| Impossible Foods IPO Date (Predicted): | 2024 |

| Impossible Foods Valuation: | $7-$10 billion |

| Impossible Foods Predicted Revenue (2022): | $400-$425 million |

| Total Funds Raised: | $1.9 billion |

| Number of Employees: | 700+ |

| Headquarters: | Redwood City, California |

| Founded: | 2011 |

Overview:

- When asked about the Impossible Foods IPO, CEO Peter McGuiness said “it will happen” but “probably not this year” in an interview with Yahoo Finance in early 2023.

- Impossible Foods produces plant-based meat substitutes, including the famous Impossible Burger.

- They have raised $1.9 billion in funding and have partnerships with major fast-food chains.

- The company's revenue comes from selling products to grocery stores and restaurants.

What you need to know about Impossible Foods

Impossible Foods' was founded back in 2011 by Patrick O. Brown, a former biochemistry professor at Stanford University. It's mission is ambitious – “to make the global food system truly sustainable by eliminating the need to make food from animals”. The motivation behind this is simple: animal agriculture has a devastating affect on the environment.

You probably already know about its flagship product – the Impossible Burger. This plant-based patty packs 19g of protein primarily from a blend of soy and potato protein. The patty mimics the flavor and texture of beef. It has managed to gain attention from both vegans and meat eaters.

They also offer other meat alternative products like plant-based pork, beef and sausages as well as popular poultry products like chicken nuggets.

In November 2021, Impossible Foods managed to secure a whopping $500 million in funding. This gave it an total valuation of approximately $9 billion.

To keep up with its rapid growth, the Impossible Foods management team has been expanding too. in October 2022, Impossible Foods brought Leslie Sims as the Chief Marketing and Creative Officer. With her expertise in the field, Sims is expected to bring a spark of creativity to drive the company's branding and marketing efforts.

Not stopping there, in November 2022, they welcomed Sherene Jagla as their first-ever Chief Demand Officer – her role is focused on linking marketing and sales efforts together to help drive more revenue.

Many are now speculating about the possibility of an Impossible Foods IPO. While nothing has been officially announced, the company's recent achievements and impressive valuation have undoubtedly caught the attention of investors.

Are Impossible Foods ready for an IPO?

This plant-based powerhouse has been making waves in the food industry. It's not hard to see why. They've managed to raise a whopping $1.9 billion in funding through 12 rounds.

Impossible Foods has also continued to expand aggressively. By partnering with iconic fast-food chains like Burger King and Starbucks Impossible Foods have been to able to showcase plant-based meat products to a mainstream customer base.

Despite raising nearly $2 billion in funding it's not clear if the company is profitable yet. Their business model relies heavily on R&D in order to keep improving their products. The company is also aiming to double production every year which requires significant capital.

How to buy Impossible Foods stock

Impossible Foods is still a private company. But this doesn't mean you can't invest.

Here's how you could get in on the action:

1. Private equity investments. This is where you invest directly into Impossible Foods while it's still private. This option is typically reserved for institutional investors or high-net-worth individuals, given the high minimum investment requirements and the risk involved. You also need to be well-connected to be able to get on the cap table for a popular pre-IPO company like Impossible Foods.

2. Secondary markets. These are platforms where pre-IPO shares are bought and sold, often by employees or early investors. These markets can be illiquid. When compared to public companies there can be less financial information available to guide your decision.

3. Crowdfunding platforms. Some of these platforms allow accredited investors to participate in late-stage, pre-IPO funding rounds. The appeal is clear: lower investment minimums and the potential for high returns. This option still comes with substantial risks, including the possibility of losing your entire investment.

While pre-IPO investing has its perks it also can be risky. Due diligence is essential. Consult with a financial advisor before making any investment decisions.

Who owns Impossible Foods?

Impossible Foods was founded back in 2011 by Patrick O. Brown, a former biochemistry professor at Stanford University. Patrick had a wild idea: why not create meat alternatives from plants? He wanted to crack the code on what makes meat so delicious – the sizzle, the smell, the taste, and the nutrition – and replicate it using only plant-based ingredients.

Fast forward to 2022, after the growth of Impossible Foods Patrick's net worth is estimated to be a cool $1.5 billion.

The company is currently led by Peter McGuiness who has been the CEO since April 2022.

Notable investors in Impossible Foods

Some of the notable investors in Impossible Foods include:

- Mirae Asset Global Investments: Participated in the Series H and Series F funding rounds.

- Rockpool Capital: Participated in the secondary market.

- Temasek Holdings: A recurrent investor, Temasek participated in the Series E and G funding rounds and in a round of convertible notes.

- Coatue: Led the Series G funding round.

- Horizons Ventures: Led the Series E funding round.

- Sailing Capital: Participated in a round of convertible notes.

- UBS: Led the Series D funding round.

- Bill Gates: A personal investment from one of the world's wealthiest individuals in the Series B funding round.

