As we take a look at 2015, it's hard to ignore the significant influence of global events on the year's IPOs.

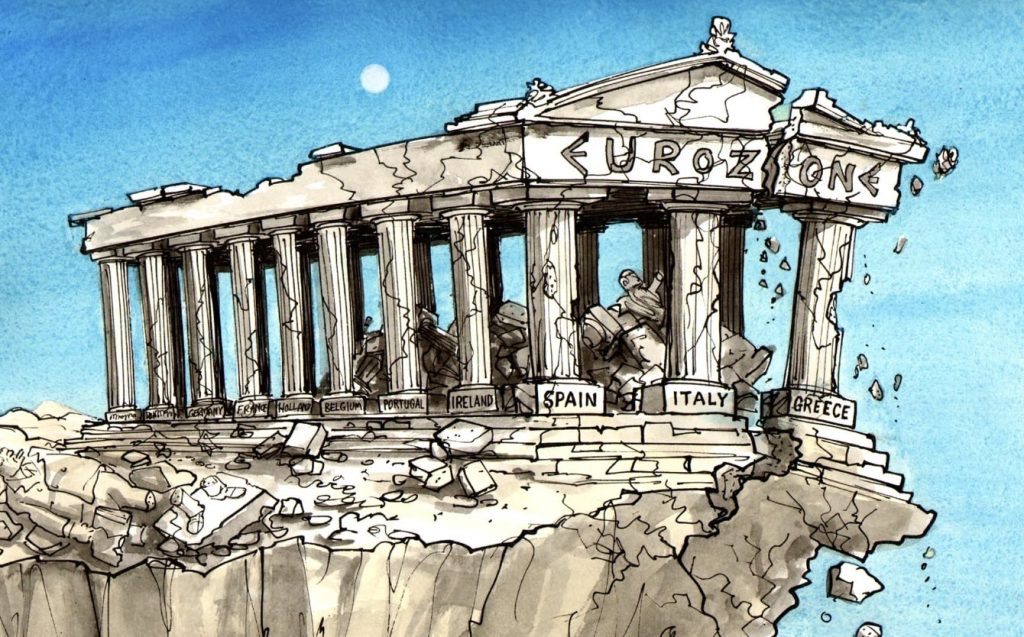

2015 was full of landmark events that rippled through financial markets. Everything from the Greek Debt Crisis to the Volkswagen Emission Scandal. The stock markets were volatile.

However, over 160 companies, including a domain register, a luxury car brand, an e-commerce platform, and a wearable fitness technology company, still managed to public.

So keep reading to discover which companies had and how they perform today.

Major world events that happened in 2015 that affected the stock market

Greek Debt Crisis: The ripple effect of the European Debt Crisis hit Greece harder than most European countries. On July 20, the country reached a bailout agreement with its creditors, averting a potential exit from the Eurozone. As you can imagine, this was bad for financial markets and caused widespread volatility in the stock market.

Volkswagen Emissions Scandal: In September, an investigation revealed that Volkswagen had installed software in its diesel cars to cheat emissions tests. The scandal resulted in recalls of up to 36,000 cars, lawsuits, and significant damage to Volkswagen's reputation.

Paris Climate Agreement: On December 12, world leaders reached an agreement at the Paris United Nations Climate Change Conference. The agreement resulted in commitments from 193 parties to reduce their emissions to offset the impacts of climate change.

Eight most notable companies that went public in 2015

1. Alarm.com

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Software—Application

- IPO Price: $14 per share

- IPO Date: June 26, 2015

Alarm.com provides smart home security and automation solutions for homes, small businesses, and large organizations. They offer a suite of products that allow their customers to monitor, control, and secure their premises. Most of this is done remotely through security systems, video surveillance, energy management, smart locks, and more. Alarm.com even provides professional installation services and 24/7 customer support.

