Seeking Alpha is a household name to many investors and is easily recognizable by the orange alpha symbol.

And after being a Seeking Alpha Premium Member for a few months, the platform has definitely left an impression.

So in this Seeking Alpha review, I’m going to share why I think a Seeking Alpha Membership is a great idea for hands-on investors.

What is Seeking Alpha?

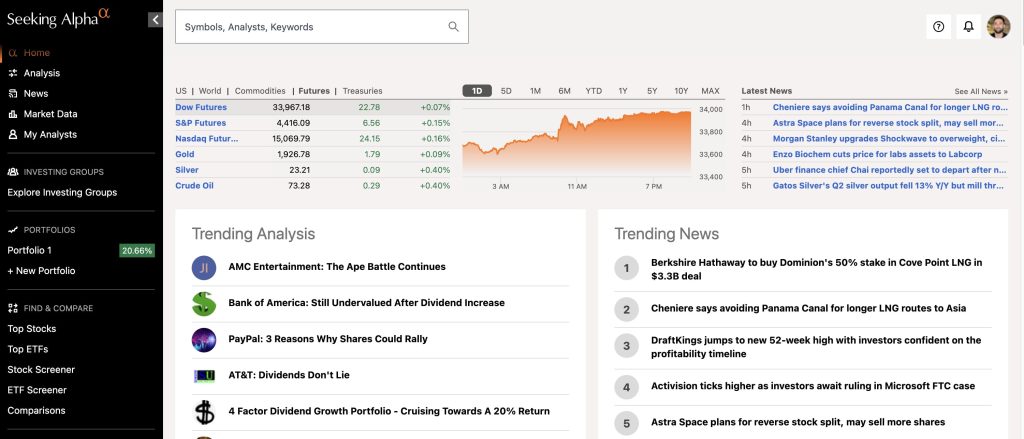

Seeking Alpha is a comprehensive investing platform with many unique data points and features. But what stands out most is the user-generated content or, in Seeking Alpha terms, “crowd sourced content”. This simply means analysts and other credible investors can share opinions for the wider community to read and act upon. You can even subscribe to specific investors for stock picks through the Investing Groups feature, which I’ll cover later.

You can also expect to find analyst ratings, analyst ideas and opinions, quant ratings, and other input from various investing professionals throughout the platform. This might sound overwhelming, but it’s presented in a clean format making Seeking Alpha modern and easy to use compared to most stock research platforms.

The Best Seeking Alpha Premium Features

Seeking Alpha is a very comprehensive platform with thousands of features. However, I’m going to cover the most important premium features that are most impressive to retail investors. Some features are great for advanced investors whilst others are built for those with only a basic understanding. Either way, I’ll dive deep into them so you can make an accurate decision on whether or not you invest in Seeking Alpha Premium.

1. Analyst Ratings & Performance

Investors subscribe to services like Seeking Alpha mainly to find guidance on which stocks to add to their portfolios. With a Seeking Alpha Premium membership, this is possible.

And the reason I bring this up is that many stock research platforms don’t actually give investors the guidance they’re seeking. More often than not, investors want clear answers on whether they should buy, sell or hold a stock.

