So you’ve decided it’s time to get an edge in the stock market.

Well, you’ve come to the right place.

But don’t get too excited just yet.

Blindly following a stock recommendation can be an easy way to lose money.

And we know that Warren Buffert's number one rule is don’t lose money.

So with that in mind, I will review only the best investments and stock newsletters. These newsletters will save you time, give you direction and ultimately supercharge your investment portfolio.

Let’s get into it!

The Best Stock and Investment Newsletters – Summary

Here's the TL;DR

- Ticker Nerd is best for growth investors that want to generate long-term wealth.

- Zacks Premium is best for do-it-yourself investors.

- Motley Fool Stock Advisor is best for average investors who don’t have much time.

- Morningstar Stock Investor is best for advanced investors who like detailed reports.

- Seeking Alpha Alpha Picks is best for investors that want to be data-driven.

- Motley Fool Rule Breaker is best for active investors that want moonshot stocks.

- The Oxford Communique is best for old-school investors.

- Finimize is best for beginners learning the ropes of investing and economics.

- Trade Ideas Free Trade of The Week is best for day traders.

- MarketWatch is best for investors that want timely and accurate news.

How To Choose The Best Investment Newsletter For You

Before we get into it, I want you to know how to choose the right investment newsletter. There are loads of services hitting the market these days, and knowing which ones are worth your money can be difficult. Here are the key considerations when deciding which stock newsletter is best for you.

- Have a goal: Are you trying to flip stocks? Or do you want to make long-term investments? Regardless of your goal, you need to have the end in mind. Some newsletters are suited for day traders, while others are best for value investors.

- Determine the asset classes you want to invest in: This might seem obvious, but some newsletters make their advertising so compelling that you sign up, not realizing they only specialize in one asset class, like precious metals or penny stocks.

- Determine your budget for the newsletter and investment: This is a critical step, especially since some newsletters cost thousands of dollars annually. You want to ensure the cost of your newsletter is relative to the size of your investment.

- Choose a newsletter that matches your risk appetite: Some newsletters will send moonshot investments with a low chance of success but a high reward if they’re successful. Other newsletters send dividend stocks that are much more stable and more likely to return a positive return on investment (ROI).

- Assess the track record and read reviews: Evey stock and investing newsletter will call out the Netflix and Uber they wrote about many moons ago. However, this is almost useless if they’ve covered every stock on the exchanges (and trust me, some almost have). So be sure to read the reviews and understand what different people say about the service so you can make an accurate and informed decision based on the hard facts.

- Transparency: Believe it or not, some investing and stock newsletters hold positions in the stocks they send their members. I think this is unethical, so avoid services that do this. They must let you know by law, so be sure to read the fine print and disclaimers.

- Free trials and cancellations: You won’t know which newsletter is best unless you try a few. The easiest way to do this is by maximizing the free trials. Run the other way if you can’t test or easily cancel a service.

The ten best investments newsletters reviewed by our team

So now you know what to look for, we’ll get into the best newsletters.

My team and I signed up and tested every newsletter on this list, including the free and paid services. We’ve gone through a lot of effort and spent a lot of money ensuring we give honest, accurate, and complete information for every service on this.

1. Ticker Nerd

Ticker Nerd is a newer player in the investment newsletter space that is growing rapidly. Their reports are transparent, unbiased, trustworthy, packed with hard-to-find data and sources, and easily skimmable. Their team of experts keeps a three to five-year horizon when covering any stock to ensure a long-term upside for members.

Each monthly report shows two undervalued growth stocks that cover hedge fund trading data, Wall St analyst ratings, social media sentiment, and fundamental and technical analysis. So if you’re an investor who appreciates objective, transparent, accurate, and well-rounded information, Ticker Nerd is for you.

As a Ticker Nerd member, you’ll gain instant access to the dashboard, which features a welcome video and database of reports. But it gets better; members that stay past the trial will be rewarded with a bonus database of buy, sell, and hold analyst ratings for each high-growth stock they have covered. This gives investors even more direction and confidence when making a decision.

