| Instacart IPO Date (Predicted): | September 19, 2023 |

| Instacart Valuation: | $13 billion |

| Total Revenue (2022): | $2.5 billion |

| Stock Ticker: | CART |

| Stock Exchange: | Nasdaq |

| Total Funds Raised: | $2.9 billion |

| Number of Full-Time Employees: | 3,486 |

| Headquarters: | San Francisco, California |

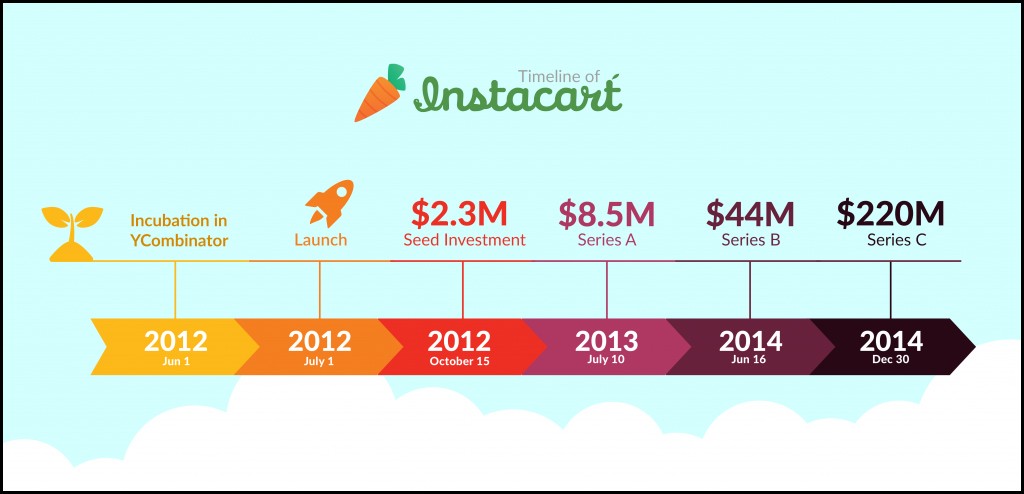

| Founded: | 2012 |

Overview:

The food delivery company Instacart confidentially filed for an IPO in May 2021.

Fidji Simo, CEO of Instacart wrote a memo to employees in October 2022 “The markets still remain closed for new IPOs, which is why there has not been a tech IPO in the last 10 months”.

He also went on to state “We do not need a perfect market, we’re just looking for an open market window.”

Instacart became publicly traded on September 19, 2023.

How to invest before Instacart’s IPO

Let's take a look at some of the ways you can invest in Instacart before they go public. We'll look at each option with its unique pros, cons, and nuances.

Investing through Private Equity Funds

Pros: Potential for solid returns and an opportunity to invest alongside major players in the market.Cons: These investment vehicles often require large minimum investments and long-term capital commitment. On top of that, their complex structure can be a headache to set up for newer investors.

Trading on Secondary Markets: Secondary markets like SharesPost and Forge Global offer platforms for the exchange of pre-IPO shares.Pros: These platforms provide an avenue to directly purchase shares of Instacart prior to the IPO, almost like securing a VIP access pass.Cons: Investing at this stage comes with substantial risk, with minimum investments usually hitting six figures. These shares will likely be illiquid which means it can be difficult to exit your position.

Investing through Crowdfunding Platforms: Websites such as EquityZen offer opportunities to invest in late-stage, pre-IPO companies such as Instacart.Pros: Compared to the previous two options, crowdfunding platforms offer accessibility to a wider range of investors, meaning retail investors (average Joes like you and me) may be able to pick up shares in pre-IPO companies.Cons: Such platforms still require significant investment and there's always the risk that the Instacart IPO never happens. It's almost like betting on a horse race that might never start.

Remember, the intention here is not to offer financial advice but to explore possible investment options. As with all investments, your capital is at risk. Seek advice from a qualified professional before embarking on any investment decisions.

