Summary

F5, Inc. ($FFIV) is a software company that provides a range of web applications and security solutions. The company currently has a presence in the cloud, cybersecurity and AI industries and continues to invest in research and development. F5 has been profitable since 2002 and continues to grow revenue every year. Consensus analyst price targets show that $FFIV has further upside despite its already strong performance in the last year.

Modine Manufacturing Company ($MOD) creates equipment for managing heat in buildings and vehicles. While it saw a decade of flat revenues and share prices, Modine recently developed a new strategic plan to streamline its business. Its new plan sees it targeting the automotive parts industry, which is also set to grow thanks to the rising adoption of EVs. Since it enacted its strategy, Modine has recorded double-digit revenue growth and its highest net income in decades. Despite the market already sending its stock price up exponentially, analysts believe there may still be further upside potential.

F5, Inc. ($FFIV)

$182.35 – Share price at the time of writing

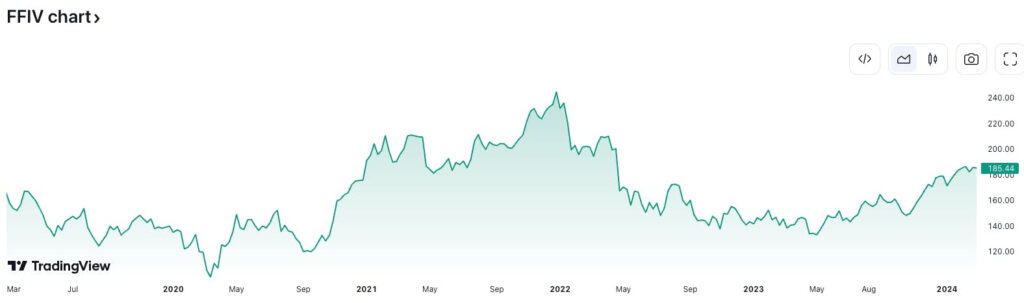

Source: tradingview.com

Summary

- Share price at the time of writing: $182.35

- F5 is a leading provider of multi-cloud application services and application security solutions.

- The company heavily invests in research and development. While starting out providing web infrastructure services, it now also provides cloud, cybersecurity and AI-powered data solutions.

- F5 has shown consistent revenue growth and has been profitable since 2002. It also has a robust balance sheet and has exhibited strong cash flow statements in the last several years.

- $FFIV has rallied over the last year and the consensus analyst price target shows further upside.

What they do

F5 is a leading provider of multi-cloud application services and application security solutions. Founded in 1996 and publicly listed three years later, F5 has a long history of growth. F5’s flagship product line is often simply referred to as “F5.” It produces a range of software designed to enhance the performance and security of applications across networks.

The company breaks down its product offerings into a few key segments:

- F5 Distributed Cloud Services: an application management service that provides security, connectivity, DNS and a management platform for cloud-based applications. Its aim is to increase efficiency and lower the costs of operating a cloud-based application, regardless of its platform or architecture.

- F5 NGINX: NGINX provides the entire architecture that enterprises need to create apps and APIs. The product includes web servers, content caches, firewalls, API gateways and load balancers. NGINX, pronounced as “engine-x”, was acquired by F5 in 2019.

- F5 BIG-IP: offers a range of hardware and software solutions designed to optimize the performance and security of legacy applications. BIG-IP is F5’s first ever product and it continues to evolve to suit newer applications and technologies.

While F5 has several product lines, it reports revenues in two segments: product and services. F5 generates product revenue through either perpetual, subscription or usage-based models. In FY2023, around 84% of F5’s product revenues were from subscriptions while the rest were from perpetual licenses. Services revenue on the other hand relates to training, maintenance and consulting services. F5’s product and services segments generally share a 48% and 52% split of total revenues.

As a provider of several product lines, F5’s customers include both medium and large companies, government entities and service providers. In the year ended September 30, 2023, sales outside the U.S. represented 44% of its net revenues. This shows the scale of F5’s operations. The company currently services corporations across all continents, including several Fortune 1000 companies.