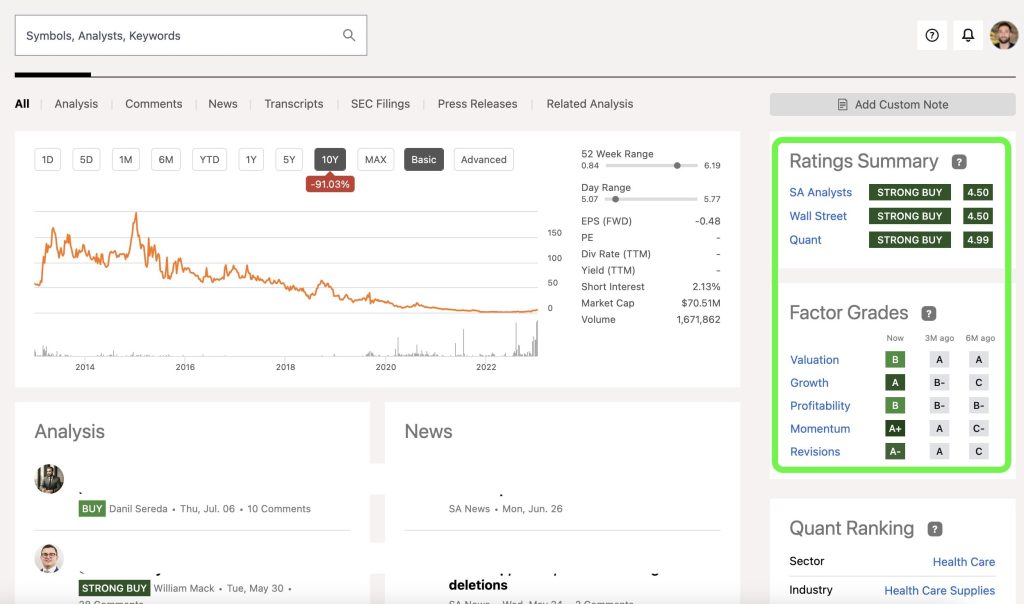

The Seeking Alpha Analyst Ratings and Performance Indicators are designed to help investors make these critical decisions. The following Seeking Alpha features are designed to help investors take action:

- Factor grades covering valuation, growth, profitability, momentum, and revisions.

- Analyst performance

- Stock quant ratings

You're not alone if you’re confused about what these terms mean. However, you can simply click each within your dashboard, and the explanation will appear with a definition and how to take action.

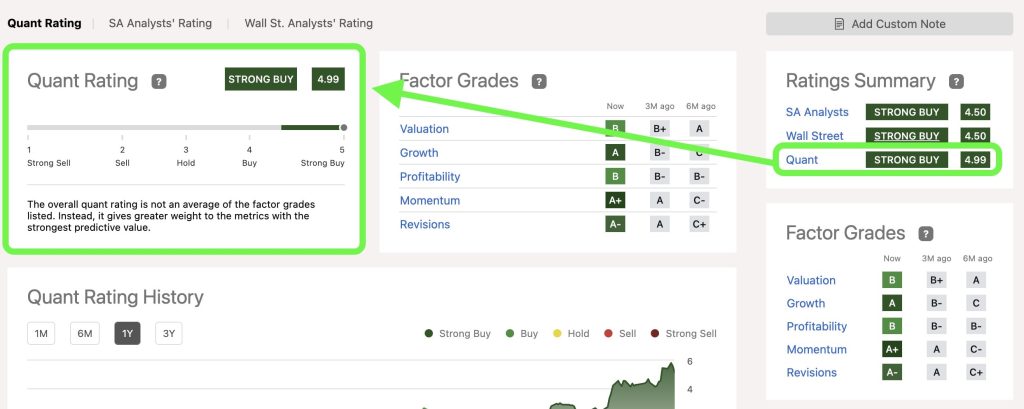

If you see a stock with a 4.99 Quant Rating labeled “Strong Buy” then it’s pretty obvious you should consider buying it. In this case, you could add a custom note or save the stock to your own personal watchlist.

But it doesn’t end here.

