ChatGPT is a cheat code for stock research.

No surprises there right?

But if your prompts suck the output will suck.

That’s why I spent two weeks building prompts to help with your stock research.

You can skip ahead to see the fifteen prompts that will save you time and help you find some interesting stocks.

Note: We’re going to keep adding prompts to this article so make sure to bookmark it.

Why ChatGPT is great for stock research

Investing tools have come a long way over the last few decades.

But they still require a lot of manual work to find interesting stocks.

You have to know what you’re looking for AND know how to use whichever tool you end up choosing.

But that’s now a thing of the past.

Here’s why ChatGPT crushes the old way of researching stocks:

- Instant responses

Ask and you shall receive.

ChatGPT does all the heavy lifting and gives you answers within a few seconds.

All in plain simple English.

Forget about slow and clunky research platforms that give you mountains of data to analyze.

- Connects the dots for you

ChatGPT can pull information from different topics and correlate them.

Unless you’ve been investing for 20+ years and have formal training in stock analysis – connecting the dots isn’t easy.

ChatGPT can draw on historical data and the latest news headlines to come up with fresh insights.

- Ask follow up questions

This is probably my favorite benefit.

Right now there’s no investing tool in the world that lets you ask follow up questions.

You can ask ChatGPT to explain its reasoning or steelman its arguments.

You can ask it to explain the risks behind a specific stock.

The possibilities are infinite.

- Cost-effective

For a small monthly fee, ChatGPT Plus makes most investing tools redundant.

Plus it can be used for a million other things outside of stock research.

It’s hard to find a reason not to make the investment.

If you’re reading this article there’s a good chance you’re already sold on the value of OpenAI's ChatGPT.

In the next section, I’m going to cover some of the downsides that come with using ChatGPT for stock research.

Risks of using ChatGPT for stock research

ChatGPT isn’t perfect.

Blindly following everything ChatGPT says is a recipe for disaster.

There’s some very real risks you need to watch out for when using it for stock research.

Here’s what to watch out for when using ChatGPT for stock research:

- Doesn’t replace human analysis

Large language models (the technology powering ChatGPT) are essentially using super powerful autocomplete to come up with answers.

While this might not be immediately obvious when reading an answer from ChatGPT its important to remember.

You’ll still need a human to check and review anything it states is correct and makes sense.

- Bias and misinformation

As with all AI, it's based on the data it's trained on, so there might be inherent biases.

These biases aren’t always obvious either.

For example, how do we know ChatGPT isn’t only showing us renewable energy stocks because it has a bias towards sustainability?

- Hallucinations

ChatGPT and other AI technologies are known to hallucinate.

This means they can sometimes tell us (and confidently at that) things that are flat-out false.

This is why you can never blindly follow stock advice shared by ChatGPT.

That’s why all of our reports at Ticker Nerd are written and reviewed by analysts with expertise in stock analysis.

ChatGPT prompts for stock research

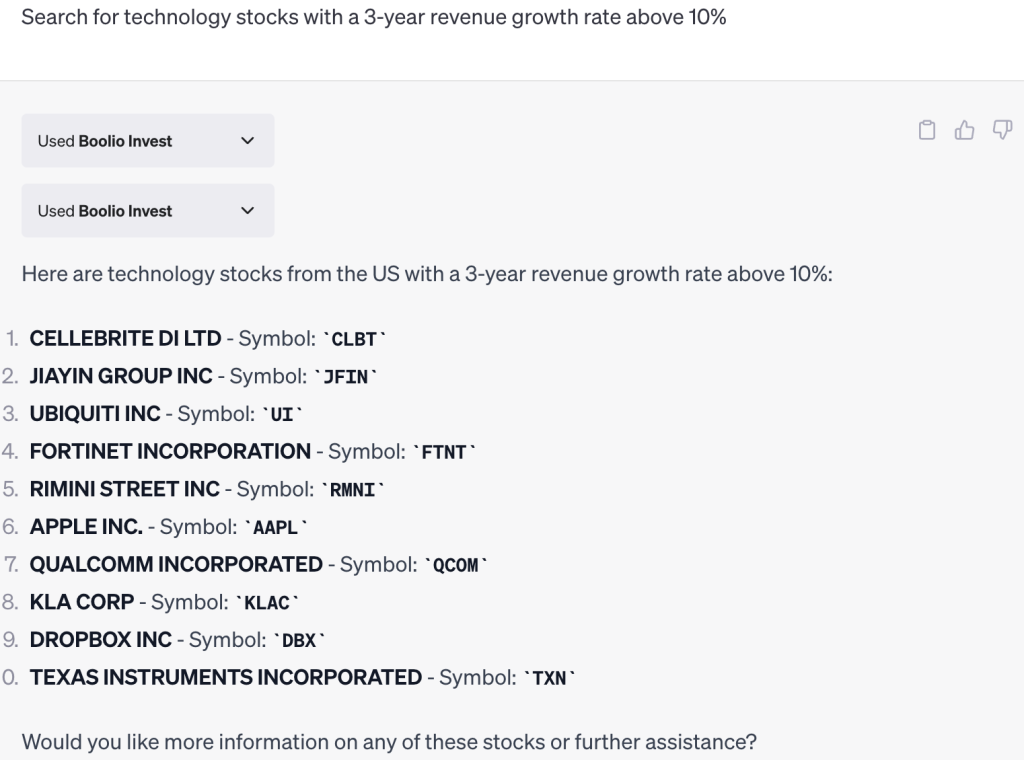

Prompt: “Search for technology stocks with a 3-year revenue growth rate above 10%.”