Ticker Nerd Pros

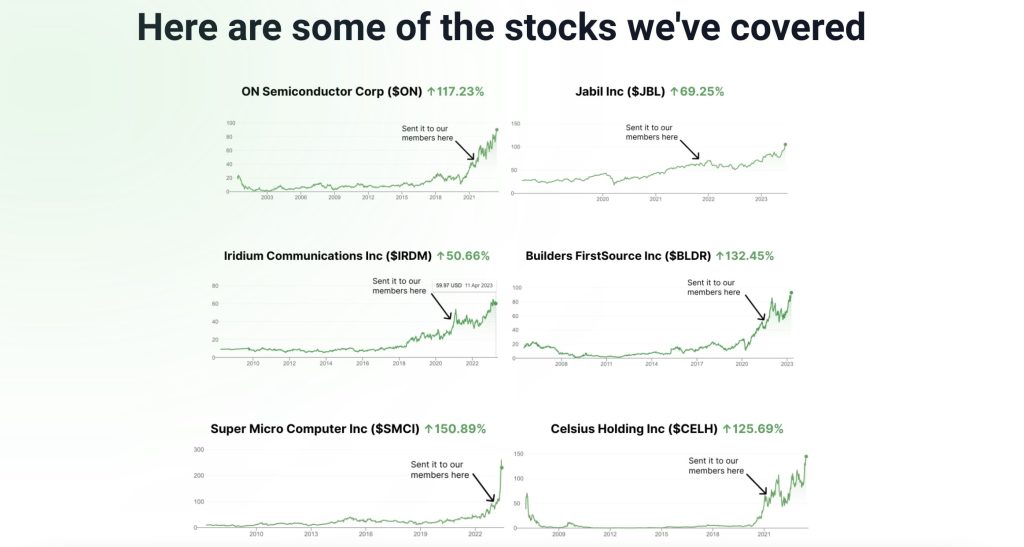

- As of 30 June 2023, Ticker Nerd has sent 36 stocks that have increased in value. Ten of these stocks returned over 50% since they covered them.

- Leverages alternative data sources such as data from hedge fund managers, Reddit mentions, and insider buying to paint an accurate picture of a stock.

- You can access the reports in your inbox or online through your dashboard.

- The reports are transparent, thorough and cover the risks.

Ticker Nerd Cons

- They only cover US stocks.

- They don’t have a free daily newsletter.

- Don’t provide buy, hold or sell data unless you pass the trial.

Ticker Nerd Track record

So far, Ticker Nerd has covered 12 stocks in 2023 (January to June), and 10 are up in value, meaning their hit rate is over 80%. Of course, this doesn’t necessarily mean they will continue to perform this way; it doesn’t mean the stocks they’ve covered will continue rising in value. However, it is a positive sign and confirms they cover high-quality stocks that investors would want in their portfolios.

Price: $199 per year.

Free trial: No although a 30-day money-back guarantee.

Disclaimer: Yes, I know Ticker Nerd is our very own investing newsletter, and even though we’re telling you why it’s amazing, we’ve also been straight up about why it might not be suitable for you to keep this article as objective as possible. P.S. Here's a Ticker Nerd review you might want to read 🙂

2. Zacks Investment Research (Premium)

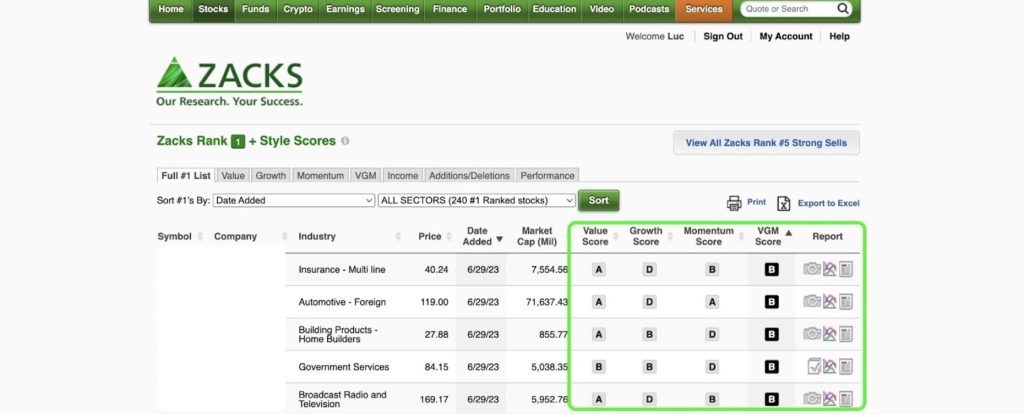

Unlike most newsletters, Zacks Premium is a stock research platform first and a newsletter second. Most of the value sits within the platform under the stock screener, portfolio, and hours of educational content to help you become a better investor. It’s important to note that Zacks Premium requires a hands-on approach to investing. You won’t receive a curated list of stocks each month with everything you need. Instead, you’ll need to take the initiative and explore the platform yourself.