What the market is saying

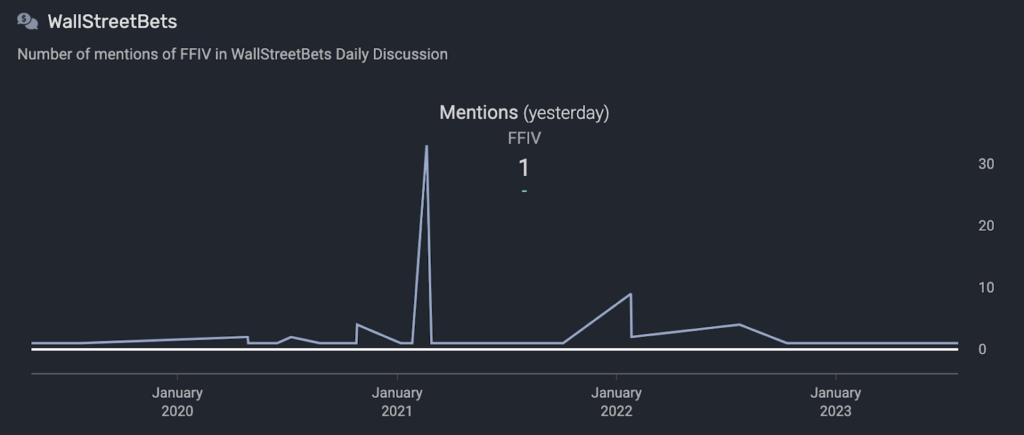

$FFIV as a stock does not currently see too many mentions in stock-related forums. However, it does see a lot of discussion among its users. Several of them are extremely happy with F5’s products and services. F5 also has a dedicated subreddit with several thousand members.

Source: quiverquant.com

Notable comments from Reddit:

“I have had FFIV stock on and off for a few years, it's great! ”

- [redacted]

“If you're a smaller shop without huge throughput scale, then you can run the free verison of HAProxy or NGINX and call it a day.If you're a bigger shop that needs 99.999% uptime in your current “or else”, then F5 is the best on the market.”

- NickiNicotine

“It's like a swiss army knife. It can do everything.”

- SensitiveBug0

Why $FFIV could be valuable

Industry

F5 mainly operates in the software industry. Thanks to its long history, it has successfully capitalized on decades of global digital transformation. Despite the historical growth, the software industry is still set to see a CAGR of about 5.3% in the next four years. Application development and enterprise software are expected to grow the most. These areas are where F5 specializes in.

F5’s numerous product lines also allow it to diversify its business across the industries of cloud and cybersecurity. Cloud-based software architecture is expected to become an integral part of enterprises in the future. Some even estimate that total enterprise spending for cloud software will go over $1 trillion by this year. Additionally, F5 specializes in hybrid and multi-cloud application management. These areas are now gaining traction as a preferred choice for enterprises.

The demand for cybersecurity unsurprisingly also goes hand-in-hand with the growth of software and cloud. In fact, McKinsey believes that the total addressable market of the global cybersecurity industry presents a $2 trillion opportunity.

Earlier this month, F5 further unveiled its new AI-powered data platform. Called the “F5 AI Data Fabric”, the new development would leverage AI into making F5’s current product lines bring more value to customers. This latest announcement would thus potentially open the doors for F5 to be a player in the AI industry.

Aside from the above, F5 has also diversified its market to both developed and developing countries. The company is exposed to both the growing demand of web infrastructure (from developing countries) and cloud and cybersecurity (from developed countries). This means that all of F5’s product suite remains relevant, including BIG-IP which was created in the 90’s.