How it works: This prompt targets the technology sector and focuses on revenue growth, a key indicator of future upside.

Example output:

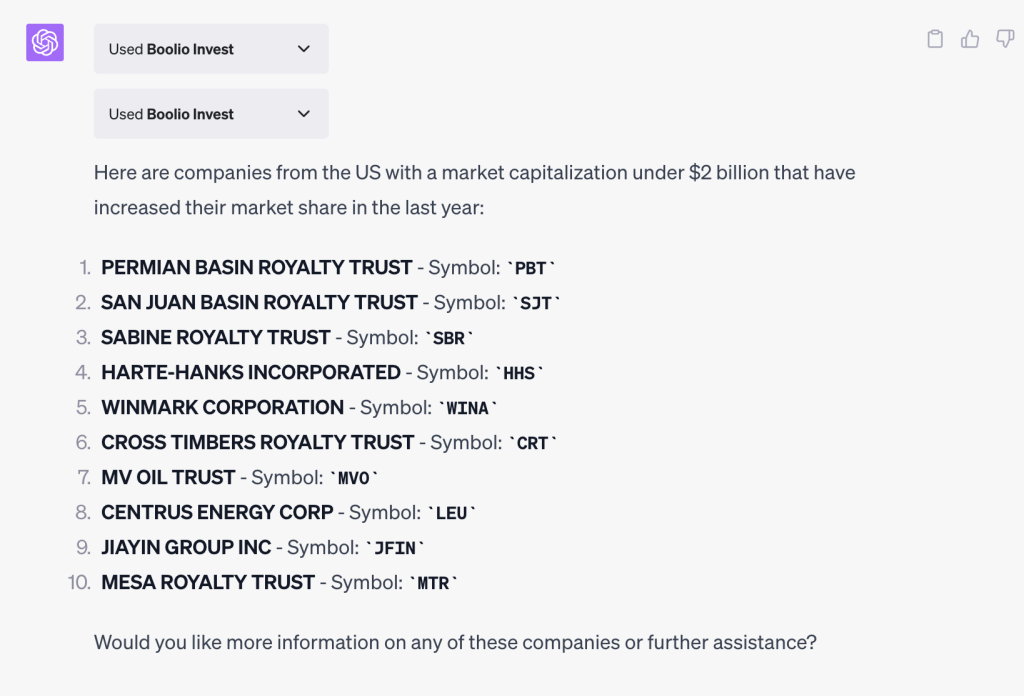

Prompt: “Find companies with a market capitalization under $2 billion that have increased their market share in the last year.”

How it works: This prompt looks for companies that are still small but are growing.

Example output:

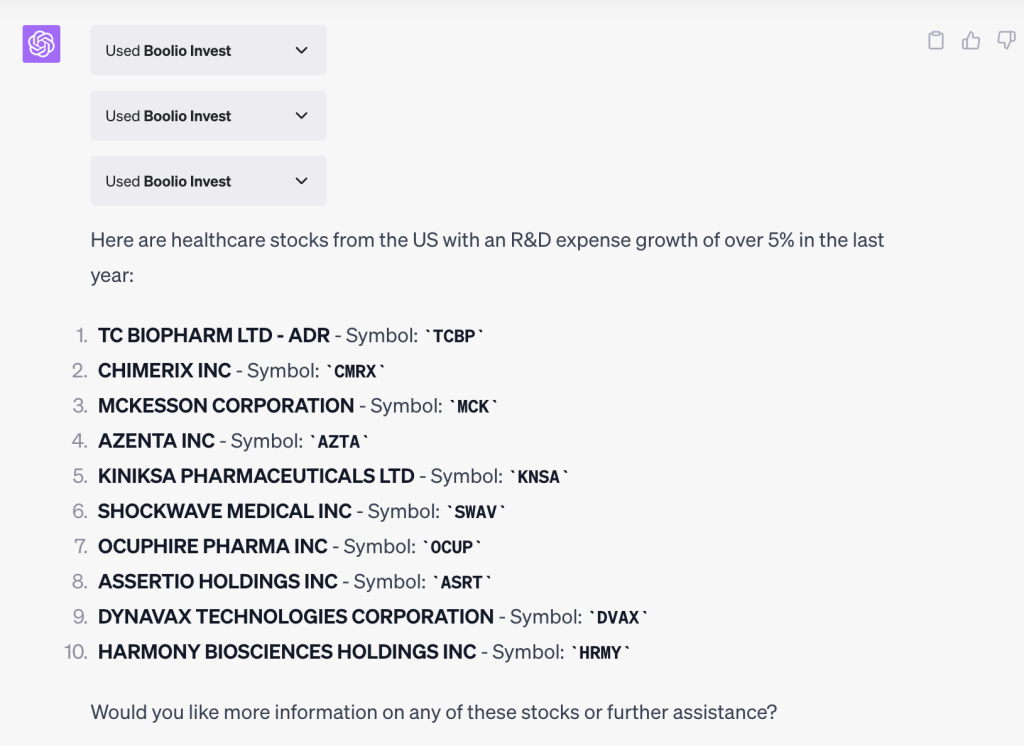

Prompt: “List healthcare stocks with an R&D expense growth of over 5% in the last year.”

How it works: Focusing on R&D expense growth in the healthcare sector can uncover innovative companies.

Example output:

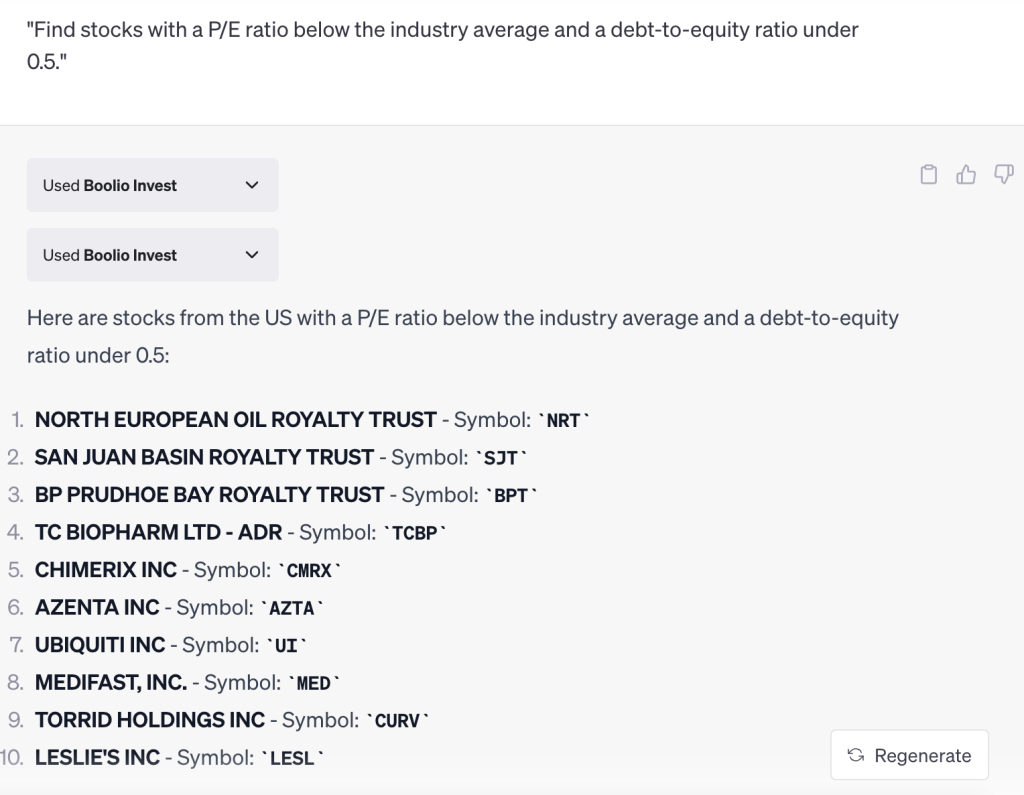

Prompt: “Find stocks with a P/E ratio below the industry average and a debt-to-equity ratio under 0.5.”

How it works: This prompt identifies stocks that may be undervalued and have low leverage.

Example output:

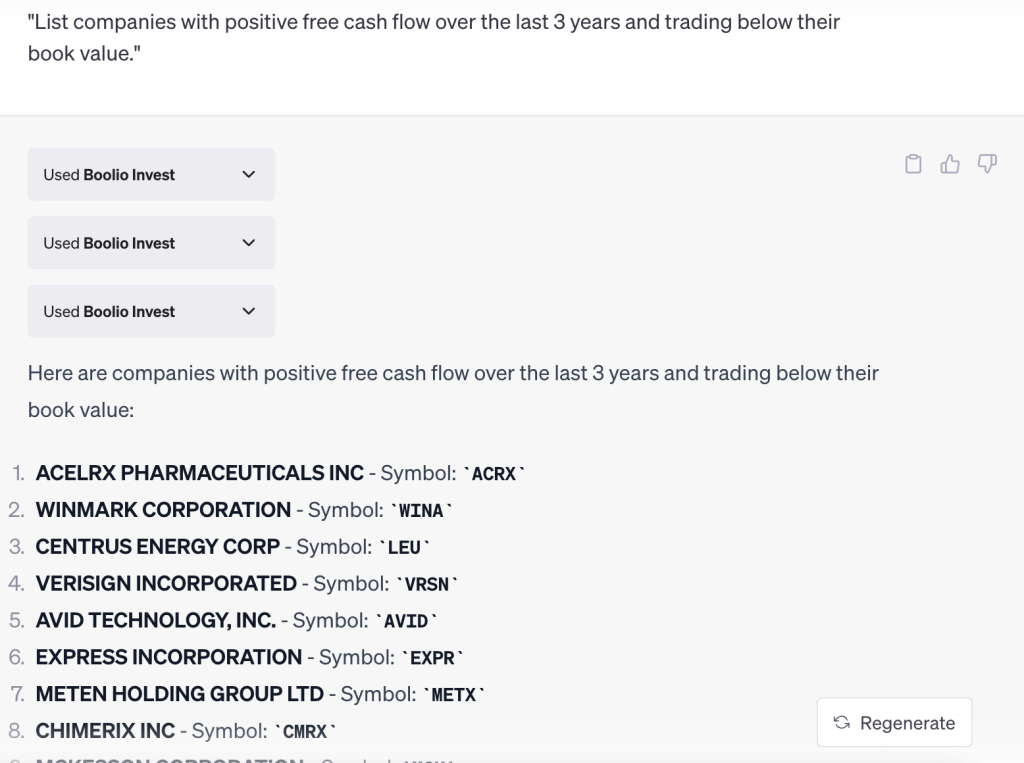

Prompt: “List companies with positive free cash flow over the last 3 years and trading below their book value.”

How it works: Free cash flow and book value are standard financial metrics that can be used to identify potential value investments.

Example output:

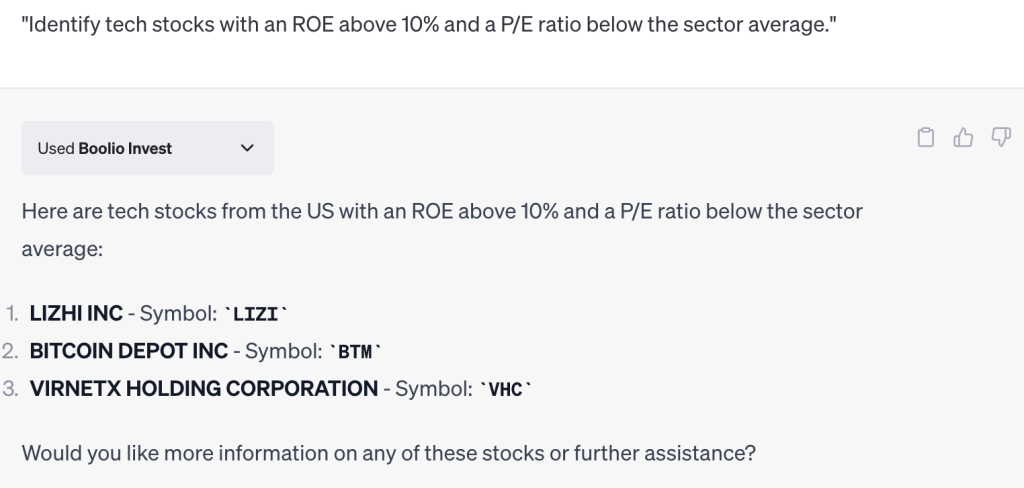

Prompt: “Identify tech stocks with an ROE above 10% and a P/E ratio below the sector average.”

How it works: ROE and P/E ratio are widely used metrics that can be accessed to find value stocks in a specific sector.

Example output:

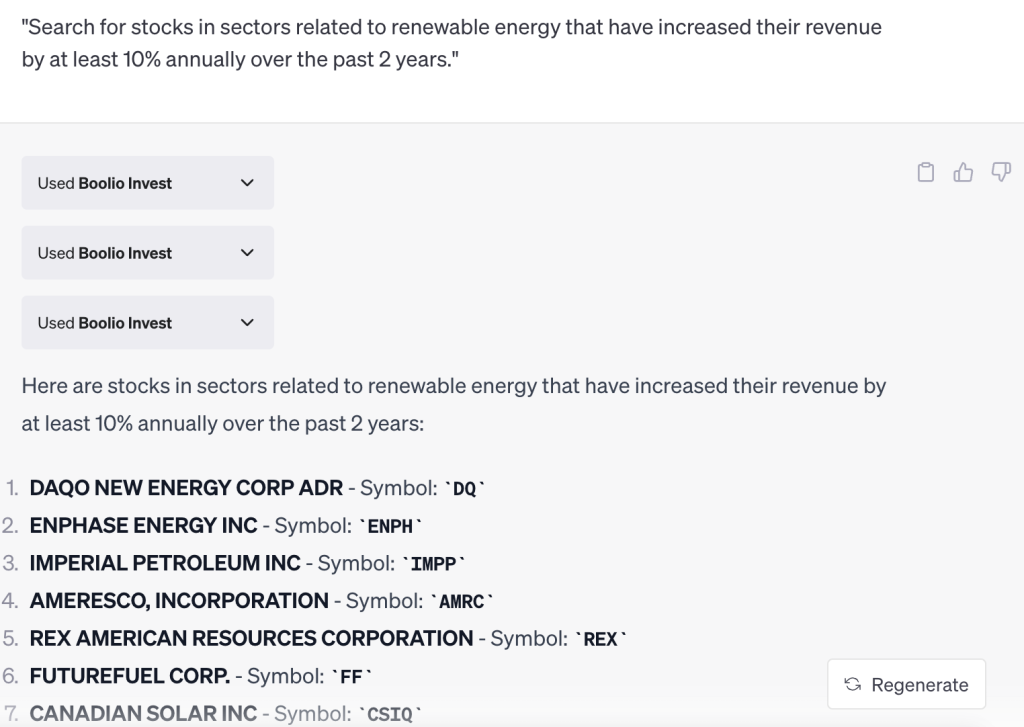

Prompt: “Search for stocks in sectors related to renewable energy that have increased their revenue by at least 10% annually over the past 2 years.”

How it works: This prompt focuses on sectors related to renewable energy and that are showing consistent revenue growth.

Example output:

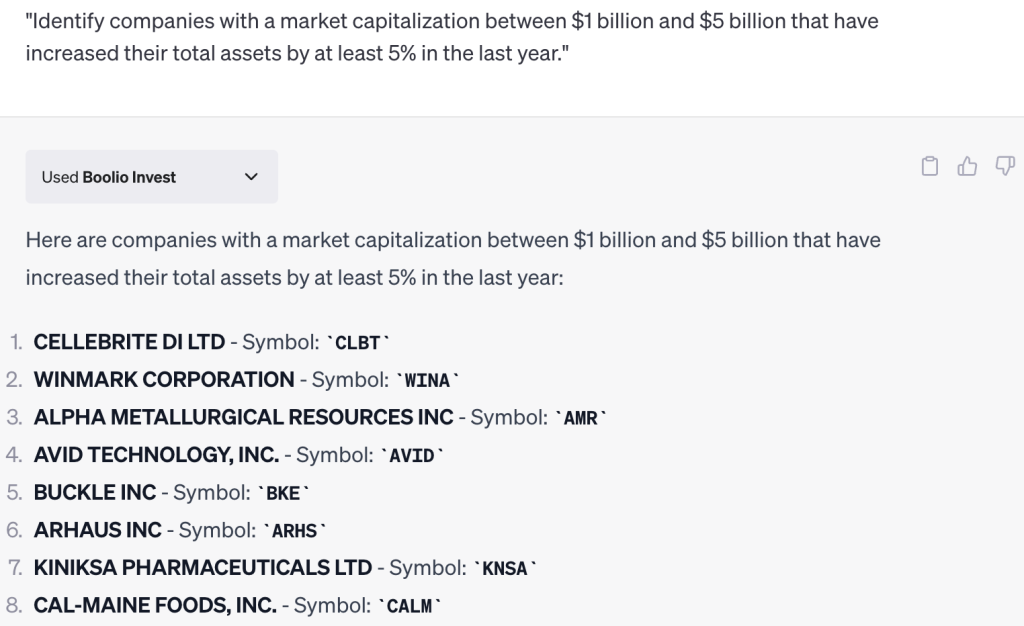

Prompt: “Identify companies with a market capitalization between $1 billion and $5 billion that have increased their total assets by at least 5% in the last year.”

How it works: This prompt targets mid-cap companies and focuses on total asset growth, a metric that can be used as a proxy for expansion and innovation.

Example output:

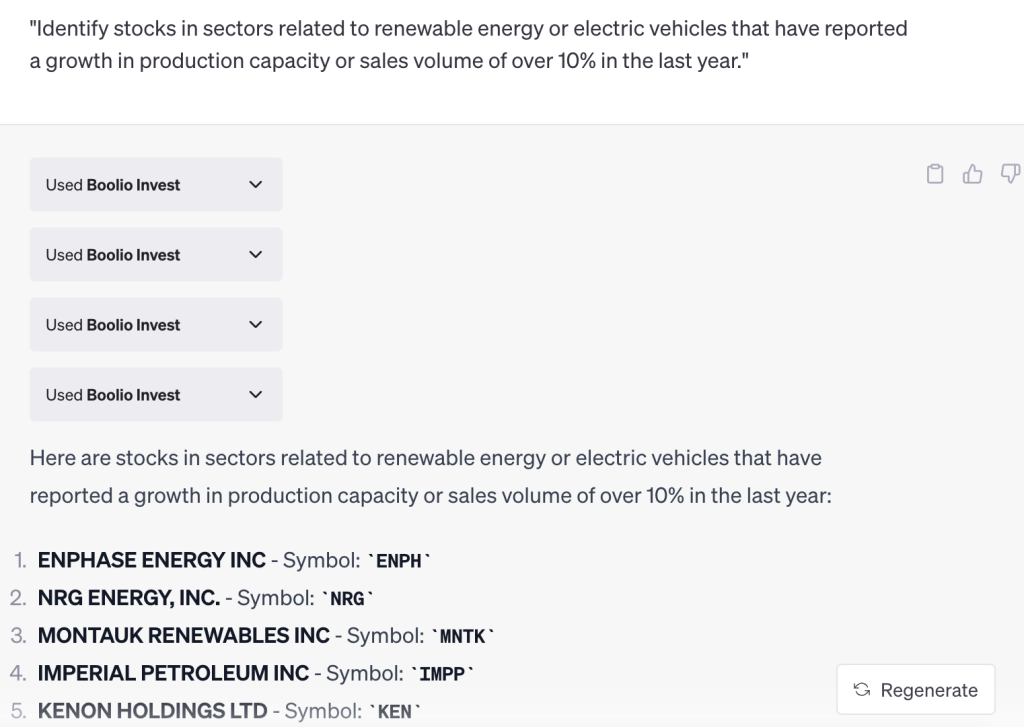

Prompt: “Identify stocks in sectors related to renewable energy or electric vehicles that have reported a growth in production capacity or sales volume of over 10% in the last year.”

How it works: Renewable energy and electric vehicles are sectors with significant growth potential due to global shifts towards sustainability. Companies showing growth in these sectors are likely riding the wave of this trend.

Example output:

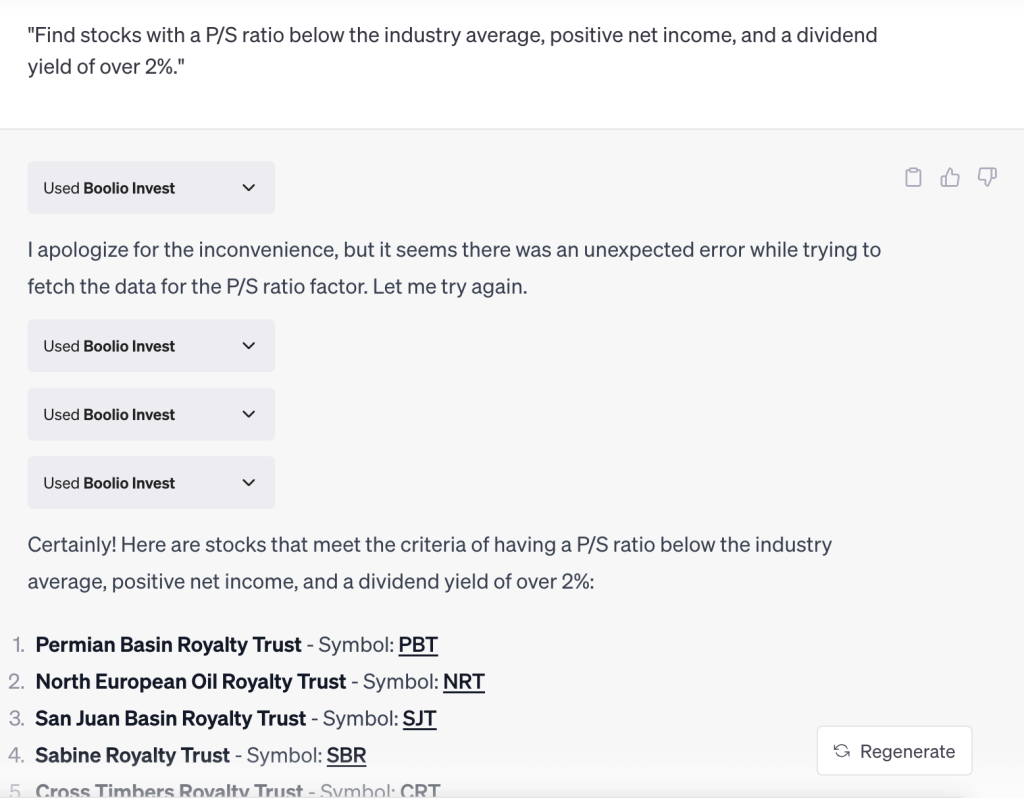

Prompt: “Find stocks with a P/S ratio below the industry average, positive net income, and a dividend yield of over 2%.”

How it works: This prompt focuses on commonly available financial metrics like P/S ratio, net income, and dividend yield, allowing for a comprehensive analysis of potential value stocks.

