Summary

Paylocity is a leading provider of human capital management and payroll software that targets small and mid-sized businesses. Founded in 1997, it has seen accelerating growth and withstood macroeconomic trends and periods of high unemployment during the COVID-19 pandemic.

Extreme Networks is a mid-cap networking business that provides networking hardware and software for enterprise and service providers. It has its hands in multiple growing markets, including network automation and cloud-based network management. The company is expecting revenue growth greater than 20% year-over-year.

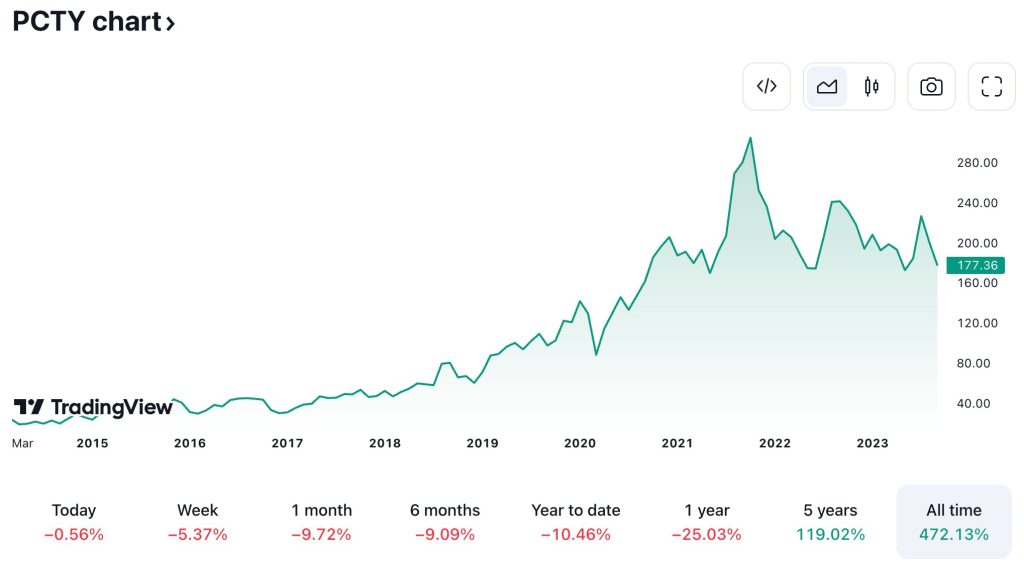

Paylocity Holding Corporation ($PCTY)

$177.36 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $192.63

- Leading cloud-based payroll and human capital management provider.

- The company is growing quickly, with FY2023 total revenue up 38% year-over-year.

- Shares have been trending downward roughly 25% below it’s 1-year high price despite good performance.

What they do

Paylocity offers cloud-based payroll and human capital management services. Its product offerings include:

- Payroll. This includes tools for making sure that employees get their paycheck each payday, but goes further, including expense tracking and reimbursement tools, tax services, on-demand payments, and wage garnishment services. Paylocity is set up to handle payroll in more than 100 countries.

- Time and labor management. Paylocity helps with tracking time, scheduling, recruiting and onboarding new talent, and handling compensation.

- HR. Paylocity’s HR solutions help improve workflows and compliance, deals with benefits, and give employees self-service options to handle things like time off requests, time entry, and updating their personal data.

Paylocity tends to focus on small and mid-sized businesses but has enterprise software available for larger companies. The company has more than 36,000 clients using its services and a workforce of more than 6,000 employees.

Though the company is fifteen years old, it has seen significant growth in the past few years, with revenue growing at a rate higher than 30% year-over-year in FY22 and FY23.

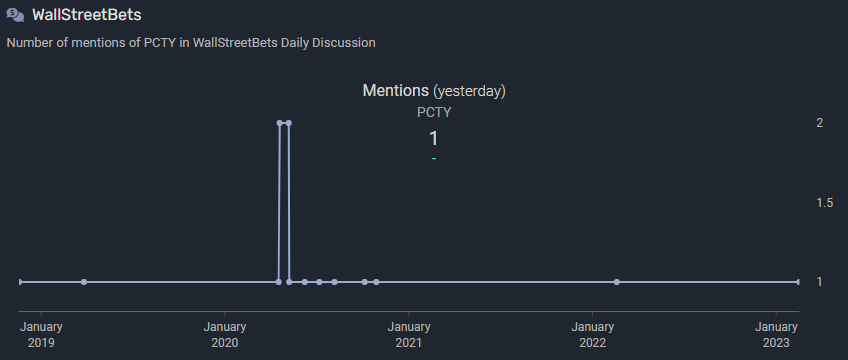

What the market is saying

$PCTY is very much flying under the radar. In fact, it’s only seen a single mention on Reddit’s Wall Street Bets in the past year. That makes sense given the company’s size (market cap of $10.75 billion) and relatively unexciting line of business.

