| Number of companies that went public | 169 |

| Notable companies that went public | Beyond Meat, Uber, Cloudflare, Fiverr, Lyft, Pinterest |

| Number of companies that have been acquired | 2 |

| Largest company that went public | Uber (Market Cap of ~$92B) |

In retrospect, 2019 was the calm before the storm.

Even though there was some economic turbulence, over 160 companies still hit the stock exchange for the first time. This included two ride-hailing giants, cloud based tech companies, a social media company, and an internet video conferencing tool.

Keep reading to learn which companies went public in 2019 and how they're performing today.

Major world events that happened in 2019 that affected the stock markets

Brexit: In March 2019, The United Kingdom was scheduled to leave the European Union. However, the deadline was extended multiple times which affected global financial markets and led to heightened volatility.

US-China trade war continues: The trade tensions between the United States and China continued to escalate in 2019. Both countries imposed tariffs on each other's goods, impacting global trade and causing uncertainty in financial markets.

Hong Kong protests: Major protests erupted in Hong Kong in June 2019. What initially started as a protest against a proposed extradition bill, grew into a broader pro-democracy movement. This led to significant disruptions and clashes with authorities.

Rival ride-hailing companies go public: Two of the most notable tech disrupters, Uber and Lyft, hit the stock exchange for the first time. Uber had one of the largest IPOs in history. Even though it raised over $640m, its stock debut faced some challenges, and the company experienced a decline in share price following the initial offering. Lyft faced the same issue shortly after.

Seven interesting companies that went public in 2019

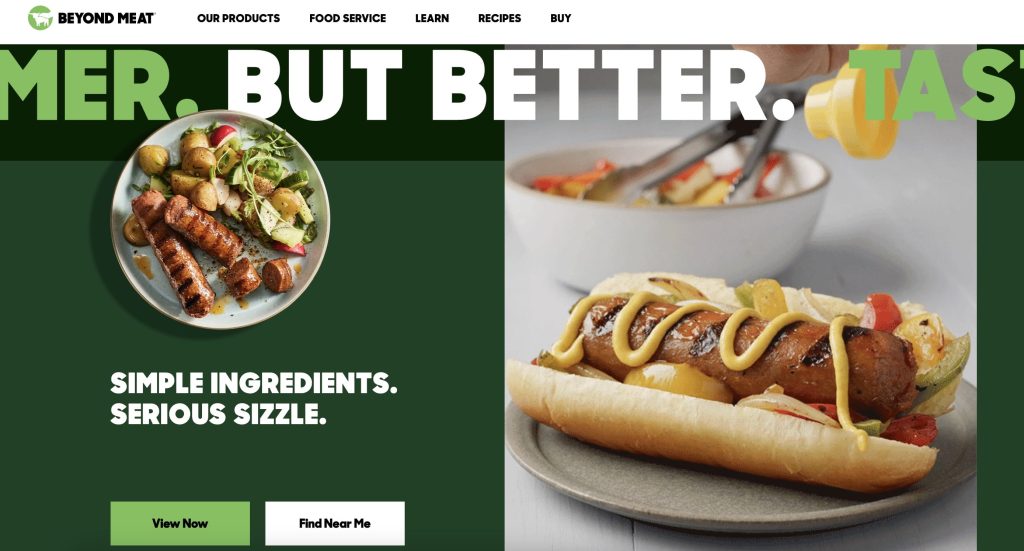

1. Beyond Meat

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Packaged Foods

- IPO Price: $25

- IPO Date: May 2, 2019

Beyond Meat is a popular plant-based food company that produces burgers, sausages, and other products that look, cook, and taste like traditional animal-based meat. Their products are made from simple, plant-based ingredients such as peas, mung beans, and rice. Their mission is to create delicious and sustainable plant-based meat products that are better for people and the planet. This was an exciting company to reach the stock exchange with both public investors and private investors anticipating big returns, however, Beyond Meat's stock has flopped and is trading at an all-time low.

