Summary

Stride is an online education platform that has generated profits since 2006. Despite recording double-digit revenue and income growth for over a decade, it shows no signs of slowing down. Stride is poised to benefit from the increased adoption of online education for both K-12 and adult learning.

Remitly Global is a digital-first remittance company that facilitates international money transfers mainly catered to migrants sending funds back home. It is a disruptor in a longstanding established industry rife with high fees and lack of transparency, in which it provides market-leading features that have seen it quadruple revenues in the last four years alone.

Stride Inc. ($LRN)

$57.14 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $57.14

- Stride is an online education service that provides an alternative to traditional brick-and-mortar schools. It offers both K-12 and adult learning programs.

- Stride has been generating profits since 2006 and has grown net income at an average CAGR of 13.5% since 2010.

- $LRN surged 30% earlier this month after smashing analyst earnings expectations, however analyst price targets show it might still have room to grow.

What they do

Stride, Inc. operates as an online education provider designed to provide an alternative to traditional “brick-and-mortar” schools. It offers a wide range of products and services, with its main ones being its school-as-a-service offerings, individual courses and software services.

Stride segments its revenue into its two main markets: General Education and Career Learning.

- General Education: education focused on core subjects such as math, English, science and history, for kindergarten through twelfth grade.

- Career Prep: education focused on career prep for in-demand industries, such as information technology, healthcare and business, tailored for both students and adults.

The bulk of Stride’s revenue comes from its school-as-a-service business model, where Stride provides its curriculum, resources, administrative services and software infrastructure to an affiliated school, who can then offer a virtual learning environment to its students.

This service sees Stride partnering with public schools, private schools and school districts. As of last year, its school-as-a-service offering was provided to 87 schools across the U.S. for its General Education segment and 52 schools for its Career Learning segment.

Stride has also invested heavily into further advancing its Career Learning segment. In 2020, it acquired Galvanize, a software engineering bootcamp, Tech Elevator, a coding bootcamp, and MedCerts, an online healthcare career training program. These acquisitions followed its rebranding from K12 to Stride, showing the company’s long-term plan of expanding into the adult learning market. As such, the company now also has contracts with employers, government agencies and consumers.

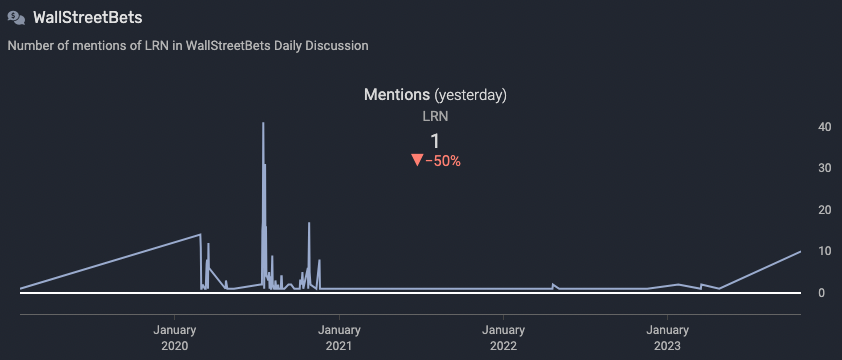

What the market is saying

Like many companies that operated virtual/online-based business models, $LRN saw distinctly high levels of discussion during the pandemic. The chatter has mostly minimized since then, with the exception of recent weeks after $LRN surged 30% following its quarterly earnings greatly exceeding analyst expectations.

Source: quiverquant.com

While not much is said about the stock currently, there is plenty of positive talk around Stride as a business.

Notable comments from Reddit:

“We did k12 for middle school this year. It’s very flexible. There are live help sessions, recorded lessons, and the teachers are responsive on Skype and email. My son wants to try in person school in the fall, otherwise I’d happily enroll him with k12 again.”

– sneakydonuts

“I teach with the Stride/K12 in my state. I really love it!

–There are scheduled class times, but I can make my own schedule for the most part.

–I feel I'm able to provide really thorough feedback, and create creative lessons that I can't do in Brick and Mortar.”

– Waywardottsel

Why $LRN could be valuable

Industry and Market

Stride operates a unique business model where it’s categorized as being in both education and tech (EdTech) – a mix of defensive and growth.

Since its inception in 2000, over three million students have attended schools powered by Stride’s curriculum and services. Despite that, Stride believes it has only served less than 1% of public school students in the states it’s currently operating in, citing the massive market opportunity it has to grow into.

Across the US, a survey last year found that 53.7% of parents had considered changing their child’s school, with 20.8% of them exploring online school options. From historical data taken by the NHERI, the number of home-schooled students had a CAGR of 5.3% between 2016 and 2022, with this growth accelerating in recent years. This trend has also been found in nations such as the UK, Australia and Canada – showing significant opportunity for Stride given that its business model can be expanded internationally at relatively low costs.

Additionally, the company’s expansion into adult learning courses through its acquisitions of Galvanize, Tech Elevator and Medcerts opened its doors to benefiting from a strong labor market.

The US Bureau of Labor estimates that demand for expertise that requires non-degree education – what Stride offers – will grow at a faster rate than overall employment.

