Summary

TL;DR: Morningstar Investor is a comprehensive and flexible investing research platform built for intermediate to advanced investors. The stock and economic reports are thorough, accurate, and written by industry experts.

What is Morningstar?

Morningstar is an investment research company founded in 1984 by Joe Mansueto. The company is based in Chicago and according to Similarweb, the site gets around 7M visitors per month.

They mostly cover stocks, funds, ETFs, and bonds. Anyone can access their content, read their articles, and even subscribe to their free newsletter. Although, like many other financial research companies, they offer premium services. And that’s what I’m going to cover today. Specifically the Morningstar Investor service.

Morningstar Investor is a research platform that reminds me of Seeking Alpha Premium. They’re very similar services with very similar features. Although their rating system, user interface, and community features separate them.

My favorite Morningstar Investor features

There are hundreds of tools and subsequent features I could discuss in this article since the platform is so comprehensive. However, there are seven core features I want to cover that will make your investment into Morningstar worth it.

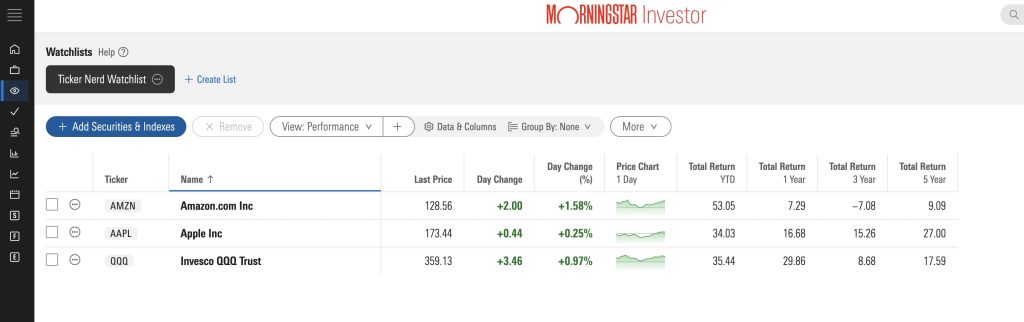

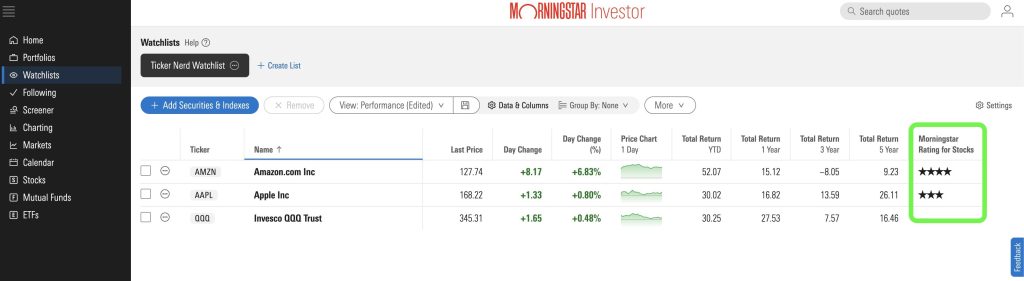

1. Custom watchlist

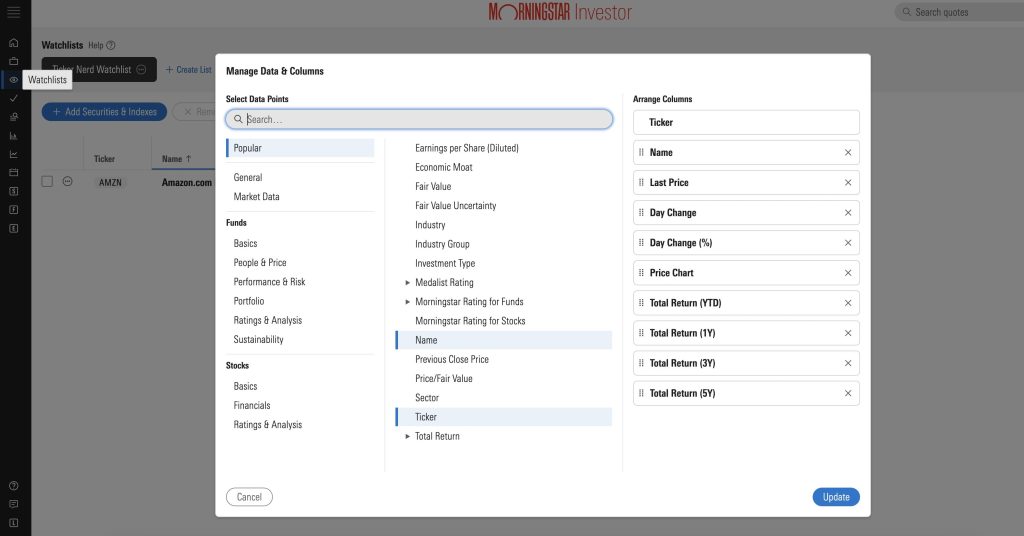