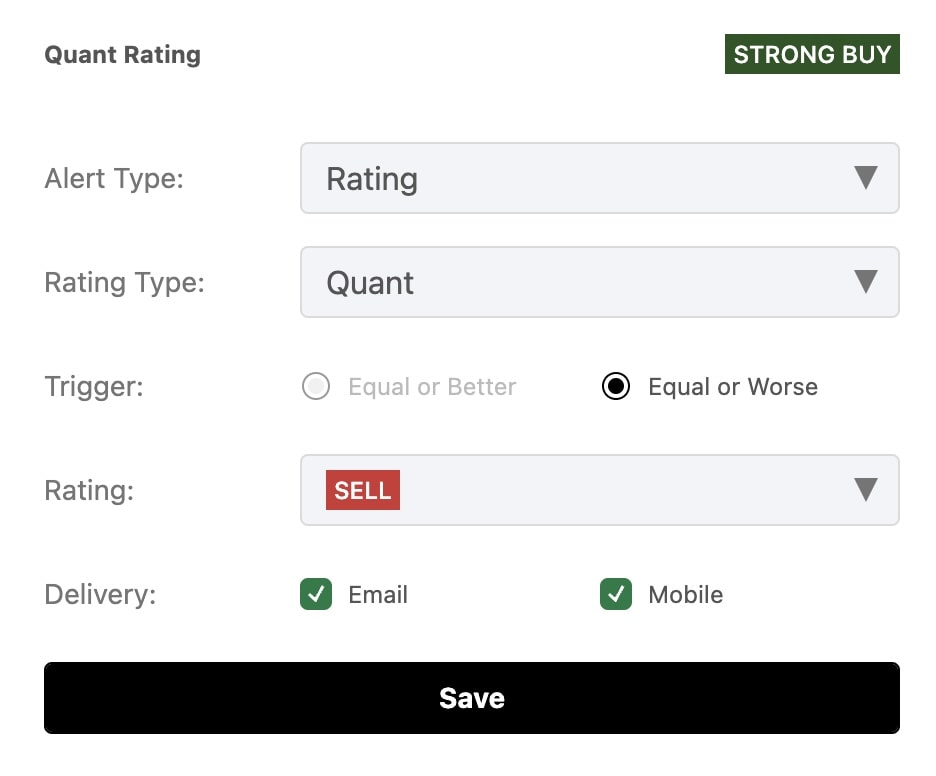

You might be thinking, “how do I know when to sell it?” well, you can simply set up an alert to email you when the Quant Rating changes to a “Sell” or “Strong Sell”.

I particularly like the fact I can receive the Quant Rating alert on my mobile. If a stock in my portfolio changes from a buy to a strong sell, I want to act instantly. Sometimes I don’t check my emails but check my text messages, so this is critical for me.

2. Premium Content

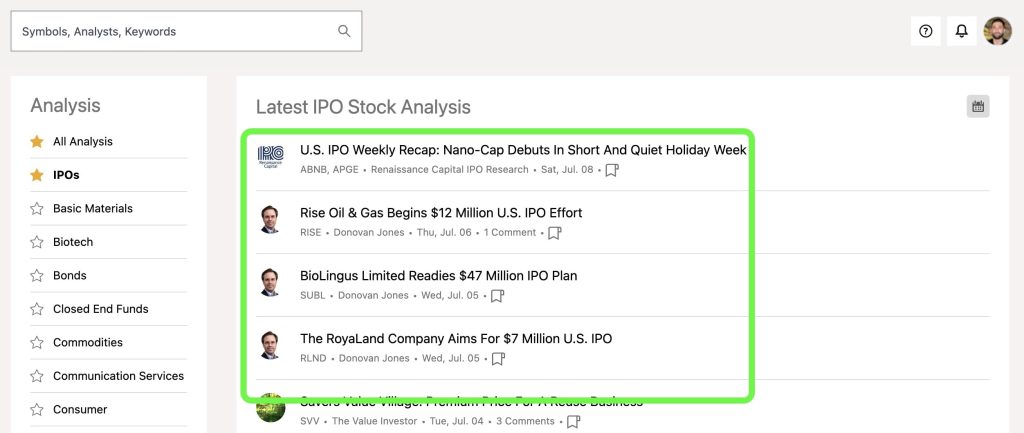

Another benefit of subscribing to Seeking Alpha is the premium content. Since I’m a massive fan of IPO investing, I found analyst commentary on recent and upcoming IPOs incredibly useful.

If IPO investing isn’t your thing, that's cool. Investors can find news and analysis on other investments and industries like Bonds, Commodities, REITs, Micro-Cap stocks, BioTech stocks, Consumer stocks, and more.

Either way, the premium content alone is worth the membership. It’s hard to access expert opinions, analysis, and the latest news without spending hours digging for it on sites like Reddit, Twitter, or even MarketWatch (which isn’t even free!).

