Summary

Okta is a hyper-growth cybersecurity company. They help businesses keep their online information safe by managing who gets access to what. Okta's total addressable market has a strong growth trajectory. Driven by trends such as the increasing adoption of cloud technology, the rise of remote work, and Okta's expansion into the customer identity and access management market.

Cencora is a leading pharmaceutical distribution and services company with a strong presence in the global healthcare industry. The company has a solid track record of generating stable revenue growth, improving operating margins, and delivering shareholder value.

Okta Inc. ($OKTA)

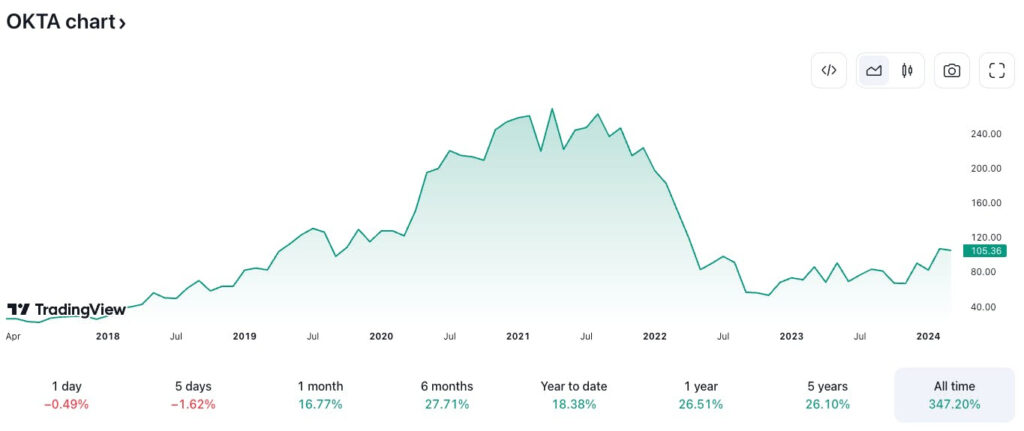

$105.36 – Share price at the time of writing

Source: tradingview.com

Summary

- Okta is a hyper-growth cybersecurity company. They help businesses keep their online information safe by managing who gets access to what.

- Okta's total addressable market is valued at approximately $80 billion

- With a strong growth trajectory driven by trends such as the increasing adoption of cloud technology, the rise of remote work, and Okta's expansion into the customer identity and access management market.

- Okta's free cash flow margins jumped in Q4 2024 results leading to a surge in its stock price, although the stock is still down more than 60% from its all-time high in 2021.

What they do

Okta specializes in identity and access management. In simple terms, this means they make sure the right people can access the right digital tools and data they need at work, securely. They help businesses manage who gets to log in to their systems, apps, and devices, adding an extra layer of security by verifying users' identities and managing their permissions.

Okta makes money by offering its services on a subscription basis. Businesses pay a recurring fee to use Okta's tools and services, which can vary depending on the size of the company and the specific services they choose.

Their services range from basic sign-in and authentication (making sure you are who you say you are when you log in) to more complex security measures like multi-factor authentication (adding extra steps for verifying identity, like a text message code in addition to a password).

They also offer services to manage and secure user identities across cloud services, applications, and devices, ensuring that access is granted securely and efficiently. Essentially, Okta helps keep digital workspaces secure and straightforward to use, making sure only the right people have access to the right information.

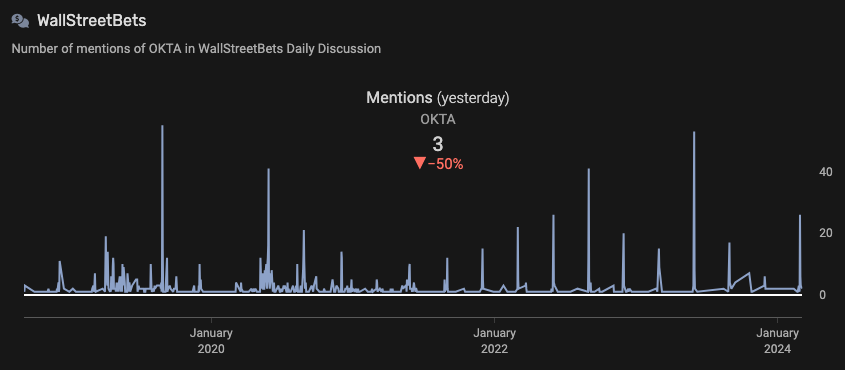

What the market is saying

Since Okta’s services are in the technical and complex cybersecurity space, most retail investors aren’t familiar with the company. The stock has seen sporadic interest over the past few years and is usually mentioned in discussions regarding other cybersecurity stocks such as CrowdStrike and Zscaler.