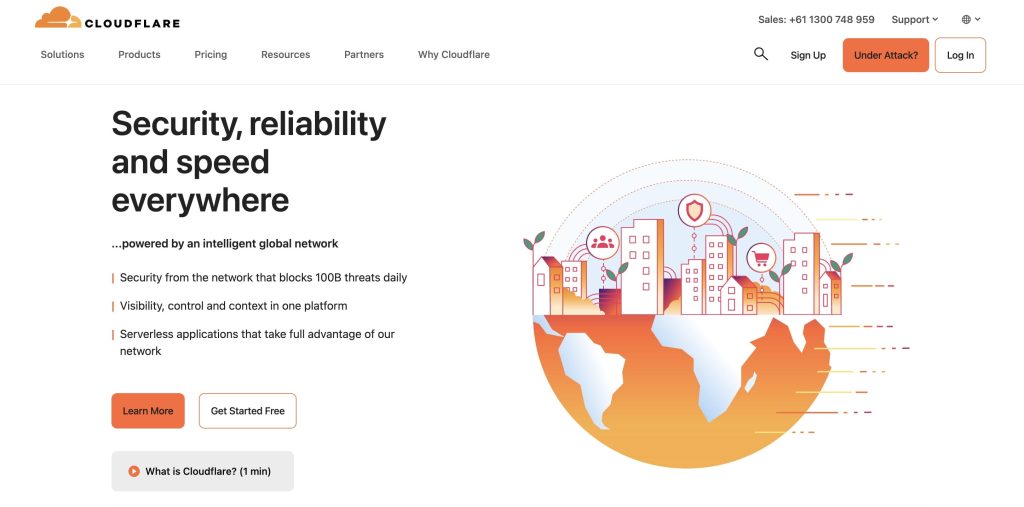

2. Cloudflare

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Software—Infrastructure

- IPO Price: $15

- IPO Date: September 13, 2019

Cloudflare is a global cloud platform that provides security, reliability, and performance solutions for websites, applications, and APIs. In some way, they're the backbone of the internet and millions of websites rely on them. They offer a range of services, including DDoS protection, web application firewall, content delivery network (CDN), and more. It also provides analytics and insights to help customers optimize their online presence.

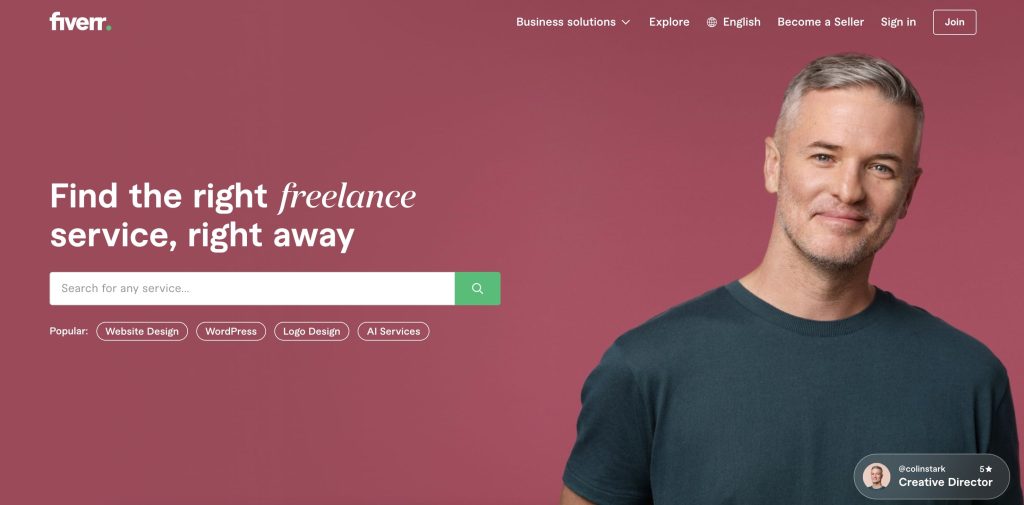

3. Fiverr

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Internet Content & Information

- IPO Price: $21

- IPO Date: June 13, 2019

Fiverr is an online marketplace that connects freelancers with businesses and individuals looking for services. The name “Fiverr” was derived from the $5 asking price attached to each task. These days, most tasks are above the $5 mark but the spirit of quick, affordable, and reliable tasks remains. Fiverr also provides tools to help customers manage their projects, such as tracking progress and communication with freelancers. The stock opened at around $31 per share and climbed to $323 per share although it's been hit like other tech ipos and is now trading closer to its 52-week low.