3. Stock Quant Ratings

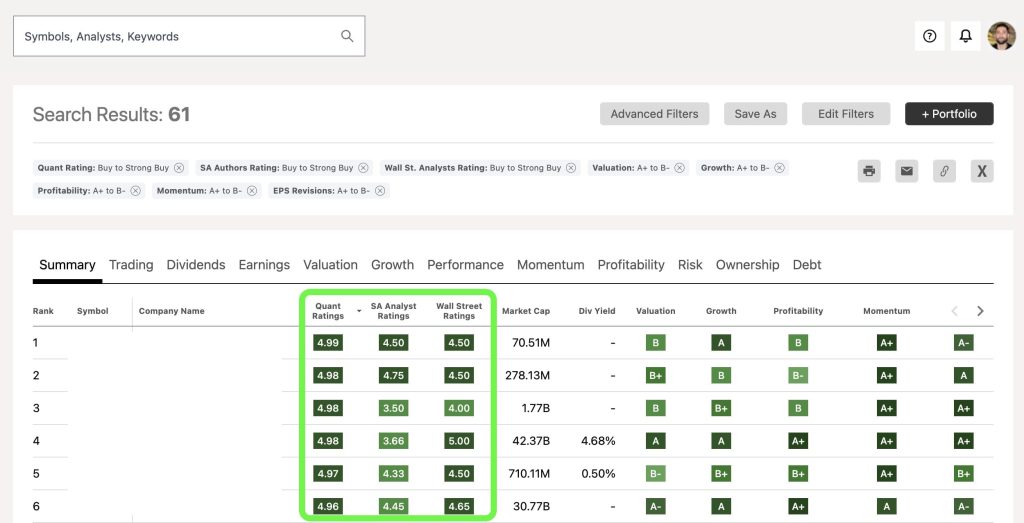

The Stock Quant Ratings is one of the most impressive and sought-after features with a Seeking Alpha Pro membership. This is where investors can make key decisions about investing in a particular stock.

According to the Seeking Alpha Quant Ratings FAQ “over 100 metrics for each stock are compared to the same metrics for the other stocks in its sector. The stock is then assigned a rating (Strong Buy, Buy, Hold, Sell, or Strong Sell), and a score (from 1.0 to 5.0, where 1.0 is Strong Sell and 5.0 is Strong Buy).”

I noticed the rating makes decisions less confusing or stressful. It prevents me from having to do all the necessary fundamental and quantitative analysis I usually would when deciding if I should invest in the stock. But even if you still want to do this (and I always recommend it to DYOR), you can click the stock name, and you’ll be navigated to a page with more data to supplement your research.

4. Stock Dividends Ratings

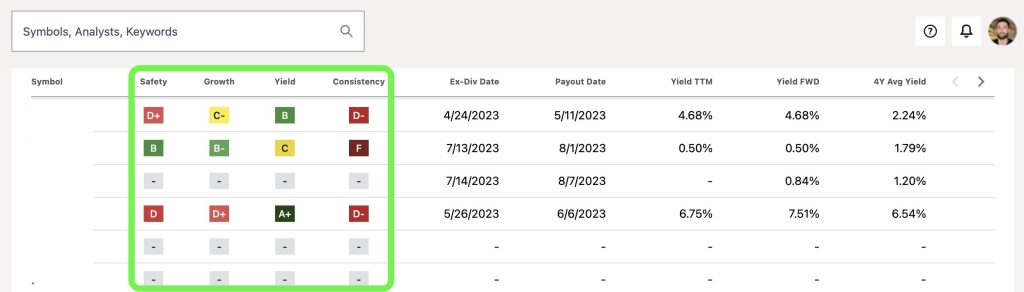

For dividend investors, the Seeking Alpha Stock Dividends Rating is somewhat beneficial. Each dividend stock is graded and given a rating from A+ to F for the following criteria:

- Safety – The company's ability to continue paying the current dividend amount.

- Growth – The attractiveness of the dividend growth rate when compared to peers.

- Yield – The attractiveness of the dividend yield compared to peers.

- Consistency – The company's track record for paying consistent dividends.

The grade is calculated via an algorithm, or in Seeking Alpha terms, “culmination of powerful computer processing and ‘Data-Driven’ analysis”. This seems like another way of saying they simply weigh each metric and then produce a simple score. Something you could probably do in a Google Sheet with a Google Finance add-on.

So if you’re a dividend investor, there are likely better services you can subscribe to for identifying and analyzing the best dividend stocks to add to your portfolio.

