2009 was a year of rebuilding from the chaotic global financial crisis in 2008.

The repercussions were felt worldwide and intervention was necessary.

On top of this America saw the inauguration of President Barack Obama along with the deadly Swine Flu Pandemic. However, over 70 companies still went public this year despite the chaotic and uncertain financial markets.

Major world events that happened in 2009 that affected the stock markets

Global Financial Crisis: The repercussions of the 2008 Global Financial Crisis was still felt worldwide a year later. Governments and central banks took extreme measures to stabilize the economy and prevent further collapse. As expected, this had a significant impact on IPO activity and investor sentiment.

Barack Obama's Inauguration: On January 20, 2009, Barack Obama was inaugurated as the 44th President of the United States. This was marked by efforts to revive the economy and implement various financial reforms.

Auto Industry Crisis: The global automotive industry faced severe challenges in 2009. General Motors and Chrysler filed for bankruptcy and received government assistance to avoid collapse. This crisis had a ripple effect on related industries and economies. Financial marketers were not in a good state this year.

Swine Flu Pandemic: In April 2009, the H1N1 influenza virus (Swine Flu), became a global health pandemic. It affected millions of people worldwide, leading to widespread health concerns and economic implications.

Four interesting companies that went public in 2009

1. Broadcom Inc

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Semiconductors

- IPO Price: $15

- IPO Date: August 6, 2009

Broadcom is a global tech leader in semiconductors for wired and wireless communications. They design, develop, and supply semiconductors and infrastructure software solutions. This might not seem like a big deal, although Broadcom's products enable voice, video, data, and multimedia to be played throughout the home, the office, and mobile environments. You'll find their products and applications in data centers, home networking, broadband access, telecommunications equipment, smartphones, and base stations.

2. Hyatt

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Lodging

- IPO Price: $25

- IPO Date: November 10, 2009

Hyatt Hotels Corporation is a global hospitality company that manages, franchises, and owns a portfolio of hotels and resorts. They offer mostly luxury options and I can appreciate their design and luxurious essence. Hyatt operates more than 900 hotels and resorts in 65 countries. It also provides services such as dining, spa, and wellness, as well as meetings and events. Hyatt Hotels Corporation is committed to providing guests with exceptional experiences and creating meaningful connections with their customers.

3. OpenTable (Acquired by Priceline Inc.)

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Table Reservation

- IPO Price: $20

- IPO Date: May 21, 2009

OpenTable is an online restaurant reservation service that connects diners with restaurants. It allows users to book tables, view restaurant menus, and read reviews from other diners. I can confidently say I use OpenTable at least once a week to plan dinners and lunches. In 2014 Priceline Inc. acquired OpenTable for ~$2.6 billion.

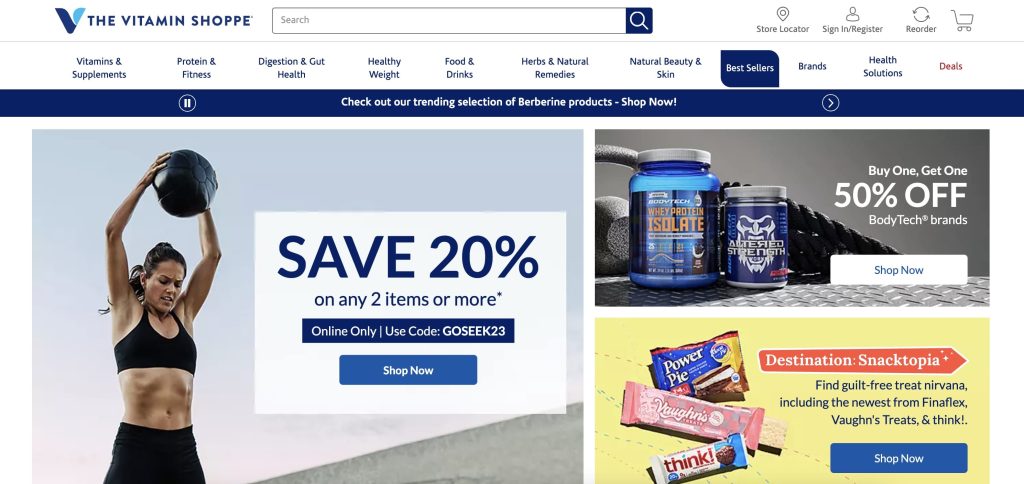

4. The Vitamin Shoppe

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Interner Retail

- IPO Price: $17

- IPO Date: October 26, 2009

The Vitamin Shoppe is a leading health and wellness retailer offering a selection of vitamins, supplements, minerals, herbs, sports nutrition, and health and beauty products. You can access their products in-store or online via their eCommerce website.

The 80 companies that had their Initial Public Offering (IPO) in 2009

| Company Name | Year Founded | Ticker | Company Status |

|---|---|---|---|

| 7 Days Group Holdings Ltd | 2004 | SVN | Acquired by Carlyle Group |

| A123 Systems Inc | 2001 | AONE | Acquired by Chinese Consortium |

| Addus Homecare Corp | 1979 | ADUS | Active |

| AGA Medical Holdings Inc | 1995 | AGAM | Acquired by Abbott Laboratories. |

| Ancestry.com | 1998 | ACOM | Active |

| Apollo Coml RE Fin Inc | 2009 | ARI | Active |

| Archipelago Learning | 2000 | ARCL | Acquired by PLATO Learning |

| Artio Global Investors Inc | 1962 | ART | Acquired by Aberdeen Asset Management. |

