Summary

StoneCo is a Brazilian fintech company that has a unique position of offering both financial and software services. It has a strong history of revenue growth with its CEO anticipating an eightfold increase in its net income by 2027. One of StoneCo’s prominent shareholders is Berkshire Hathaway.

Snowflake is a fintech company that provides customers with a comprehensive cloud-based data platform. Despite competing with larger names such as Amazon and Google within its field, Snowflake has been able to take market leadership in its industry. Analysts believe that Snowflake’s current share price may present a potential upside.

StoneCo Inc. ($STNE)

$18.01 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $18.01

- StoneCo is a Brazilian fintech company that operates in both the financial services and software industries of Brazil.

- Its CEO expects its net profits to grow eightfold by 2027.

- $STNE rallied over 70% in the past month after its CEO announced his bullish outlook for the company. Despite that, it currently trades below its IPO price and significantly below its all-time high.

- Berkshire Hathaway has invested in StoneCo since its IPO and continues to hold a stake.

What they do

StoneCo is a Brazilian fintech company that provides payment processing and financial services. It currently reports and operates two main segments: financial services and software solutions.

- Financial Services Segment: Comprising financial services solutions which includes payments solutions, digital banking, credit, insurance solutions as well as its registry business TAG.

- Software Segment: Further segmented into two sub-categories.

- Core: Composed of point-of-sale/ERP solutions, electronic fund transfer and QR Code gateways used for payment solutions and CRM and reconciliations services.

- Digital: E-commerce platform (Linx Commerce), marketing tools and a marketplace hub.

StoneCo initially operated as a pureplay financial services company but its US$1.28B acquisition of Linx, a company formerly listed on the NYSE, allowed the company to expand into software solutions. StoneCo now prides itself as the only company in Brazil to operate in both the financial services and software industries.

While the acquisition has expanded StoneCo’s operations, the majority of its revenue still comes from its financial services segment. StoneCo’s software segment comparatively generates between 14% to 15% of StoneCo’s total annual revenue.

StoneCo was founded in 2000 and had its Nasdaq IPO in 2018 at a price range of $21 to $23 a share.

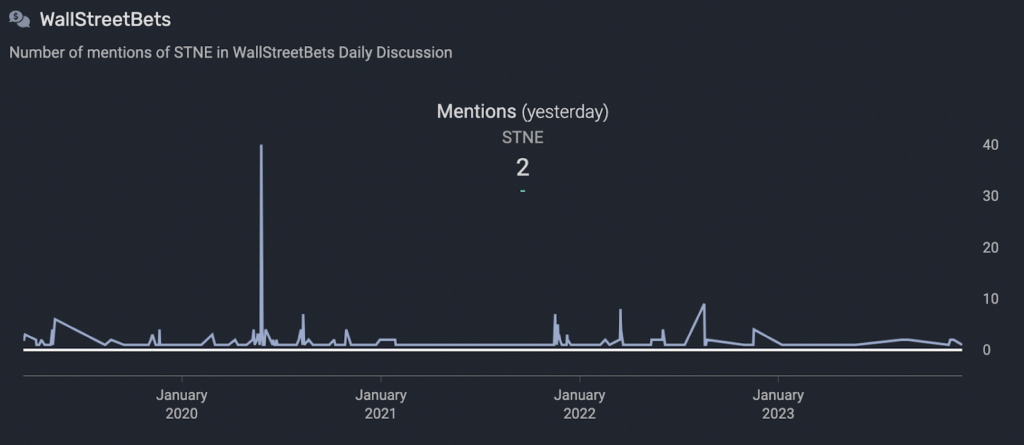

What the market is saying

Despite being a Brazilian company, StoneCo actually gets a decent number of mentions on US forums. Most of it could perhaps be attributed to the fact that Berkshire Hathaway has held shares of the company since its IPO. StoneCo gets mentioned noticeably more in the “ValueInvesting” subreddit.

Source: quiverquant.com

Recent sentiment around StoneCo as a stock and company are mixed. On the one hand, some think that it has strong potential for growth and is currently undervalued, but on the other hand, others find it risky given its operations being in an emerging market.

Notable comments from Reddit:

“Brazil is way behind in the times compared to more developed countries in this industry. The merchants like StoneCo because they're local and have the white glove customer service and they have other products (such as business /financial software solutions) for the merchants beyond just POS solutions. The switching costs thus become high and it's harder for competitors to take share from StoneCo..”