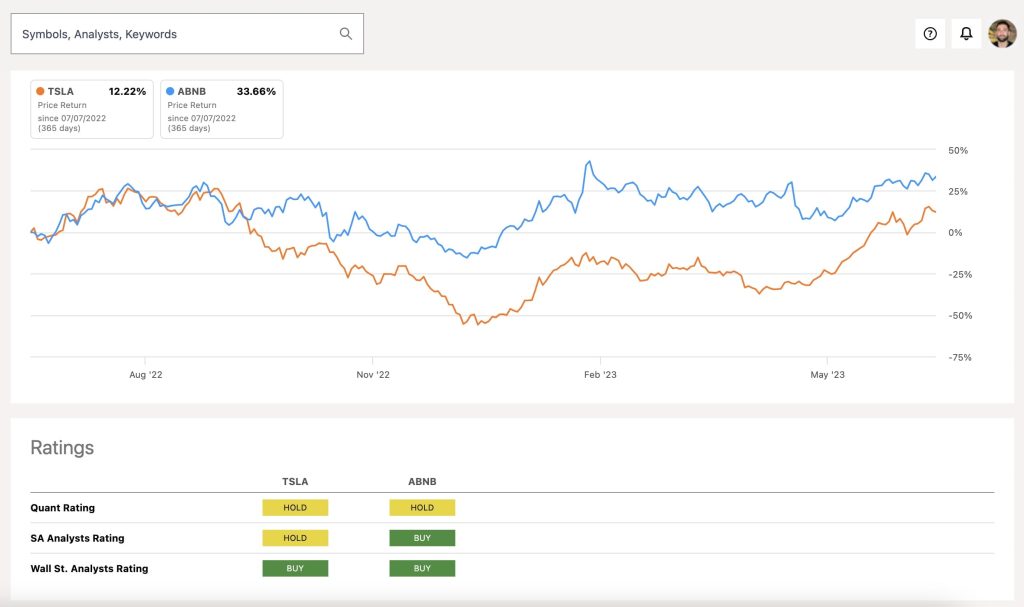

5. Stock Comparisons

As I mentioned in the introduction, Seeking Alpha is best suited for hands-on investors still interested in doing their own research. The stock comparison tool is a perfect example of why.

You can select a list of stocks you might be considering investing in and visually identify trends between them to see if one stands out as superior. The comparison tool features a stock price chart, seeking alpha's quant rating, SA analyst ratings, Wall St. Analyst ratings, and more.

It’s a bit of a gimmick though, and tools like Barcharts or Portfolios lab offer this feature for free. But as a paying subscriber, I still expect this to be a standard feature, so I would be annoyed if it was removed.

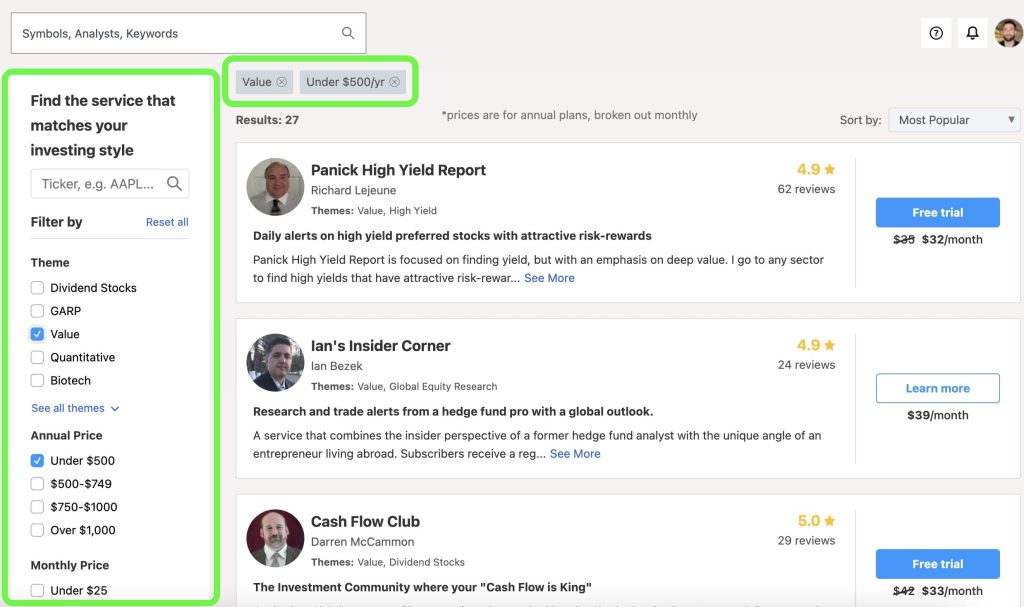

6. Premium Investing Groups

This feature caught me off guard the most.

