TL;DR: Motley Fool is a stock-picking service suited for beginner to intermediate investors who are time-poor. Motley Fool tells you which stocks to buy and why. Morningstar on the other hand does not pick stocks, it is a comprehensive investing platform that helps investors track and measure their portfolios. It’s best suited for investors with financial markets and macroeconomic knowledge.

Both Morningstar and Motley Fool have been empowering investors for over 25 years.

Considering most businesses don’t make it this far, they’ve been doing something right.

So it’s no surprise investors want to size them up and see which is best.

However, it’s important to understand that they’re not the same service so we aren’t comparing apples with apples. One is a stock-picking service and the other is a research platform.

Either way, I’ll do my best to accurately compare both services so you can make an informed decision on which is best for you.

Let’s get into it!

What is Morningstar?

Morningstar is an investment research company founded in 1984 by Joe Mansueto. The company is based in Chicago and according to Similarweb, the site gets around 7M monthly visitors. They cover assets like stocks, funds, ETFs, and bonds.

They have a free service that allows users to access articles and other helpful information. However, their premium service called Morningstar Investor is what I’ll be referring to in this article. It’s a financial research platform that empowers investors to make better financial decisions.

Morningstar pros & cons

| Pros | Cons |

| ✅ Highly customizable to suit your specific investment strategy | ❌ The reports are too long and technical |

| ✅ Easy to navigate and edit widgets | ❌ Morningstar’s Rating system has been said to be inaccurate compared to benchmarks |

| ✅ The reports are very detailed and accurate (separate from the rating system) | ❌ The AI chatbot is unusable |

| ✅ Investors can access Stocks, ETFs, Mutual Funds, and more | ❌ The platform doesn’t actually tell you which assets to invest in |

| ✅ Pricing is fair in comparison to other similar services | ❌ Requires some technical knowledge to make sense of the reports |

| ✅ Alternative data points like ESG scores and sustainability metrics |

Related: Morningstar Investor Review

What is The Motley Fool?

Similar to Morningstar, Motley Fool is a very popular finance and investing website. They’re best known for their stock recommendations newsletters. The company was founded in 1993 by brothers Tom and David Gardner. It’s now grown to become one of the most recognized sources of investment advice globally.

Their advice covers asset classes like stocks, real estate, exchange-traded funds (ETFs), and cryptocurrency. Unlike Morningstar, the Motley Fool has over 20 different membership types so for the purpose of this review I’ll only reference Stock Advisor and Rule Breakers since they’re the most popular services (and both give you access to the platform).

Motley Fool pros & cons

| Pros | Cons |

| ✅ Very easy to navigate and understand | ❌ The reports are a bit too short for my liking |

| ✅ Tells you which stocks to invest in with a report to justify | ❌ The Motley Fool platform is very basic and the reports weren’t interesting |

| ✅ Buy and sell notices | ❌ There are too many services to choose from |

| ✅ A strong track record when compared to the S&P 500 and other similar services | ❌ It’s hard to trust the Motley Fool since they’ve been accused of holding some of the companies they |

| ✅ Pricing is fair in comparison to other similar services |

Related: Motley Fool Review

Morningstar vs Motley Fool – Overview

What is Morningstar best known for?

Morningstar is best known for its comprehensive investment research platform and in-house analysis. As a free member, you can access thousands of articles like this one – The Best Companies to Own.

On top of this, they have a premium investing platform that allows investors to track their portfolios and research more deeply using their propriety software and in-house analysis. Some of my favorite features include:

- Custom watchlist: Allows you to track securities (stocks, bonds, ETFs, etc) in one place. Investors can customize the data/metrics and columns that appear in your watchlist dashboard

- Stock screener: Similar to most investing research platforms Morningstar allows users to search for stocks based on custom criteria. This includes metrics like stock style, sector, industry, market cap, ratings, performance, valuation, etc.

- Calendar: The calendar is displayed daily and can be filtered by four key events — Earnings, Stock Splits, Economic Releases, and IPOs. Since I’m a fan of IPO investing this is particularly helpful for my research.