What you need to know about Instacart

Instacart is a market leader in the online grocery delivery space.

The company is currently dominating the North American market and is constantly innovating to redefine the traditional grocery shopping experience. Instacart's main service revolves around its platform that seamlessly connects customers with personal shoppers. These shoppers hand-pick and deliver groceries from neighborhood stores, then bring them straight to your door with same-day delivery.

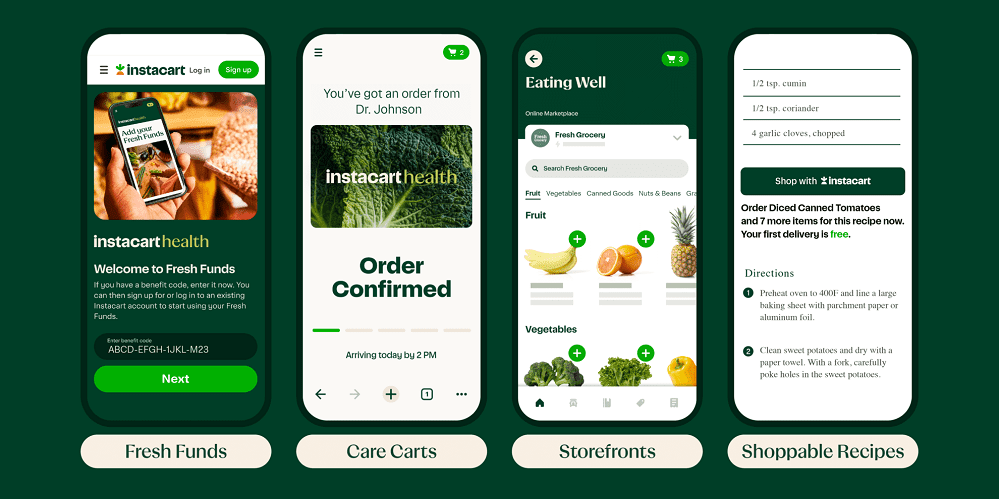

Recently, Instacart announced the rollout of an ambitious new initiative – “Instacart Health Products For Providers“. This suite of advanced digital tools is designed to facilitate scalable food-as-medicine programs.

This means healthcare providers will be able to give patients a stipend to order fresh food via Instacart. Providers will also be able to send patients custom grocery deliveries called “Care Carts”.

The goal of this is to encourage healthier food choices and enable the delivery of nutritious foods to patients. This strategic move tells us Instacart is committed to growing its services outside of offering convenient grocery delivery.

Is Instacart ready for an IPO?

In May 2021, Instacart confidentially filed with the Securities and Exchange Commission and was considering either a direct listing or a traditional IPO. Fast forward to today and Instacart still isn't publicly traded.

Based on recent developments it looks we'll need to wait a little while longer to see Instacart trading on the stock market. Comments from CEO Fidji Simo suggest that Instacart plans to wait for more favorable market conditions before making a move toward becoming a publicly traded company.

