Summary

- Cathie Wood is the popular investor behind ARK Investment Management.

- ARK Invest has performed poorly with a 3-year annualized return of -21.66%.

- Cathie Wood mostly invests in emerging and disruptive technologies.

- ARK Invest recently sold shares in Coinbase but entered a position in Robinhood.

Cathie Wood – ARK Investment Management Top 10 Current Holdings

Based on filings from Q3 2023, Cathie Wood’s portfolio is in line with the investment philosophy at Ark Invest. There’s a strong emphasis on disruptive technology and some exposure to healthcare. For instance, 6.9% of the ARK portfolio is in Roku which manufactures and sells streaming technology and other smart TV products and licensing. Similarly, UiPath and Zoom, are tech companies focused on innovation. However, when it comes to healthcare stocks, CRISPR Therapeutics is the only company that makes a top 10 holding.

| Ticker | Company Name | Sector | Percentage of portfolio |

| COIN | Coinbase Global Inc | Financials | 8.5% |

| ROKU | Roku Inc | Communication Services | 6.9% |

| TSLA | Tesla Inc | Consumer Discretionary | 6.7% |

| PATH | UiPath Inc | Information Technology | 6.0% |

| ZM | Zoom Video Communications Inc | Information Technology | 4.6% |

| SQ | Blocks Inc (formerly Square) | Financials | 4.5% |

| DKNG | DraftKings Inc | Consumer Discretionary | 3.9% |

| SHOP | Shopify Inc | Information Technology | 3.5% |

| CRSP | CRISPR Therapeutics AG | Health Care | 3.5% |

| RBLX | Roblox Corporation | Communication Services | 3.2% |

Who is Cathie Wood?

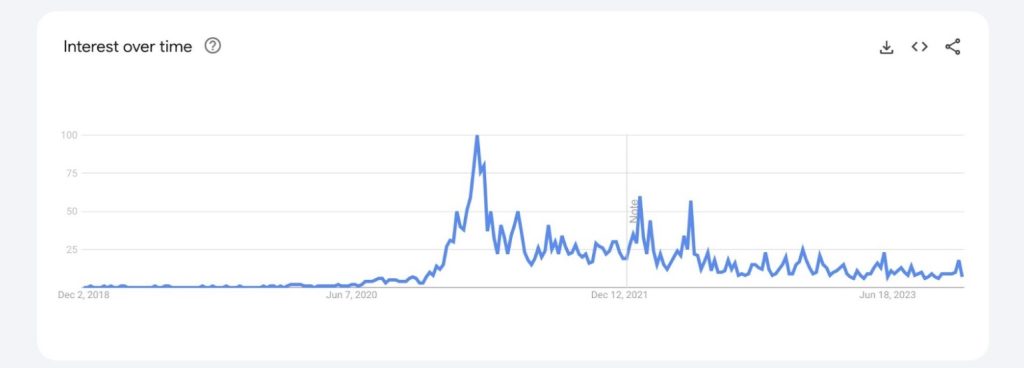

Cathie Wood was a highly popular (and scrutinized) investor in 2021. She’s a prominent investment manager and the founder and CEO of Ark Invest (also known as ARK Investment Management LLC).

In 2021, she gained a reputation for investing in cutting-edge sectors like artificial intelligence, genomics, and renewable energy. Wood's bold investment strategies, particularly her focus on growth stocks have made her an influential voice in the financial community.

However, the hype started to die down in early 2022 and the excessive interest in her portfolio is disappearing. Her portfolio, often characterized by high-risk, high-reward investments, has attracted significant attention. Which is hard to justify given its poor performance.

What is ARK Investment Management?

ARK Investment Management (i.e ARK Invest) is the hedge fund that Cathie Wood founded in 2014. ARK Invest is known for targeting disruptive sections like genomics, AI, robotics, energy, blockchain, and other similar industries. According to Wikipedia, Ark Invest had $50 billion in assets under management (AUM) in February 2021 although this dropped to $15.9 billion by May 2022.

On top of this, the firm operates several actively managed exchange-traded funds (ETFs), these include:

| ARK ETF | ETF Ticker | Industry/Sector |

| ARK Innovation ETF | ARKK | Broad-based disruptive innovation |

| ARK Genomic Revolution ETF | ARKG | Genomics and biotechnology |

| ARK Fintech Innovation ETF | ARKF | Financial technology and innovation |

| ARK Autonomous Technology & Robotics ETF | ARKQ | Autonomous technology and robotics |

| ARK Next Generation Internet ETF | ARKW | Internet technology and innovation |

| ARK Space Exploration & Innovation ETF | ARKX | Space exploration and innovation |

Cathie Wood – ARK Investment Management Performance Overview

Ark Investment Management’s top 20 weighted holdings have a 3-year annualized return of -21.66% with a 3-year cumulative return of approximately -51.92%. The top 50 weighted holdings have similar returns. This is a terrible performance in comparison to other hedge funds.

It’s important to remember that as of late 2023, the economic environment has faced challenges such as inflation, interest rate hikes, and geopolitical uncertainties contributing to volatility. Tech stocks in particular have experienced fluctuations, with many facing downward pressure due to concerns over valuation and profitability in a slower economic growth scenario. Ark Invest is heavily exposed to these stocks so it’s no surprise their recent returns are negative.