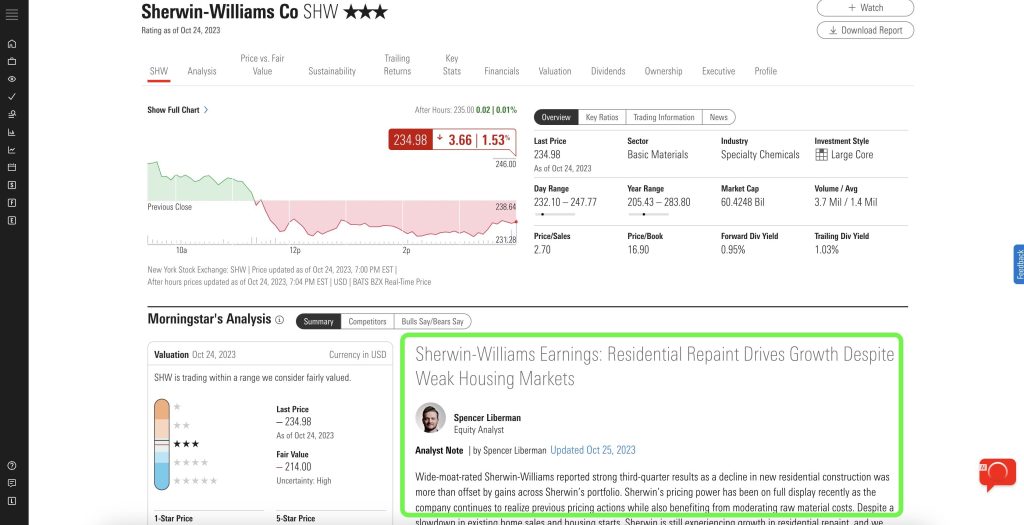

- Stock analysis and reports: This is where users can find detailed reports and metrics on a given

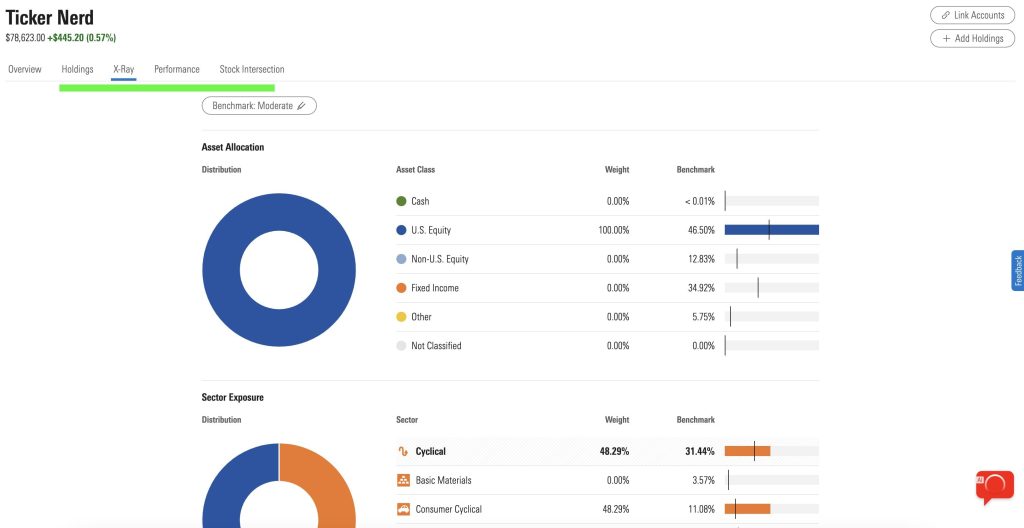

- X-Ray: The X-Ray feature is something I’ve only seen with Morningstar, it shows the overall asset allocation of your portfolio and benchmarks it against portfolio types (e.g. aggressive, moderately aggressive, conservative, etc).

- Market Overview: For investors interested in broader market movements and macroeconomic trends the market overview feature provides all necessary reports and data points.

- Morningstar Rating System: This is Morningstar’s core value proposition. Each stock has a five-star rating system that shows whether or not it’s undervalued and worth investing in.

What is the Motley Fool best known for?

Motley Fool is best known for their stock picking services and email newsletters. The company was founded in 1993 by brothers Tom and David Gardner. It’s grown to become one of the most recognized sources of investment advice globally. Their advice covers asset classes like stocks, real estate, exchange-traded funds (ETFs), and cryptocurrency.

They have over 25 different services, although the most popular seem to be Motley Fool Stock Advisor and Motley Fool Rule Breakers.

Motley Fool Stock Advisor: This membership grants premium subscribers two monthly stock recommendations and access to the investor platform. On top of this, investors can access the top 10 ranked stocks, buy and sell notices, reports, news articles, and the community. In a previous review, I noted that Stock Advisor is best suited for beginner investors who will commit to their picks for medium to long-term growth and appreciate well-researched recommendations.