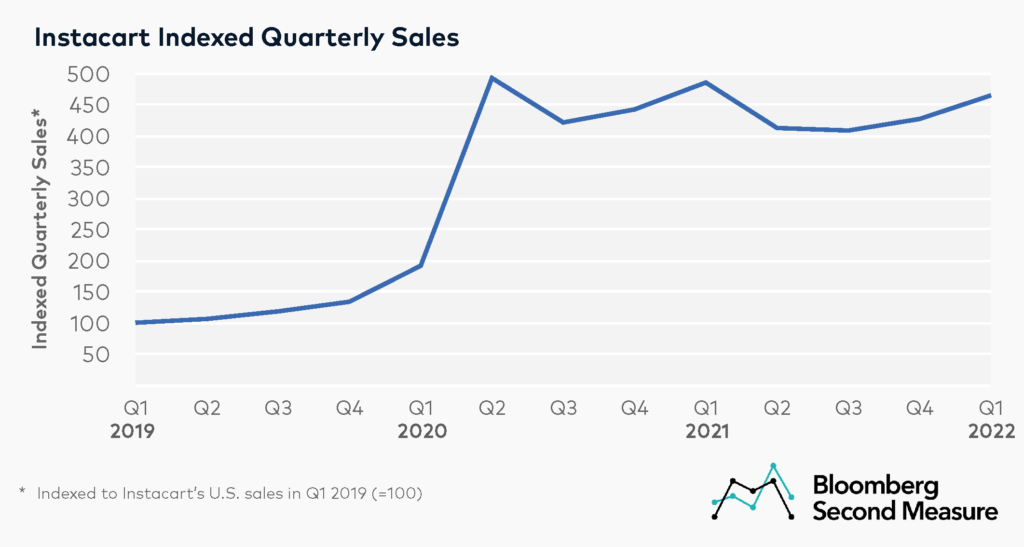

Despite all the doom and gloom, Instacart has continued to show explosive growth as well as expanding its services to include a software platform for grocers and advertising.

According to The Wall Street Journal, Instacart has been crushing its financials. The company's revenue surged by half in the last quarter of 2022. On top of that, it was revealed that its gross profit margin rose by over 80% in the closing months of the previous year, with adjusted growth earnings before interest, taxes, depreciation, and amortization hitting $100 million in the fourth quarter.

WSJ also went on to report, Instacart's annual sales reached a staggering $29 billion, reflecting a 16% leap compared to the previous financial year. Its FY revenues for 2022 increased by 39% from the 2021, totaling $2.5 billion. To be clear these figures have not been publicly disclosed by Instacart. WSJ had to rely on an internal memo and the company's investor call held on February 28 2023 to source this information.

Who founded Instacart?

Instacart was founded by Apoorva Mehta, a humble engineer who became a billionaire entrepreneur.

Apoorva, an Indian native, relocated with his family to Canada in 2000. After graduating from the University of Waterloo in 2008, he dived headfirst into the tech world, gaining experience with industry giants such as BlackBerry, Qualcomm, and Amazon.

During his time at Amazon, he specialized in supply chain engineering, building efficient systems that ensured seamless delivery of packages from Amazon's warehouses to customers' doorsteps. This gave him specialist knowledge he would later be able to apply to Instcart.

While Apoorva's career trajectory alone was impressive, it was only the prelude to his entrepreneurial journey. After leaving Amazon in 2010, he redirected his energy towards launching startups, with 20 ventures under his belt before landing on Instacart in 2012.

Fast forward to 2023, Apoorva boasts an estimated net worth of a staggering $4 billion.

Apoorva left his role as Instacart CEO to make way for Fidji Simo in 2021.

Notable investors in Instacart

There are currently 37 investors who hold Instacart stock. Some notable investors include:

Andreessen Horowitz

Sequoia Capital

D1 Capital Partners

Fidelity Management & Research Company LLC

T. Rowe Price Associates, Inc

Source: Crunchbase

What’s the market saying about the Instacart IPO?

Earlier in 2022, the hype around the Instacart IPO reached a fever pitch. The investing world was on the edge of its seat as it looked like the public debut of this grocery delivery titan was about to happen.

However as the year went on, circumstances changed rather dramatically. Poor market conditions and escalating volatility seemed to force the company to retreat from its IPO plans.

Despite the setback, the company hasn't entirely shelved its plans to become a publicly traded company, it's more a question of ‘when' rather than ‘if.'

It's worth mentioning that the company has had to implement some cost-cutting measures. This includes layoffs and curbing other expenses. This has sparked concerns among investors surrounding the company's financial stability.

How does Instacart make money?

Instacart's cash flow is mainly generated through delivery fees and service fees paid by its customers. The delivery fee generally hovers around $3.99 for orders above $35, while the service fee typically equals about 5% of the total order.

