Summary

- Michael Burry is a famous investor who operates Scion Asset Management LLC.

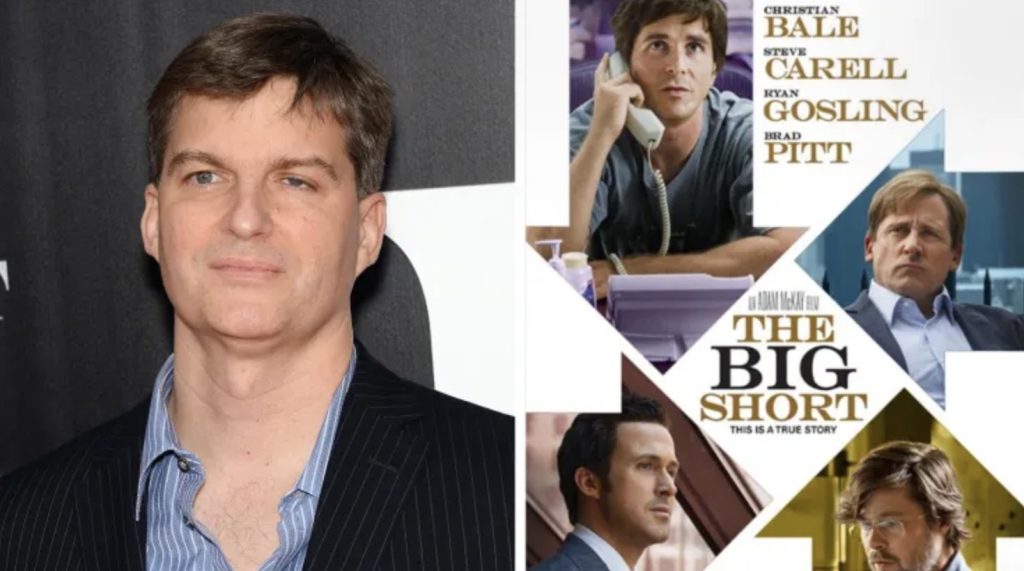

- The Big Short was a movie based on Michael Burry’s big bet against the housing market in 2008.

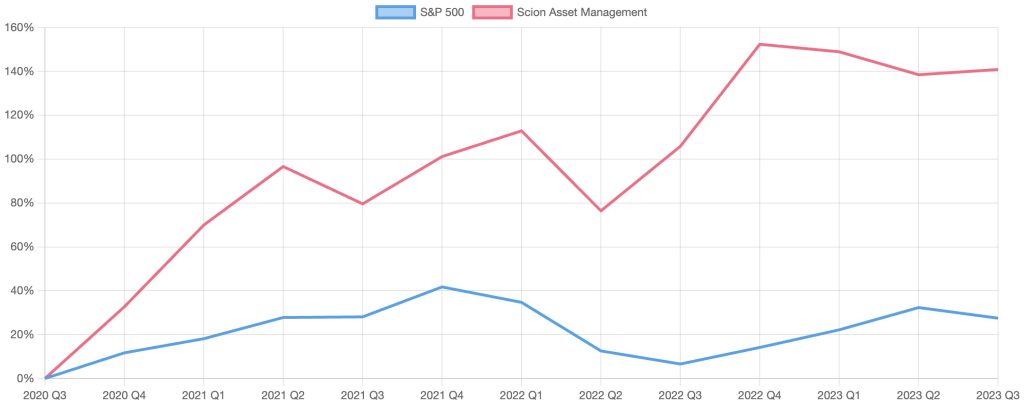

- Scion Asset Management LLC has returned over 160% over the last 10 years and has outperformed the S&P 500 over the same period.

- Scion Asset Management’s latest 13F fillings show substantial trading activity on the buy and sell side.

- In Q3 of 2023, Michael Burry entered multiple short positions.

