Summary

Axcelis Technologies ($ACLS) manufactures capital equipment used in the production of semiconductor chips. The company has grown off the back of two megatrends: the increasing adoption of EVs and the rise of AI. Axcelis believes that these factors will continue to drive long-term growth. The current consensus analyst price target also supports this thesis.

AppFolio ($APPF) operates as a provider of real estate property management software. AppFolio has recorded consistent double-digit revenue growth since its IPO. $APPF expects to grow from the industry shift to automated cloud-based property management.

Axcelis Technologies ($ACLS)

$137.88 – Share price at the time of writing

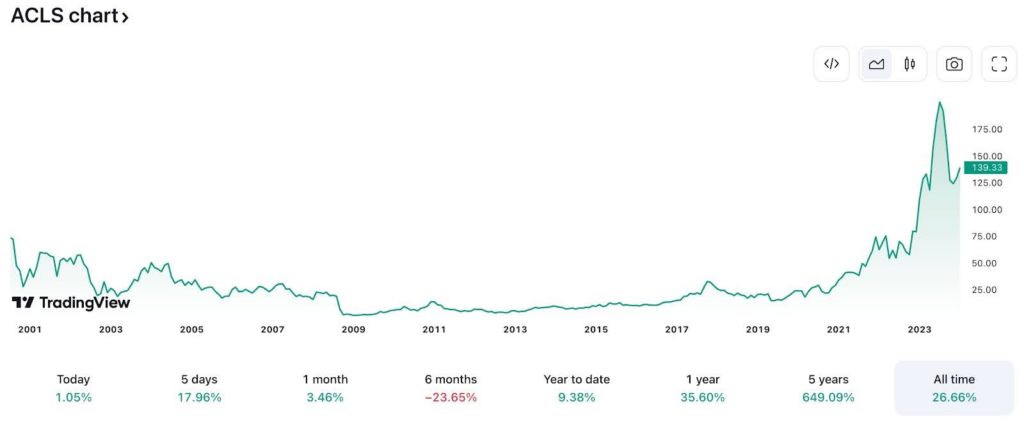

Source: tradingview.com

Summary

- Share price at the time of writing: $137.88

- Axcelis Technologies manufactures ion implantation equipment used in the production of semiconductor chips.

- The company’s customers include large semiconductor chip manufacturers, including Samsung and SMIC.

- Axcelis’ financial reports show that it is growing from the increased adoption of EVs, AI and advancements in the communication sector.

- $ACLS has returned over 500% in the last five years. The consensus analyst price target estimates a further 20% upside.

What they do

Axcelis Technologies is a US-based company with a 46-year long history of designing, manufacturing and servicing large equipment needed to fabricate semiconductor chips.

The company produces equipment for ion implantation. This is a material engineering process used to control the flow of electricity in circuits. This means that Axcelis’ technology is essential for the production of semiconductor chips.

Axcelis’ revenue model operates in two segments: product and services. Product includes new and used sales of its equipment, sales of spare parts and product upgrades. Services include set-up labor and aftermarket maintenance. Axcelis has made the majority of its revenue from its product segment, with it making up 96.8% of total revenue in 2022.

Axcelis has a customer base of leading semiconductor chip manufacturers all over the globe. These include Samsung, Semiconductor Manufacturing International Corporation (better known as SMIC) and Yangtze Memory Technologies. The company’s ten largest customers accounted for 59%, 70% and 74% of total revenue in 2022, 2021 and 2020.

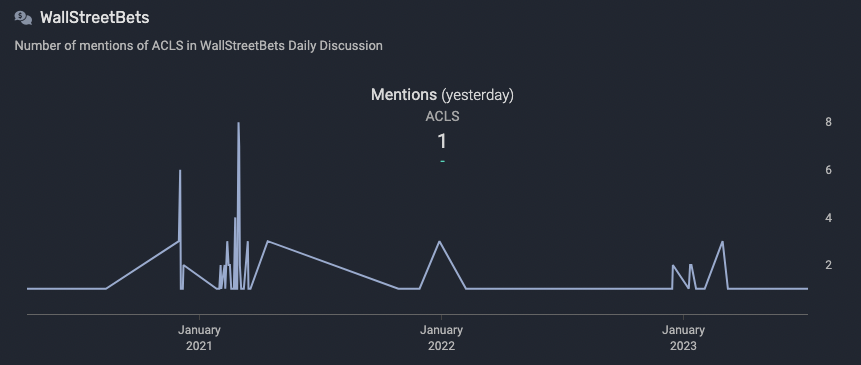

What the market is saying

Semiconductors have been a hot topic on investment forums since the US started legislating export controls for them. As a company operating in the sector, Axcelis is often mentioned. A lot of the chatter around Axcelis is discussion on its line of business and the potential growth of the stock.