2. Atlassian

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Software—Application

- IPO Price: $21 per share

- IPO Date: December 10, 2015

As an Aussie and Atlassian power user, this is an IPO I was genuinely excited about. They're a highly regarded software company with collaboration tools like Jira, Confluence, Bitbucket, and Trello. Their tools help teams plan, track, and release projects, share and collaborate on documents, and manage code repositories. Atlassian is the tool of choice for most software companies, so it's no surprise the share price has steadily increased since the public offering.

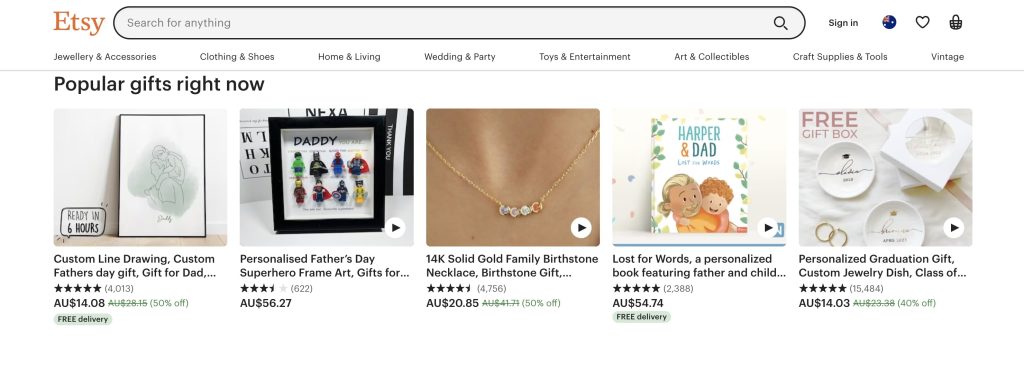

3. Etsy

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Internet Retail

- IPO Price: $16 per share

- IPO Date: April 16, 2015

Etsy is an online marketplace that connects buyers and sellers of handmade, vintage, and unique goods. It provides a platform for artists and entrepreneurs to showcase their products to a global audience. Etsy has become popular since its products are customizable, unique, and hard to find elsewhere. They also offer tools that help sellers manage their businesses, including payment processing, shipping, and customer support. In 2021, Etsy acquired a smaller competitor, Depop, for $1.65 billion, making Etsy stock even more valuable to retail investors.

4. Ferrari

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Auto Manufacturers

- IPO Price: $52 per share

- IPO Date: October 21, 2015

Ferrari is one of my favorite performance car brands; it's also one of the few businesses most people are familiar with. But for the uninitiated, Ferrari is an Italian luxury sports car manufacturer. Founded by Enzo Ferrari in 1939, the company produces some of the world's most iconic vehicles. Ferrari is renowned for its high-performance engines, distinct red color, sleek designs, and racing heritage. When you take a closer look at the business, you'll notice they also produce other luxury products, including apparel, accessories, and fragrances. In September 2023, there's set to be a film released about the story of Enzo Ferrari and the growth of the company.