Motley Fool Rule Breakers: Similar to Stock Advisor, Rule Breakers subscribers get access to two monthly growth stock recommendations. Although, this membership specifically covers stocks that can significantly outperform the market. Members can still access all the other features like the top 10 growth stocks, buy and sell notices, reports, news articles, and the community. However, I would recommend Motley Fool Rule Breakers for impatient investors who want to see gains sooner than 5 years.

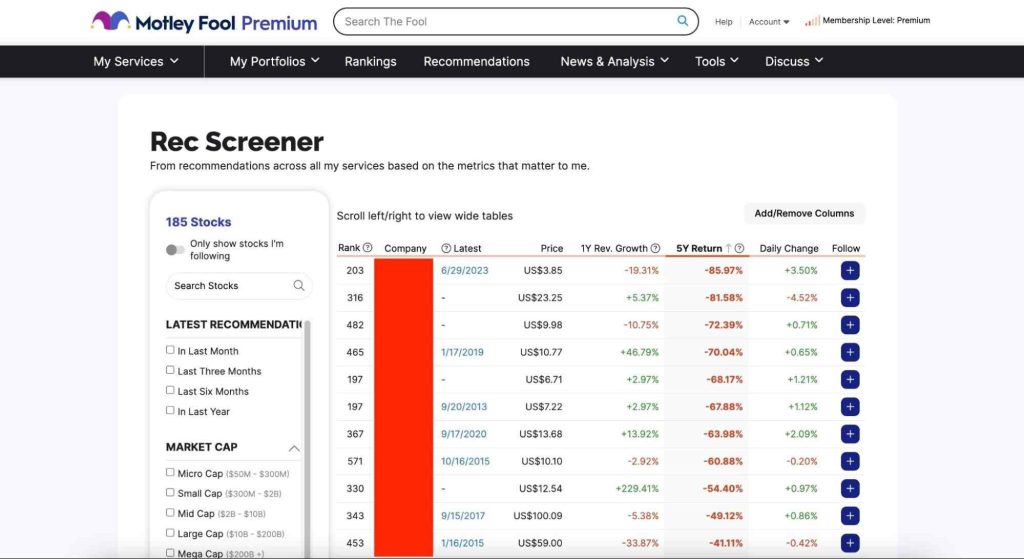

Both memberships still have a stock screener (called a “Rec Screener”) that allows investors to do their own basic research and filtering.

What does Morningstar do really well?

Morningstar nails a few things like the portfolio X-Ray and Market Overview. However, their reports are incredibly detailed and helpful. I’ve yet to come across another investing service that provides this level of detail for almost all of the assets they cover. As an investor with a deeper knowledge of the economy and stock market, I found this to be the biggest value proposition.

What does the Motley Fool do really well?

One thing I believe the Motley Fool does incredibly well is showing investors which stock to buy. They have a simple top 10 list of stocks with the most potential. Investors don’t need to waste time researching or thinking about which stocks to invest in. They simply sign up, look for the top buys, and then take action. This is the main value proposition and compared with Morningstar it’s much more aligned with investors who want minimal involvement in the research process.

What are the main differences between Morningstar and Motley Fool?

Hopefully, by now it’s clear that Morningstar is an incredibly helpful research platform that doesn’t pick stocks for you. Whereas the Motley Fool does pick stocks while still offering basic research functionality for investors. Morningstar is best for hands-on investors with a deeper understanding of financial markets and macroeconomics. Motley Fool is best for investors who want a done-for-you stock-picking service.

Morningstar vs Motley Fool – Track Record & Performance

Morningstar track record

Since Morningstar isn’t necessarily a stock picking service it’s very hard to assign a track record or performance rating. However, they do rate stocks based on a five-star rating system which has been criticized by sites like Investopedia.

“A study performed by Vanguard found that Morningstar's ratings were not a good method to predict performance when measured against a benchmark.”

Sean Ross, Investopedia

For this reason, I would not solely rely on the star rating system and I would simply use it as an additional metric that is included in your overall research.

Motley Fool track record

The Motley Fool's track record is dependent upon the specific service. According to the Motley Fool, the Stock Advisor has returned 466.4% since 2002 vs the S&P 500 which has returned 125.3% over the same period. This is incredibly profitable so The Motley Fool wins here by a long shot.

Morningstar vs Motley Fool – The Ideal User

The Morningstar ideal user is an investor who prefers to spend time doing research themselves. They’re likely interested in financial markets, economics, and diversification. Their portfolio isn’t just stocks but likely ETFs and commodities. They don’t mind spending 5-10 hours per month researching on the Morningstar platform.

