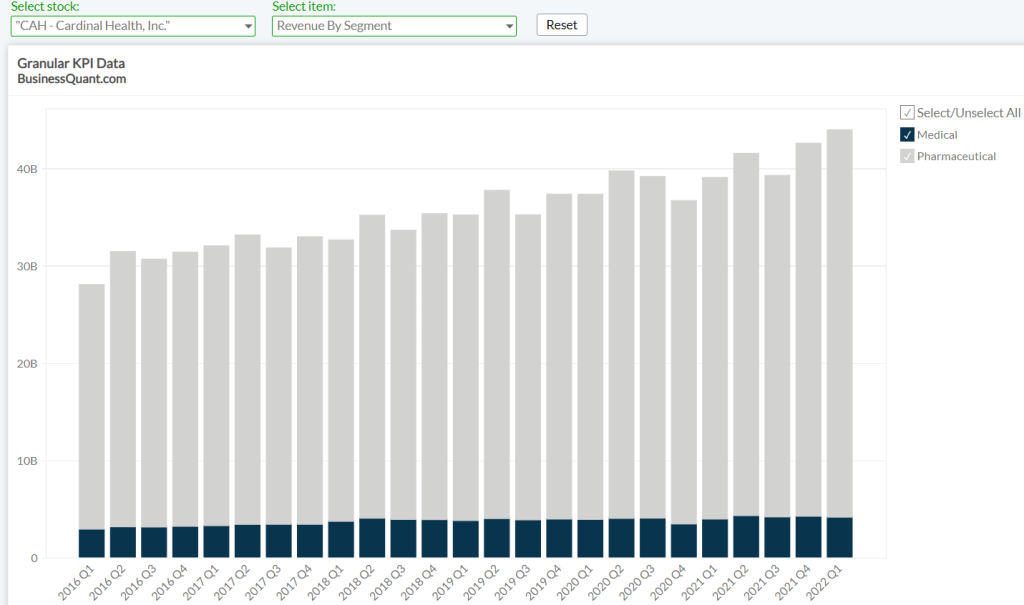

Cardinal Health, Inc. (NYSE: CAH) is a global, integrated healthcare services and products company that provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, and physician offices worldwide. The company operates through two segments: Pharmaceutical and Medical.

The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical, over-the-counter healthcare, and consumer products to retailers, hospitals, and other healthcare providers. It also provides services to pharmaceutical manufacturers, such as reimbursement and pharmaceutical distribution. This segment also offers a suite of services, including pharmaceutical manufacturer solutions, which help manufacturers maximize their brand value during the product life cycle.

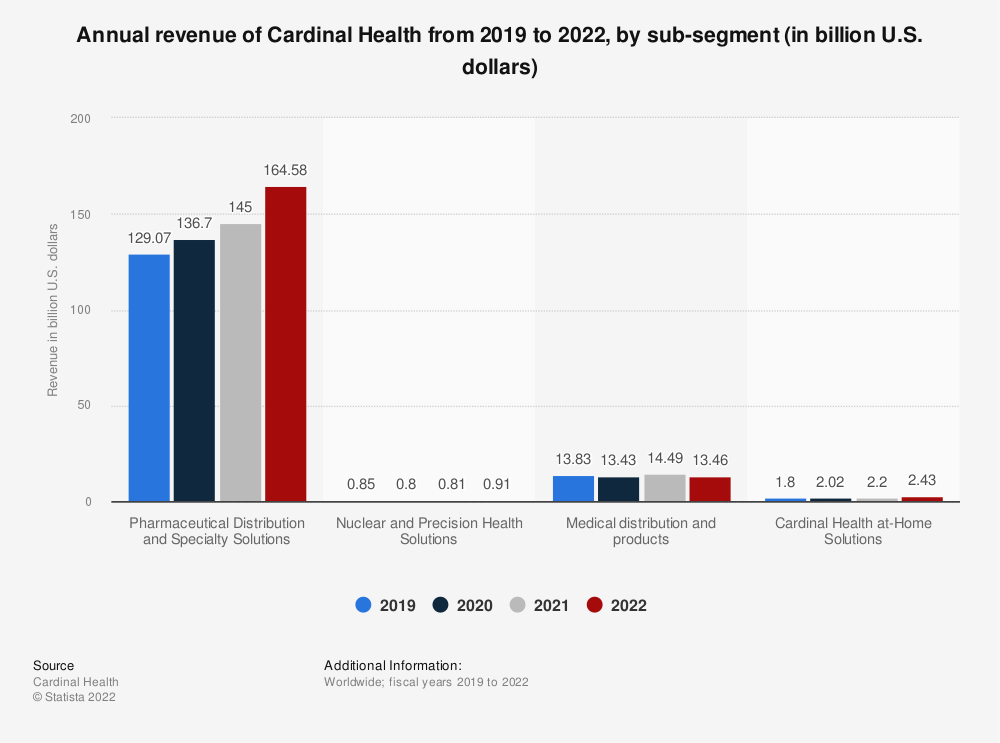

Source: Business Quant

The Medical segment manufactures, sources, and distributes Cardinal Health branded medical, surgical, and laboratory products. It provides medical products and services to hospitals, ambulatory care centers, clinical laboratories, and other healthcare providers. This segment also distributes a broad range of national brand products.