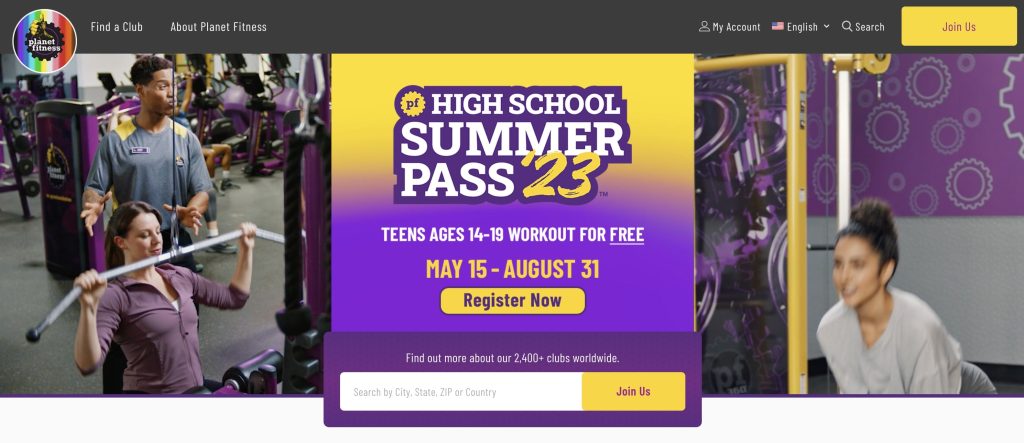

5. Planet Fitness

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Leisure

- IPO Price: $16 per share

- IPO Date: August 6, 2015

Planet Fitness is one of the largest global fitness franchises in the world. They provide affordable and convenient access to their fitness facilities, including access to classes like yoga and Zumba. One of the reasons the chain is so popular is its no-frills approach and “judgment-free zone” which encourages people from all walks of life to join the gym.

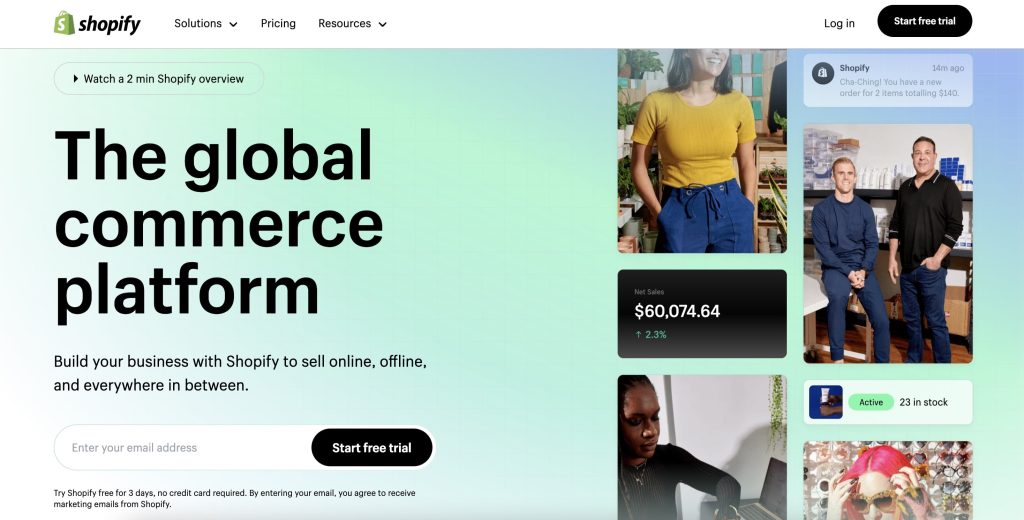

6. Shopify

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Software—Application

- IPO Price: $17 per share

- IPO Date: May 20, 2015

Shopify is my favorite e-commerce platform since it's easy to set up, use, and scale. They enable businesses to create and manage online stores without coding experience. Shopify has removed the entry barrier when it comes to creating an e-commerce business; anyone can take their idea online in a matter of minutes. According to Tracxn, Shopify has made 13 acquisitions and 15 investments, costing over $2 billion. Their stock price has been trending down since late 2021 but seems to be slowly recovering.