Source: quiverquant.com

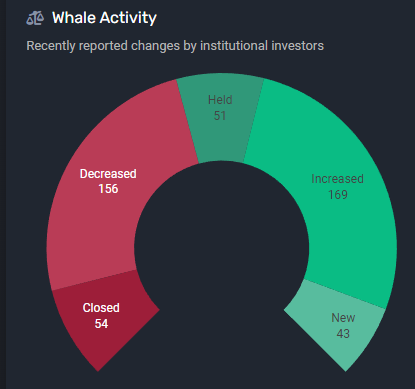

Despite, or perhaps because of its unexciting line of business, a lot of institutional investors have gotten involved with $PCTY. Activity slightly favors the expansion of positions, though many institutional investors have closed or reduced their positions.

Source: quiverquant.com

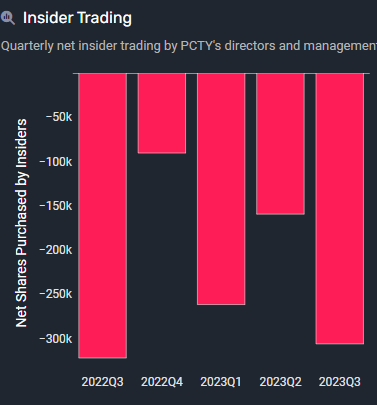

Insiders have also been more likely to reduce their positions over the past year, perhaps due to recent highs in the company’s stock price. Despite reducing their holdings, 23.78% of all shares are still held by company insiders.

Source: quiverquant.com

Why PCTY could be valuable

Human capital management is a key aspect of any business, so Paylocity has plenty of room to expand. Many of its clients have between 10 and 5,000 employees. Currently, it has 36,200 clients in this segment. That represents less than 3% of the 1.3 million businesses in that segment.

Paylocity states that its focus is on increasing its market share in that segment. To that end, it focuses on differentiating itself by offering best-in-class client support, which has led to 92% revenue retention.

If the company can succeed at gaining customers, it tends to do a good job of retaining them, which could help it further grow and maintain revenue.

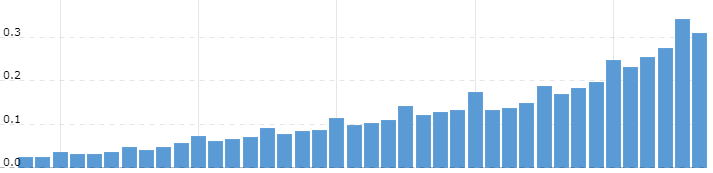

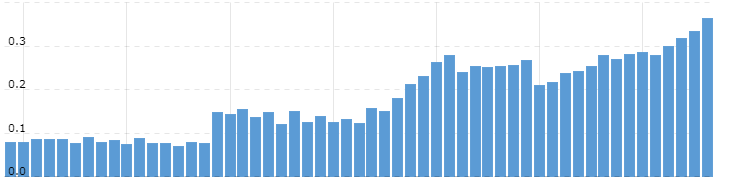

Quarterly Revenues (billions):

Another good sign for the company is that the global market for HR technology is expected to more than double between 2021 and 2031, with a CAGR of 9.2%. More HR technology will move the cloud, and Paylocity is well-positioned to take advantage of that move.

The company has also started to leverage AI in its offerings. AI integrations can increase efficiency and puts the company on the cutting edge for HR tech going forward.

Since FY20, the company has seen a 28% CAGR in its revenue.

What the risks are

Bottom line: Paylocity has seen strong revenue growth over the past few years, but insider and smart money sentiment seems negative. While it seems positioned for success and has weathered economic storms in the past, the future is uncertain.

Extreme Networks Inc. ($EXTR)

$24.16 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $24.22

- Extreme Networks Inc. is a mid-cap company that specializes in hardware and software-driven networking solutions.

- Market share in cloud-managed services grew from less than 1% in 2018 to 12% in 2021

- Shares are slightly below their all-time high of $32.27 but have trended upward since 2019.

What they do

Extreme Networks Inc. offers networking solutions to a variety of industries, including financial services, education, healthcare, higher education, hospitality, and more. It breaks its products into a few main categories.

- Cloud applications. Extreme Networks offers cloud services for network management, including management of wired, wireless, SD-WAN, and Internet of Things devices.

- Network Fabric. Extreme Fabric ties together customers' networks across their data centers, campuses, and branches. It is a network abstraction technology, letting organizations build multiple virtual networks using the same infrastructure, boosting security and reducing the risk of network errors, all while allowing for automated provisioning that reduces the need for manual device configuration.

- Wired and Wireless Access Points. Extreme Networks sells a variety of physical and wireless network switches.

Customers can get technical help and training on the products and services they purchase. Extreme Networks also offers customer success options, helping its clients customize the products and services they purchase to their unique needs.