The watchlist might seem like a standard feature you would expect with a service like this, and it is. However, it’s useful and I’ve found it more intuitive than other tools I've played around with. The feature allows you to add all of the securities (stocks, bonds, ETFs, etc) you want to keep an eye on in one place.

On top of this, you can customize the data and columns that appear in your watchlist dashboard. Some investors might prefer specific columns showing fund details, while others might need specific financial data points for their stocks. Either way, it’s flexible so you can keep an eye on the most important metrics to suit your portfolio.

I would say this is probably one of the differentiators between Morningstar and other platforms. The ability to hyper-customize the dashboard gives enough flexibility to justify the price considering some of these watchlists are free (like Barchart).

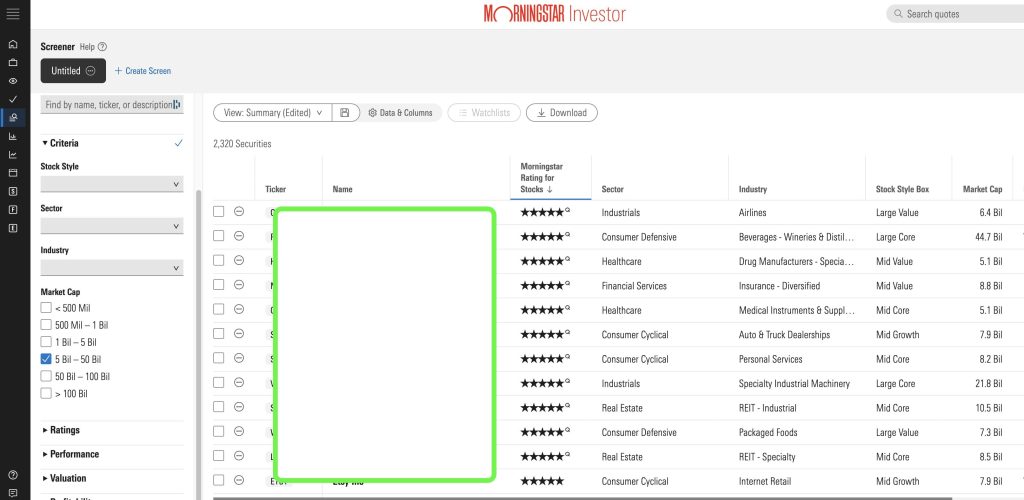

2. Stock screener

The stock screener is another feature I think is critical to the Morningstar Investor platform. Similar to Seeking Alpha you’re able to search for stocks based on custom criteria. This includes metrics like stock style, sector, industry, market cap, ratings, performance, valuation, etc.

However, the most important part of this feature is the Morningstar Ratings for Stocks. This is the easiest way for investors to quickly filter and sort for the “best” stocks in a market given their ratings.

A 5-star rating generally means the stock is trading below what analysts think it’s worth. It’s calculated based on comparing the stock's current market price with Morningstar’s estimate of the stock's fair value.