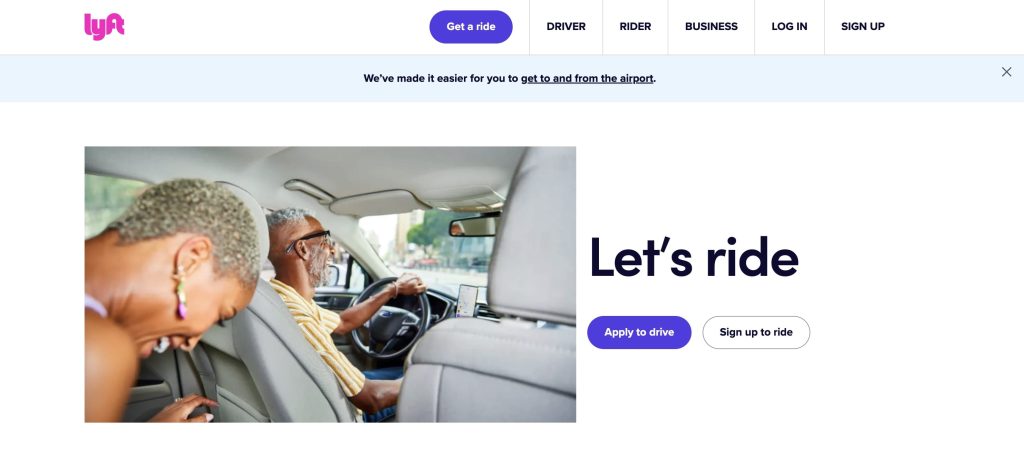

4. Lyft

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Software—Application

- IPO Price: $72

- IPO Date: March 29, 2019

Lyft is a popular transportation network that connects drivers with passengers. It provides a convenient, affordable, and reliable way to get around. Similar to Uber, a competitor that also went public in 2019, passengers can request a ride through the app and drivers will pick them up and take them to their destination. Even though Lyft was a part of revolutionizing the way people get around, the market is becoming more competitive with other players entering the market. Not to mention, neither Lyft nor Uber are profitable.

5. Peloton Interactive

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Leisure

- IPO Price: $29

- IPO Date: September 26, 2019

Peloton is a tech company that provides interactive and connected fitness solutions. They're best known for their stationary bikes fitted with huge interactive screens. Although, Peleton has a suite of products and services, including connected fitness equipment, digital fitness content, and an online community. Their stationary fitness equipment includes a bike, treadmill, and rowing machine, all of which are equipped with a touchscreen display and connected to the Peloton app. As great as this sounds, their stock price has been declining since its peak in December 2020.

6. Pinterest

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Internet Content & Information

- IPO Price: $19

- IPO Date: April 18, 2019

Pinterest is a highly popular online platform that allows users to discover, save, and share ideas and images. According to Omnicore Agency, 76.2% of Pinterest audiences are female and 17.2% are male. Their main point of differentiation is the visual discovery engine which helps users find ideas for their projects, hobbies, and interests. Users can create boards to organize and save their ideas and follow other users to get inspired.

7. Zoom Video Communications

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Software—Application

- IPO Price: $36

- IPO Date: April 18, 2019

Zoom is a cloud-based video conferencing platform that most people are now familiar with as a result of the recent pandemic. The platform enables users to connect with colleagues, customers, and partners around the world. With its easy-to-use interface, Zoom makes it simple for users to connect with anyone, anywhere, anytime. Similar to Peleton, it began trading strong in the public market although its stock price has been declining rapidly since its peak in October 2020.

