Summary

- Li Lu is the founder and chairman of Himalya Capital Management.

- Charlier Munger called Li Lu ‘China’s Warren Buffet’.

- Himalaya Capital did not trade any stocks in Q3 2023.

- Li Lu’s biggest holding is Bank of America ($BAC).

Li Lu – Himalaya Capital Top 10 Current Holdings

Based on filings from Q3 2023, Li Lu’s portfolio shows a concentrated investment strategy with a focus on large established companies. Himalaya Capital only has six companies in its portfolio with only two different sectors.

The largest holding is in Bank of America Corp (BAC) at 27.2%, indicating a strong confidence in the financial sector. There's also a significant investment in both classes of Alphabet Inc (GOOG and GOOGL), accounting for 40.34% of the portfolio. This could reflect a strong belief in the long-term prospects of the tech giant.

Other key investments include Berkshire Hathaway and East West Bancorp, both in the financial sector and Apple Inc in the information technology sector, highlighting a preference for companies with strong market positions and potential for steady growth.

| Ticker | Company Name | Sector | Percentage of portfolio |

| BAC | Bank of America Corp | Financials | 27.2% |

| GOOG | Alphabet Inc – Class C | Communication Services | 22.05% |

| GOOGL | Alphabet Inc – Class A | Communication Services | 18.29% |

| BRK.B | Berkshire Hathaway Inc | Financials | 17.28% |

| EWBC | East West Bancorp Inc | Financials | 8.04% |

| AAPL | Apple Inc | Information Technology | 7.15% |

Related: Alphabet (Google) Earnings Call, Apple Earnings Call

Who is Li Lu?

Li Lu is a well-known hedge fund manager and the founder and chairman of Himalaya Capital. Lu was born in China but attended Columbia University. He’s also published two books Civilization, Modernization, Value Investing and China and Moving the Mountain: My Life in China.

Lu is a notable investor who has received a lot of attention over the last decade. This is mostly due to his success in generating consistent returns. His reputation is further enhanced by his connection to Warren Buffett. This association with Buffett, along with his track record of success, has garnered Li Lu significant respect and attention in the financial world.

What is Himalaya Capital Management?

Himalaya Capital is a hedge fund founded by Li Lu in 1997. Lu is still the chairman and is responsible for the direction of the company. Himalaya Capital primarily focuses on long-term value investing which has resulted in a strong track record.

Similar to Warren Buffet’s strategy from Berkshire Hathaway, Lu finds companies that are not only undervalued but also have strong business models and good leadership. This leads to significant growth and profitability in the long term.

This is very similar to Warren Buffet's investment philosophy at Berkshire Hathaway.

Another reason they’ve succeeded for so long is their core values, which include:

- Honesty

- Accountability

- Integrity

- Meritocracy

- Confidentiality

- Loyalty

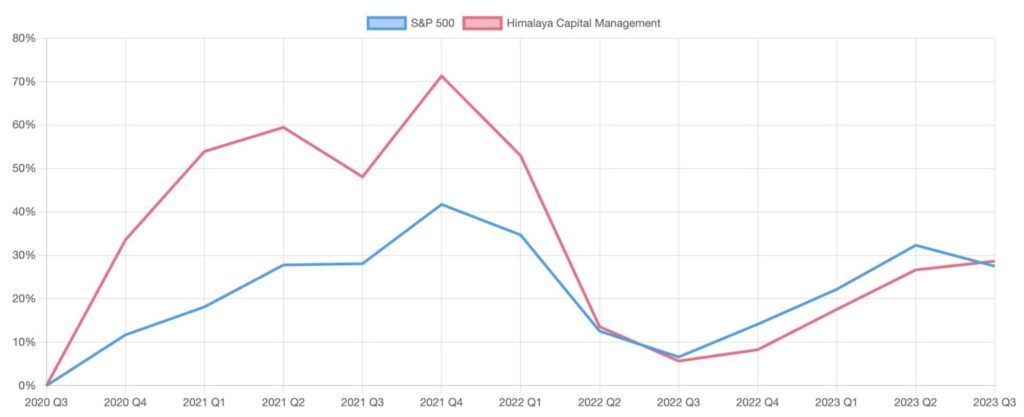

Li Lu – Himalaya Capital Performance Overview

Himalaya Capital’s top 20 weighted holdings have a 3-year annualized return of 8.77% with a 3-year cumulative return of approximately 28.66%. The top 50 weighted holdings are the same since Li Lu’s portfolio doesn’t have more than 20 holdings. This is an exceptional performance given the recent instability in the economy. It’s also an exceptional performance when compared to other hedge funds such as Ark Invest.