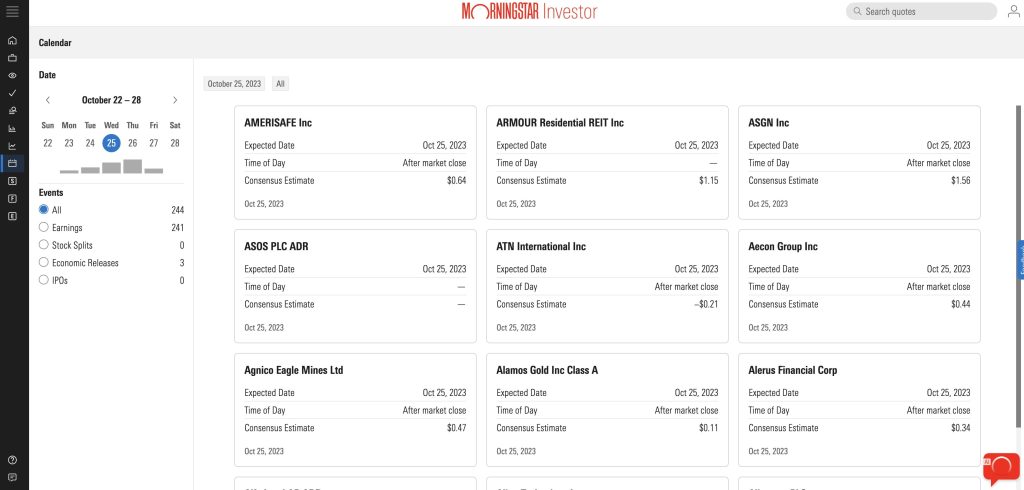

3. Calendar

Some investors might not believe this is a critical feature, but I do. Too often investors (me included) miss key events and therefore miss the opportunity to enter or exit a position at the right time.

The calendar is displayed daily and can be filtered by four key events — Earnings, Stock Splits, Economic Releases, and IPOs. Since I’m a major fan of IPO investing this is particularly interesting to me and I did use it.

4. Stock analysis and reports

This is probably the most important aspect of the platform. It’s where you can find deeper fundamental and quantitative analysis for the asset you’re researching.

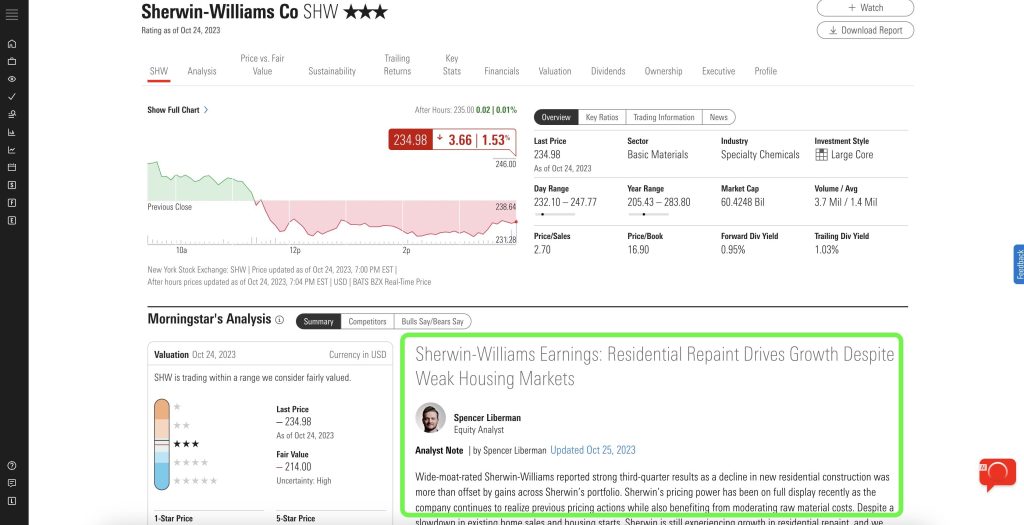

Once you navigate to the stock you’re interested in researching you’ll be able to see an overview that covers the latest price, Morningstar’s Analysis, fair value estimates, financials, valuations, ownership, company information, and a lot more.

However, the most useful part of this page is the detailed analysis written by a Morningstar Analyst.

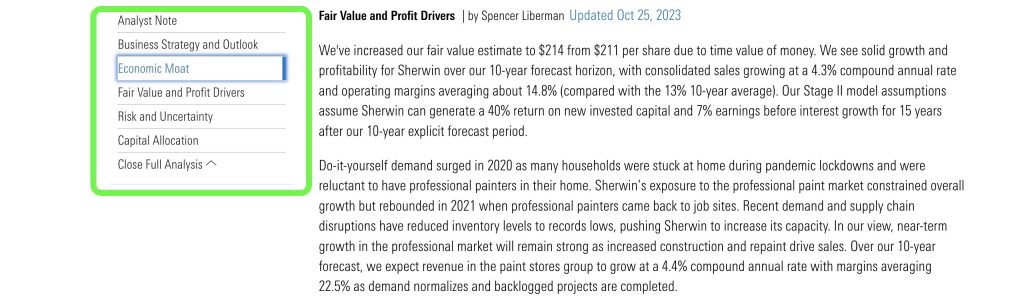

The reports cover various aspects based on the company's current circumstances and recent events. The one above covers things like business strategy and outlook, economic moat, fair value and profit drivers, risk and uncertainty, and capital.