They also have a membership program, Instacart Express, with an annual fee of $99 or a $9.99 monthly fee, which offers free delivery for orders over $35, which provides recurring revenue for the company.

Its retail customers aren't their only source of income. Instacart also generates revenues from its retail partners through partnership agreements. Grocers pay a premium to be featured on Instacart's platform, in exchange for more visibility and increased sales.

There's also income from advertising, as brands can opt to promote their products in search results.

However, this business model isn't perfect. The delivery-based model requires a lot of human labor. This comes with higher expenses as Instacart needs to hire and manage a team of personal shoppers, which can hurt its profit margin.

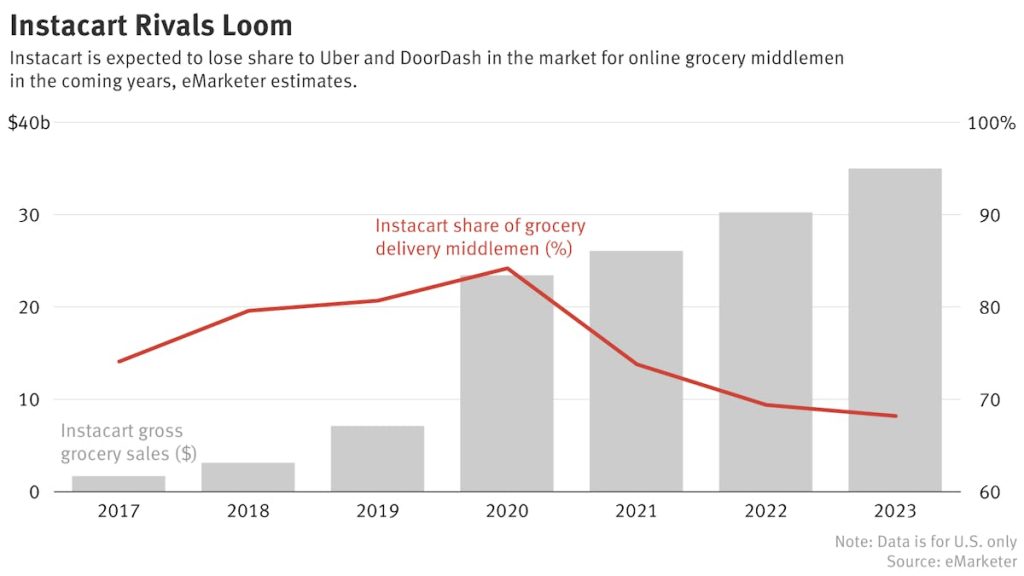

Maintaining partnerships with grocery stores also comes with its challenges. Some retailers, like Kroger, have begun establishing their own delivery services, cutting out Instacart.

Who is Instacart’s competition?

Competition in the online grocery delivery space is fierce.

One notable Instacart competitor is GoPuff, an on-demand delivery service that operates around the clock. Its commitment to quick delivery and its strategic acquisition of BevMo! has significantly grown its position in the market.

The competition doesn't end with GoPuff, though. AmazonFresh, backed by Amazon's seemingly unlimited resources and its Whole Foods subsidiary, also poses a serious threat. Walmart, another major player, is leveraging its massive network of physical stores to grow its online grocery service.

Emerging players such as Shipt and FreshDirect also deserve attention. While they may not be at the same scale as their larger rivals, their ambition, and aggressive growth strategies could eat into Instacart's market share in the future.

Frequently Asked Questions

While an Instacart IPO looked certain for 2022, recent reports suggest the company has postponed its plans indefinitely due to market volatility.

Instacart increased its internal valuation to $12 billion in April 2023 after cutting it to $10 billion in January 2023.

During the height of the COVID-19 pandemic in 2020 Instacart netted $10 million of profit in a single month. It's not clear whether Instacart is still profitable as it has not published its financials.