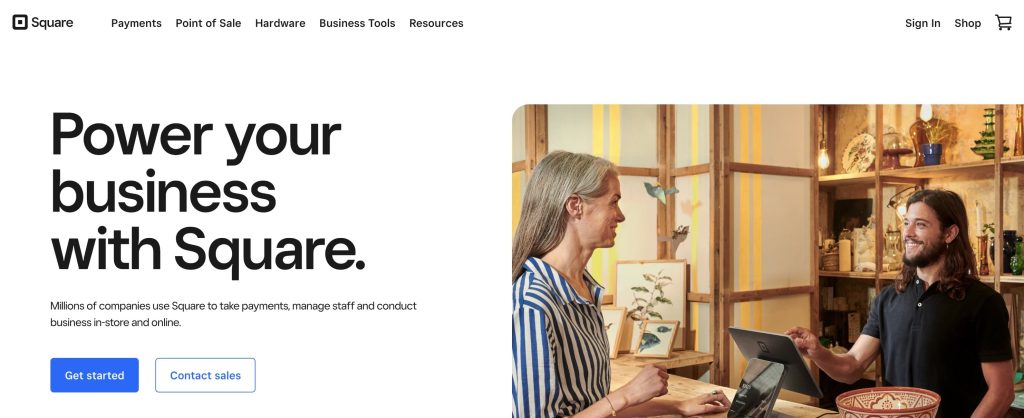

7. Square

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Software—Application

- IPO Price: $9 per share

- IPO Date: November 19, 2015

Square is a FinTech company that provides small businesses with hardware and software to accept and process payments. Their product suite includes Point of Sale (POS) hardware and software, payment processing services (similar to Stripe), and eCommerce applications. If you've ever paid for something by tapping your card or phone on a small nifty device, the chances are it was a Square device. In 2021, Square acquired Afterpay for $29 billion in an all-stock transaction.

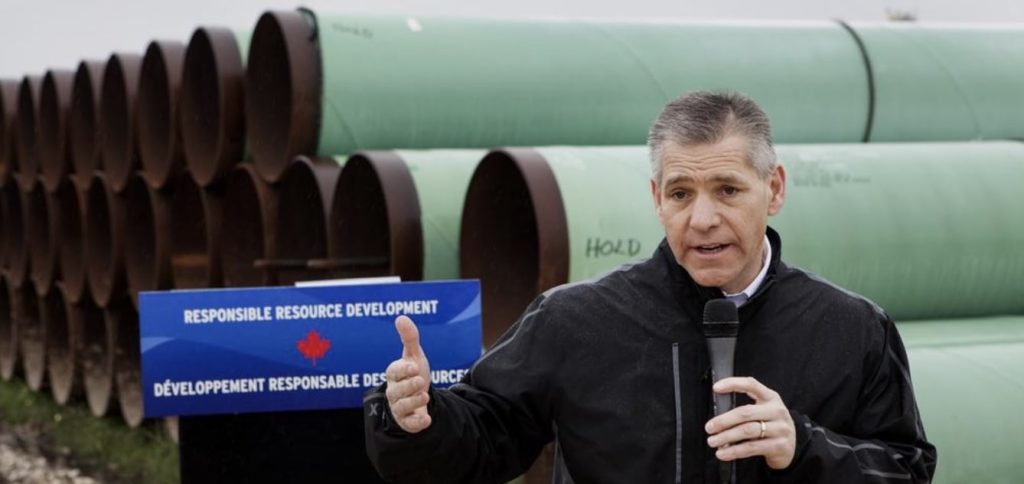

8. Columbian Pipeline Partners (Acquired by TransCanada)

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Natural Energy

- IPO Price: $23 per share

- IPO Date: February 6, 2015

Columbian Pipeline Partners was a company that owned and operated more than 15,000 miles of natural gas transmission pipelines (interstate pipelines). The company also held 300 billion cubic feet of underground natural gas storage and a growing portfolio of midstream and related facilities. The 2015 IPO made sense, given the drop in oil and gas prices. However, in 2016 TransCanada acquired them for $13 billion dollars in an all-cash deal.

The 163 companies that had their IPO in 2015

| Company Name | Year Founded | Ticker | Current Status |

|---|---|---|---|

| 8point3 Energy Partners LP | 2015 | CAFD | Acquired by Brookfield Renewable Partners. |