The Motley Fool's ideal user is an investor who doesn’t want to spend time doing research. They want to be told what stocks to buy and trust the research is accurate. They don’t have a deep knowledge of financial markets or economics and are primarily interested in stock investing.

Morningstar vs Motley Fool – Pricing

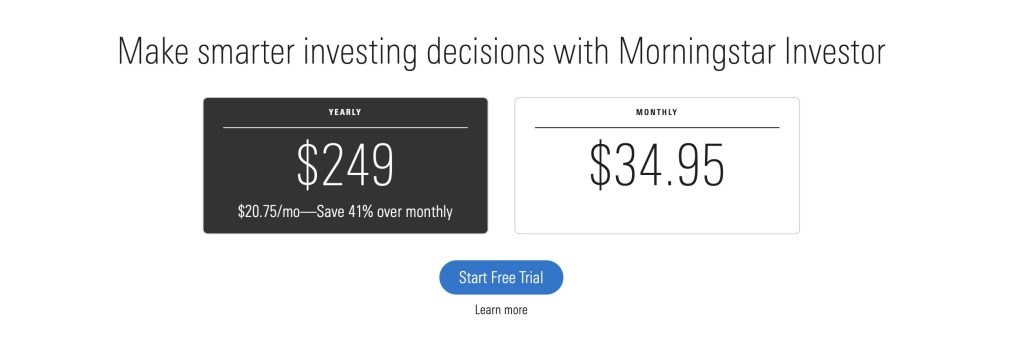

Morningstar pricing

Morningstar Investor is reasonably priced at either $249 per year or $34.95 per month. All users are entitled to a 7-day free trial which I encourage.

Motley Fool pricing

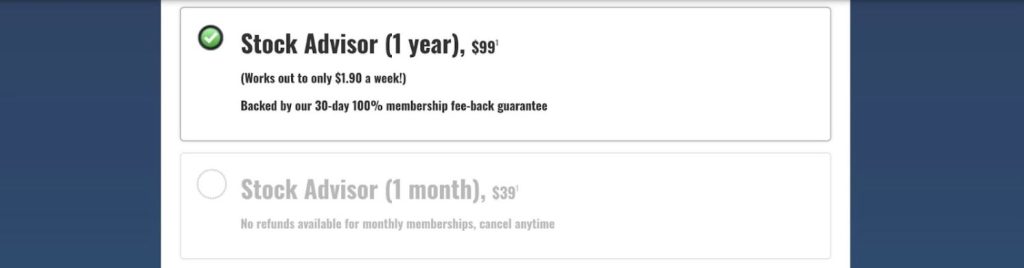

- Motley Fool Stock Advisor:

- $39 paid monthly

- $99 paid annually for the first year, then $199 each year after that

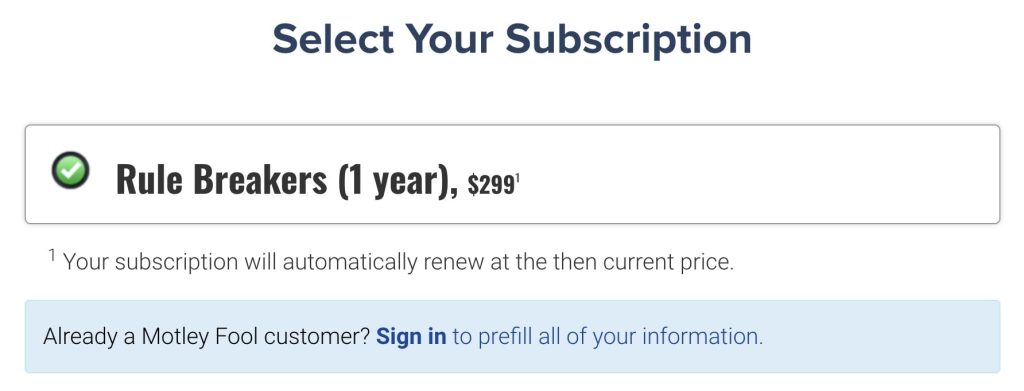

- Motley Fool Rule Breakers:

- $299 per year (new members can subscribe for $99 for the first year).

Note: monthly pricing does not come with a money-back guarantee.

Wrapping up

Both of these services are incredibly helpful in their own way. As mentioned in the beginner of this article, we're not exactly comparing apples with apples. We're comparing a broad investment research platform (Morningstar) with a stock picking service (Motley Fool). However, the distinction is clear which should make your decision easier.