Cardinal Health's offerings are designed to improve the cost-effectiveness of healthcare and the safety and productivity of healthcare providers. The company's extensive network of distribution facilities, combined with its broad product line, enables it to provide rapid and reliable service to its customers.

The company's recent focus has been on core strengths and operational efficiency, which has led to margin expansion. Cardinal Health's commitment to meeting expectations and its recent financial performance, including raising its Fiscal Year 2023 Non-GAAP EPS guidance, demonstrate its resilience in the healthcare market.

???? What we learned from social media and institutional investment patterns:

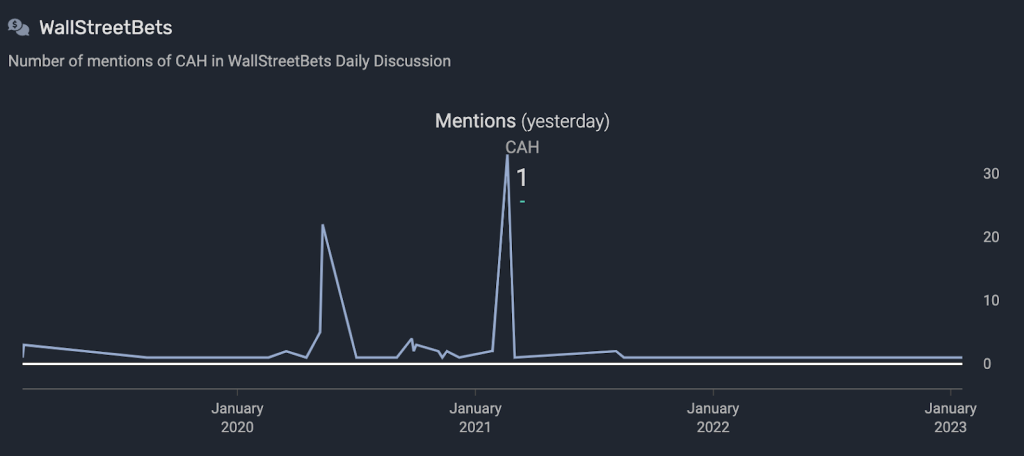

$CAH is almost invisible on stock discussion forums such as Wall Street Bets. This isn’t surprising considering that most people wouldn’t have heard of the company unless they worked in the healthcare industry.

Source: quiverquant.com

The largest holder of $CAH shares is The Vanguard Group who currently have a 12.41% stake in the company.

Mutual funds currently hold 47.82% of the company, while individual stakeholders only make up 3.45% of ownership in the company.

Source: CNN Business

???? Smart Money Signal: In Q1 2023 two notable hedge funds – Point72 Asset Management and Citadel Advisors invested $248.9 million into $CAH.

???? Why $CAH could be valuable:

Cardinal Health (CAH) presents a compelling value proposition in the healthcare sector, driven by its robust market position, financial strength, and growth potential. As a leading distributor of pharmaceuticals and medical products, the company is well-positioned to capitalize on the growing healthcare market, which is expected to expand due to the aging population and increasing healthcare needs.

The company's financial strength is evident in its recent Q3 FY2023 results, where it reported a 5% increase in revenue to $41.3 billion and a 14% increase in non-GAAP operating earnings. This performance underscores the company's ability to generate consistent revenue and earnings growth, which is a key indicator of its financial health and stability. Furthermore, the company raised its FY2023 non-GAAP EPS guidance, reflecting its confidence in its future performance.

Source: Statista

Cardinal Health's growth potential is underpinned by its strategic focus on core strengths and operational efficiency. The company is making concerted efforts to streamline its operations and improve its margin profile, as evidenced by its recent initiatives to optimize its pharmaceutical segment and expand its customer base. These efforts are expected to drive margin expansion and enhance shareholder value over the long term.

However, it's important to note that the company faces certain challenges, including potential headwinds from drug pricing pressures and regulatory uncertainties. While the company has demonstrated resilience in navigating these challenges, they could impact its future performance and growth trajectory.

Analysts' opinions on the stock are mixed, with some viewing it as a solid investment due to its stable earnings and dividend yield, while others express concerns about its long-term prospects. Despite these differing views, the consensus is that the company's strong fundamentals and growth initiatives make it a potentially valuable investment.

⚠️ What the risks are:

Competition: The company operates in a highly competitive industry. Cardinal Health faces stiff competition from other large healthcare distributors, which could lead to pricing pressures and impact the company's market share and profitability.

Customer concentration: Cardinal Health's business is heavily dependent on a few key customers and suppliers. The loss of a major customer or supplier, or significant changes in their purchasing patterns, could have a material adverse effect on the company's revenues and profitability.

Opioid litigation: The company's pharmaceutical segment has been under pressure due to ongoing opioid litigation. While Cardinal Health has made provisions for potential settlements, there is a risk that the final settlement costs could be higher than anticipated, which could impact the company's financial position and reputation.

Bottom line: Cardinal Health ($CAH) demonstrates solid financial performance and strategic focus on operational efficiency. However, it faces challenges including competitive pressures, regulatory uncertainties, and ongoing opioid litigation. Despite these risks, its stable earnings and dividend yield make it a potentially valuable addition to a diversified portfolio. Investors should monitor the company's performance and growth initiatives closely.