Summary

Grab Holdings is a Southeast Asian tech company that operates a super-app offering everything from ride-sharing to financial services. Despite consistently growing revenues and a monopoly over its product offering, $GRAB’s share price remains depressed at 80% off its peak.

Asana operates a work management platform that has grown substantially in recent years. With double-digit revenue growth and gross profit margins consistently at 80-90%, $ASAN may be one to watch in a future where its industry is set to soar.

Grab Holdings ($GRAB)

$3.25 – Share price at time of writing

Source: tradingview.com

Summary:

- Share price at the time of writing: $3.25

- Grab Holdings is a Southeast Asian tech company that operates a super-app offering a wide spectrum of services, encompassing everything from ride-sharing to financials.

- Since its inception in 2012, Grab has expanded its market to over 500 cities in eight different countries.

- Grab has shown consistent revenue growth and widening gross profit margins over the last few years.

- $GRAB is currently trading at nearly 80% below its peak in 2021.

What they do:

Grab Holdings is a Singapore-based tech company that has established itself as one of the leading super-apps in Southeast Asia. Starting out as a ride-hailing app in 2012, Grab has since expanded its portfolio to include a full range of services under various key brands:

- Mobility: GrabCar, GrabTaxi, GrabBike, GrabShare, Grab for Business, GrabRentals;

- Delivery: GrabFood, GrabKitchen, GrabMart, GrabExpress;

- Financial Services: GrabPay, a GrabFinance, GrabInsure, GrabInvest, GrabLink, PayLater;

- Enterprise Services: GrabAds, GrabMaps, GrabDefense;

- Loyalty Program: GrabRewards.

Grab prides itself in its ability to offer all these in a single app. It now has more than 32 million monthly transacting users in over 500 cities across Singapore, Malaysia, Cambodia, Indonesia, Myanmar, Thailand, Vietnam and the Philippines .

Despite tremendous growth, the company continues to aggressively expand into areas where it sees opportunity. One of Grab’s key developments last year included launching Singapore’s first digital bank, GXS Bank, in a bid to further penetrate the country’s financial services sector.

The company also continuously invests in furthering its B2B services. GrabAds for example not only offers merchants a platform for in-app digital marketing, but also allows for product placements inside partner vehicles. Similarly, Grab offers anti-fraud solutions to digital companies through GrabDefense.

Interestingly, Grab used to compete heavily against Uber for market share in Southeast Asia’s ride-hailing sector. That ended in 2018 when Uber finally gave up all its operations within the region in exchange for a 27.5% stake in Grab.

Grab currently has a monopoly of all ride-hailing services in Southeast Asia.

What the market is saying:

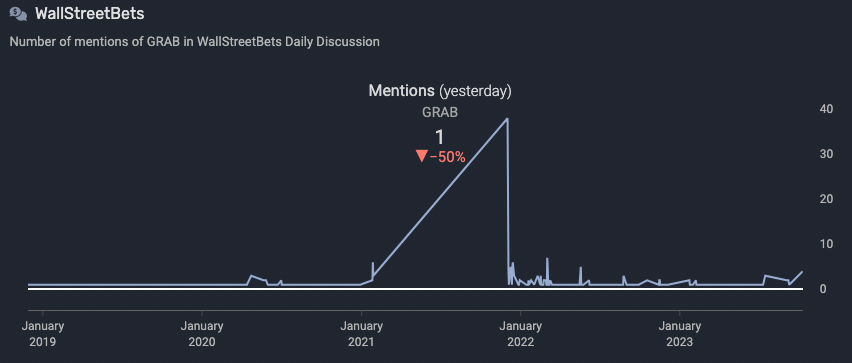

Unsurprisingly, $GRAB is mentioned regularly in forums catered to Southeast Asia users, especially in r/Singapore where its headquarters are. Discussions tend to be around the company’s latest business activities, with some chatter around its stock price.

While it used to be a larger topic when it first debuted into public markets, $GRAB currently sees minimal discussion on forums such as r/WallStreetBets which are dominated by users living in Western countries. This tends to be the case for companies that operate in specific regions despite them being listed on U.S. exchanges.