– ContrarianValues

“I personally am bullish on both Stoneco and PagSeguro, but Stoneco is the better longer term investment. Valuation wise, we are looking at a 75% gross margin business trading at 2x sales. No growth is priced in, yet the fundamentals say high growth. I wouldn't consider this a “value” stock, due to it's short track record. But I do consider the business a good one, and I find the valuation compelling.”

– r_silver1

Why $STNE could be valuable

Industry and Market

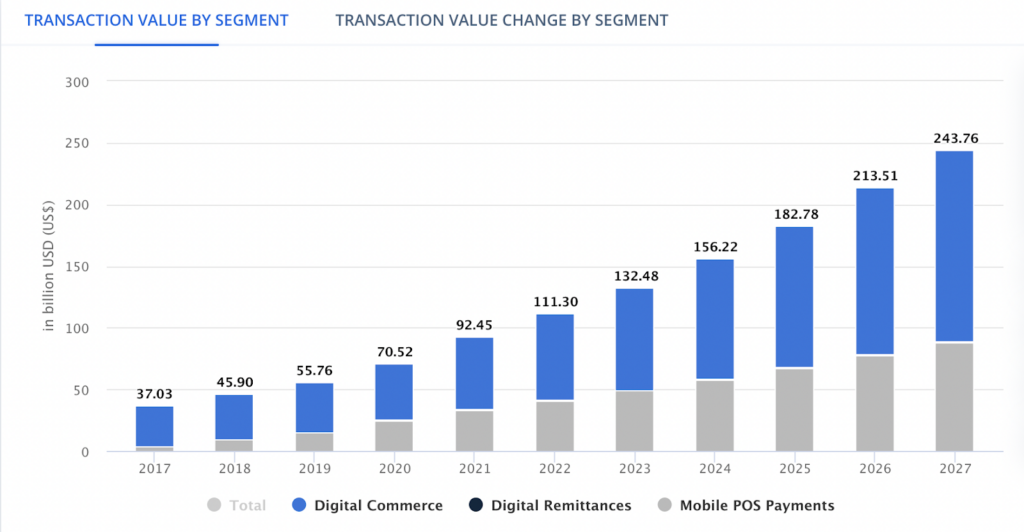

StoneCo currently operates purely within Brazil, having presence in its digital payments, retail software, and e-commerce industries. Operating in an emerging market is often considered a double-edged sword – it has the potential to grow at an accelerated rate compared to developed markets but also at an increased macroeconomic risk.

The total transaction value of Brazil’s digital payments sector is estimated to be US$132.5B in 2023, but this is expected to grow at an astounding CAGR of 16.5% to reach US$243B by 2027. As of its latest data, StoneCo is estimated to have captured only 11% of this market, marking tremendous opportunity for growth.

Source: Statista

StoneCo’s main target market is the micro, small and medium-sized businesses (MSMB). A growing customer base that it has successfully engaged with since its inception.

Financials

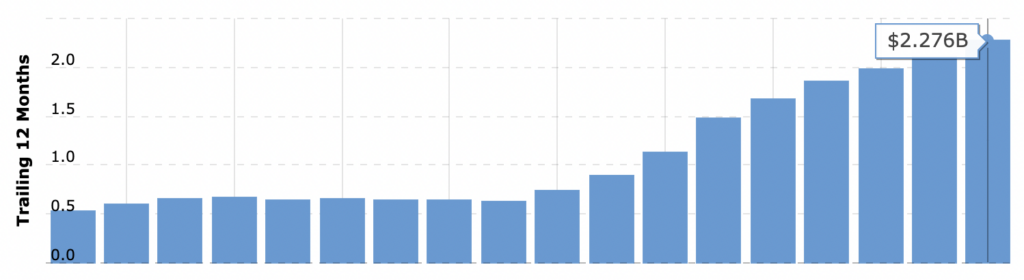

Since publicly listing in 2018, StoneCo has consistently increased annual revenue – recording double-digit growth rates in the last three years. As of its last quarterly report released in September, StoneCo posted year-on-year revenue growth of 35.4%.