Source: quiverquant.com

Meanwhile, institutional investors appear to be bullish on Okta. With famous investors such as Ken Fisher, Steven Cohen and Paul Tudor Jones II increasing their holdings in Q4 2023.

Source: stockcircle.com

Why $OKTA could be valuable

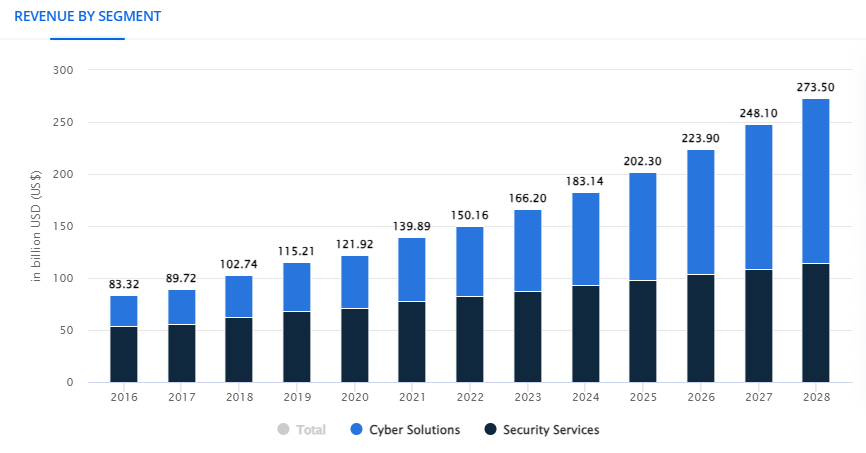

Industry and Market

Okta's future relies heavily on the cybersecurity market's expected growth, with the global market projected to expand from USD 172.32 billion in 2023 to USD 424.97 billion by 2030, showcasing a 13.8% CAGR.

This growth is driven by demand across different sectors, including financial, healthcare, and governments, all looking for advanced security solutions to protect against increasing cyber threats.

The North American market, in particular, is leading this surge, fueled by a rise in high-profile security breaches and investments in cloud application security. Okta has also been expanding aggressively into the Asia Pacific market, opening an Innovation Center in India late last year. India's cybersecurity spending is expected to increase by 18% between 2020 and 2025. Okta plans to work closely with Indian policymakers and educational institutions to position itself as a market leader while developing cybersecurity talent in the country.

Source: Statista

One of Okta’s biggest strengths is that it’s products are incredibly sticky.

Once Okta’s platform becomes integrated into its customer's IT operations it becomes entrenched within the customer's IT infrastructure and systems.

Once this entrenchment happens it makes transitioning away from Okta a long and expensive process. This helps prevent customers from switching to competing products.

Financials

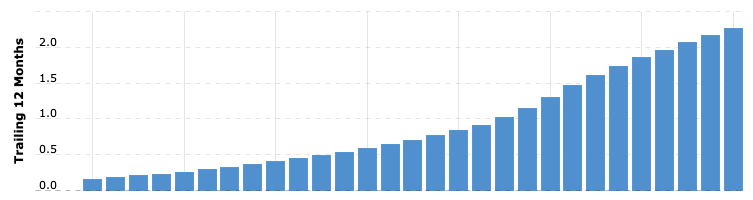

Since going public in 2016, Okta has consistently increased annual revenue for 8 straight years. As of its last quarterly report released in February 2024, Okta’s free cash flow surged from 3.5% in FY23 to 21.6% in FY24. This 7x surge in free cash flow is what triggered the most recent stock price jump.

Okta’s TTM Revenues (2016-2024):

Source: Macrotrends

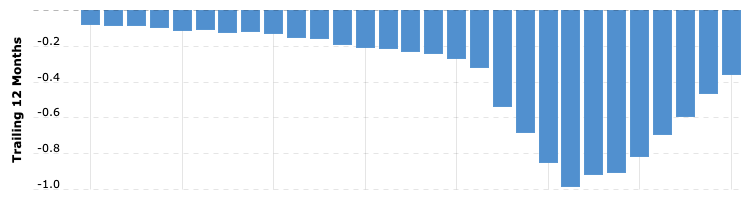

Despite this impressive growth, Okta is yet to turn over a profit. Up until recently, investors only cared about growth at all costs with less focus on profitability. However, this has now flipped. With investors looking for profitability over pure revenue growth. We can see below that Okta has made a consistent effort improve it’s net income which is now sitting around -$300 million per quarter (versus a peak loss of -$950 million).