- Khosla Ventures: Participated alongside Gates in the Series B funding round.

- Serena Williams and William Adams (Will.i.am): Both celebrities invested in the Series F funding round.

Source: Crunchbase

What’s the market saying about the Impossible Foods IPO?

Back in November 2021, Impossible Foods made headlines by securing a staggering $500 million in funding. This resulted in a $9 billion valuation for the company. You can imagine the excitement among investors who immediately started predicting a potential IPO.

However, no official announcements have been made just yet. In an interview with Yahoo Finance in February 2023, CEO Peter McGuiness said that an Impossible Foods IPO “will happen, but probably not this year”.

The company has experienced nothing short of a meteoric rise and is considered one of the market leaders in the plant-based meat industry.

Impossible Foods has a lot going for it. In 2022, the company's retail sales broke its previous record achieving more than 50% revenue growth. On top of that, the company is riding broader consumer trends around healthy, ethical and environmentally-friendly products.

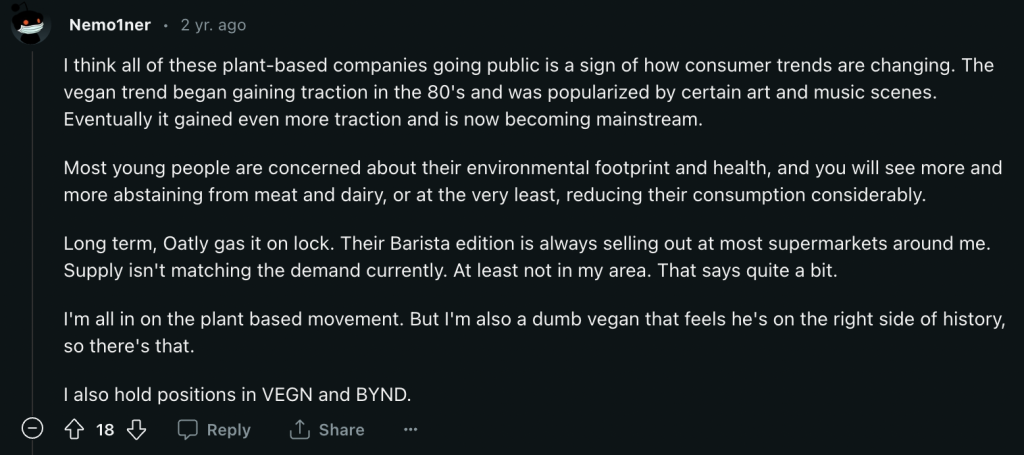

This Redditor shared a great summary behind why plant-based companies still have plenty of room for growth.

You can read the original Reddit thread for more insights. Bear in mind the thread was posted in April 2021.

How does Impossible Foods make money?

The Impossible Foods business model relies on producing plant-based meat products then selling those products to grocery stores and restaurants. They also have established partnerships with major fast-food chains like Burger King and Starbucks.

Their products, made from ingredients like soy protein and potato protein, are sold across the United States and internationally.

One of the major selling points of Impossible Foods' products is that it provides consumers with a more sustainable and environmentally friendly alternative to traditional meat. Plant-based meat requires fewer resources to produce, reducing greenhouse gas emissions and other environmental impacts.

Who is Impossible Foods’ competitors?

Impossible Foods operates in the rapidly growing plant-based meat market. As the number of consumers looking for sustainable and environmentally friendly food options grows, so does the demand for Impossible Foods' products.

But Impossible Foods aren't the only option on the menu.

One of Impossible Foods' biggest competitors is Beyond Meat. They've got a wide range of plant-based meat alternatives that give Impossible Foods a run for their money. Since Beyond Meat is a publicly traded company we can get a deeper look into their financial performance. The company released its financial results for FY2022 in February 2023. The results were disappointing. Net revenues declined by nearly 10% year-on-year. Its hard to say if this is a reflection of Beyond Meat's performance specifically or the broader plant-based meat market.

Nestle has also jumped into the market with their own line of plant-based protein products. Even traditional meat producers, Tyson Foods and Perdue Farms are moving into the market—entering the game with their own plant-based meat alternatives.

One of the biggest criticisms and threats to plant-based food companies is that their products are still more expensive compared to traditional meat products. Impossible Foods CEO Peter McGuiness stated, “plant-based meat doesn't work if it's an academic thing or it's a bi-coastal thing, or it's for upper income.”

Question marks also still remain over the taste of plant-based products on whether they truly mimic their “real” counterparts.

Frequently Asked Questions

Impossible Foods has not gone public yet, but there is speculation about a potential IPO in 2024.

As of June 2023, Impossible Foods has a post-money valuation ranging from $7 billion to $10 billion.

It's not clear whether Impossible Foods is profitable as they are still a private company. The company has been investing heavily in research and development and expanding its production capacity. Once Impossible Foods hits the stock market they will need to publicly reveal their financial performance.