Example output:

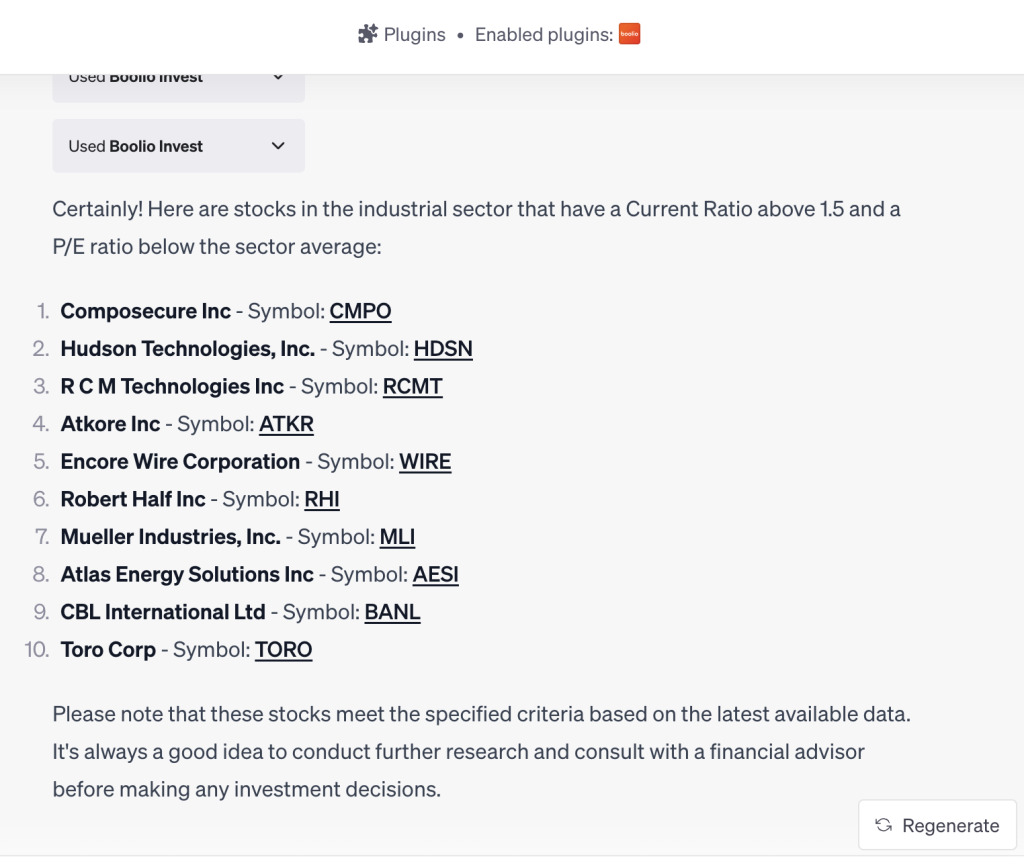

Prompt: “List stocks in the industrial sector with a Current Ratio above 1.5 and a P/E ratio below the sector average.”

How it works: The Current Ratio and P/E ratio are standard financial metrics that can be used to identify potential value stocks in the industrial sector.

Example output:

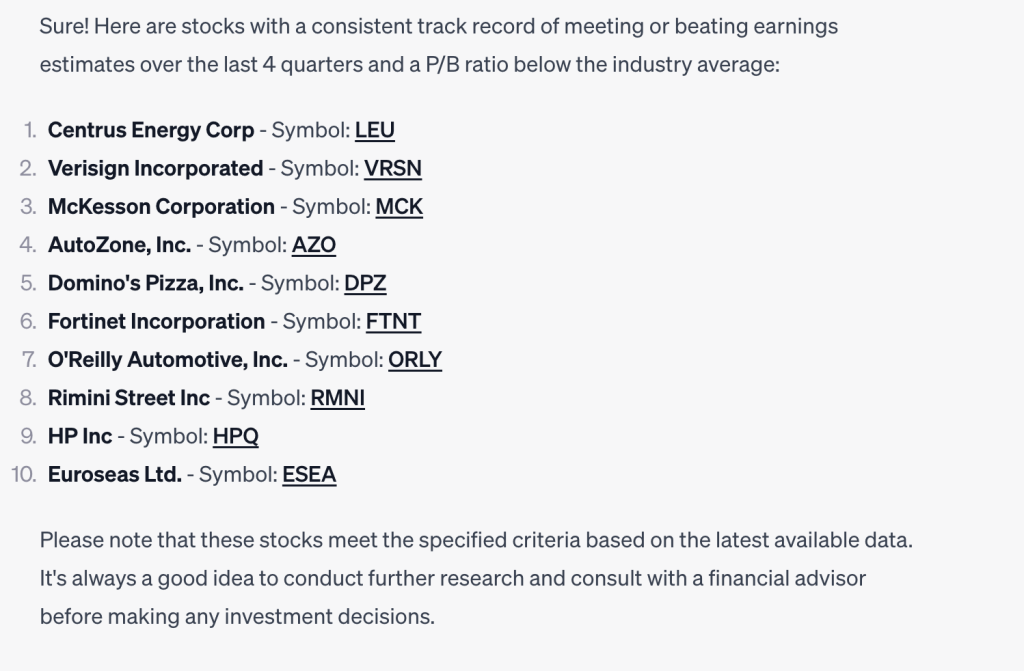

Prompt: “Identify stocks with a consistent track record of meeting or beating earnings estimates over the last 4 quarters and a P/B ratio below the industry average.”