Before signing up, I didn’t realize there was an option to subscribe to other investors for stock-picking recommendations. This includes Wall St Analysts, economists, and general enthusiasts with good track records.

Users can filter by price range (annual and monthly), investing themes, and popularity.

While I found this feature intriguing and helpful, I prefer a professional service like Ticker Nerd or The Oxford Communique. The pricing is also quite expensive, especially if you’re already paying for a Seeking Alpha Premium subscription.

Related article: Best Stock Picking Services and Best Investing Newsletters

7. Other features I liked

If you add all the features of Seeking Alpha, there will be thousands. I’ve covered the most important, but there are some smaller ones that I think investors should know before signing up. Here are the other features I think deserve an honorable mention:

- Earnings calendar and earning call transcripts

- ETF screeners and in-depth research data

- You can create your own portfolio

- Mutual funds research and data points

- Seeking Alpha Author Ratings

- Fundamental analysis and quantitative analysis

- Breaking news with analyst opinions

- SEC filing data with commentary

- Company press releases

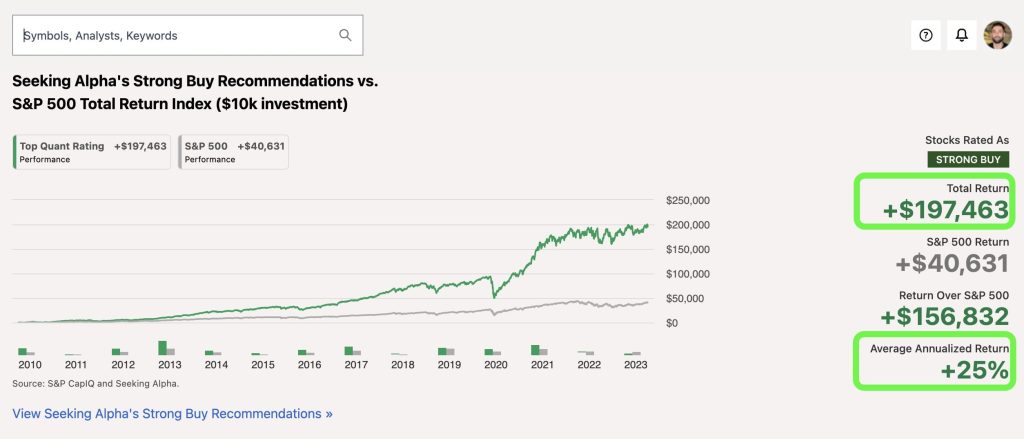

Seeking Alpha Performance and Track Record

At first glance, this looks like a no-brainer. If you invested $10,000 in 2010 into the “Strong Buy” recommendations, you could expect to make a $197,463 return. You would beat the S&P500 by a long shot.

“Over the last 12 years, the backtested strategy has delivered very impressive returns, beating the S&P 500 every single year.”

Seeking Alpha Quant Performance

However, investors should know this is a back-tested model, not the actual returns of the Seeking Alpha picks. While I still think this is impressive, I have some reservations about these models as performance indicators. Here’s why:

“The trading strategy consists of being fully invested in Seeking Alpha's ‘Strong Buy’ ratings with equal weighting, daily rebalancing, and no transaction costs. Any stock where the rating drops i.e. from ‘Strong Buy’ to ‘Buy’, gets sold at the market open. A computer runs this model daily without human intervention.“

Seeking Alpha Quant Performance

Unfortunately, I do not believe every investor will take a position in every single “Strong Buy” recommendation, rebalance, have no transaction costs, and immediately sell at market open.

This is unreasonable and not typical of most investors. So for these reasons, I think investors shouldn’t use performance indicators to decide whether they subscribe to Seeking Alpha. Since it's slightly misleading, you should consider the other features before relying on the performance and track record.

Is Seeking Alpha Legit?