| Avago Technologies Ltd | 1961 | AVGO | Active |

| Banco Santander Brasil SA | -99 | BSBR | Active |

| Bridgepoint Education Inc | 1999 | BPI | Active |

| CDC Software Corp | 2006 | CDCS | Inactive |

| Changyou.com Ltd | 2007 | CYOU | Active |

| ChemSpec International Ltd | 2006 | CPC | Active |

| China Nuokang Bio-Pharmac | 1997 | NKBP | Active |

| China Real Estate Information | 2002 | CRIC | Active |

| Cloud Peak Energy | 1993 | CLD | Bankrupt |

| Cobalt International Energy | 2005 | CIE | Bankrupt |

| Colony Financial Inc | 2009 | CLNY | Merged |

| Concord Medical Services Ltd | 2007 | CCM | Active |

| CreXus Investment Corp | 2008 | CXS | Acquired by Annaly Capital Management. |

| Cumberland Pharmaceuticals Inc | 1999 | CPIX | Active |

| Cypress Sharpridge Investments | 2006 | CYS | Active |

| DigitalGlobe Inc | 1995 | DGI | Acquired by Maxar Technologies |

| Dole Food Co Inc | 1851 | DOLE | Active |

| Dollar General Corp | 1939 | DG | Active |

| Duoyuan Global Water Inc | 1992 | DWG | Active |

| Duoyuan Printing | 1994 | DYP | Inactive |

| Eaton Vance Natl Municipal Opp | 2009 | EOT | Active |

| Echo Global Logistics Inc | 2005 | ECHO | Active |

| Education Management Corp | 1962 | EDMC | Bankrupt |

| Emdeon Inc | 1984 | EM | Acquired by Blackstone |

| Fortinet Inc | 2000 | FTNT | Active |

| Global Defense Tech & Systems | 1969 | GTEC | Acquired by ST Engineering. |

| Government Properties Income | 2009 | GOV | Active |

| Hibernia Homestead Bancorp Inc | -99 | HIBE | Inactive |

| Hyatt Hotels Corp | 1957 | H | Active |

| Invesco Mortgage Capital Inc | -99 | IVR | Active |

| Kar Auction Services | 1989 | KAR | Active |

| Kraton Performance Polymers | 1955 | KRA | Active |

| Lihua International Inc | 2006 | LIWA | Inactive |

| LogMeIn Inc | 2003 | LOGM | Acquired by Francisco Partners and Evergreen Coast Capital. |

| Mead Johnson Nutrition Co | 1905 | MJN | Acquired by Reckitt Benckiser Group plc. |

| Medidata Solutions Inc | 2000 | MDSO | Acquired by Dassault Systèmes |

| Mistras Group Inc | 1968 | MG | Active |

| NIVS IntelliMedia Tech Gp Inc | 1998 | NIV | Inactive |

| Nuveen Calif Muni Value Fd2 | -99 | NCB | Active |

| Nuveen Enhanced Municipal | 2009 | NEV | Active |

| Nuveen Mortgage Opportunity | -99 | JLS | Active |

| Nuveen Municipal Value Fund 2 | -99 | NUW | Active |

| Nuveen New Jersey Muni Value | -99 | NJV | Active |

| Nuveen New York Muni Value 2 | -99 | NYV | Active |

| Nuveen Pennsyl Muni Value | -99 | NPN | Active |

| Omeros Corp | 1994 | OMER | Active |

| OpenTable Inc | 1999 | OPEN | Active |

| Pebblebrook Hotel Trust | 2009 | PEB | Active |

| Penn Millers Holding Corp | 1887 | PMIC | Acquired by ACE Group (now Chubb Limited) |

| Pennymac Mtg Invest Tr | -99 | PMT | Active |

| RailAmerica Inc | 1992 | RA | Acquired by Genesee & Wyoming Inc. |

| Recon Technology Ltd | 2007 | RCON | Active |

| Rosetta Stone Inc | 2003 | RST | Active |

| rue21 | 1976 | RUE | Active |

| Select Medical Holdings Corp | 1997 | SEM | Active |

| Seligman Premium Technology | -99 | STK | Unknown |

| Shanda Games Ltd | 2003 | GAME | Active |

| SolarWinds Inc | 1998 | SWI | Active |

| Starwood Property Trust Inc | -99 | STWD | Active |

| STR Holdings Inc | 1973 | STRI | Acquired by SK Materials |

| Talecris Biotherapeutics Hldg | 1995 | TLCR | Acquired by Grifols |

| Team Health Holdings | 1979 | TMH | Active |

| Territorial Bancorp Inc | -99 | TBNK | Active |

| Tortoise Power & Energy | -99 | TPZ | Active |

| Tri-Tech Holding Inc | 2002 | TRIT | Active |

| Verisk Analytics Inc | 1971 | VRSK | Active |

| Vitacost.com Inc | 1994 | VITC | Acquired by Kroger. |

| Vitamin Shoppe Inc | 1977 | VSI | Active |

| Western Asset Global Corporate | 2009 | GDO | Active |

| Western Asset Mun Defined Opp | 2009 | MTT | Active |

| Wstn Asset Invest Grade Define | 2009 | IGI | Unknown |

| ZST Digital Networks Inc | 1996 | ZSTN | Inactive |

Frequently asked questions

There were approximately 80 IPOs in 2009 according to Wikipedia, Crunchbase, Yahoo Finance, Techcrunch, and Jay R. Ritter’s data from UF Warrington College of Business. However, it’s hard to find a complete list of every company that has hit the stock exchange for the first time since the global data is fragmented. Please do your own research to confirm this figure.

As of June 2023, Broadcom Inc. has a market capitalization of $330B followed by Fortinet with a market capitalization of $52B. Of course, this is subject to change and you should check for the latest data.

There are approximately 9 companies that have been classified as either Inactive or Bankrupt. They include companies such as CDC Software Cord, Cloud Peak Energy, and ZST Digital Networks Inc.