The few posts around $GRAB on r/stocks are generally around its growth potential and its volatility.

Source: quiverquant.com

Notable comments from Reddit:

“Grab is huge here for ride sharing.

But one of the biggest things that Grab does is food delivery. That is where I think they probably are even bigger.

I was just wondering if Grab was a public company just yesterday. You see Grab everywhere.”

- Bartturner

“With a strong warchest, dominance in the Asian market, diversification of services through digital banking, and the potential for increased usage as lockdowns ease and Chinese tourism increases, probably a good bet for 2023.”

- Redsel1

Why $GRAB could be valuable:

Despite being a relatively young company, $GRAB has already successfully attained the distinctive status of a super-app that serves one of the world's most rapidly expanding regions.

Southeast Asia is marked by a growing population and an emerging middle class. In 2022, the region’s combined GDP total to approximately US$3.6 trillion – larger than the economies of the UK, France and Canada. As a bloc, Southeast Asia is projected to have a CAGR of 4% in the next few decades to become the world’s fourth largest economy by 2040.

Its population skews notably younger, boasting a median age of 29.6 years old. This stark contrast becomes evident when comparing it to the demographics of other major economies' such as the U.S. (38.5), the UK (40.6) and Japan (48.6). With Southeast Asia's population poised for growth, coupled with the expanding reach of smartphones and internet access in the region, the surge in demand for mobile-accessible services, including ride-hailing, food delivery, and digital payments, is all but certain.

In addition to its wide geographical reach, $GRAB offers a diverse array of services beyond its core ride-sharing business. For example, Grab now commands 90% ownership of Ovo, one of Southeast Asia’s biggest fintech platforms. As a super-app, Grab is not just Southeast Asia’s “Uber” – it is also the region’s “Affirm”, “Square”, “DoorDash”, “Instacart” and “Paypal”.

Grab has also worked extensively to establish numerous strategic partnerships with prominent multinational companies, of which include SoftBank and Toyota. These partnerships offer not only financial resources but also valuable expertise for further expansion and development.

Finally, Grab places a strong emphasis on innovation and technology. Last year, the company spent a total of US$647m in R&D expenses – approximately 33% of its total revenues. The company is clearly dedicated to developing new services and features aimed at furthering its growth. As at December 2022, Grab had been granted 71 patents with 745 more pending applications.

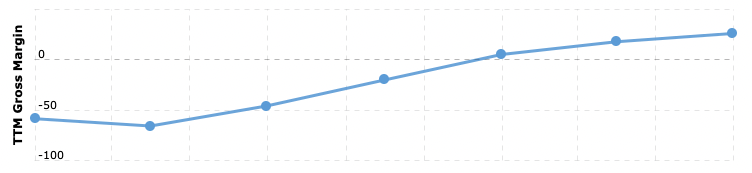

Financially, $GRAB has consistently grown revenues in the last few years. Full-year totals for 2022 more than doubled the previous year’s numbers (US$1.43b vs. US$675m), while the first half of 2023 alone already recorded US$1.09b in revenues. The company has also steadily improved gross profit margins over time.

Quarterly gross profit margins from Q1 2022 to Q2 2023:

Source: macrotrends.net

While the company currently remains unprofitable due to high operating expenses, it ended Q2 2023 with a healthy cash balance of US$2.28b. This is in addition to short-term investments that amount to another US$2.82b, bringing $GRAB’s total cash and cash equivalents balance to US$4.57b.

Contrasting this to the company’s total liabilities of US$1.9b, Grab’s liquid assets alone can cover its debts many times over.

Despite tremendous growth in both its financials and its business activities, $GRAB’s share price has dropped over 80% from its peak in 2021.

With coverage from 24 analysts, the current mean price target stands at US$4.71 – representing a potential upside of approximately 37%.

What the risks are:

Bottom line: Grab is a rapidly-expanding company that has already proven its dominance in the markets where it has established a presence. With its highly aggressive growth business model, its currently depressed share price may offer an opportunity to those who align with the company’s mission and values.

Asana ($ASAN)

$18.45 – Share price at time of writing

Source: tradingview.com

Summary:

- Share price at the time of writing: $18.45

- Asana is a work management platform that currently services over 139,000 customers.