By now, you should know that Seeking Alpha is 100% legit.

Seeking Alpha was founded in 2004 by former Morgan Stanley analyst David Jackson. The headquarters is based in Israel, employing over 150 people worldwide. With over 100,000 followers on LinkedIn and 229,000 Twitter followers, if Seeking Alpha wasn’t legit, they wouldn’t still be around. On top of this, it’s straightforward to contact customer support.

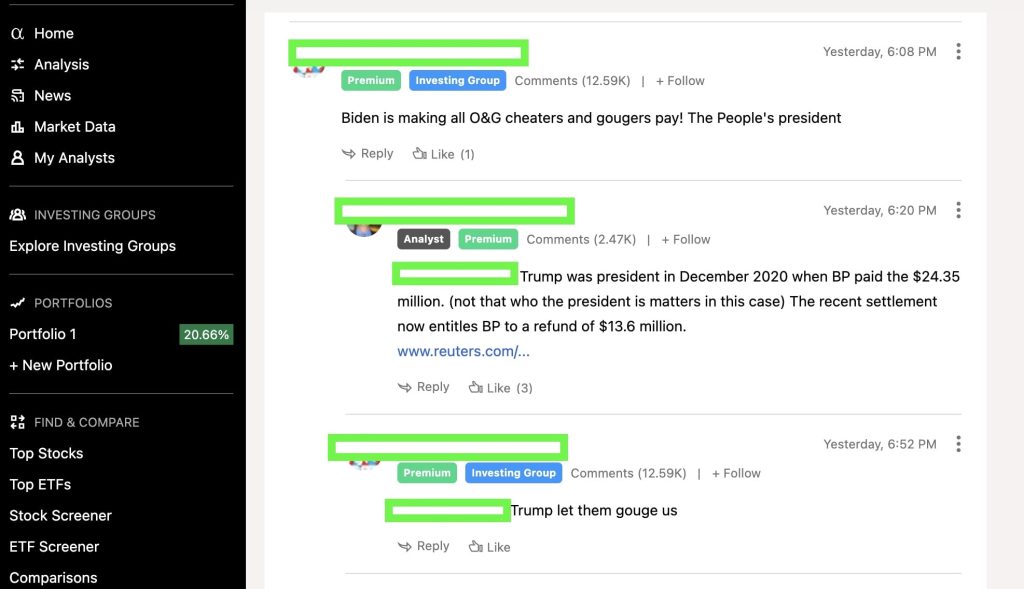

In terms of their data sources and the platform, the information seems accurate. However, some news articles and comments from community members seem a bit random at times and make the service look less legit.

I wouldn’t pay too much attention to the comments since investors are just debating their points of view, and it’s easy to get fired up when you see something silly.

Seeking Alpha Premium Pros and Cons

Seeking Alpha Premium Pros

- The Seeking Alpha Quant ratings make deciding whether to invest in stock easy.

- You can opt-in and customize mobile or email alerts for changes to any of the ratings.

- Investing Groups give members more exposure to expert analysis.

- The user interface is easy to navigate.