| Aclaris Therapeutics Inc | 2012 | ACRS | Active |

| Adaptimmune Therapeutics plc | 2008 | ADAP | Active |

| Adesto Technologies Corp | 2006 | IOTS | Acquired by Dialog Semiconductor |

| Aduro BioTech Inc | 2000 | ADRO | Active |

| Advanced Accelerator | 2002 | AAAP | Active |

| Aimmune Therapeutics Inc | 2011 | AIMT | Acquired by Nestle. |

| Alarm.com Holdings Inc | 2000 | ALRM | Active |

| Allegiance Bancshares Inc | 2007 | ABTX | Active |

| AllianzGI Diversified Income | 2015 | ACV | Active |

| American Farmland Co | 2009 | AFCO | Active |

| Amplify Snack Brands Inc | 2010 | BETR | Acquired by Hershey's. |

| Apigee Corp | 2004 | APIC | Acquired by Google |

| AppFolio Inc | 2006 | APPF | Active |

| Aqua Metals Inc | 2014 | AQMS | Active |

| Arcadia Biosciences Inc | 2002 | RKDA | Active |

| Ascendis Pharma A/S | 2006 | ASND | Active |

| Atlassian Corp PLC | 2002 | TEAM | Active |

| aTyr Pharma Inc | 2005 | LIFE | Active |

| Avenue Financial Holdings Inc | 2006 | AVNU | Acquired by PNC Financial Services Group Inc. |

| Avinger Inc | 2007 | AVGR | Active |

| Axovant Sciences Ltd | 2014 | AXON | Active |

| Axsome Therapeutics Inc | 2012 | AXSM | Active |

| Baozun Inc | 2007 | BZUN | Active |

| Bellerophon Therapeutics LLC | 2013 | BLPH | Active |

| Black Knight Financial Svcs | 2007 | BKFS | Acquired by Fidelity National Financial |

| Black Stone Minerals LP | 2014 | BSM | Active |

| Blue Buffalo Pet Products Inc | 2002 | BUFF | Acquired by General Mills |

| Blueprint Medicines Corp | 2008 | BPMC | Active |

| Bojangles' Inc | 1977 | BOJA | Active |

| Box Inc | 2005 | BOX | Active |

| Calamos Dynamic Convertible | 2014 | CCD | Active |

| Carbylan Therapeutics Inc | 2004 | CBYL | Inactive |

| Catabasis Pharmaceuticals Inc | 2008 | CATB | Active |

| Cerecor Inc | 2011 | CERC | Active |

| Check-Cap Ltd | 2009 | CHEKU | Active |

| Chiasma Inc | 2001 | CHMA | Active |

| Cidara Therapeutics Inc | 2012 | CDTX | Active |

| CNX Coal Resources LP | 2015 | CNXC | Active |

| Code Rebel Corp | 2007 | CDRB | Inactive |

| Collegium Pharmaceutical Inc | 2002 | COLL | Active |

| CoLucid Pharmaceuticals Inc | 2005 | CLCD | Acquired by Eli Lilly. |

| Columbia Pipeline Partners LP | 2007 | CPPL | Acquired |

| Community Healthcare Trust Inc | 2014 | CHCT | Active |

| ConforMIS Inc | 2004 | CFMS | Active |

| Conifer Holdings Inc | 2009 | CNFR | Active |

| County Bancorp Inc | 1996 | ICBK | Active |

| CPI Card Group Inc | 1982 | PMTS | Active |

| CytomX Therapeutics Inc | 2008 | CTMX | Active |

| DAVIDsTea Inc | 2008 | DTEA | Bankrupt. |

| Dimension Therapeutics Inc | 2013 | DMTX | Acquired by Ultragenyx. |

| Duluth Holdings Inc | 1986 | DLTH | Active |

| Eagle Growth & Income Opport | 1986 | EGIF | Active |

| Easterly Government Properties | 2014 | DEA | Active |

| Edge Therapeutics Inc | 2009 | EDGE | Acquired by BioCryst Pharmaceuticals Inc. |