Li Lu – Himalaya Capital Top Buys and Sells in Q1 & Q2 2023

In Q1 and Q2 of 2023, Li Lu increased his position in Bank of America and opened a new position in East West Bankcorp. However, he sold 100% of his shares in Micron Technologies which could indicate that the semiconductor companies are overvalued. On top of this, there seems to be a focus on the banking and financial sector.

Li Lu isn’t known for actively trading stocks, he prefers to hold good companies for life, which is why there was no trading activity in Q3 2023. This is very similar to Warren Buffet and Charlie Munger’s style of investing.

| Period | Ticker | Company Name | % of portfolio | Bought/Sold | Amount |

| Q2 2023 | EWBC | East West Bancorp Inc | 8.18% | Bought shares (20.91%) | +480,051 shares |

| Q2 2023 | MU | Micron Technology Inc | 0.00% | Sold shares (-100%) | -6.826,079 shares |

| Q1 2023 | EWBC | East West Bancorp Inc | 6.25% | Bought shares (new holding) | +2,296,300 shares |

| Q1 2023 | BAC | Bank of America Corp | 25.36% | Bought shares (23.95%) | +3,494,146 shares |

| Q1 2023 | MU | Micron Technology Inc | 0.00% | Sold shares (-40.52%) | -4,650,444 shares |

Li Lu – Himalaya Capital Sector Allocation

Should you blindly copy Li Lu's stock picks?

Copying Li Lu

❌ Hedge fund holdings are updated each quarter.

❌ Trades can be months old by the time they are public.

❌ Investment horizons and strategies can change without warning.

❌ Can hold thousands of different stocks. This isn't realistic for investors.

❌ Hedge funds can still buy underperforming stocks.

Ticker Nerd Premium

✅ Latest ratings from Wall Street Analysts every week.

✅ Top 10 Rated Stocks updated every month.

✅ Two stock ideas with massive potential each month.

✅ Get in-depth reports on stocks with potential.

✅ Learn the risks behind each stock.

✅ Save 80+ hours of research per month.

Li Lu – Himalaya Capital Investment Strategy & Quotes

Li Lu’s investment strategies:

- Value investing: Li Lu focuses on long-term undervalued companies that he understands deeply. This style of investing tends to perform best over a long period of time.

- Concentrated investments: Unlike most hedge funds, Li Lu doesn’t invest in a large number of companies. His investments are concentrated in great businesses that have huge potential over the long run.

- Quality businesses only: Li Lu looks for companies with durable competitive advantages, strong management teams, and healthy financials. He prefers businesses that are capable of generating high returns on capital over the long term.

- Independent thinking: Li Lu has been known to talk about the importance of independent thinking when it comes to investment decisions. He avoids herd mentality and lets his own research and analysis guide his decisions.

- Ethical investing: (evident this his quotes about the 2008 global financial crisis and how many investment managers did the wrong thing.

- Margin of safety: Having a margin of safety is particularly important for Li Lu. He is known for investing in companies at a price that offers a significant bugger against potential losses.

Li Lu’s famous quotes:

- “Whatever you are is because of what your ancestors have done.”

- “Everyone has blind spots, and even the brightest people are no exceptions.”

- “The game of investing is a process of discovering who you are, what you're interested in, what you're good at, what you love to do, then magnifying that until you gain a sizable edge over all the other people.”

- “Investing is about predicting the future, and the future is inherently unpredictable. Therefore, the only way you can do better is to assess all the facts and truly know what you know and know what you don't know. That's your probability edge.”

Li Lu – Himalaya Capital News & Resources

- Himalaya Capital Investment Philosophy

- Himalaya Capital Management – EDGAR files

- No other investor has a life story quite as unbelievable as Li Lu

- Charlie Munger only trusted one person besides Warren Buffett with his personal fortune

Frequently Asked Questions

Himalaya Capital Management is run by the founder and hedge fund manager, Li Lu.

Estimating Li Lu's net worth is difficult since the value of his company and the assets under management fluctuate often. On top of this, Li Lu has multiple assets that might not be accurately incorporated in the calculation of his net worth. However, it's estimated that Li Lu is worth at least $200m.

Data was collected from (but not limited to) the sources below:

– Stockcircle

– HedgeFollow

– WhaleWisdom

– EDGAR filings from the SEC