Okta’s TTM Net Income (2016-2024):

Source: Macrotrends

Management has actively focused on driving operational efficiency, as it reduced Sales & Marketing spend by 7% YoY and still managed to grow its revenue by 22%. Management is projecting to close FY24 with $2.245B in revenue, which would represent a growth rate of 21% YoY.

Price action

$OKTA’s share price jumped by over 25% after it’s most recent earnings call at the end of February 2024. Despite that, at its current share price of $105.36, Okta continues to trade well below its all time high of $293.83 (-63.75%) that was set during the bull run of 2021.

What the risks are

Bottom line: Okta ($OKTA) operates in the critical industry of identity and access management, adding an extra layer of security by verifying users' identities and managing their permissions. The company's subscription-based revenue model has fueled consistent revenue growth over the years, with a notable surge in free cash flow driving recent investor enthusiasm. However, despite its strong market position and growth prospects, Okta faces inherent risks. While Okta's recent performance has been promising, investors should remain vigilant of these risks as they evaluate the company's long-term potential and stock performance.

Cencora Inc. ($COR)

$241.87 – Share price at the time of writing

Source: tradingview.com

Summary

- Share price at the time of writing: $241.87

- Cencora reported a revenue of $262.2 billion in FY2023 and operates in 50 countries.

- The company acquired PharmaLex Holding GmbH, a provider of specialized services for the life sciences industry, for €1.28 billion.

- Future growth is expected to be driven by the aging global population, increasing prevalence of chronic diseases, and a surge in healthcare spending.

What they do

Cencora (previously known as AmerisourceBergen) focuses on sourcing and distributing pharmaceutical products.

Cencora operates globally, distributing a wide range of products including pharmaceuticals, over-the-counter healthcare items, home healthcare supplies and equipment, and other specialty products like plasma and injectable pharmaceuticals to healthcare providers such as hospitals, retail pharmacies, and medical clinics.

Why is this valuable? The pharmaceutical supply chain is complex. It comes with stringent regulatory requirements, the need for temperature-controlled logistics, and even faces counterfeit products. Cencora works in the background to help it’s clients (hospitals, retail pharmarcies, etc.) in navigating these complexities, ensuring the integrity and safety of pharmaceutical products from manufacturers to patients.

Cencora generates revenue by leveraging its distribution network and expertise to serve its customers.

The company reported a revenue of $262.2 billion in FY 2023 and operates in 50 countries, making it a key player in the global healthcare distribution space.

What the market is saying

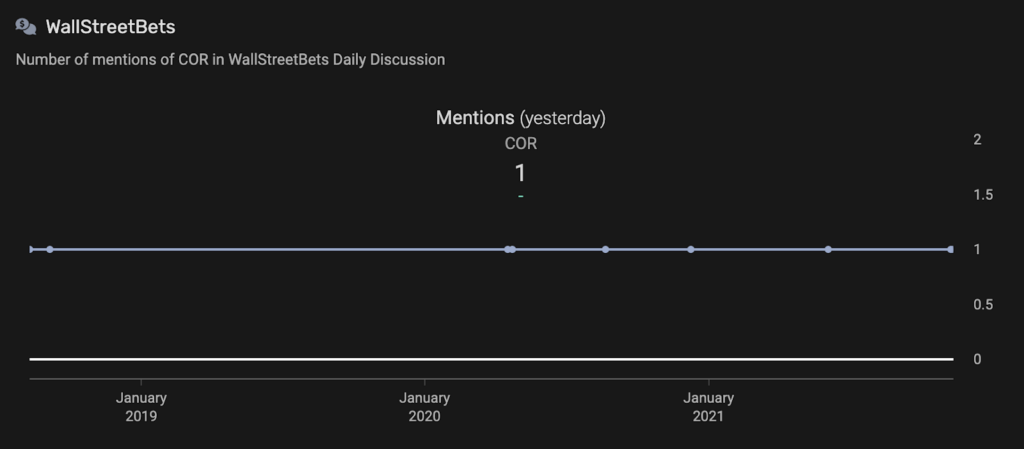

$COR is essentially invisible when it comes to social media sentiment. This could be due to the company changing names from Amerisource Bergen to Cencora or that the company is simply under the radar.