I will note the reports are very detailed and technical, they can be over 4,000 words. In comparison to services like Motley Fool or Seeking Alpha for instance these reports are more thorough and best suited for advanced investors who understand finance and economics.

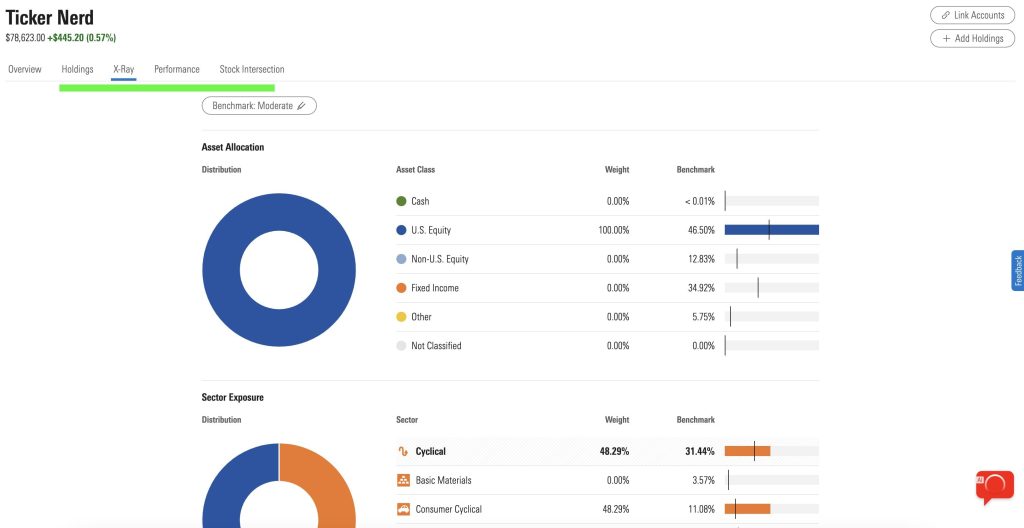

5. X-Ray

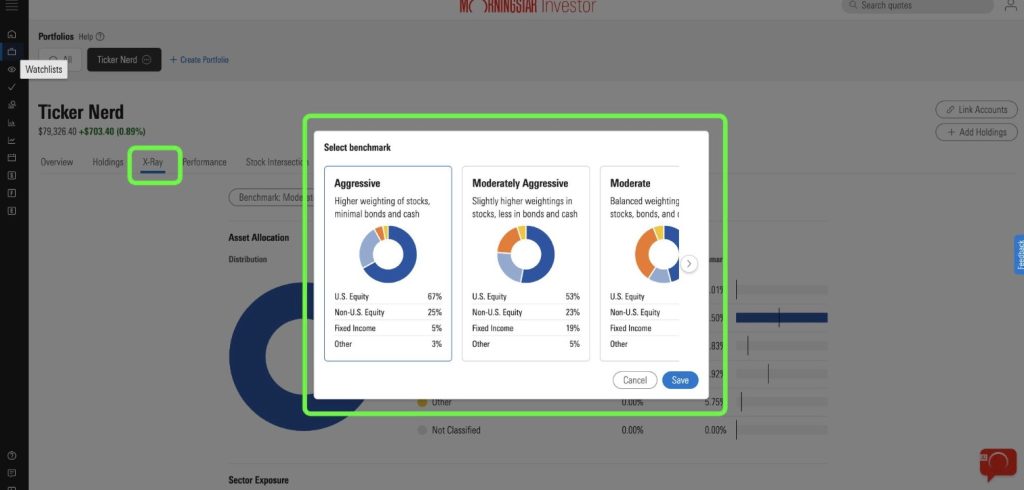

The X-ray feature can be found within the portfolio tracker. The purpose of this is to give investors an overview of their holdings. It breaks down your portfolio and shows you the allocation you have. If you’re trying to manage or hedge your risk then it’s useful. On top of this investors can set a portfolio benchmark.