Financials

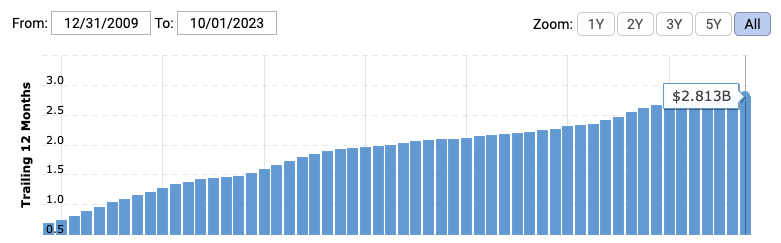

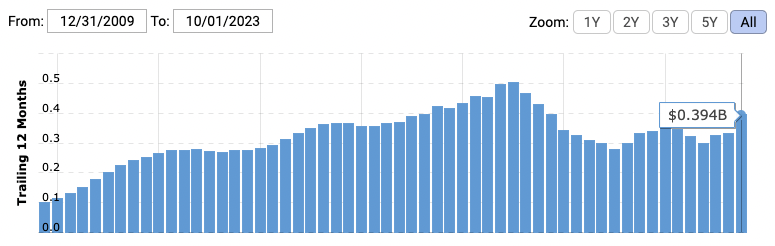

Since listing in 1999, F5 has consistently recorded higher revenues almost every year. The company has also been profitable since 2002. F5 has grown net income over the long-term, however it has trended relatively flat in the last four years.

$FFIV TTM revenues per quarter from 2009 to Q3 2023:

Source: macrotrends.com

$FFIV TTM net income per quarter from 2009 to Q3 2023:

Source: macrotrends.net

Like many software companies, F5 enjoys higher levels of gross margins. Since 2010, F5’s gross profit margin has trended at around the 80% mark. Its income statements show that the company constantly pours substantial funds ($540m in 2023) into research and development. Similarly, F5 does not cut corners with sales and marketing expenses with these taking up over half of gross profits last year. These may provide some insight as to why F5 has not paid out a single dividend despite a long history of profitability.

F5 has posted robust balance sheets and cash flow statements in the last few years. At the end of 2023, F5 sat on a cash balance of close to $800m. This amount more than doubles its short-term payables. F5 has also recorded strong levels of positive free cash flows since 2008 (except for 2020). Interestingly, F5 even has years where it earns cash from investment income.

Given its growing revenues, consistent profitability and strong financials, F5 does not currently show high financial risks and looks to have a long future ahead.

Price action

Like the broader tech industry, $FFIV saw strong gains in 2021 where it hit a high of about $245. While it fell to a low of $127 in April 2023, $FFIV has been rallying since then after constantly reporting upbeat earnings in the last few quarters.

It currently trades at a P/E ratio between the range of 20-25. Despite its strong gains in the last year, analysts believe there is further potential upside to $FFIV. The current consensus target price is at $193.

What the risks are

Bottom line: F5 is a leading provider of multi-cloud application services and application security solutions. The company has been profitable since 2002 and has continued to grow revenues every year. By constantly innovating, the company is poised to benefit from high growth industries including AI. Consensus analyst price targets indicate that analysts believe $FFIV has further upside despite its already strong growth in the last year.

Modine Manufacturing Company ($MOD)

$77.54 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $77.54

- Modine Manufacturing Company has a long history of developing solutions for managing heat in buildings and vehicles worldwide.

- In 2022, Modine enacted a multi-year strategy plan to streamline operations and target higher profitability. So far, the strategy has outperformed initial estimates and has improved revenue and net income considerably.

- $MOD has seen exponential share price growth since it executed its strategy plan.

- Despite this, consensus analyst price target shows further potential upside to $MOD.

What they do

Modine Manufacturing Company creates parts and equipment for managing heat in buildings and vehicles. Founded in 1916, Modine is one of the oldest companies still listed on the U.S. markets.

Modine’s products include systems for cooling data centers, heating, ventilating, air conditioning and refrigeration (HVAC&R) and other advanced technologies. These products help improve indoor air quality, reduce emissions, and make vehicles run cleaner.