Michael Burry – Scion Asset Management Top 10 Current Holdings

Based on filings from Q3 2023, when looking at Scion Asset Management’s portfolio the firm's holdings appear to go against the grain. This is no surprise as Michael Burry is famous for his contrarian investing strategy. For example, we can see the firm has around 16% of its portfolio allocated to two Chinese technology stocks – JD.com and Alibaba. Meanwhile, other top hedge funds have been reducing their holdings in these companies.

We can also see the firm has bought put options for the iShares Semiconductor ETF (SOXX) and Booking Holdings Inc (BKNG). This suggests that the firm believes popular semiconductor stocks are overpriced and are likely to lose value over the next quarter (or quarters). The put options for BKNG also suggest the firm believes the travel tech stock is overpriced and will lose value. This could be viewed as surprising since most travel companies have outperformed the market since the COVID-19 pandemic has subsided.

| Ticker | Company Name | Industry | Percentage of portfolio |

| STLA | Stellantis N.V | Automobile Manufacturing | 18.4% |

| NXST | Nexstar Media Group Inc. | Television Broadcasting | 16.4% |

| SBLK | Star Bulk Carriers Corp | Deep Sea Freight Transportation | 11.4% |

| BKNG | Bookings Holdings Inc | Travel Technology | 10.5% |

| EURN | Euronav NV | Marine Shipping | 10.2% |

| BABA | Alibaba Group Holding Ltd – ADR | Software | 8.8% |

| JD | JD.com Inc – ADR | Software | 8.1% |

| CRG | Crescent Energy Co. – Class A | Energy | 5.2% |

| HPP | Hudson Pacific Properties Inc | Property | 4.8% |

| REAL | Therealreal Inc | Shopping | 3.7% |

Who is Michael Burry?

Ever seen the movie The Big Short?

It’s where an investor bets big against the housing market in 2007 and profits through the collapse of the Global Financial Market.

Well, it was based on this rogue investor.

Dr. Michael Burry is arguably the most popular modern American Investor.

He’s also a hedge fund manager and qualified physician. Burry has been popularised for predicting the 2000s housing market bubble along with the subsequent Global Financial Crisis in 2008. On top of this, he had such conviction in his predictions that he bet everything he could against the housing market.

This risky move made a personal profit of $100 million which is why Hollywood decided to create a movie showcasing the insane bet.

Despite Burry’s unconventional approach to investing, he has been praised for his foresight and accurate market analysis.

What is Scion Asset Management?

As you might have already guessed Scion Asset Management is the private investment firm and hedge fund that Michael Burry owns and operates. It’s one of the more popular (and scrutinized) hedge funds given Burry’s “colorful” history with the markets.

Scion Asset Management mostly engages in long-term value investing. This means they primarily target undervalued stocks. To find these stocks Burry conducts detailed research (both technical and fundamental) to identify great investments that other analysts have likely missed.

Michael Burry – Scion Asset Management Performance Overview

Scion Asset Management’s top 20 weighted holdings have a 3-year annualized return of approximately 34.04% with a 3-year cumulative return of approximately 140.8%. The top 50 weighted holdings have almost identical returns. In comparison to other hedge funds and the S&P 500, this is a strong performance.

Should you blindly copy Michael Burry's stock picks?

Copying Michael Burry

❌ Hedge fund holdings are updated each quarter.

❌ Trades can be months old by the time they are public.

❌ Investment horizons and strategies can change without warning.

❌ Can hold thousands of different stocks. This isn't realistic for investors.

❌ Hedge funds can still buy underperforming stocks.

Ticker Nerd Premium

✅ Latest ratings from Wall Street Analysts every week.

✅ Top 10 Rated Stocks updated every month.

✅ Two stock ideas with massive potential each month.

✅ Get in-depth reports on stocks with potential.

✅ Learn the risks behind each stock.

✅ Save 80+ hours of research per month.