Investors can choose from aggressive to conservative. From here your X-ray dashboard will automatically rate your portfolio and set up benchmarks to help you get closer to the risk type you chose. I can see how this is an interesting feature and would help some investors although I found it to be more of a novelty.

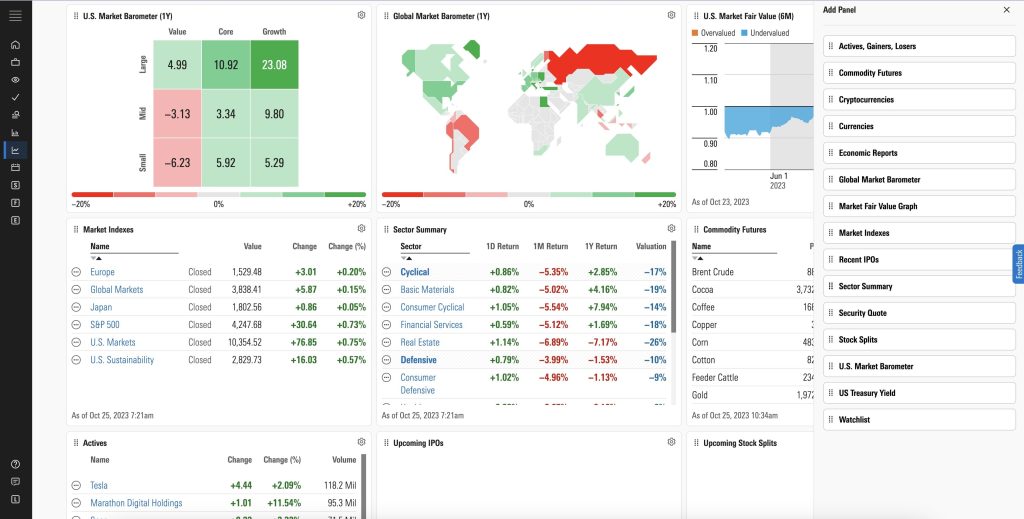

6. Market overview

The market overview is exactly what you think it is. It’s for all the economists who want to know exactly what’s happening in global markets that might impact their portfolio. Investors can see things like US and Global market sentiment, sector performances, commodity performances, cryptocurrency metrics, upcoming IPOs, upcoming economic reports, and a lot more.

One thing I particularly like about this feature is the level of customization available. Investors can choose from over 15 different widgets to customize their market overview dashboard. This seems to be one of the main value propositions that Morningstar offers, complete customization of every aspect of the platform to help investors get the most tailored research.

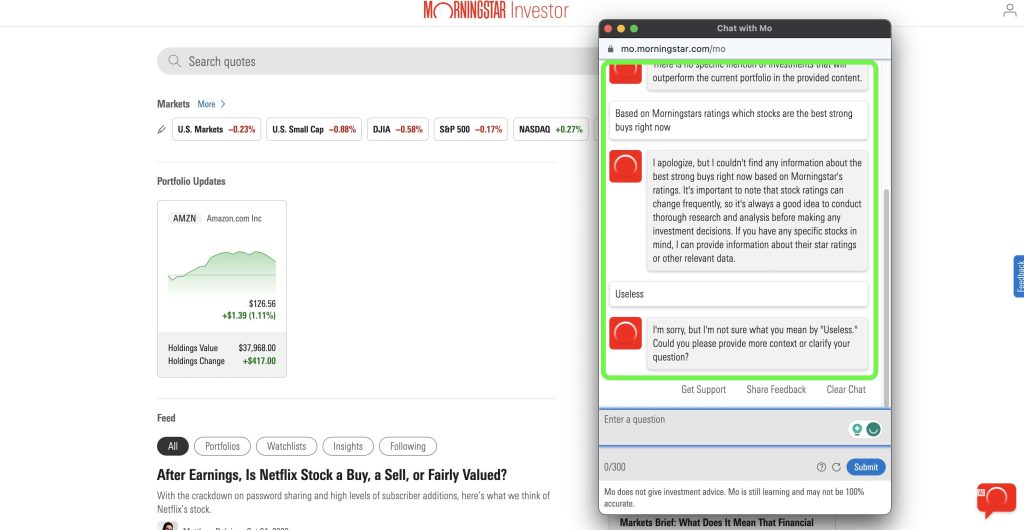

7. AI chatbot called “Mo”

Since AI is a hot topic right now I thought I should mention Morningstar's new AI chatbot called “Mo”. It’s only available to members in the US but Morningstar is trying to leverage AI to help its members make better decisions. However, my experience was far from impressive. Basic questions are still too difficult to be answered which is a letdown. At Ticker Nerd, we’ve spent a lot of time exploring AI so this feature was very basic and didn’t include any of the latest AI developments. Investors can do a better job using Chat GPT + Boolio Invest to ask technical questions and receive highly detailed responses.

