Summary

Quanta Services, a global leader in infrastructure solutions, has witnessed a remarkable 16% revenue growth in just six months, largely driven by its innovative renewable energy and underground utility solutions. With its expansive reach across the U.S., Canada, and Australia, and a significant surge in sectors like renewable energy, Quanta is poised to redefine the infrastructure landscape.

Perion Network, a global pioneer in digital advertising, is making waves with its innovative solutions that prioritize user privacy without compromising on targeted outreach. With strategic partnerships spanning across major platforms and a unique approach to ad delivery, Perion is well-positioned to ride the digital advertising wave.

Quanta Services, Inc.($PWR)

$208.60 – Share price at the time of writing

Source: tradingview.com

???? Summary:

- Quanta Services, Inc. is a prominent infrastructure solutions provider, catering to sectors like electric and gas utility, renewable energy, and communications, with operations spanning the U.S., Canada, Australia, and other international markets.

- For the first half of 2023, the company reported a 16% revenue increase to $9.48B, with significant growth in renewable energy and underground utility solutions.

- Market discussions on $PWR are minimal on platforms like Reddit, with 92.87% of the stock held by institutional investors, indicating stability and minimal influence from social media trends.

- Potential risks for Quanta include project execution challenges, dependency on skilled labor, and a high revenue concentration in North America, especially the U.S.

???? What they do:

Quanta Services, Inc. is a leading provider of comprehensive infrastructure solutions across various sectors, including:

- Electric and gas utility

- Renewable energy

- Communications

- Pipeline and energy industries

The company operates in the United States, Canada, Australia, and select other international markets. Their services are segmented as follows:

Electric Power Infrastructure Solutions: This segment focuses on the design, procurement, new construction, upgrade, repair, and maintenance services for electric power transmission and distribution infrastructure.

Renewable Energy Infrastructure Solutions: Quanta provides infrastructure solutions for renewable generation facilities, such as wind, solar, hydropower generation facilities, and battery storage facilities.

Underground Utility and Infrastructure Solutions: This segment offers infrastructure solutions for the transportation, distribution, storage, development, and processing of natural gas, oil, and other products.

For the six months ended 30 June 2023, Quanta Services reported revenues of $9.48B, a 16% increase. The revenue growth is attributed to:

- Renewable Energy Infrastructure Solutions: Increase from $924.2M to $2.4B

- Underground Utility and Infrastructure Solutions: 13% increase to $2.33B

- United States: 14% increase to $7.95B

- Australia: Increase from $144.6M to $311.4M

???? What the market is saying:

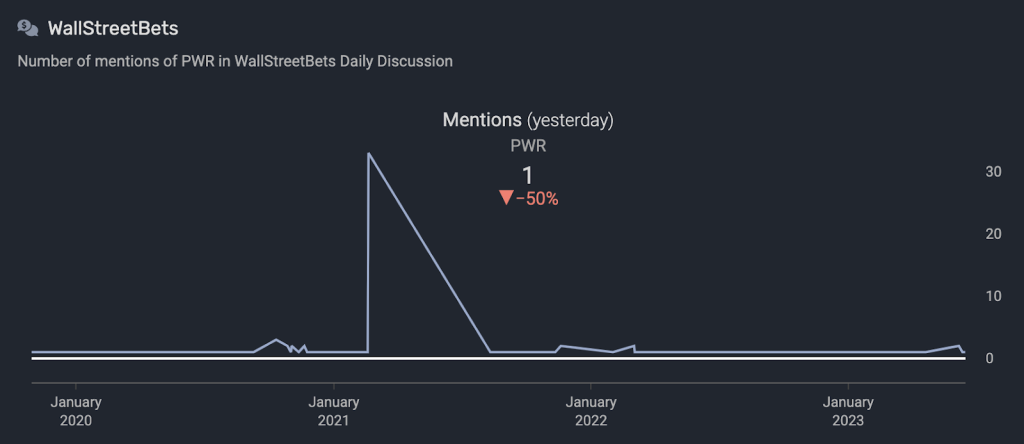

$PWR sees minimal discussion on Reddit, and what little there is can be found as a general discussion of infrastructure stocks.