Source: quiverquant.com

Notable comments from Reddit:

“Axcelis Technologies Inc is a leading semiconductor equipment manufacturer. If that isn't enough these days…

… Diving into their financials is where we really see the impressive side of Axcelis the company has seen 38.9% growth in total revenue from 2021 to 2022. ”

- SmokeyChunk659

“I agree with your investment thesis. Axcelis is a strong company in a growing industry, and I believe their share price will continue to rise as the demand for semiconductors increases.”

- VisualMod

Why $ACLS could be valuable

Industry and Market

Axcelis Technologies operates in the semiconductor industry. A sector that is essential in the automotive, AI, communications and technology industries.

Axcelis is part of the semiconductor capital equipment sector. This sector supplies the equipment required for semiconductor producers to manufacture their products.

The broader semiconductor industry has grown exponentially in recent years. Total revenues in the sector almost doubled between 2016 and 2022. The strong growth is not expected to slow down. Gartner estimates the sector to grow 17% this year with revenues totaling US$624B. McKinsey predicts the global semiconductor industry to be worth a trillion dollars by 2030.

Axcelis believes the main growth drivers in the industry will remain strong. These include the rising adoption of electric vehicles which use almost double the amount of semiconductors than diesel vehicles. Companies also need semiconductors to develop and use AI.

But, it’s important to note that the semiconductor industry is cyclical. Chip manufacturers invest in capital equipment during periods of high chip demand, but reduce capital spending during phases of low chip inventories and prices. For Axcelis, this may mean short-term inconsistency in its growth rates and profitability despite a promising long-term outlook.

Financials

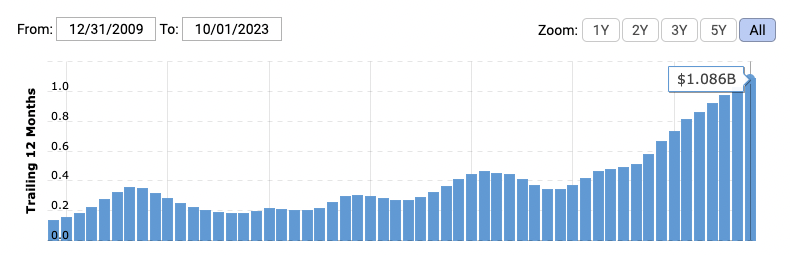

Despite the cyclical nature of its industry, Axcelis has consistently recorded growing revenues. The last few years have returned especially well. With revenues growing an average of 39% every year since 2020.

$ACLS quarterly revenue from 2009 to 2023:

Source: macrotrends.com

$ACLS’s gross profit margin also sits healthy at about 43.7% in 2022. The company targets a gross profit margin of over 45% by 2025. Axcelis has proven its ability to grow this figure, with gross profit margins recorded at the level of 34.7% just a decade prior.

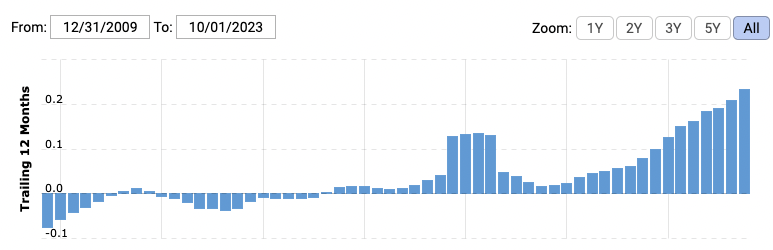

This growth in revenues and profit margins has translated into increased net income levels for Axcelis, especially in the last three years. Axcelis recorded impressive net income year-on-year growth rates of 193%, 97% and 86% in 2020, 2021 and 2022.

$ACLS quarterly net income from 2009 to 2023:

Source: macrotrends.net

Axcelis has rewarded investors by implementing a growing share repurchase plan that began back in 2019. As of September 30, 2023, Axcelis recorded a robust balance sheet that boasted high levels of current assets that can alone already more than cover its total liabilities.

Price action

It seems the reaction to Axcelis’ growth or its share repurchase plan may have helped prop it up. Despite this, $ACLS’ share price has increased more than five-fold over the last five years. It currently trades 30% off its 2023 high.

Analysts still seem to expect further upside. The consensus analyst price target is about 20% higher than $ACLS’ current share price.

What the risks are

1️⃣ Geopolitical Risks: $ACLS operates in an industry that is currently under heavy regulation. With a customer base that is domiciled all over the globe, Axcelis runs a higher risk of being impacted by changes in trade relationships and taxes. Axcelis has very recently had to acquire new licenses in order to continue existing business relations with one of its largest customers.