| EndoChoice Holdings Inc | 2007 | GI | Acquired by Boston Scientific. |

| Entellus Medical Inc | 2006 | ENTL | Acquired by Stryker |

| Enviva Partners LP | 2013 | EVA | Active |

| EQT GP Holdings LP | 2015 | EQGP | Active |

| Equity Bancshares Inc | 2003 | EQBK | Active |

| Etsy Inc | 2005 | ETSY | Active |

| Evolent Health Inc | 2011 | EVH | Active |

| Fenix Parts Inc | 1980 | FENX | Acquired by Stellex Capital Management |

| Ferrari NV | 1939 | RACE | Active |

| First Data Corp | 1989 | FDC | Acquired by Fiserv |

| First Tr Dynamic Europe Eq | 2015 | FDEU | Active |

| Fitbit Inc | 2007 | FIT | Acquired by Google. |

| Flex Pharma Inc | 2014 | FLKS | Acquired by Salarius Pharmaceuticals LLC. |

| Fogo De Chao Inc | 1979 | FOGO | Active |

| Fortress Transp & Infra Inv | 2013 | FTAI | Active |

| Fuling Global Inc | 1995 | FORK | Active |

| Gener8 Maritime Inc | 1997 | GNRT | Acquired. |

| Glaukos Corp | 1998 | GKOS | Active |

| Global Blood Therapeutics Inc | 2011 | GBT | Active |

| GoDaddy Inc | 1997 | GDDY | Active |

| Goldman Sachs BDC Inc | 2012 | GSBD | Active |

| Great Ajax Corp | 2014 | AJX | Active |

| Green Plains Partners LP | -99 | GPP | Active |

| Houlihan Lokey Inc | 1972 | HLI | Active |

| HTG Molecular Diagnostics Inc | 1997 | HTGM | Active |

| InfraREIT Inc | 2001 | HIFR | Acquired by Oncor Electric Delivery Company LLC |

| Inotek Pharmaceuticals Corp | 1996 | ITEK | Acquired by Bausch Health Companies Inc. |

| Inovalon Holdings Inc | 1998 | INOV | Active |

| Instructure Inc | 2008 | INST | Acquired by Thoma Bravo |

| Invitae Corp | 2010 | NVTA | Active |

| Invuity Inc | 2004 | IVTY | Acquired by Stryker |

| Jaguar Animal Health Inc | 2013 | JAGX | Active |

| Jernigan Capital Inc | 2014 | JCAP | Active |

| Jupai Holdings Ltd | 2012 | JP | Active |

| KemPharm Inc | 2006 | KMPH | Active |

| Kornit Digital Ltd | 2002 | KRNT | Active |

| Lantheus Holdings Inc | 1956 | LNTH | Active |

| Live Oak Bancshares Inc | 2008 | LOB | Active |

| Match Group Inc | 2010 | MTCH | Active |

| MaxPoint Interactive Inc | 2006 | MXPT | Acquired by Valassis Communications Inc. |