Source: quiverquant.com

There are a few posts on r/stocks and the discussion is generally positive, but there’s too little of it to draw any conclusions. It is reasonable to assume that price movements will not be driven by social media buzz.

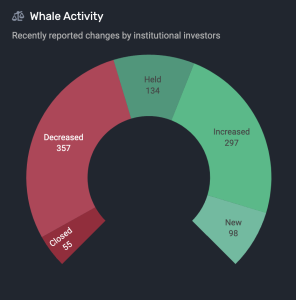

92.87% of the float is held by institutional investors, led by Vanguard and Blackrock.

Recent institutional activity has been generally positive:

Notable comments from Reddit:

“It’s my favorite stock right now which Ive been holding and buying more of since June 2020. I also couldn’t tell you why it’s spiking recently. The daily volume seems very low relative to the price and movement of the stock. I bought a number of other infrastructure and electrical stocks and some are also doing very good with no retail investor hype. It might be related to the Dem infrastructure plan. Quanta is based in Houston and Texas just found out they weren’t ready for a snow storm a couple months ago, so there’s work. Govt money”

– Reddit User

Smart Money Signal: Ron Baron of Baron Funds purchased 24,800 shares of $PWR in Q2 2023. His current holdings are worth approximately $50 million.

???? Why $PWR could be valuable:

Quanta Services operates in the infrastructure solutions sector, catering to electric and gas utilities, renewable energy, communications, pipeline, and energy industries.

The increasing global demand for energy, especially renewable energy, and the need for infrastructure development and maintenance presents significant growth opportunities.

The Renewable Energy Infrastructure Solutions segment, which provides solutions for renewable generation facilities, has seen substantial growth, reflecting the industry's potential.

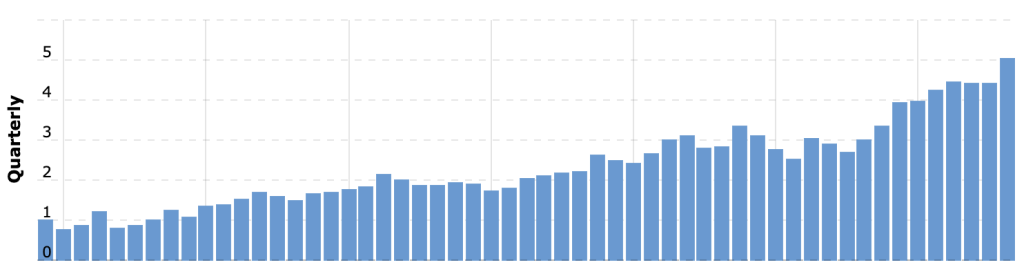

PWR's growth data show that the company has been expanding. This is because its energy portfolio continues to see high demand thanks to the expanding energy transition.

PWR's revenue, EBITDA, EBIT, and operating cash flows are all expanding at double-digit rates year over year (23.14%, 26%, 29.21%, and 99.98%), which is significantly higher than the industry median of 11.75%, 13.91%, 11.41%, and 17.66%.

Quarterly Revenues (billions):

The term “energy transition” describes the ongoing transformation of the world's energy infrastructure away from traditional fossil fuels like oil, natural gas, and coal and toward renewable energy sources like wind, solar, and lithium-ion batteries.

Key drivers of the energy transition include the increasing share of renewable energy in the overall energy supply mix, the advent of electrification, and advancements in energy storage. Despite varied regulations and commitment to decarbonization, the energy transition will gain prominence as ESG elements become increasingly valued by investors.

Between 2019 and 2024, the total electricity capacity of the world based on renewable sources is expected to grow by 50%, according to the International Energy Agency. Utilities are rapidly shifting away from coal as a result of this change.

PWR's management has noted that there is a considerable demand for their products in the market for green energy. This will help to drive growth for $PWR in the long term.

⚠️ What the risks are:

Project Execution: PWR primarily operates on a project basis, contracting to complete large-scale projects for its clients. Delays, cost overruns, or failures to successfully complete projects can impact the company's financial performance and reputation.