The 169 companies that had their IPO in 2019

| Company name | Year founded | Ticker | Current status |

|---|---|---|---|

| 10X Genomics Inc | 2012 | TXG | Active |

| 1895 Bancorp of Wisconsin | 1995 | BCOW | Active |

| 36kr Hldg Inc | 2010 | KRKR | Active |

| 89bio Inc | 2018 | ETNB | Active |

| 9F Inc | 2006 | JFG | Active |

| Adaptive Biotechnologies Corp | 2009 | ADPT | Active |

| Aesthetic Medical | 1997 | AIH | Active |

| Afya Ltd | 1999 | AFYA | Active |

| Akero Therapeutics Inc | 2017 | AKRO | Active |

| Alector Inc | 1997 | ALEC | Active |

| AllianzGI Artificial Int Fund | 2019 | AIO | Active |

| Alpine Income Property Trust | 2010 | PINE | Active |

| AMTD International Inc | 2003 | HKIB | Active |

| Applied Therapeutics Inc | 2016 | APLT | Active |

| Aprea Therapeutics Inc | 2003 | APRE | Active |

| AssetMark Finl Hldg Inc | 1996 | AMK | Active |

| Atif Holdings Ltd | 2015 | ATIF | Active |

| Atreca Inc | 2010 | BCEL | Active |

| Avantor Inc | 1904 | AVTR | Active |

| Avedro Inc | 2002 | AVDR | Acquired by Glaukos Corporation |

| Axcella Health Inc | 2008 | AXLA | Active |

| BellRing Brands Inc | 1986 | BRBR | Active |

| Beyond Meat Inc | 2009 | BYND | Active |

| Bicycle Therapeutics Ltd | 2009 | BCYC | Active |

| Bill.com Holdings Inc | 2006 | BILL | Active |

| BioNTech SE | 2008 | BNTX | Active |

| BlackRock Science and Tech II | 2019 | BSTZ | Active |

| Blue Hat Interactive | 2018 | BHAT | Active |

| BridgeBio Pharma Inc | 2015 | BBIO | Active |

| Brigham Minerals Inc | 2012 | MNRL | Active |

| BRP Group Inc | 2011 | BRP | Active |

| Cabaletta Bio Inc | 2017 | CABA | Active |

| Calamos Long/Short Equity Inc | 2017 | CPZ | Active |

| Cambium Networks Corp | 2002 | CMBM | Active |

| Canaan Inc | 2013 | CAN | Active |

| Castle Biosciences Inc | 2007 | CSTL | Active |

| Centogene BV | 2006 | CNTG | Active |

| Change Healthcare Inc | 2005 | CHNG | Active |

| Chewy Inc | 2011 | CHWY | Active |

| China Sxt Pharms Inc | 2006 | SXTC | Active |

| Cloudflare Inc | 2009 | NET | Active |

| CNS Pharmaceuticals Inc | 2017 | CNSP | Active |

| Cortexyme Inc | 2012 | CRTX | Active |

| Crossfirst Bankshares Inc | 2007 | CFB | Active |

| Crowdstrike Holdings Inc | 2011 | CRWD | Active |

| Datadog Inc | 2010 | DDOG | Active |

| Douyu International Holdings | 2014 | DOYU | Active |

| Dynatrace Inc | 2005 | DT | Active |

| Eagle Point Income Co Inc | 2018 | EIC | Active |

| Ecmoho Ltd | 2011 | MOHO | Active |

| EHang Holdings Ltd | 2005 | EH | Active |

| Envista Hldg Corp | 1894 | NVST | Active |

| Exagen Inc | 2002 | XGN | Active |

| Fangdd Network Group Ltd | 2011 | DUO | Active |

| Fastly Inc | 2011 | FSLY | Active |

| Fiverr International Ltd | 2010 | FVRR | Active |

| Frequency Therapeutics Inc | 2014 | FREQ | Active |

| Fulcrum Therapeutics Inc | 2015 | FULC | Active |

| Futu Holdings Ltd | 2011 | FHL | Active |

| Galera Therapeutics Inc | 2012 | GRTX | Active |

| Gossamer Bio Inc | 2003 | GOSS | Active |

| Greenlane Holdings | 2007 | GNLN | Active |