Modine recognizes revenue using two segments:

- Climate Solutions: offers heat transfer products, HVAC&R systems, and data center cooling solutions.

- Performance Technologies: creates air and liquid cooling technology for use in vehicles, power and industrial work. It also offers advanced thermal solutions for zero-emission and hybrid vehicles and cars, along with coatings products and services.

In the fiscal year ended 2023, Modine saw a revenue split of about 43% in the climate solutions segment and 57% in performance technologies. This split seems to have been consistent in the last three years.

Modine operates and distributes its products all over the world. In FY 2023, it generated about half of its revenue in the US. The remainder was from sales across geographies including Europe, Asia and South America.

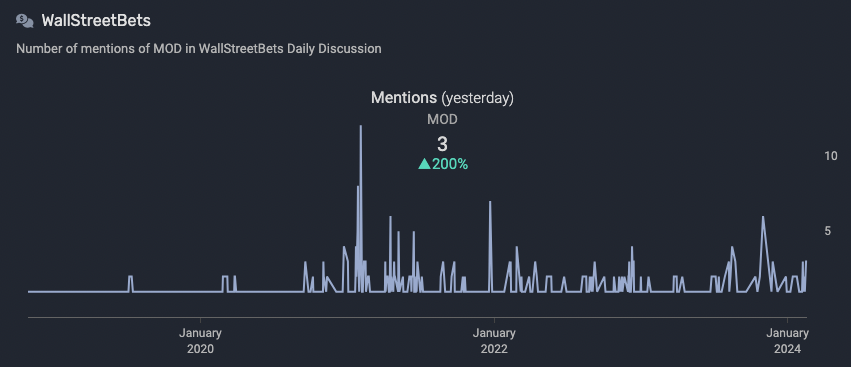

What the market is saying

$MOD has been seeing a few mentions on social media lately following its strong price performance. In the last year alone, $MOD has gained over 200%. Most of the talk has been around how it’s doing, its industry and news around the company. Modine also gets mentioned frequently in forums focused on areas such as HVACs and cooling systems.

Source: quiverquant.com

Notable comments from Reddit:

“Smaller Cap to look into would be Modine Manufacturing. Haven't looked at them in a while but I know they've been restructuring a bunch with a new focus on HVAC.”

– mke09

“MODINE Manufacturing- Provides engineer heat transfer components for vehicles. This market should not be going anywhere in the future and has had a strong bull run.”

– Sammy1e-

Why $MOD could be valuable

Industry

Modine offers several product lines that encompass different industries. It can be considered a player in the automotive parts, data center, industrial equipment and HVAC&R industries. The company considers all these industries to be highly competitive. It specifically pinpoints the HVAC&R industry to be dominated by several larger companies.

To streamline its business and target higher profitability, Modine announced a multi-year strategic plan in 2022. The plan outlines how Modine would shift its focus on industries that would generate the most returns. Part of that plan has led to Modine now pouring most of its efforts on the automotive parts and equipment industry.

The automotive parts and equipment industry has expanded exponentially in recent years thanks to the global shift towards EVs. The industry is expected to continue its growth at a CAGR of 6.8% from now to 2030. Governments have poured billions into subsidies and companies have invested heavily into R&D.

Modine has noted how quickly the industry transforms. However, it believes in its position in the market thanks to its strong customer relationships and continuous product innovation. The company expects to be able to benefit from the industry’s overall growth.