2️⃣ Cyclical Demand: Axcelis has benefited greatly from a chip shortage in the last two years, but the industry is expected to see a short-term cyclical downturn that may affect Axcelis’ financials in the near future.

3️⃣ Concentration on select few customers: In 2022, Axcelis received over half of its revenues from just 10 of its customers. In fact, its two largest customers accounted for over 10% of its revenues each. This high concentration of revenue in few customers results in greater exposure for Axcelis to changes in even a single contract, running higher risks for Axcelis in the case of negative circumstances.

Bottom line: Axcelis Technologies is a capital equipment manufacturer that supplies its technology to global semiconductor chip producers. $ACLS has greatly benefited from the growth in the semiconductor industry in the last few years and is expected to continue so in the long term. Even with the share price growth it has experienced in recent years, analysts still seem to believe it has potential upside.

AppFolio, Inc. ($APPF)

$182.07 – Share price at the time of writing

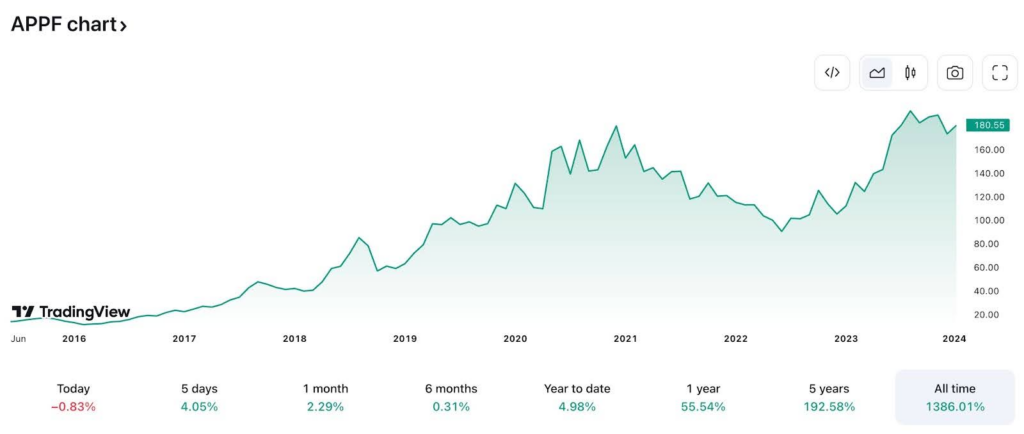

Source: tradingview.com

Summary

- Share price at the time of writing: $182.07

- AppFolio operates as a provider of real estate property management software. It helps property managers with accounting, marketing, maintenance, tenant screening, electronic payment systems and insurance.

- Its industry is set to expand at a CAGR of 8.1% by 2030. Given that its products already solve what new customers look for this will benefit $APPF.

- The company has recorded consistent double-digit revenue growth since going public in 2015.

- The consensus analyst price target shows further potential upside. This is despite its share price already recording a growth of over 1,100% since its IPO.

What they do

AppFolio is a technology company founded in 2006 that offers cloud-based software designed for the property management industry.

The company generates revenue through a subscription model and a per-use model. It reports revenues using a breakdown of three segments:

- Core Solutions: AppFolio’s flagship Property Manager platform, which assists both third-party property managers and owner-operators in handling various aspects of property management, including accounting, leasing, marketing, and maintenance.

- Value Added Services: AppFolio’s extension to its core product called AppFolio Property Manager Plus, which further includes electronic payment, tenant screening and insurance services.

- Other services: These include onboarding assistance and non-recurring services.

In 2022, AppFolio had 18,441 paying customers, generating 28% of revenues from its core solutions, 69% from its value-added services and the remaining from other services.

Before 2022, AppFolio also owned WegoWise, its cloud-based utility analytics software, and MyCase, a legal practice and case management software. MyCase sold in 2020 for a total of US$193m, while WegoWise sold in 2022 for US$5.2m.