- The company has recorded consistent double-digit revenue growth since publicly-listing and has an unmatched customer retention rate.

- Its industry is set to expand at a CAGR of 13.9% in the next decade with Asana poised to benefit greatly.

- Asana has one of the highest gross profit margins in the software industry, which means that incremental revenues contribute directly to its bottom line.

What they do:

Asana operates a work management platform designed to facilitate the coordination of tasks and projects for teams. With both web and mobile platforms, the company supports workflows spanning from daily tasks to broader cross-functional strategic initiatives. The company delivers its products as a Software-as-a-Service (SaaS) model, generating recurring subscription revenue.

While it operates in a highly competitive industry dominated by names such as $MSFT and $TEAM, Asana differentiates itself through its numerous proprietary features:

- Asana Work Graph: Framework that captures the relationships and connections between different work units creating a comprehensive and up-to-date organizational work map. It introduces features like multi-homing, allowing tasks to be shared across various projects without duplication.

- Flexibility: Users have the option to toggle between multiple types of workflow displays such as a Calendar View, Kanban Board, Timeline View, Capacity View or a simple List View.

- App Integration: Asana’s platform can be integrated into over 260 third-party applications; including apps within Microsoft 365, Google Workspace and Adobe Suite, and stand-alone software such as Slack, Dropbox, Tableau and Salesforce.

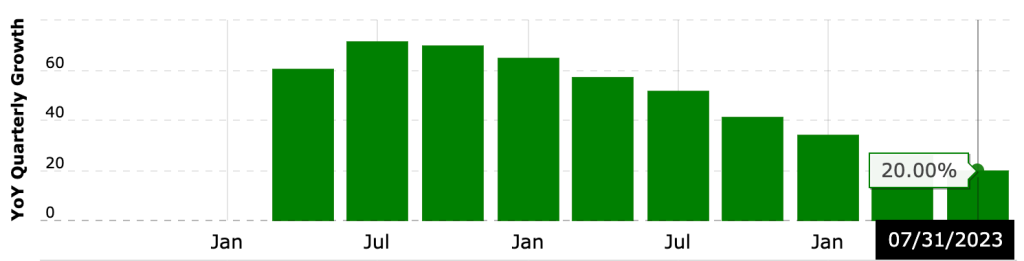

Founded in 2008, Asana has since expanded its client base to over 139,000 paying customers. This has been marked by its consistent double-digit revenue growth in the last few years – an average annual growth of 66% since 2019.

What the market is saying:

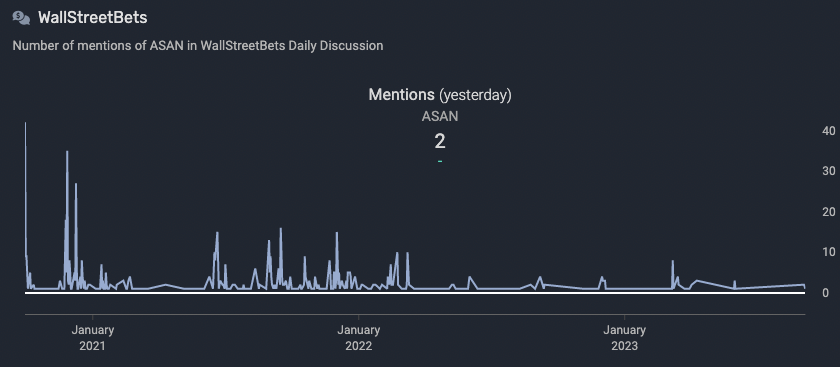

While $ASAN is not widely discussed on social media, it does get regular mentions in daily discussion forums, signaling its visibility to retail traders.

Asana had a lot of chatter when its share price hit a new high in 2021 however this was largely in line with the increased interest that tech stocks garnered that year.

Source: quiverquant.com

Asana is more often mentioned in tech forums where individuals within the software industry discuss competing products. The software regularly gets kudos for its usability.

