Overview

- DataBricks is a strong contender for a blockbuster IPO in the data analytics sector. Its potential post-IPO valuation could exceed $40 billion. However, the company has made no official IPO announcement yet.

- CEO Ali Ghodsi stresses that DataBricks isn't rushing to IPO. Instead, the company is focusing on strategic growth and market position consolidation.

- DataBricks is showing impressive growth. The company has raised over $1.2 billion in funding and exceeded $1 billion in annualized revenue in 2022.

What you need to know about DataBricks

DataBrick is a serious player in the world of cloud-based data analytics. Their platform is a godsend for businesses, giving them the power to whip up, manage, and launch data-driven applications insanely quickly.

The brains behind DataBricks set things in motion back in 2013, and since then, they've managed to amass a cool $1.2 billion in funding. And we're talking some big-name backers here, including Andreessen Horowitz, Microsoft, and NEA. They've also made some savvy acquisitions. Snapping up several companies, such as Okera and DataJoy.

DataBricks offers a cohesive platform for all things data engineering, machine learning, and analytics. The name of the game here is speed and ease when it comes to crafting, managing, and rolling out data-driven applications.

DataBricks is an essential toolkit for data scientists – brimming with notebooks, dashboards, and data pipelines.

Source: sacra.com

Is DataBricks ready for an IPO?

Databricks has been on quite a growth spurt over recent years. To give you an idea, their revenue shot up by a whopping 200% in 2020 alone. Fast forward to 2022, and the company's CEO, Ali Ghodsi, was announcing revenues had zoomed past the $1 billion mark.

It's not just about revenue, though. Databricks has claimed a sizable chunk of the market – around 20%, by some estimates – earning itself a spot as one of the big hitters in the industry.

Now, the crew at the helm of Databricks is nothing short of impressive. They're brimming with deep-seated experience and expertise in data engineering, machine learning, and analytics. What's more, they've been channeling serious investment into honing the company's operational efficiency and scalability, which lets them bob and weave with the best of them in response to market changes.

Their customer base is solid too. In 2020, they served over 1,000 customers. It seems like Databricks' must be doing something right since they have a customer renewal rate north of 90%.

The company has a lot going for it. A top-notch management team, streamlined operations, and a scalable business model. And when you throw in robust user growth and stellar retention rates, well, it's not hard to imagine Databricks going public in the near future.

How does DataBricks make money?

Databricks' makes money using the standard SaaS business model – by charging customers for using its platform. They have offer a range of pricing options. Starting at the low end with a free plan all the way up to enterprise-level plans.

The beauty of Databricks' business model lies in its scalability. Customers can handpick a plan that marries well with their needs and budget, and can shuffle between plans as those needs evolve. So, whether you're a new startup or a Fortune 500 company, Databricks makes it simple to get started and scale up when your data needs ramp up.

Databricks isn't just a one-trick pony – it's got an arsenal of features and services up its sleeve, from data storage and processing to machine learning and analytics. This breadth of offerings makes it super easy for customers to get the most out of their data.

But, there's no such thing as a free lunch. The flip side to Databricks' model is that it can get pricey for customers juggling hefty data storage needs or requiring serious processing power. Plus, to truly unlock all the platform's potential, customers might need to shell out extra cash for additional services or features. So, while the initial cost may seem low, the extras can start to add up.

Who is DataBricks' competition?