Financials

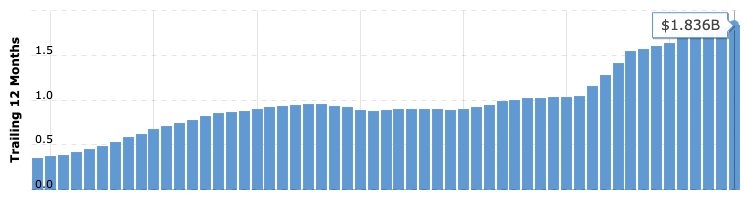

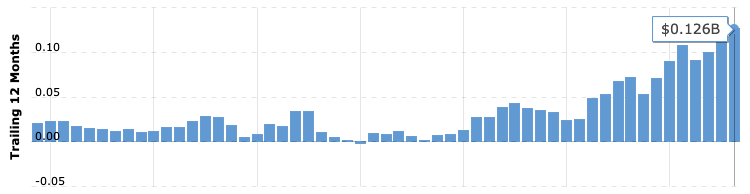

Since Stride became profitable in 2006, its revenue and earnings have increased considerably. From 2009 to 2023, it had recorded an average CAGR of approximately 13.6% in revenues and 13.5% in net profits.

Stride’s revenue from 2009 to its latest earnings report:

Stride’s net income from 2009 to its latest earnings report:

This growth had unsurprisingly accelerated at a faster rate during COVID-19, and yet had not at all decreased even after lockdowns in the US have ended. On the contrary, Stride believes that the forced online learning environment during the pandemic increased parental interest in long-term virtual learning.

Despite its consistent profitability however, Stride has not paid out a single dividend – choosing instead to reinvest in its growth. This allowed Stride to fund its three biggest acquisitions, worth a combined US$260 million, all in cash. As at September 30 2023, Stride’s cash balance sat at US$255 million – almost enough to do all three acquisitions all over again.

Price action

$LRN recently surged 30% to $57 after its quarterly earnings exceeded expectations. Despite that, analysts have a mean price target of $64.25 – a potential upside of over 12%.

Despite being a relatively young company, $GRAB has already successfully attained the distinctive status of a super-app that serves one of the world's most rapidly expanding regions.

What the risks are

Bottom line: $LRN is an EdTech company that has delivered consistently strong revenue and earnings growth without showing signs of slowing down. $LRN is poised to benefit from the growing adoption of online learning and increasing demand for non-degree education.

Remitly Global Inc. ($RELY)

$22.08 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $22.08

- Remitly Global operates as a digital-first remittance company with services extending to over 170 countries and 4 billion bank accounts.

- The company has grown revenue multiple times since publicly listing and operates in an industry that is ripe for accelerating growth.

- Remitly Global’s key risk is that it currently does not yet generate net income due to prioritizing growth over profitability.

What they do

Remitly Global is a fintech company that provides international money transfer services. Its services mainly cater to migrants (in a developed country) initiating a transfer to family and friends overseas (usually a developing country), generating revenue from transaction fees and foreign exchange spreads.

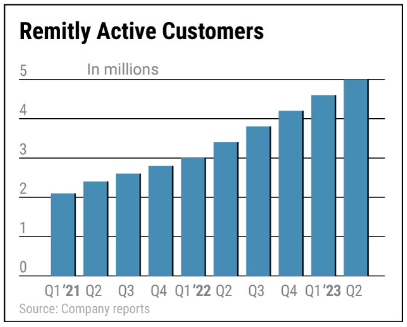

Founded in 2011, the company has since grown its presence to over 170 countries, creating connections between approximately 4 billion bank accounts, 1.1 billion mobile wallets and over 435,000 cash pickup locations. In Q3 2023 alone, Remitly recorded 5.4 million active customers – 42% higher than its number from Q3 2022.

What sets it apart from competitors is its digital-first approach, transparent fee structure and speedy transfers. Users can easily initiate transfers through the Remitly website or mobile app, providing a streamlined and efficient way to send funds across borders. In fact, Remitly’s model is purely digital – not operating a single physical location.

On January 5, 2023, Remitly fully acquired Rewire, an Israeli-based remittance platform for migrant workers, for US$80 million. Remitly states that this acquisition will allow it to accelerate its business in new geographies.

The countries Remitly currently operate in include the US, UK, Europe, Canada and Australia. So far this year, 67% of its revenue has been generated from senders based in the US, 12% from Canada and the remainder from the other parts of the globe.

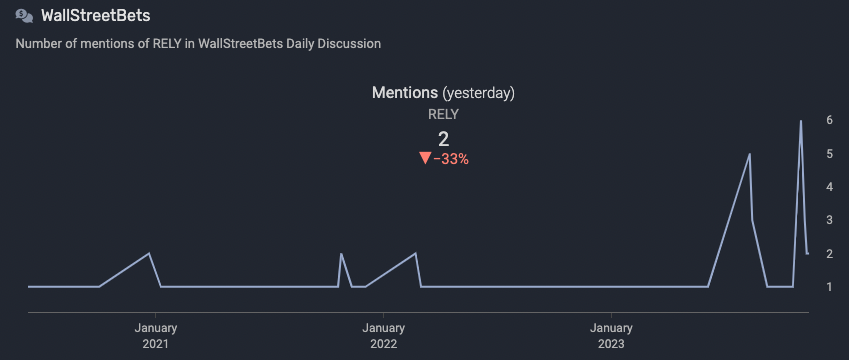

What the market is saying

$RELY sees minimal chatter on social media and what little there is tends to see its business model being compared with its dominant competitors on the market.