What the market is saying

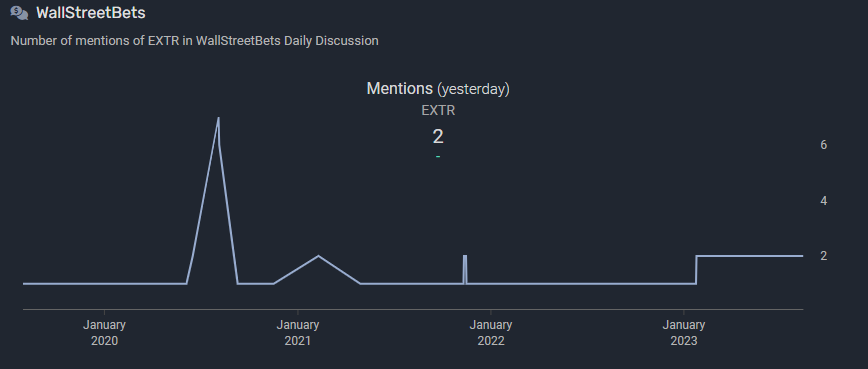

Like Paylocity, Extreme Networks isn’t a particularly popular stock on social media. Though it isn’t quite as under-the-radar, it’s only seen seven mentions on Reddit’s Wall Street Bets forum in 2023. It does have a Twitter presence, with slightly fewer than 31,000 followers at the time of writing.

Source: quiverquant.com

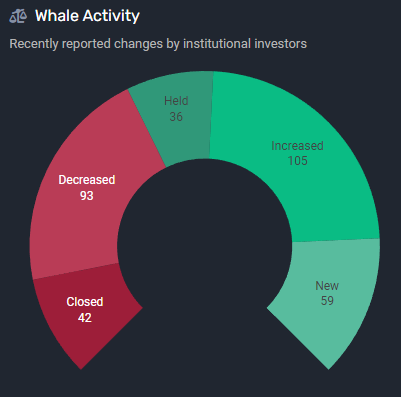

Institutional investors have trended toward increasing or maintaining their positions in Extreme Networking. This could be a good sign for the company’s future potential. 105 institutional investors grew their positions while 93 decreased their positions. Similarly, 59 new institutional investors purchased shares and just 42 closed their position.

Source: quiverquant.com

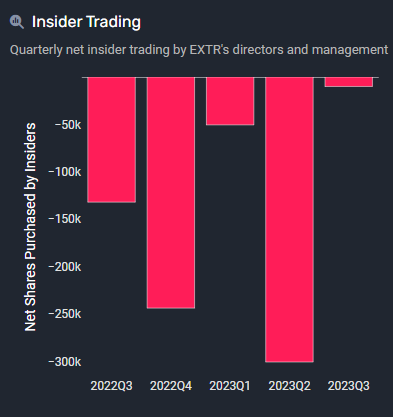

Insiders have mostly sold stock over the past year, with net trading seeing insiders decrease their holdings by more than 500,000 shares.

Source: quiverquant.com

Notable comments from Reddit:

“They have the best networking tech” – MrMortons

“Extreme is AWESOME! I've used Cisco in my past life, I came from an HP shop. Extreme was brand new to me about 5 years ago. Extreme EXOS is just like HP..maybe even easier to learn and manage… Sales and support are great too.” – Source

Why EXTR could be valuable

The market for networking companies has grown quickly, with the industry expected to grow 6.1% over the next five years.

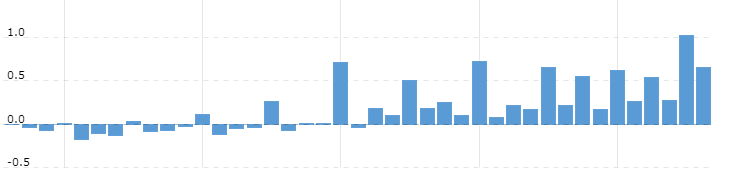

Extreme Networks has outpaced the rest of the industry. Between 2018 and 2021, it grew its market share in cloud-managed services from less than 1% to more than 12%. It’s also seen growth in its annual recurring revenue each year since FY19.

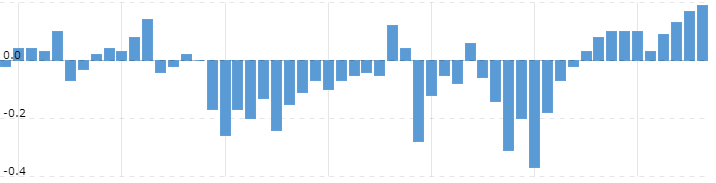

Another good sign is that it roughly doubled analyst estimates during its August financial reporting.

Quarterly Revenues (billions):

Like many companies, Extreme Networks has recently started to leverage artificial intelligence and machine learning. The company offers AI tools to help identify trends in network data, giving customers insight into how they can improve their network’s performance or shut down threats.

This early adoption of AI helps put Extreme at the forefront of the market and positions it well to utilize AI more in the future.

If it can maintain its growth and acquire more market share, Extreme Networks could see a massive jump in its value over the next few years.

What the risks are

Bottom line: Networking is key for any large business that uses technology. Extreme Networks has managed to grow its market share in cloud networking solutions significantly. If it can continue that growth, it’s poised to see its value rise.