StoneCo’s TTM Revenues (2019-2023):

Source: Macrotrends

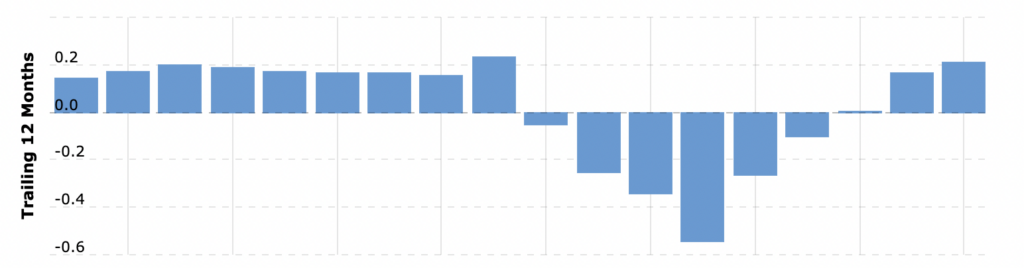

Despite this, however, StoneCo records varying levels of net income with some years green and some in the red. The last two years have been unprofitable, largely due to ballooning levels of interest expense that it pays. StoneCo addressed this earlier this year, citing rising interest rates as the main cause rather than larger levels of debt.

StoneCo’s TTM Net Income (2019-2023):

Source: Macrotrends

Just last month, StoneCo made headlines after it unveiled plans to multiply its profit eightfold by 2027. In an extremely bullish outlook, StoneCo’s CEO highlighted that after finally building a “super-profitable, cash-generating business model” in the last few years, it will finally look to leverage this into improving profitability.

Price action

$STNE’s share price increased by over 70% in the weeks following its CEO’s statement. Despite that, at its current share price of $17.84, StoneCo continues to trade below its IPO price and at a tiny fraction of its all-time high of $92.

What the risks are

Bottom line: $STNE is a Brazilian fintech company that has a unique position of offering both financial and software services. It has been able to grow revenue consistently, and while it has not generated profit in the last two years due to a challenging interest rate environment, its CEO believes that it has laid down the foundations to become a highly profitable cash-generating company in the coming years.

Snowflake Inc. ($SNOW)

$195.67 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $195.67

- Snowflake is a fintech company that operates a market-leading cloud-based data platform.

- The company recorded a total revenue growth of approximately 780% since its IPO in 2020. It has also consistently grown its customer base.

- Snowflake has not yet achieved profitability due to higher marketing and research and development expenditures.

What they do

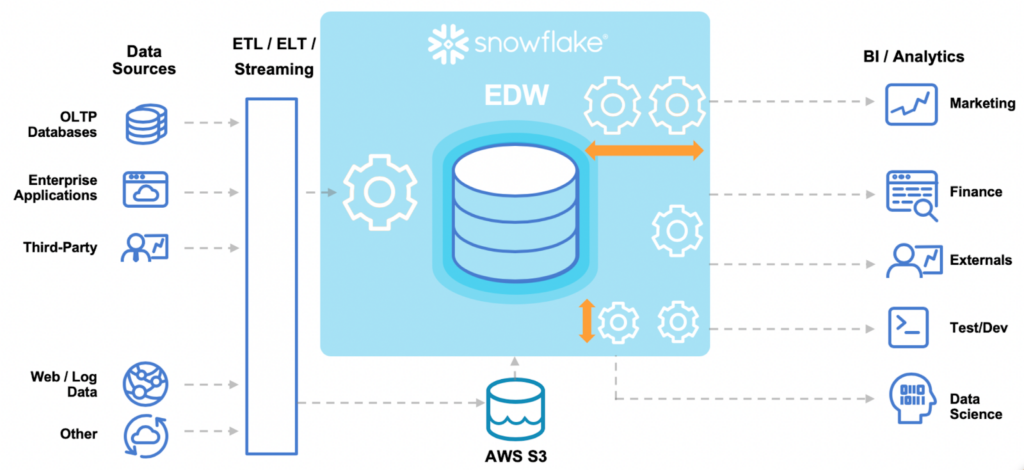

Snowflake is a fintech company that provides customers with a comprehensive cloud-based data platform. Catering mainly to businesses and enterprises, the company’s platform allows for data across different sources – including large cloud platforms like AWS, Azure and Google Cloud – to be unified and used for workloads including data warehousing, data lake, data engineering, data science and data sharing.

In simpler terms, Snowflake markets itself as “data-as-a-service” that provides an end-to-end solution for users to query data for a wide variety of use cases.

While Snowflake separates its revenue into two segments – product and professional services – the fintech company generates the vast majority of its revenue from its product. Snowflake has made it clear in its annual report that its services are mainly used to provide support to customers who use its product rather than as a source of profitability.

A sample of how Snowflake works. Source: AWS.