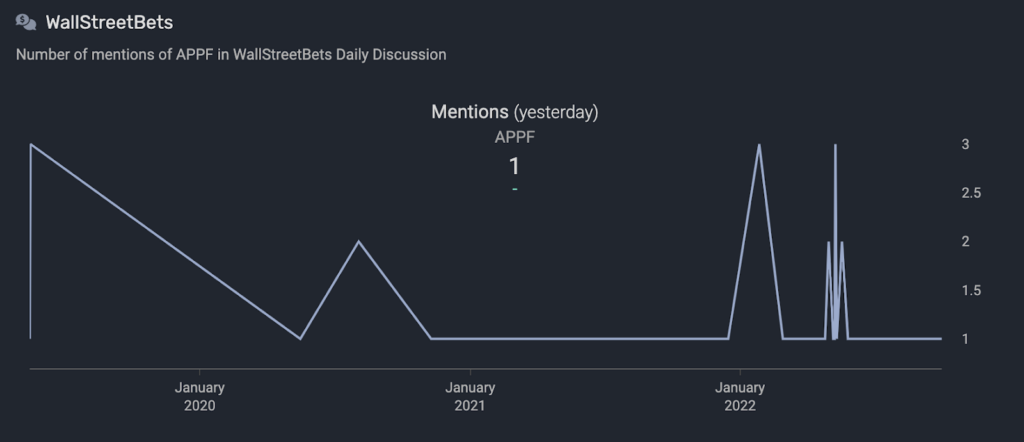

What the market is saying

$APPF as a stock is not mentioned often on social media. Most of the discussion is from customers on how AppFolio’s services benefit them. A dedicated subreddit for the company called r/AppFolio also sees activity from time to time.

Most of the discussion around the stock occurred close to the time of its IPO back in 2015.

Source: quiverquant.com

Notable comments from Reddit:

“I have used Appfolio for over 10 years. It would be excellent for you. There are many features to learn and use to get your dollars worth out of the program.”

– bikermom45

“My company uses Appfolio, we are pretty happy about it as they are constantly coming out with new updates and improvements.”

– iZWi

Why $APPF could be valuable

Industry and Market

AppFolio operates in the real estate property management software (PMS) industry. The industry is still in its infancy. It has seen growth in demand as the real estate sector moves towards using web-based platforms.

The global PMS industry was valued at US$4.5B in 2022 and is estimated to grow at a compound annual growth rate of 8.1% until 2030 as property managers move from manual to automated management. As one of the leading players in the industry, AppFolio expects to benefit from this growth.

Within the industry, certain segments are also thought to stand out. One notable segment is the cloud segment, an AppFolio already operates in. Many businesses of various sizes continue to migrate towards cloud-based software.

In 2022, the cloud segment dominated the industry's revenue. Making up over 60% of it's revenue. Showcasing the widespread adoption of cloud solutions across businesses of all sizes.

Financials

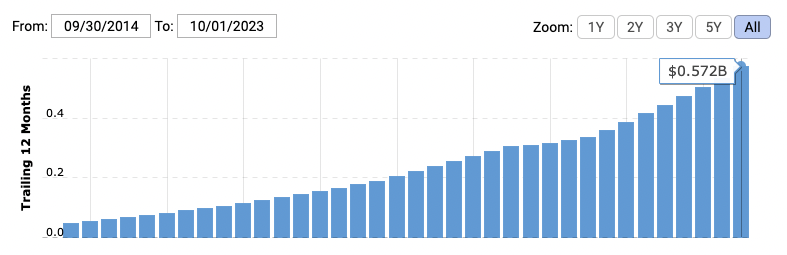

Since its IPO in 2015, AppFolio has seen its business perform well. With revenues increasing with consistent double-digit growth rates yearly.

AppFolio revenue from 2014 to 2023:

Source: macrotrends.net

AppFolio has cycled between years of being in the green and years of red. With its most recent full-year report (2022) showing a net loss of US$68M.

While this may turn off investors seeking returns through dividend payouts, this isn't a major cause for concern. The lack of profitability was due to its research and development costs almost doubling from the previous year. This is part of AppFolio’s strategy as it aims to increase its pace of innovation. The company has consistently added new features to its products.

Despite recording a net loss, AppFolio boasts a strong balance sheet. With high liquidity and minimal debt. The company used the funds it received from selling its subsidiaries in 2020 and 2022 to fuel further growth.

Price action

$APPF has recorded a share price growth of over 1,100% since its IPO. A testament to the level of optimism investors have in its business model.

Despite that, the current consensus analyst price target is at US$228. Which is around 25% higher than the current stock price.

What the risks are

1️⃣ Inconsistent profitability: AppFolio has recorded some years of profitability since its inception. However, this short track record presents higher risk and uncertainty of AppFolio being able to sustain its operations in the long run. Additionally, the majority of its total earnings came from the gains on the sale of its subsidiary – a non-operating event that is unlikely to happen regularly.

2️⃣ Industry-related risk: AppFolio’s operations tie in heavily with the real estate industry, which is generally considered to be cyclical and can have periods of downturn.

3️⃣ Cybersecurity: AppFolio operates purely web-based and also has exposure to the cloud. This means a higher exposure to breaches in cybersecurity that may adversely affect AppFolio’s reputation and its relationships with its customers.

Bottom line: $APPF has grown to become one of the dominant names in the real estate property management software industry, thanks to its focus on innovation and development. This is proven by AppFolio’s record of consistent double-digit revenue growth since its IPO. Operating in an industry set for further growth, AppFolio’s strong product may see it benefit greatly.