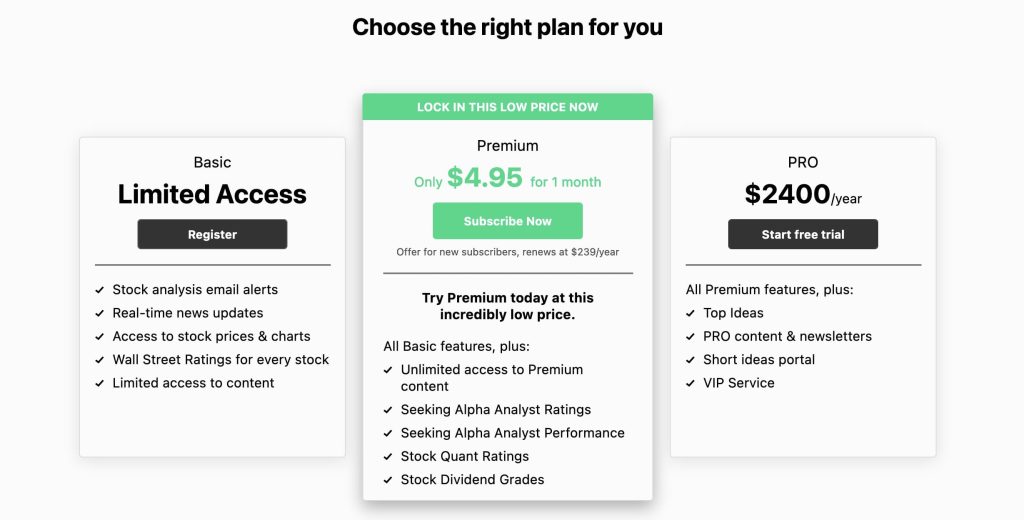

- You can trial the membership for $4.95 for one month.

- Support is easy to contact.

Seeking Alpha Premium Cons

- The performance models are back-tested and not that helpful.

- You must pay an additional subscription fee to access investor group recommendations.

- Some of the comments for articles get political and annoying.

- No free trial, and then billed annually.

- Some of the features (like comparison) can be found for free elsewhere.

Seeking Alpha Premium Pricing

Seeking Alpha Premium costs $229 per year, but investors can trial the platform for one month if unsure. It’s easy to cancel your subscription; if you get stuck, the support team is helpful.

If you’re not ready for the premium membership, try Seeking Alpha Basic, which has limited access but will still give you a feel for the platform.

Consider a Seeking Alpha Pro subscription if you’re an advanced investor and want the best service. But be warned, it will cost you a whopping $2,400 per year.

Seeking Alpha alternatives

If you’re reading this review because you’re on the fence about choosing an investment newsletter, consider these alternatives. We’ve reviewed the best stock-picking services along with the best investment newsletters and these are the ones that have come out on top.

- Ticker Nerd is best for investors who want to generate long-term wealth.

- Mindful Trader is best for experienced investors who want to day trade stocks.

- Motley Fool is the best for beginner investors who want straight stock picks.

- Morningstar Investor is best for investors who prefer reading detailed stock reports.

- Tim’s Alerts is best for day traders who are looking for daily recommendations.

- Zacks Premium is best for do-it-yourself investors.

What to do next

I wrote this Seeking Alpha review to be as helpful as possible. Overall, if investors were to spend money on an investment research platform, I would recommend Seeking Alpha Premium over the competitors. I genuinely believe the investment ideas, stock analysis, and Seeking Alpha contributors give me an edge I couldn’t find elsewhere.

However, I don’t like that all their performance indicators are from back-tested models. Some might argue that this is a better performance indicator, but I would prefer seeing real performance since you can not invest in a back-tested model.

Many of the features can be found for free in other platforms like Barcharts, Public.com, and Trading View. Most of the value comes from the stock ratings (not the standard stock analysis), Wall Street ratings, Wall Street analysis, and comparison which helps investors make an informed buy, sell, or hold decision.

Frequently Asked Questions (FAQs)

Yes. Seeking Alpha has great support for its members. You can choose from three support options: a phone number support line, an online chat, and a knowledge base.

Overall, a Seeking Alpha Premium Membership is 100% worth it for investors planning to buy and sell stock throughout the year. It’s also beneficial for investors that plan to do their own research and want access to a complete platform that’s easy to navigate.

I wouldn’t recommend Seeking Alpha to day traders or buy-and-hold investors making only one or two investments yearly. However, the yearly fee is fair, and Seeking Alpha offers an entry-level trial period to reduce the risk for investors still on the fence.

After reviewing the platform and the Seeking Alpha authors, I would say that Seeking Alpha is reliable. Their backtested strategy and robust platform tell me they are reliable and worth subscribing to. But always remember to do your own research and never blindly follow any advice, regardless of how legit something seems.

Seeking Alpha Premium doesn’t pick stocks, but you can take a look at the stock ratings and decide based on the “strong buy” ratings. If you’re interested in the stock picks, subscribe to the Seeking Alpha Alpha Picks instead (you can read about that here).

Great question! Seeking Alpha is a more advanced investing platform, while Motley Fool is best known for their stock recommendations. It's hard to know which is best since we're not comparing apples with apples. If I were to choose one I would choose Seeking Alpha since I think it's more comprehensive while still offering stock picks through the Alpha Picks membership.