Other features worth noting

I’ve covered most of the features investors will use most of find the most helpful, however, some features deserve an honorable mention. These include:

- Morningstar’s editorial news articles

- ETFs & Mutual Funds analysis and reports

- Sustainability index (i.e. ESG, Carbon, Product Involvement)

- Charting feature which allows you to overlay various assets on the same time horizon

Morningstar's star rating system

Since this feature is incredibly important I’ve decided to dedicate a section to cover the rating system. The Morning Star Rating system refers to the stars next to each stock. It’s purely based on quantitative analysis with a backward lens on past performance.

The specific algorithm or rating methodology isn’t clear (which is expected for a service like this) although it’s updated at the end of each month.

Based on Investopedia research, it was noted that Morningstar’s rating methodology is not that accurate in comparison to others.

“A study performed by Vanguard found that Morningstar's ratings were not a good method to predict performance when measured against a benchmark.”

Based on this I wouldn’t solely rely on the rating system to make decisions, but rather use it as a guide post for looking deeper into a company or asset you find interesting.

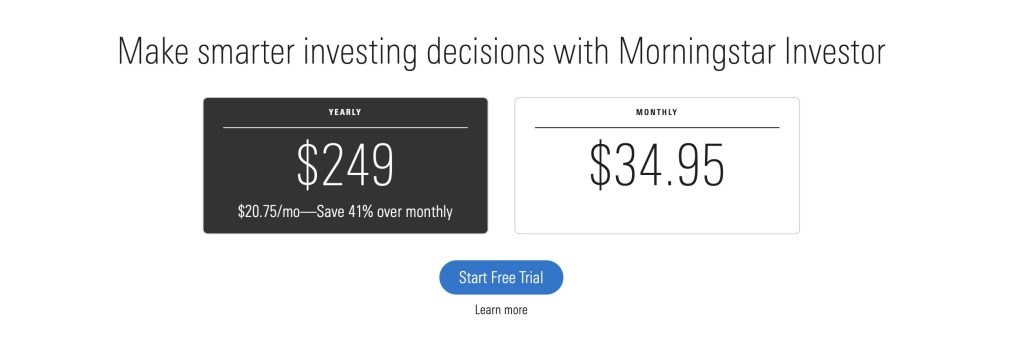

Morningstar Investor price

Morningstar Investor is reasonably priced at either $249 per year or $34.95 per month. All users are entitled to a 7-day free trial which I encourage. If you’re reading this review there’s a chance you’re comparing it to Seeking Alpha Premium which is $239 per year. Even though the two platforms are different I believe Morningstar provides a lot of value in some instances, especially when it comes to the economic reports and in-depth analysis.

Morningstar's pros and cons

| Pros | Cons |

| ✅ Highly customizable to suit your specific investment strategy | ❌ The reports are too long and technical |

| ✅ Easy to navigate and edit widgets | ❌ Morningstar’s Rating system has been said to be inaccurate compared to benchmarks |

| ✅ The reports are very detailed and accurate | ❌ The AI chatbot is unusable |

| ✅ Investors can access Stocks, ETFs, Mutual Funds, and more | ❌ The platform doesn’t tell you which assets to invest in |

| ✅ Pricing is fair in comparison to other similar services | |

| ✅ Alternative data points like ESG scores and sustainability metrics |

Morningstar alternatives

If you’re reading this review because you’re on the fence about choosing an investment research platform, consider these alternatives. We’ve reviewed the best stock-picking services along with the best investment newsletters and these are the ones that have come out on top.

- Ticker Nerd is best for investors who want to generate long-term wealth.

- Finimize is best for beginners learning the ropes of investing and economics.

- Mindful Trader is best for experienced investors who want to day trade stocks.

- Seeking Alpha Premium is best for investors who love analyzing financial data.

- Alpha Picks by Seeking Alpha is best for investors looking for data-driven stock picks.

- Tim’s Alerts is best for day traders who are looking for daily recommendations.

- Zacks Premium is best for do-it-yourself investors.