Cathie Wood – ARK Investment Management Top Buys and Sells in Q3 2023

In Q3 2023, there was a significant sell-off in the technology and consumer discretionary sectors. This includes major companies like Tesla and Roku.

Ark Invest also reduced its positions in financials and healthcare stocks, notably Coinbase and Exact Sciences. Even though Cathie Wood sold 12.53% of Ark’s Coinbase shares, she is still bullish on cryptocurrency. This is evident in the recent $1.2m position Ark opened in Robinhood.

Despite the overall trend of selling, Wood has strategically increased investments in Block and Twilio, indicating confidence in digital payments and cloud communication services.

| Ticker | Company Name | Industry | Current % of portfolio | Bought/Sold | Amount |

| TSLA | Tesla Inc | Consumer Discretionary | 7.81% | Sold shares (-15.79%) | -764,970 shares |

| PATH | UiPath Inc | Information Technology | 6.20% | Sold shares (-1.98%) | -954,511 shares |

| COIN | Coinbase Global Inc | Financials | 6.09% | Sold shares (-12.53%) | -1,518,317 shares |

| ROKU | Roku Inc | Communication Services | 5.64% | Sold shares (-12.70%) | -1,518,479 shares |

| ZM | Zoom Video Communications Inc | Information Technology | 5.45% | Sold shares (-2.67%) | -278,393 shares |

| SQ | Blocks Inc (formerly Square) | Financials | 3.69% | Bought shares (1.49%) | 160,179 shares |

| DKNG | DraftKings Inc | Consumer Discretionary | 3.29% | Sold shares (-19.01%) | -3,432,611 shares |

| EXAS | Exact Sciences Corporation | Health Care | 3.28% | Sold shares (-12.22%) | -874,167 shares |

| TWLO | Twilio Inc | Information Technology | 3.19% | Bought shares (1.33%) | 93,828 shares |

| SHOP | Shopify Inc | Information Technology | 2.90% | Sold shares (-21.63%) | -1,919,646 shares |

Cathie Wood – ARK Investment Management Sector Allocation

Should you blindly copy Cathie Wood's stock picks?

Copying Cathie Wood

❌ Hedge fund holdings are updated each quarter.

❌ Trades can be months old by the time they are public.

❌ Investment horizons and strategies can change without warning.

❌ Can hold thousands of different stocks. This isn't realistic for investors.

❌ Hedge funds can still buy underperforming stocks.

Ticker Nerd Premium

✅ Latest ratings from Wall Street Analysts every week.

✅ Top 10 Rated Stocks updated every month.

✅ Two stock ideas with massive potential each month.

✅ Get in-depth reports on stocks with potential.

✅ Learn the risks behind each stock.

✅ Save 80+ hours of research per month.

Cathie Wood – ARK Investment Management Investment Strategy & Quotes

Cathie Wood’s investment strategy:

- Focus on disruptive innovation: Wood's core investment philosophy revolves around identifying and investing in disruptive technologies and innovations. These include areas like artificial intelligence, robotics, energy storage, DNA sequencing, and blockchain technology. She believes that these sectors have the potential to transform industries and the global economy.

- Long-term growth orientation: Wood's strategy is distinctly long-term. She often invests in companies that may not be profitable in the short term but have the potential for substantial growth and market dominance in the future. This approach often involves a higher level of risk but also the possibility of higher returns. Her current portfolio signals this might be true given the short-term poor performance.

- Active management: ARK Invest actively manages its funds. Wood and her team frequently adjust their holdings based on new research and market analysis. This approach allows them to capitalize on emerging trends and reduce exposure to declining ones. For example, Wood has traded Coinbase stock eight times from October 2021 to October 2022.

- Transparency and research-driven process: Wood is known for the transparency of her investment process (which is available to download on their website). ARK regularly publishes its trades and research, fostering an open dialogue with investors. Her team’s research process is thorough, focusing on both the technological aspects and the potential market impact of innovations.

- Contrarian bets: Often, Wood's picks are contrarian, investing in companies that are overlooked or undervalued by the market. She is not afraid to make big bold bets as seen with her investments in Tesla and Bitcoin.

Cathie Wood’s famous quotes:

- “Innovation is all about finding solutions to problems or creating new products and services that address unmet needs.”

- “The five innovation platforms we follow are evolving and converging at such a rapid pace that we believe they are going to transform the world and create enormous investment opportunities.”

- “Volatility is not risk. What we think is risky is to avoid high-volatility stocks. They’re going to be the winners in the long run.”

- “The world is changing fast, but most people do not see it. By the time they recognize change, we believe it will be too late.”

- “The big ideas in the early stages of growth are controversial, so to capitalize on them, you must have the courage of your convictions.”

Cathie Wood – ARK Investment Management News & Resources

- ARK Invest Investment Process

- Cathie Wood Forbes Profile

- ARK's big ideas 2023

- Cathie Wood on Bitcoin ETF, Tesla, and China Market

- ARK Investment Management EDGAR file

Frequently Asked Questions

ARK Investment Management is run by Catherine Wood. However, there are other board members who also influence the direction of the company. This includes Gary H. Neems, John Duddy, and Tony Glover.

Estimating Cathie Wood's net worth is difficult since the value of her company and the assets under management fluctuate often. However, it's estimated that Wood's is worth anywhere between $150 million and $250 million.

Data was collected from (but not limited to) the sources below:

– Stockcircle

– HedgeFollow

– WhaleWisdom

– EDGAR filings from the SEC