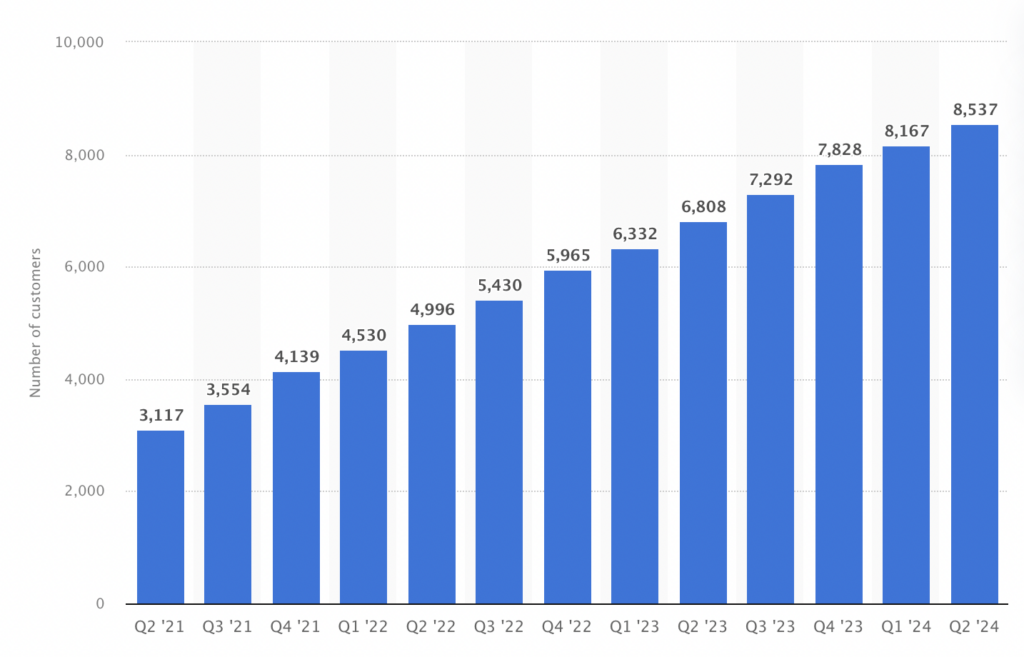

Since its founding in 2012, the company has already grown its customer base to over 8,500 organizations across the globe, with clients including over 600 of the Forbes Global 2000 companies. The company was one of the largest IPOs in 2020, listing with an impressive valuation of $33B.

One probable factor to this astounding growth is Snowflake’s consumption-based business model. In contrast to the more common subscription-based model, Snowflake’s business model charges customers based on how much of its services is used within a given time frame. This flexibility means businesses have control over how much they spend on the product. This allows Snowflake to capture more market share.

What the market is saying

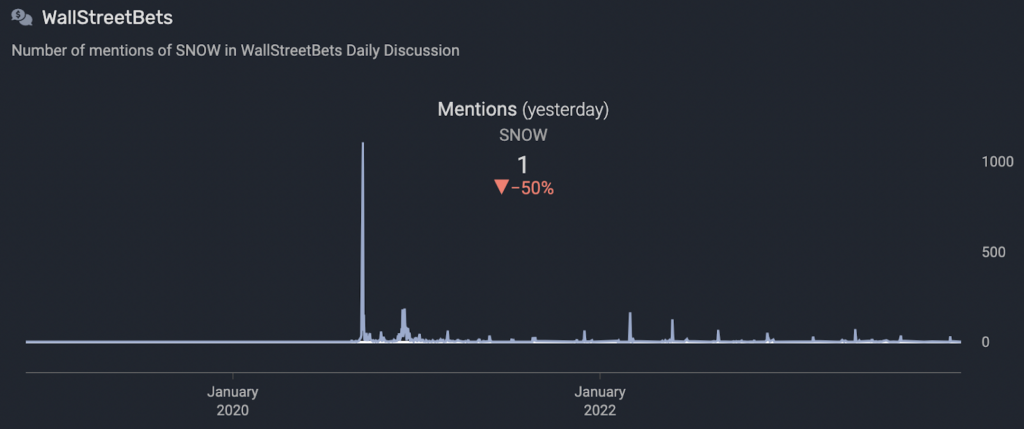

$SNOW sees minimal chatter on social media these days compared to when it was first listed, however recent posts that mention the stock have mostly been positive sentiment about its current share price and its business model.