Notable comments from Reddit:

“I lead teams that use both. Asana for PMO hands down. Much easier to customize per project, automations are easier to build, integrations are easier, automated status roll up. I also use asana to track quarterly OKRs, individual development plans. I integrated outlook and send emails to a “follow up” project. It's a great tool, good interface and new features coming out all the time.”

– copper_acorn

“I’m currently implementing our Asana roll-out for my org (small nonprofit, but still a big paradigm shift!). We’re still adjusting but even with the normal bumps that come with a new system it’s an absolute game-changer.”

– 5261

$ASAN also gets some buzz thanks to its co-founder and CEO, Dustin Moskovitz, constantly buying the stock whenever it dips. His position in the stock has steadily grown over the years and now equates to over 54% of $ASAN’s total shares outstanding. His most recent purchase was just this month – 7.24 million shares at a price of $19.25 in October 17, 2023.

Why $ASAN could be valuable:

Asana's long-term outlook is poised to benefit from the ongoing shift toward remote and dispersed teams. With the growing adoption of work management software by companies globally, the industry is forecast to expand at a CAGR of 13.9% in the next decade. $ASAN has already consistently recorded double-digit revenue growth since debuting in the public markets:

Source: macrotrends.net

Similarly, the company projects a total addressable market (TAM) of $51 billion by 2025, catering to approximately 1.25 billion information workers worldwide. In comparison, Asana's current user base represents less than 5% of the global eligible workforce. As one of the sector’s top players, Asana is poised to benefit from this forecasted growth.

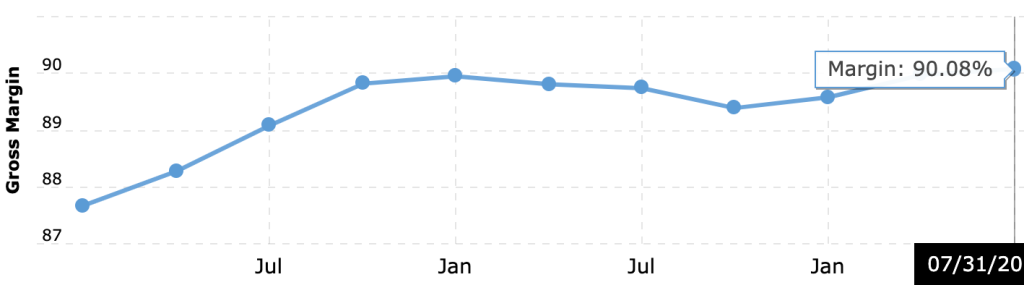

Asana enjoys a robust gross margin profile, with gross profit margins consistently hovering between 82% to 90%. This positions it as one of the most high-margin software companies in the market.

$ASAN’s gross profit margins from 2021 to present:

Source: macrotrends.net

While Asana may currently be unprofitable, this high gross profit margin, in addition to the industry’s expected growth, provides ample room for profitable scaling as incremental revenue contributes significantly to the bottom line.

Additionally, Asana’s lack of profitability stems partly from its high investment in research and development. Since 2019, Asana has continually invested approximately 50% of its total revenue figures into R&D.

When it comes to customer acquisition and retention, Asana has also nailed the formula. The company follows the classic “land and expand” playbook in the software market. What this means is that Asana proves its concept and value with smaller teams, later expanding its reach to encompass entire organizations and businesses.

Asana’s dollar-based net retention rates, which is the percentage of revenue retained from existing customers over the previous period, exceed 100% for all paying customers (as per $ASAN’s latest annual report). This means that on average, Asana’s clients contribute more revenue every succeeding year. This especially means a lot for enterprises spending over $100,000 annually, whose dollar retention rates average over 135% across 506 customers.

Despite being 86% off its share price peak, Asana currently still trades at a seemingly expensive 6.4x TTM sales. However, this valuation appears to be justified by the $50 billion market opportunity and leading revenue growth rates. Competitors like Monday.com and Atlassian trade at P/S ratios of 12x and 15x respectively – both with slower growth rates in the 25-40% range.

What the risks are:

Bottom line: Asana is a promising software company poised to benefit from the tremendous growth its industry is expected to see in the coming years. It may appeal to investors willing to take on more risk in favor of strong growth potential.