| Grocery Outlet Holding Corp | 1946 | GO | Active |

| Gsx Techedu Inc | 2014 | GSX | Active |

| Guardion Health Sciences | 1948 | GHSI | Active |

| Happiness Biotech Group Ltd | 2004 | HAPP | Active |

| Harpoon Therapeutics Inc | 2015 | HARP | Active |

| Hbt Financial Inc | 1920 | HBT | Active |

| Headhunter Grp Plc | 2000 | HHR | Active |

| Health Catalyst Inc | 2008 | HCAT | Active |

| Hookipa Pharma Inc | 2011 | HOOK | Active |

| Hoth Therapeutics Inc | 2017 | HOTH | Active |

| Ideaya Biosciences Inc | 2015 | IDYA | Active |

| IGM Biosciences Inc | 1993 | IGMS | Active |

| IMAC Holdings Inc | 2000 | IMAC | Active |

| Indonesia Energy Corp Ltd | 2014 | INDO | Active |

| InMode Ltd | 2008 | INMD | Active |

| Inmune Bio Inc | 1972 | INMB | Active |

| Jiayin Grp Inc | 2011 | JFIN | Active |

| Kaleido Biosciences Inc | 2015 | KLDO | Active |

| Karuna Therapeutics Inc | 2009 | KRTX | Active |

| Kura Sushi USA Inc | 2008 | KRUS | Active |

| Levi Strauss & Co | 1853 | LEVI | Active |

| Livongo Health Inc | 2008 | LVGO | Acquired by Teladoc Health |

| LMP Automotive Holdings Inc | 2017 | LMPX | Active |

| Luckin Coffee Inc | 2017 | LK | Active |

| Lyft Inc | 2007 | LYFT | Active |

| Mayville Engineering Co Inc | 1945 | MEC | Active |

| Mdjm Ltd | 2014 | MDJH | Active |

| Medallia Inc | 2000 | MDLA | Active |

| Milestone Pharmaceuticals Inc | 2003 | MIST | Active |

| Mirum Pharmaceuticals Inc | 2018 | MIRM | Active |

| Mmtec Inc | 1956 | MTC | Active |

| Mohawk Group Holdings Inc | 2014 | MWK | Active |

| Molecular Data | 2013 | MKD | Active |

| Monopar Therapeutics | 2014 | MNPR | Active |

| Morphic Holding Inc | 2014 | MORF | Active |

| New Fortress Energy LLC | 2014 | NFE | Active |

| NextCure Inc | 2015 | NXTC | Active |

| NGM Biopharmaceuticals Inc | 2007 | NGM | Active |

| OneConnect Finl Tech Co Ltd | 2015 | OCFT | Active |

| Oportun Financial Corp | 2005 | OPRT | Active |

| Owl Rock Capital Corp | 2015 | ORCC | Active |

| Oyster Point Pharma Inc | 2015 | OYST | Active |

| Pagerduty Inc | 2009 | PD | Active |

| Palomar Holdings Inc | 2014 | PLMR | Active |

| Parsons Corp | 1944 | PSN | Active |

| Peloton Interactive Inc | 2012 | PTON | Active |

| Personalis Inc | 2011 | PSNL | Active |

| Phathom Pharmaceuticals Inc | 2018 | PHAT | Active |

| Phreesia Inc | 2005 | PHR | Active |

| Pimco Energy & Tactical Credit | -99 | NRGX | Active |

| Ping Identity Holding Corp | 2002 | PING | Active |

| Pinterest Inc | 2008 | PINS | Active |

| Postal Realty Trust Inc | 2018 | PSTL | Active |

| Powerbridge Technologies Co | 1997 | PBTS | Active |

| Precision Biosciences Inc | 2006 | DTIL | Active |

| Prevail Therapeutics Inc | 2017 | PRVL | Active |

| Progyny Inc | 2008 | PGNY | Active |

| ProSight Global Inc | 2009 | PROS | Active |

| Puyi Inc | 1979 | PUYI | Active |

| Q&K Intl Grp Ltd | 2012 | QK | Active |

| RAPT Therapeutics Inc | 2015 | RAPT | Active |

| Rattler Midstream Partners LP | 2007 | RTLR | Active |

| Red River Bancshares Inc | 1998 | RRBI | Active |

| Revolve Group LLC | 2003 | RVLV | Active |