Labor and Workforce: Quanta heavily rely on skilled labor and workforce availability. Competition for qualified workers, labor disputes, wage inflation, or a shortage of skilled workers can impact the company's ability to complete projects and affect profitability.

Geographical Concentration Risk: The company generates a substantial portion of its revenue from operations in North America, particularly the United States. This concentration makes it vulnerable to regional economic factors, weather conditions, political instability, and natural disasters.

Bottom line: $PWR stands as a dominant force in the infrastructure solutions sector, with a significant presence in key markets like the United States, Canada, and Australia. Their diversified portfolio, spanning electric and gas utilities to renewable energy and communications, positions them at the forefront of the global energy transition.

Perion Network Ltd. ($PERI)

$33.60 – Share price at the time of writing

Source: tradingview.com

???? Summary:

- Perion Network is a global frontrunner in digital advertising, offering state-of-the-art solutions tailored for brands and agencies.

- Their unique SORT technology emphasizes user privacy, ensuring targeted advertising without invasive tracking.

- Strategic partnerships, like the one with Microsoft Advertising, and a focus on acquisitions position Perion for sustained growth in an evolving market.

- Despite the dynamic nature of the digital advertising industry, Perion's innovative approach and financial stability make it stand out as a promising player in the ad tech market.

???? What they do:

Perion Network is a digital advertising services company based out of Israel with offices across the world. The company helps its customers grow by showing ads to target audiences.

The company is deeply entrenched in the digital advertising ecosystem. It provides brands, agencies, and publishers with an easy way to identify and reach their customers across all channels.

Some of its biggest customers include names like General Motors, McDonald's, Microsoft, and Nike.

Perion Network Ltd operates in three main pillars of digital advertising: ad search, social media, and video.

Search Ads: When you search for something on the internet, sometimes you see ads at the top of the results. Perion helps companies put those ads there.

Social Media Ads: Perion helps companies show relevant ads to potential customers using social media platforms like Facebook.

Videos & TV Ads: When you're watching videos online or on apps, sometimes there's a short ad before your video starts. Perion can help companies show their ads there.

A significant technological solution from Perion is the SORT technology. This alternative technology is a machine learning model that analyzes millions of data combinations to create cookieless targeting groups. These groups consist of individuals who think and react similarly to ads.

In other words, SORT figures out which groups of people might like the same things. This way, companies can show the right ads to the right people.

Perion also has a partnership with Microsoft Advertising that involves providing technology and services to enhance the performance of Bing Ads. Perion's role in this context includes tools for optimizing ad delivery, improving targeting capabilities, and enhancing the overall effectiveness of advertising campaigns on the Bing platform.

???? What the market is saying:

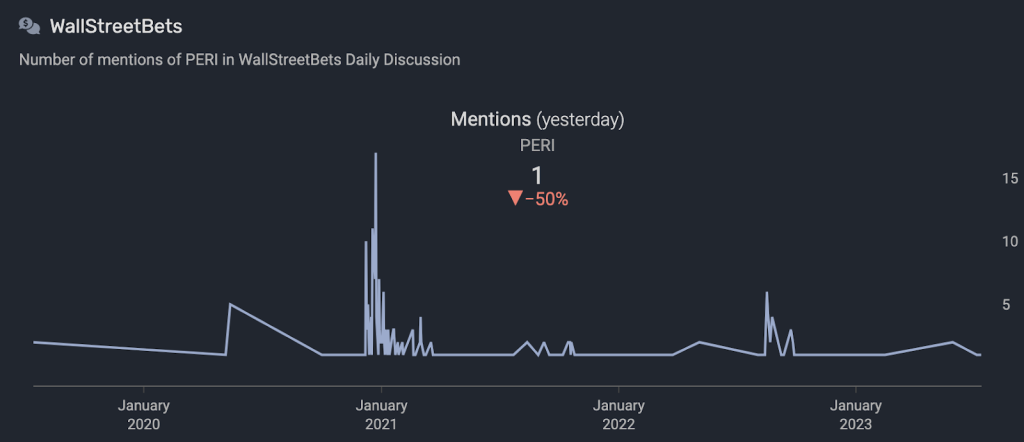

Apart from a few Reddit threads discussing the stock in 2021, social media mentions of Perion Network are almost non-existent. Swings in the stock price have also failed to get the attention of investors.