Source: quiverquant.com

Several comments on social media see the stock as a potential investment, mainly thanks to Snowflake’s astounding potential for growth. Additionally, several of those working within the field find Snowflake’s platform to be invaluable in handling their workload – some going as far as to saying that Snowflake’s product is leagues ahead of its competitors.

Notable comments from Reddit:

“Tough company to value imo. Yes the multiples are absurd and SBC is out of control, but it’s the best of the best at what it does. No other company comes close.”

– LargeDan

“Snowflake charges for computation and storage. Its so powerful that it can deliver data that is impossible or absurdly slow on older platforms. The more complex their customers’ data is, the more valuable / costly snowflake becomes for said customers.

As tech grows and digital transformation grows in non-tech, and recent development in AI. I see it having really strong future”

– twrex67535

Why $SNOW could be valuable

Industry and Market

Given its data-as-a-service business model, Snowflake can realistically offer its services to any enterprise that handles data.

To provide a more specific reference however, Snowflake has directed its focus towards the total addressable market of the Cloud Data Platform, which it estimates to grow to almost $250B by 2026. Snowflake has also been proactive in penetrating the fast-growing AI market with its recent partnership with NVIDIA. Earlier this year, Snowflake noted a 91% growth in customers that use its product for generative AI workloads.

Despite competing with products funded by global behemoths (e.g. Amazon’s Redshift and Google’s BigQuery), Snowflake has risen to become the market leader in data warehousing technology. With cloud-storage, big data and AI set to grow, Snowflake continues to have a massive market opportunity and a long runway for growth.

Financials

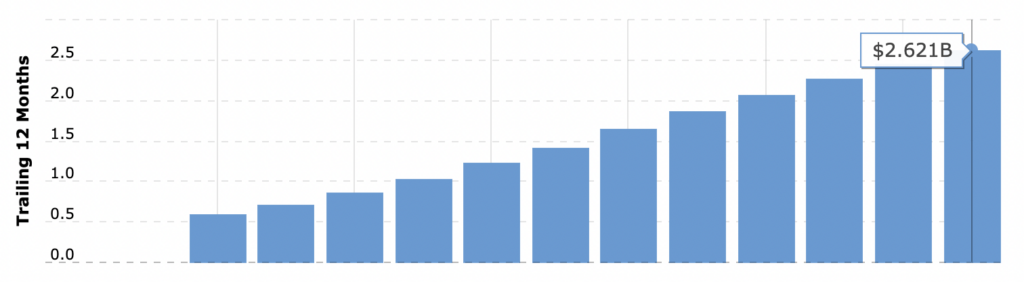

Since its IPO, Snowflake has achieved an unprecedented level of revenue growth. Looking at the numbers can prove the point – its total revenue had grown from $265m in FY2020 to $2.1B in FY2023. That’s a 780% increase in three years alone.

Snowflake’s TTM revenues every quarter since 2021:

Source: Macrotrends

Despite challenging macroeconomic conditions, the company’s latest report showed third-quarter revenue of $734 million and product sales of $699 million.

This marked impressive year-over-year growth rates of 32% and 34%, respectively. What makes this impressive is that Snowflake’s consumption-based model theoretically has a higher chance of seeing larger decreases in revenue than a subscription-based model during a slowdown in economic activity.

Snowflake has not only consistently increased its customer base, but it has also seen an increase in the number of high-spending customers. 436 enterprise customers now contribute over $1M in revenue each – a 52% growth from the previous year.

Snowflake’s customer base:

Source: Statista

While Snowflake’s exponential revenue growth is noteworthy, one major thing to note is that the company has yet to generate profits. In conjunction with its growth, Snowflake has consistently increased the amount it spends on marketing plus research and development, to the point where its total expenses exceed its revenues.

While this has paid off so far, Snowflake has only kept itself afloat by regularly raising more capital through the issuance of new shares.

Price action

Snowflake had one of the most explosive IPOs in recent years with its share price more than doubling its IPO price of $120 on the first day of trading. While it reached a high of $392 in 2021, some believe that its price back then was severely overvalued at a P/S ratio of over 180.

Snowflake now sees a relatively depressed stock price below $200, which some analysts believe to be below its fair value.

What the risks are

Bottom line: Snowflake is a market leader in its field and its explosive revenue growth and customer base is a testament to that. However, it operates in a highly competitive environment and is still unprofitable. Analysts believe that its currently depressed share price may have room to grow.