Source: quiverquant.com

But when it comes to institutional investment, it’s a different story. We can see below a huge spike in buying activity from hedge funds in Q4 2023. $COR is currently held by hedge funds including Bridgewater Associates (formerly run by Ray Dalio), Renaissance Technologies and Citadel Advisors. This is a bullish signal that these hedge funds believe $COR has future upside.

Source: stockcircle.com

Why $COR could be valuable

Industry and Market

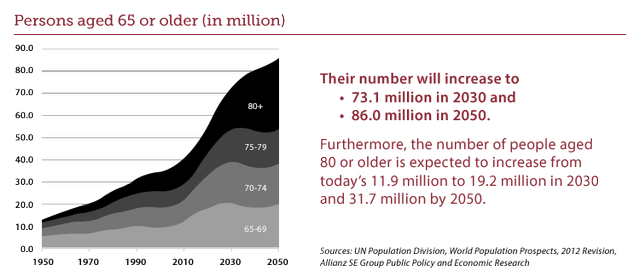

Cencora has several tailwinds working in its favor. The healthcare and pharmaceutical distribution industry is experiencing growth due to an aging global population, increasing prevalence of chronic diseases, and a surge in healthcare spending, especially in emerging markets. These trends are likely to lead to more demand for pharmaceutical distribution services, giving Cencora opportunity for expansion and increased market share.

The number of people aged 65 or older in the US is expected to rise to 73.1 million by 2030 and 86 million by 2050. Driven by the baby boomer generation retiring and as increasing lifespans. $COR is well-positioned to leverage this increased demand, leading with key customer partnerships in retail, specialty, and health systems in the US and Europe.

As part of Cencora’s strategic growth initiatives, the company established it’s own investment arm called Cencora Ventures, a $150 million corporate venture fund. This fund is focused on investing in emerging healthcare startups, looking to disrupt the healthcare sector. Cencora also plans to leverage its own resources and expertise to help these startups scale.

In addition to financial investments in startups, Cencora made a strategic acquisition to expand its global biopharma services platform. The company acquired PharmaLex Holding GmbH, a provider of specialized services for the life sciences industry, for €1.28 billion.

This acquisition is expected to expand Cencora’s global portfolio of solutions to support pharmaceutical manufacturers throughout the development and commercialization journey. PharmaLex's expertise in scientific, regulatory, and safety compliance is particularly aimed at offering strategic guidance and regulatory support to biopharma companies across the product lifecycle.

Given its data-as-a-service business model, Snowflake can realistically offer its services to any enterprise that handles data.

Financials

For FY2023, Cencora reported an eye-watering revenue of $262.2 billion, marking a 9.9% increase from the previous year. The first quarter of FY2024 is off to a strong start with revenue hitting $72.3 billion, a 15% increase compared to the same quarter in the previous fiscal year.

A key strength in Cencora's income statement is its adjusted gross profit, which saw a 12.5% increase in the first quarter of FY2024 compared to the same period in the previous fiscal year. This rise is attributed to increased sales across both its U.S. Healthcare Solutions and International Healthcare Solutions segments. The company's adjusted operating income has also seen significant growth. Highlighting its operational efficiency, with a 20.7% increase in the first quarter of fiscal 2024 compared to the prior fiscal year.

Price action

$COR’s stock price has been surprisingly resilient over the past few decades.

The stock price was essentially untouched during times where the rest of the market collapsed (e.g. the GFC and COVID-19 crash).

This can give investors confidence that the company is more than capable of wethering poor market conditions.

According to TipRanks, Cencora currently has 15 Buy Ratings, 4 Hold Ratings, and 0 Sell Ratings from the analysts covering the stock.

What the risks are

Bottom line: Cencora ($COR), plays a key role in the pharmaceutical supply chain, providing essential distribution services globally. With revenue soaring to $262.2 billion in FY 2023 and a strong start in FY 2024, the company demonstrates robust financial performance and strategic initiatives. Despite regulatory pressures and risks associated with aggressive M&A strategies and global expansion, Cencora's resilience in turbulent market conditions and widespread analyst confidence underscore its potential for future growth.