While the platform can be overwhelming, a good starting point is the stock screener, which makes it incredibly easy to filter for growth stocks. You can navigate to the report icon and read a brief summary of what makes the stock stand out and why it has such a high rating. The reports generally leverage the other data points that Zacks features, such as the fundamental analysis tools. In my eyes, this is a curation of their data sources packaged into scannable reports. The only downside is that there could be hundreds of these to read.

Zacks Premium Pros

- Investors can create a portfolio and watchlist of their desired stocks.

- Zacks cover Stocks, Crypto, Exchange Traded Funds (ETFs), Mutual Funds, Personal Finance, and more.

- Its strong buy ratings give you more direction on whether you should execute.

Zacks Premium Cons

- More of a do-it-yourself research platform than a newsletter.

- Investors need to spend time learning how to use the platform.

- You need to contact your account manager to cancel.

Zacks Premium Track record

Since Zacks Premium is more of a screening tool, evaluating its track record is challenging. However, according to their performance disclosure, the Focus List has outperformed the S&P 500, whereas the Zacks #1 Rank list has not performed as well.

Price: $249 per year

Free trial: Yes

3. Motley Fool Stock Advisor

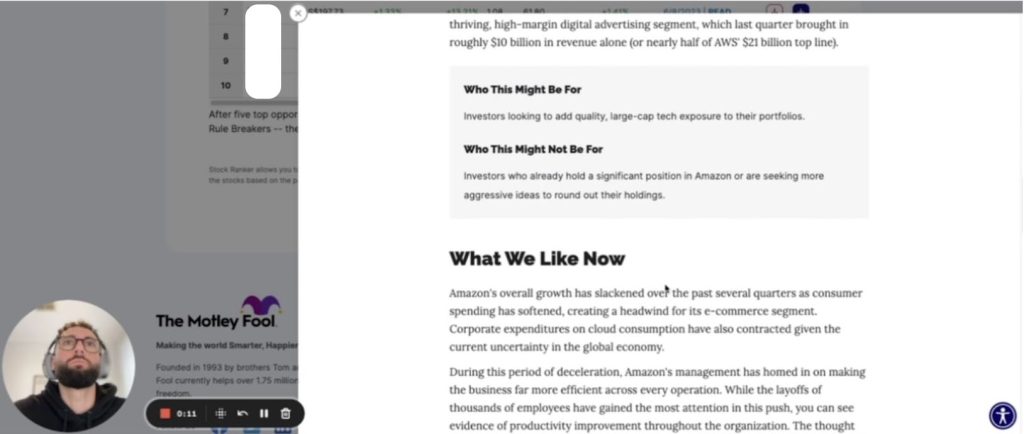

Unless you’ve been living under a rock, you’re probably familiar with Motley Fool. They’ve been around for over 25 years and are relentless with their email marketing campaigns. Motley Fool’s Stock Advisor is their flagship and entry-level stock report service. Like Zacks, they’re not a traditional newsletter since all their reports and tools are hosted on the website. They also leverage their proprietary data and research to generate reports.

I was pretty surprised at how short the reports were and expected to see a more thorough analysis of their stock picks. They cover the basics, like what the company does, why they’re worth looking into, and why the team chose them. But even the highest-rated stocks had thin reports that didn’t have sources to back up any claims they made. The bottom of each report had updated metrics like the price, market cap, and 52-week high, although it wasn’t enough for me to feel confident in making a decision.

Motley Fool Stock Advisor Pros

- Investors can create a portfolio and watchlist of the recommended stocks.

- The reports are fairly short and easy to read if you’re short on time.

- You get two new reports each month to help you select a stock.

Motley Fool Stock Advisor Cons

- They cover so many stocks that it’s challenging to make a decision.

- Getting a refund is challenging if you’re unsatisfied with the service.

- The reports are short and don’t contain many sources.

- They upsell you many additional products and services, confusing investors on which service is best suited for them.

- You’re expected to invest in 25 stocks before canceling their service.

- The Motley Fool often has a position in the stocks they send you.