| Rhinebeck Bancorp | 1960 | RBKB | Independent |

| Ruhnn Holding Ltd | 2016 | RUHN | Active |

| Satsuma Pharmaceuticals Inc | 2016 | STSA | Active |

| Sciplay Corp | 1997 | SCPL | Active |

| Shockwave Medical Inc | 2009 | SWAV | Active |

| Silk Road Medical Inc | 2007 | SILK | Active |

| Silvergate Capital Corp | 1987 | SI | Active |

| SiTime Corp | 2003 | SITM | Active |

| Slack | 2009 | WORK | Active |

| SmileDirectClub Inc | 2014 | SDC | Active |

| So-Young International Inc | 2013 | SY | Active |

| Soliton | 2020 | SOLY | Active |

| Sonim Technologies Inc | 1999 | SONM | Active |

| South Plains Financial Inc | 1941 | SPFI | Active |

| Springworks Therapeutics Inc | 2017 | SWTX | Active |

| Sprout Social Inc | 2010 | SPT | Active |

| Stealth Biotherapeutics Inc | 2006 | MITO | Active |

| Stoke Therapeutics Inc | 2014 | STOK | Active |

| Sundial Growers Inc | 2006 | SNDL | Active |

| Sunnova Energy Intl Inc | 2012 | NOVA | Active |

| Super League Gaming Inc | 2014 | SLGG | Active |

| TCR2 Therapeutics Inc | 2015 | TCRR | Active |

| TELA Bio Inc | 2012 | TELA | Active |

| TFF Pharmaceuticals Inc | 2018 | TFFP | Active |

| The Realreal Inc | 2011 | REAL | Active |

| Tortoise Essential Assets | 2017 | TEAF | Active |

| Tradeweb Markets Inc | 1998 | TW | Active |

| Transmedics Group Inc | 1998 | TMDX | Active |

| Trevi Therapeutics Inc | 2011 | TRVI | Active |

| Tufin Software Tech Ltd | 2005 | TUFN | Active |

| Turning Point Therapeutics | 2013 | TPTX | Active |

| Uber Technologies Inc | 2009 | UBER | Active |

| Up Fintech Holding Ltd | 2014 | TIGR | Active |

| Viela Bio Inc | 2017 | VIE | Active |

| Vir Biotechnology Inc | 2016 | VIR | Active |

| Wah Fu Education Group Ltd | 1999 | WAFU | Active |

| Wanda Sports Group Co Ltd | 2015 | WSG | Active |

| Watford Holdings Ltd | 2014 | WTRE | Active |

| XP Inc | 2001 | XP | Active |

| YayYo Inc | 2016 | YAYO | Active |

| Youdao Inc | 2006 | DAO | Active |

| Yunji Inc | 2015 | YJ | Active |

| Zoom Video Communications Inc | 2011 | ZM | Active |

Frequently asked questions

There were approximately 169 IPOs in 2019, according to Wikipedia, Crunchbase, Yahoo Finance, Techcrunch, and Jay R. Ritter’s data from UF Warrington College of Business. However, it’s difficult to find a complete list of every company that has hit the stock exchange for the first time since the data is fragmented. Please do your own research to confirm this figure.

As of June 2023, Uber has a market capitalization of $82B followed by CrowdStrike with a market capitalization of $35B. Of course, this is subject to change and you should check for the latest data.

Zero company has been classified as inactive or bankrupt.

Related articles

- What is an Initial Public Offering (IPO)?

- Chime IPO: Frozen IPO market delays listing

- The 169 Companies That Had Their IPO In 2017

- The 197 Companies That Had Their IPO In 2018

- Reddit IPO: Will the “front page of the Internet” go public?

- Stripe IPO: Founders tell employees it will decide within the next year