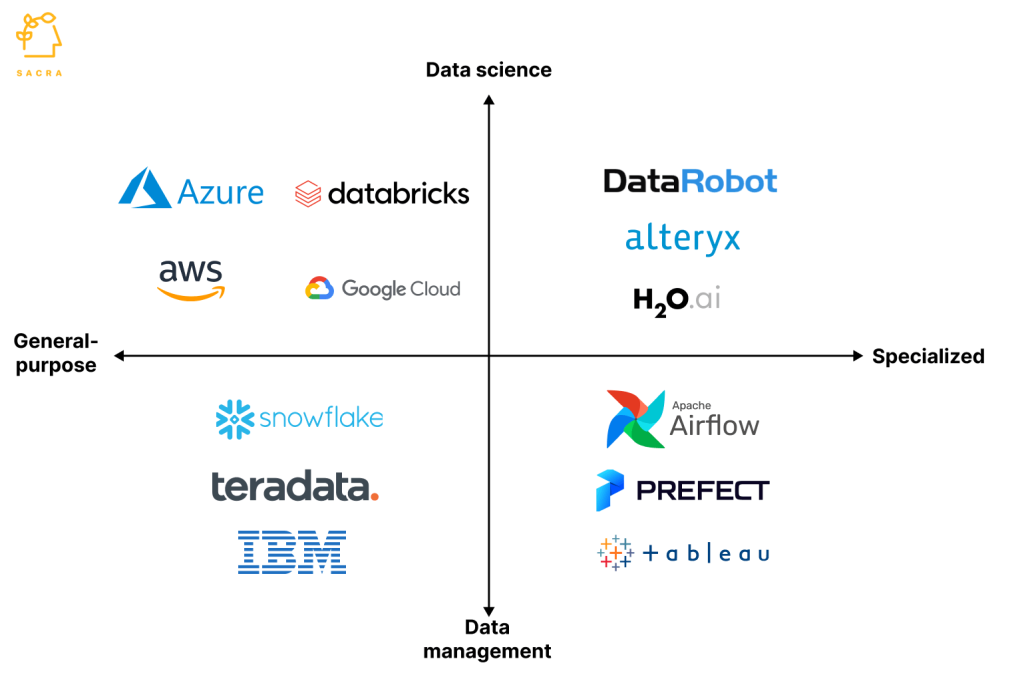

Databricks is squaring off with some big guns – think Amazon Web Services, Microsoft Azure, and Google Cloud Platform. These tech behemoths are all in the same game, providing services like data storage, analytics, and machine learning.

But, Databricks isn't just a carbon copy of these established players. What makes them stand out is their unified platform. This allows them to bundle together data engineering, machine learning, and analytics. This means customers can easily access and analyze data from multiple sources. This part of the reason they've been able to grow so quickly.

Despite all the competition the cloud-based data analytics market is ballooning, and fast. And Databricks is well positioned to ride this wave of growth. It's not going to be easy though – competitors are hot on their heels, offering more services that mirror Databricks'. So, it's not just about running the race – Databricks needs to stay a step ahead, constantly innovating and carving out a niche, if it wants to keep a slice of the market.

Who founded DataBricks?

Back in 2013, Databricks was just a brainchild of seven computer science Ph.D. students at UC Berkeley. The founding team included Ali Ghodsi, Andy Konwinski, Arsalan Tavakoli-Shiraji, Ion Stoica, Matei Zaharia, Patrick Wendell, and Reynold Xin.

Databricks didn't just spring up out of nowhere – it's got roots in the AMPLab project at the University of California, Berkeley. They were the brains behind Apache Spark, an open-source distributed computing system built on Scala.

Since we flipped our calendars to 2016, Ali Ghodsi has been in the driver's seat as Databricks' CEO.

His ambition? It's as clear as daylight – he's aiming to make Databricks the numero uno in the big data platform arena.

What’s the market saying about the DataBricks’ IPO?

At the time of writing, Databricks hasn't locked in a dates for their initial public offering (IPO).

It's an intriguing pause, especially as Wall Street's enthusiasm for the software industry seems to be on a bit of a roller coaster ride. What makes Databricks' potential IPO even more interesting is that it isn't just any startup – it's among the big guns in the U.S., boasting a whopping valuation of $38 billion.

There's chatter among investors that Databricks could be taking a leaf out of Snowflake Inc.'s book, which pulled off a record-breaking IPO in the data analytics sphere in 2020. Could Databricks be the next one to grab the IPO spotlight? Time will tell.

Ali Ghodsi, the CEO at the helm of Databricks, is playing it cool. In his view, a shaky stock market isn't going to dictate their IPO plans, and they don't seem desperate to make their debut. For now, he's kept his lips sealed about the timing of any potential IPO.

Some analysts had their money on 2022 being the year Databricks steps onto the public market stage, but it seems their crystal balls were a little off. After the confetti settles post-IPO, the buzz is that Databricks' valuation could skyrocket past the $40 billion mark.

Frequently Asked Questions

DataBricks has not yet announced any plans for an IPO.

DataBricks is currently valued at $38 billion.

It is not clear whether DataBricks is profitable. Since it is still a private company it has no obligation to share its financials.