Source: quiverquant.com

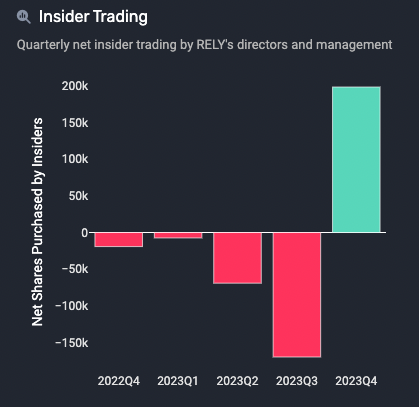

Insiders have sold a significant amount of shares in previous quarters, however the majority of it was through the exercise of derivatives. Only the company’s CTO, Ankur Sinha has sold on the open markets. This quarter saw a turnaround in insider activity, with buying activity now heavily in the green.

Notable comments from Reddit:

“Remitly is 10 years old, WesternUnion is 170 years, yet Remitly has already reached 1/5th of WesternUnion's transaction volume. Once the digital-first providers overtake brick-and-mortar incumbents, I believe the equilibrium state is that space will then be carved out by Transferwise in Europe and Remitly in America.”

– ddropthesoap

“I have used Remitly for YEARS! It is the best money transfer app in terms of best conversion rate and fees. Wise is also good but you get THE BEST rate with Remitly.”

– Glass_Evidence4956

Why $RELY could be valuable

Industry and Market

Remitly Global operates in the remittances industry, a longstanding, essential industry that contributes to more than 15% of the GDPs of several low to middle-income countries. Dominated by large players like WesternUnion, Ria and Moneygram, the nearly US$800 billion industry is expected by the World Bank to grow further as immigration accelerates amid globalization and geopolitical tensions.

Prior to mass digitization, the remittances industry required market players to have physical locations across the globe. This created high barriers to entry and allowed for long-established companies – Western Union has existed since 1851 for example – to operate in a largely oligopolistic manner. This meant high fees, lower regulation and a lack of transparency.

As technology advanced however, barriers lowered for tech companies like Remitly to enter the industry. Operating digitally-first, $RELY has been able to take market share from the industry’s key players and has since grown its number of active customers by 47% year-on-year this year. This is partly due to Remitly not operating a single physical branch – helping it keep costs down and transfer these savings to customers in the form of competitive pricing.

The World Bank noted that only 3% of remittances in 2022 were done digitally, showing the level of opportunity there is in the market as more developing markets adopt the use of mobile phones and computers.

Financials

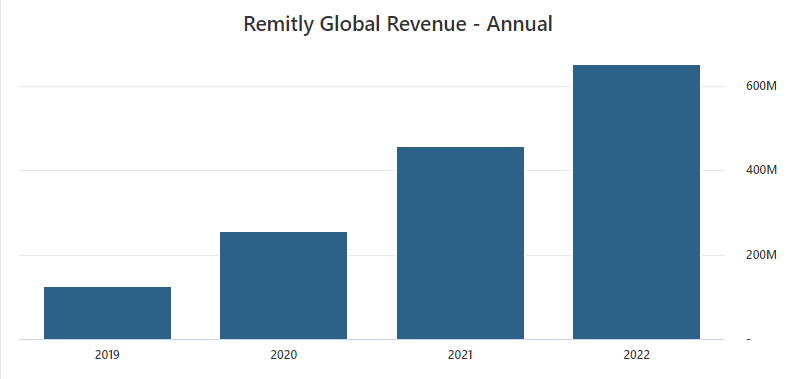

Since 2019, Remitly Global has more than quadrupled revenues, largely in line with its growth in active customers. The company currently chooses growth over profitability, investing in marketing and R&D expenses and seeing these costs grow 71% from 2021 to 2022. The return is relatively high, with revenue per employee calculated to be US$322k.

While currently unprofitable, Remitly Global’s balance sheet shows strong ratios. The company has a relatively low liquidity risk, holding $729 million in current assets against total liabilities of $300 million. Additionally, Remitly does not currently hold any long-term debt (as of the end of Q3 2023).

Price action

Since listing in 2021, $RELY’s share price is currently down almost 50%. Despite its mid-year rally this year, $RELY fell over 30% after its earnings release showed Q3 numbers to be below analyst expectations.

Despite that, the mean price target that seven analysts have for $RELY is $29.57 – representing a 34% upside to its current share price.

What the risks are

Bottom line: Remitly Global has grown tremendously in recent years within an established industry ripe for further opportunities. The company currently prioritizes further growth at the expense of profitability, which may not suit some investors, however its long-term prospects show promise.