Financials

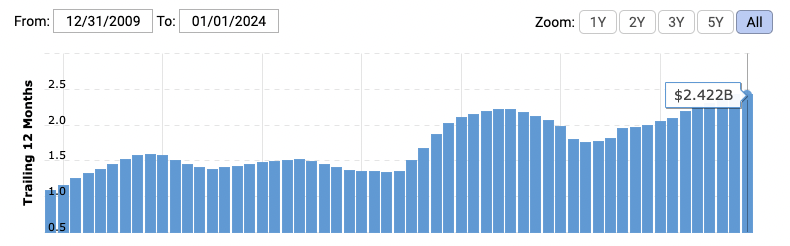

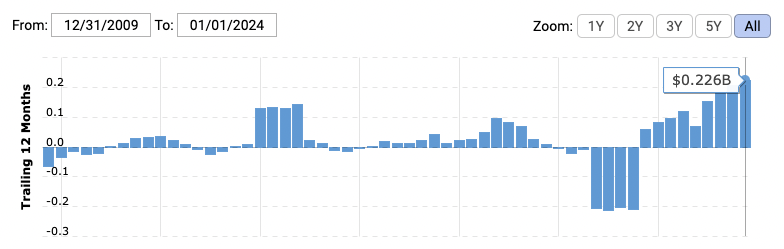

Before its new strategic plan, Modine posted fluctuating revenue figures for several years. The company even recorded net losses in 2020 and 2021. Since it started its new strategy in 2022 however, Modine posted double-digit revenue growth and got back into profitability. In fact, its net income of $153m for FY 2023 was the highest it has ever had in several decades.

Modine’s TTM revenue per quarter from 2009 to 2024:

Source: macrotrends.net

Modine’s TTM net income per quarter from 2009 to 2024:

Source: macrotrends.net

In its plan, Modine had outlined revenue growth of 6-8% in the first two years of its execution, and 8-10% in the three years after that. The company also had targets to increase operating profit margins by up to 15% in the next five years. In the first year of its execution, Modine had outperformed its revenue goal – growing it by over 12% between 2022 and 2023. Over that time, it was also able to increase its operating profit margin from 7% to 9%. The strong financial performance may be proof that Modine’s new strategy is working.

Modine’s most recent balance sheet and cash flow statements also indicate that it’s in a good financial position. Modine holds a high amount of liquid assets which can easily cover its liabilities and even long-term debt. It generated more than enough cash last year to both repay some of its financing and even invest in more equipment.

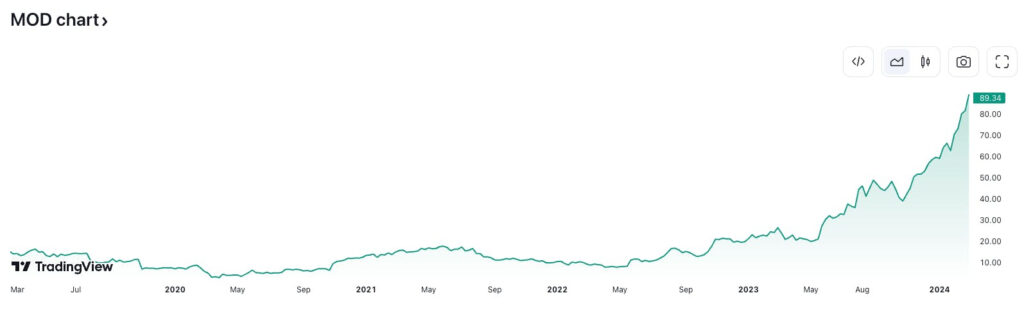

Price action

$MOD saw a decade of depressed stock prices where it traded relatively flat despite growing revenues. However this changed in 2022 when $MOD’s began its uptrend. Within this period, its share price shot up from $8.30 to where it is now, which is at about $77. This may have been a result of investors noticing the improvement its new strategic plan has brought to its financials and its operations.

Despite this strong price action, the consensus analyst price target remains above $MOD’s current share price. This shows that analysts may still expect further upside in $MOD’s performance.

What the risks are

Bottom line: Modine Manufacturing Company creates parts and equipment for buildings and vehicles. While it saw its business and share price stagnate in the last decade, its recently enacted strategic plan has shown strong promise. Since 2022, Modine has seen double-digit revenue growth and a shift from net losses to profitability. The market has seemed to have noticed its effort, sending $MOD’s stock price up exponentially. Despite that, analysts seem to believe that there is further upside potential in $MOD’s share price.