Michael Burry – Scion Asset Management Top Buys and Sells in Q3 2023

In Q3 2023, Scion Asset Management completely sold its holdings in several stocks including Expedia Group, Charter Communications, and Generac Holdings. The firm also sold its put options in SPY and QQQ which are index funds that provide exposure to the S&P 500. By selling these put options, this could suggest that the firm is bullish on the S&P 500 over the near term or it could simply be the firm locking in profits and exiting its position.

| Ticker | Company Name | Industry | Bought/Sold | Amount |

| SOXX | iShares Semiconductor ETF | Semiconductors | Bought shares (+47.86%)* | 100,000 shares |

| BKNG | Booking Holdings Inc | Travel Technology | Bought shares (+7.79%)* | 2,500 shares |

| STLA | Stellantis N.V | Automobile Manufacturing | Bought shares(+7.4%) | 400,000 shares |

| NXST | Nexstar Media Group Inc. | Television Broadcasting | Bought shares(+6.9%) | 48,700 shares |

| SBLK | Star Bulk Carriers Corp | Deep Sea Freight Transportation | Bought shares (+4.68%) | 250,000 shares |

| SPY | SPDR S&P 500 ETF TRU | Index Fund | Sold shares(-100%)* | 2,000,000 shares |

| QQQ | Invesco QQQ Trust | Index Fund | Sold shares(-100%)* | 2,000,000 shares |

| EXPE | Expedia Group Inc | Travel Technology | Sold shares (-100%) | 100,000 shares |

| CHTR | Charter Communications | Telecommunications | Sold shares (-100%) | 25,000 shares |

| GNRC | Generac Holdings Inc. | Manufacturing | Sold shares (-100%) | 55,000 shares |

*These are put options. This means the investor is betting the value of the stock/ETF will go down.

Michael Burry – Scion Asset Management Sector Allocation

Michael Burry – Scion Asset Management Investment Strategy & Quotes

Michael Burry’s investment strategies:

- Strong value investing: As mentioned earlier, Burry invests in companies he thinks are truly undervalued that have room to grow in the long run. Since Burry is capable of conducting deep analysis he’s able to find these companies.

- Contrarian approach: This shouldn’t come as a surprise. Burry has been known to go against the grain. The way he bet against the housing market in 2007-2008 shows he isn’t afraid to trust his research above market sentiment.

- Focus on fundamentals: Most of Burry’s decisions are grounded in fundamental analysis. He frequently examines financial statements and market conditions to identify mispriced assets.

- Long-term perspective: Burry truly takes a long-term perspective with the assets he invests in. His 10-year performance is over 160% in the green, whereas his YTD performance is down significantly. When you zoom out Burry is usually very successful on a longer time horizon.

- Selective short-selling: Even though Burry adopts a long-term investment horizon he’s known for taking advantage of market fluctuations. This proves to be true even in Q3 2023, where he shorted iShares Semiconductor ETF (SOXX) and Booking Holdings Inc (BKNG).

Michael Burry’s famous quotes:

- “If you are going to be a great investor, you have to fit the style to who you are”.

- “My natural state is an outsider. I've always felt outside the group, and I've always been analyzing the group”.

- “I have always believed that a single talented analyst, working very hard, can cover an amazing amount of investment landscape, and this belief remains unchallenged in my mind”.

Michael Burry – Scion Asset Management News & Resources

- Who is Michael Burry?

- Short sellers are misunderstood

- Scion Asset Management Website

- Michael Burry puts on another BIG SHORT

- Scion Asset Management, LLC – EDGAR

- Michael Burry's Scion Asset Management Makes a Big Play on Nexstar Media Group

Frequently Asked Questions

Scion Asset Management, LLC is run by Dr. Michael J. Burry.

Michael Burry is best known for being one of the first investors to predict (and profit from) the subprime mortgage crisis that occurred between 2007 and 2010.

Michael Burry is the founder and CEO of Scion Asset Management, a hedge fund that he started in 2000.

Michael Burry’s net worth is estimated to be worth somewhere between $300 million and $1.2 billion. This valuation is based on his holdings in his hedge fund Scion Asset Management as well as his returns from savvy investments involving subprime mortgages, GameStop, gold, water, and farmland.

Data was collected from (but not limited to) the sources below:

– Stockcircle

– HedgeFollow

– WhaleWisdom

– EDGAR filings from the SEC