How it works: Earnings estimates and P/B ratio are widely used in financial analysis. This prompt combines these factors to find stocks that may be undervalued and have strong operational performance.

Example output:

Prompt: “Identify companies in the technology sector with a market capitalization between $500 million and $5 billion that have increased their R&D expenditure by at least 5% in the last year.”

How it works: The technology sector is known for rapid growth and innovation. Companies that are investing significantly in R&D are likely to be at the forefront of technological advancements, positioning them for potential future growth.

Example output:

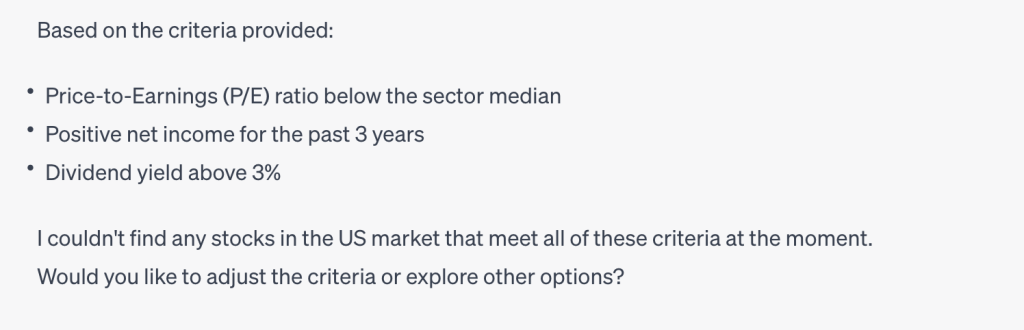

Prompt: “Search for stocks with a Price-to-Earnings (P/E) ratio below the sector median, a positive net income for the past 3 years, and a dividend yield above 3%.”

How it works: A P/E ratio below the sector median can indicate undervaluation. Consistent net income shows profitability, and a decent dividend yield provides income, making it a comprehensive approach to find potential value stocks.

Example output:

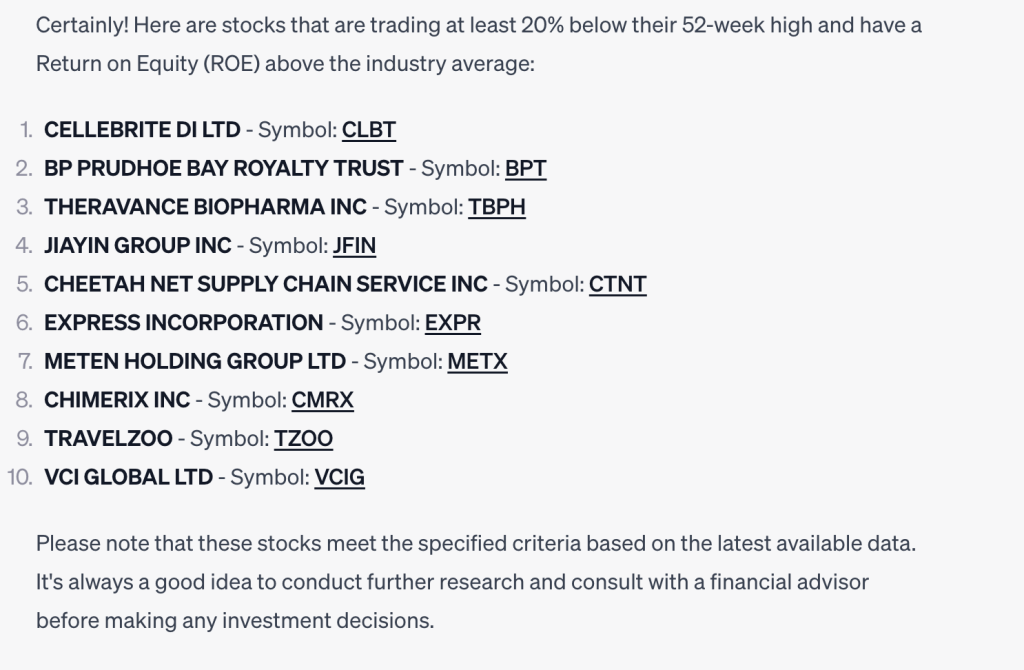

Prompt: “List stocks that are trading at least 20% below their 52-week high and have a Return on Equity (ROE) above the industry average.”

How it works: Stocks trading significantly below their 52-week high may be temporarily undervalued. A higher-than-average ROE indicates that the company is generating good returns on shareholders' equity, suggesting strong management.

Example output:

Note: These prompts are a helpful starting point but always do your own research before making an investment decision.