| MCBC Holdings Inc | 1968 | MCFT | Active |

| Milacron Holdings Corp | 1970 | MCRN | Active |

| Mimecast Ltd | 2003 | MIME | Active |

| MINDBODY Inc | 1998 | MB | Acquired by Vista Equity Partners |

| Mirna Therapeutics Inc | 2007 | MIRN | Acquired by Vir Biotechnology. |

| Multi Packaging Solutions | 2005 | MPSX | Acquired by WestRock. |

| MyoKardia Inc | 2012 | MYOK | Acquired by Bristol Myers Squibb. |

| Nabriva Therapeutics | 2005 | NBRV | Active |

| NantKwest Inc | 2002 | NK | Active |

| Natera Inc | 2003 | NTRA | Active |

| National Commerce Corp | 2006 | NCOM | Active |

| National Storage Affiliates Tr | 2013 | NSA | Active |

| Neos Therapeutics Inc | 1994 | NEOS | Active |

| Nexvet Biopharma plc | 2010 | NVET | Acquired by Zoetis |

| Nivalis Therapeutics Inc | 2007 | NVLS | Inactive |

| Novocure Ltd | 2000 | NVCR | Active |

| Nuveen High Income 2020 | 2015 | JHY | Active |

| Nuveen High Income Dec 2018 | 2015 | JHA | Active |

| Ollie's Bargain Outlet Hldg | 1982 | OLLI | Active |

| Ooma Inc | 2003 | OOMA | Active |

| OpGen Inc | 2001 | OPGN | Active |

| Party City Holdco Inc | 1947 | PRTY | Active |

| Patriot National Inc | 2013 | PN | Active |

| PennTex Midstream Partners LP | -99 | PTXP | Acquired |

| Penumbra Inc | 2004 | PEN | Active |

| People's Utah Bancorp | 1998 | PUB | Active |

| Performance Food Group Co | 1885 | PFGC | Active |

| Planet Fitness Inc | 1992 | PLNT | Active |

| Presbia PLC | 2014 | LENS | Active |

| Press Ganey Holdings Inc | 1985 | PGND | Acquired by EQT |

| ProNAi Therapeutics Inc | 2003 | DNAI | Inactive (Bankrupt) |

| Pure Storage Inc | 2009 | PSTG | Active |

| Rapid7 Inc | 2000 | RPD | Active |

| Regenxbio Inc | 2008 | RGNX | Active |

| Ritter Pharmaceuticals Inc | 2004 | RTTR | Inactive |

| Seres Therapeutics Inc | 2010 | MCRB | Active |

| Shake Shack Inc | 2004 | SHAK | Active |

| Shopify Inc | 2004 | SHOP | Active |

| SolarEdge Technologies Inc | 2006 | SEDG | Active |

| Spark Therapeutics Inc | 2013 | ONCE | Acquired by Roche. |

| Square Inc | 2009 | SQ | Active |

| SteadyMed Ltd | 2005 | STDY | Acquired by United Therapeutics |

| Summit Materials Inc | 2008 | SUM | Active |

| Sunrun Inc | 2007 | RUN | Active |

| Surgery Partners Inc | 2004 | SGRY | Active |

| Tallgrass Energy GP LP | 2015 | TEGP | Active |

| Tantech Holdings Ltd | 2002 | TANH | Active |

| Tekla World Healthcare Fund | -99 | THW | Active |

| Teladoc Inc | 2002 | TDOC | Active |

| TerraForm Global Inc | 2014 | GLBL | Acquired by Brookfield Renewable Partners. |

| TRACON Pharmaceuticals Inc | 2004 | TCON | Active |

| TransUnion | 1968 | TRU | Active |

| Unique Fabricating | 1975 | UFAB | Active |

| Univar Inc | 1924 | UNVR | Active |

| Viking Therapeutics Inc | 2012 | VKTX | Active |

| Virtu Financial Inc | 2008 | VIRT | Active |

| Voyager Therapeutics Inc | 2013 | VYGR | Active |

| vTv Therapeutics Inc | 1998 | VTVT | Active |

| WaVe Life Sciences Ltd | 2012 | WVE | Active |

| Wingstop Inc | 1994 | WING | Active |

| Wowo Ltd | 2011 | WOWO | Active |

| Xactly Corp | 2005 | XTLY | Acquired by Vista Equity Partners |

| XBiotech Inc | 2005 | XBIT | Active |

| Xtera Communications Inc | 1998 | XCOM | Inactive |

| Yirendai Ltd | 2012 | YRD | Active |

| Yulong Eco-Materials Ltd | 2011 | YECO | Active |

| Zosano Pharma Corp | 2012 | ZSAN | Active |

| Zynerba Pharmaceuticals Inc | 2007 | ZYNE | Active |

Frequently asked questions

There were approximately 163 IPOs in 2015, according to Wikipedia, Crunchbase, Yahoo Finance, Techcrunch, and Jay R. Ritter’s data from UF Warrington College of Business. However, it’s hard to find a complete list of every company that has hit the stock exchange for the first time since the global data is fragmented. Please do your own research to confirm this figure.

As of June 2023, Shopify has a market capitalization of $82B, followed by Ferrari, with a market capitalization of $53B. Of course, this is subject to change, and you should check for the latest data.

Approximately seven companies have been classified as either inactive or bankrupt. This includes but is not limited to Code Revel Corp, Carbylan Therapeutics, Davids Tea, Nivalis Therapeutics, and Ritter Pharmaceuticals.