It does seem safe to say that future movements will probably not be driven by social media hype.

Source: quiverquant.com

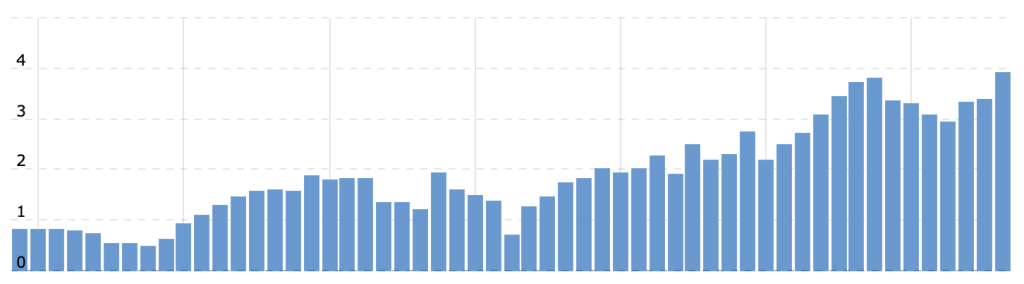

Meanwhile, if we look at insider buying activity, we can see over the past 12 months that there have been several significant purchases made. This can be a signal that insiders close to the company are bullish on the future stock price.

Source: CNN Business

Smart Money Signal: Jim Simons of Renaissance Technologies currently owns 2.75% of the outstanding shares in Perion Network.

???? Why $PERI could be valuable:

Perion Network operates in the digital advertising ecosystem, a sector that has seen consistent growth with the rise of online platforms and e-commerce.

The digital advertising industry is expected to grow at a significant CAGR over the next few years, driven by increased internet penetration and the shift from traditional to digital advertising.

A key factor that gives Perion an edge over competitors is Perion's successful history of developing new products and services to keep up with market innovation.

The most recent and notable of these is Perion's release of SORT by Perion. This cookieless targeting technology allows companies to target relevant audiences online with high engagement without the use of cookies.

This allows companies to provide safe online experiences for customers since their information (cookies) is not being stored or sold to other advertisers for user tracking purposes.

An internal study conducted by Perion revealed that Sort's cookieless technology saw, on average, a 76% higher clickthrough rate than other competitors' cookie-based strategies across multiple platforms.

Current CEO Doron Gerstel and Incoming CEO Tal Jacobson have a plan to hedge against the global decrease in ad spending by allocating some of its cash towards acquisitions in growing sectors of the advertising industry. Some of its target sectors include connected TV, retail media, and retail audio.

The digital advertising sector has shown resilience during economic downturns, primarily because businesses continue to allocate budgets for online marketing to maintain visibility and reach their target audience. Perion, with its diversified advertising solutions, is well-positioned to weather economic challenges.

Perion's increasing margins and near-zero debt place the company in a strong position to leverage the decreased global ad spending to acquire other companies that may not perform as well without Perion's management and resources.

⚠️ What the risks are:

Macro environment: The digital advertising business is cyclical and highly dependent on the overall health of the broader economy. Recession fears in the U.S. eased significantly due to solid macroeconomic indicators, but the probability is still above zero. Interest rates are still at the highest point since the Great Recession, and this inevitably affects business activity.

Failing to meet investor expectations: Since Perion is a growth company, any signs of revenue slowing or missing consensus earnings estimates will highly likely lead to a stock sell-off due to investors' disappointment.

Technology becomes obsolete: Perion offers its customers cutting-edge proprietary technology, but in the ever-evolving technological landscape, it is difficult to forecast the life cycle of a technology. New approaches emerge constantly and there is a high risk that the company's offerings can be disrupted.

Bottom line: Perion Network is a global leader in the digital advertising landscape, offering innovative solutions that cater to the evolving needs of brands and agencies. Their strategic acquisitions and financial prudence underscore their vision for sustainable growth. While the digital advertising realm is not without its challenges, Perion's adaptability and resilience make it a promising contender in the market.