Motley Fool Stock Advisor Track Record

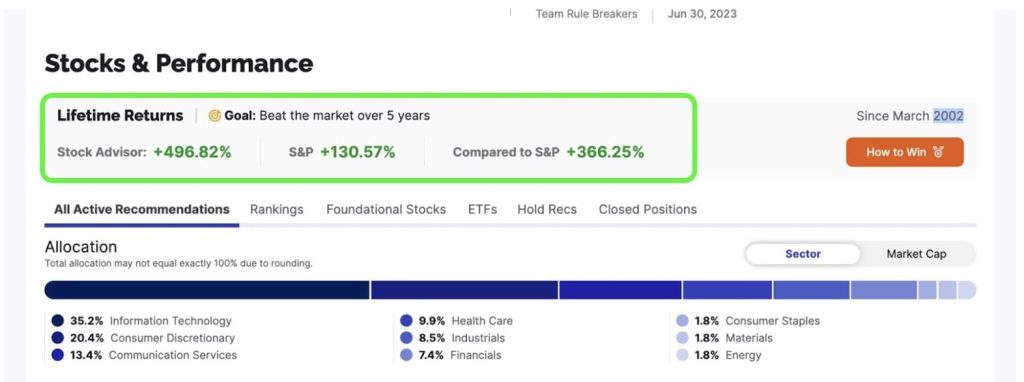

Motley Fool boasts a track record that has outperformed the S&P 500. My dashboard says that the Stock Advisor returns are at 496% from March 2002 to June 2023. This is insanely high, but it’s also over 20+ years, so it’s not that impressive. The Motley Fool covers so many stocks that this figure isn’t meaningful to me; if you avoid junk companies yearly, it’s not difficult to beat the S&P 500. On top of this, one of their principles is to invest in at least 25 companies using their service. Seriously, when was the last time you purchased 25 stocks based on an investment newsletter? Even Warren Buffet is notorious for making a handful of investments each year. Another point to consider is it only takes a handful of big winners to offset a pile of losers, so keep this in mind when considering their track record.

Price: $99 for the first year ($199 per year after).

Free trial: No (30-day money-back guarantee).

Sign up for Motley Fool Stock Advisor.

4. Morningstar Stock Investor Newsletter

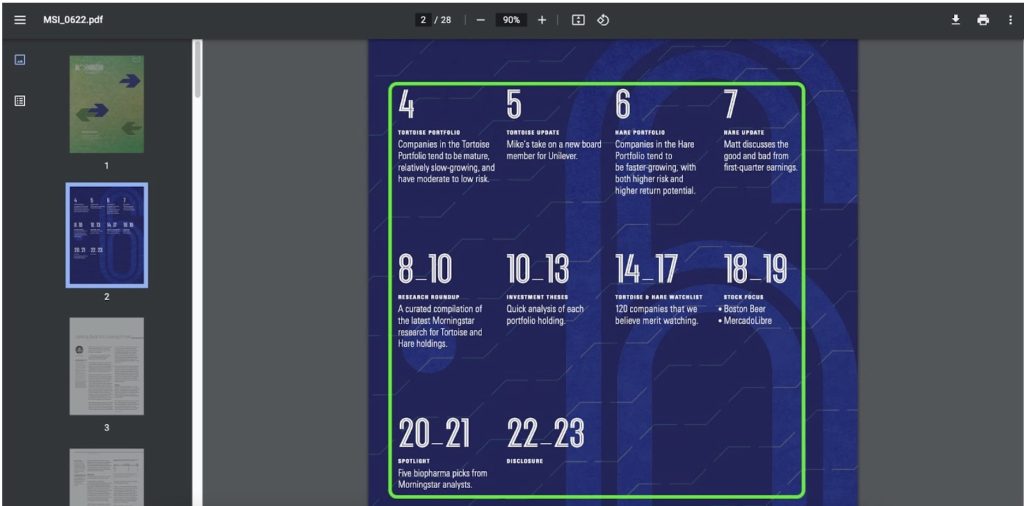

Morningstar is a household name and a company I greatly respect. When I first learned the ropes of investing, I referenced material and data produced by Morningstar. When it comes to their investment newsletter service, they produce insanely detailed reports. I'm talking about 28 pages of data, commentary, and charts. Since their reports are so detailed, I will note that they are not suited for beginner or time-poor investors. Another thing to remember is their reports don’t tell you what to buy but rather a commentary on their two core portfolios, The Tortoise Portfolio and The Hare Portfolio. This is why I believe Morningstar Stock Investor is best for experienced investors who are comfortable doing more investing research before picking individual stocks.

As you can see, the stock reports are insanely detailed and thorough. You can expect to receive a curation of stocks in various portfolios with different levels of risk. The example report covers the following:

- Tortoise portfolio (mature, low-risk companies)

- Hare portfolio (faster growing, high-risk, high-reward companies)

- 120 companies worth keeping an eye on

- 5 biopharma picks from Morningstar Analyst

- Additional research from the Morningstar Team

- Latest news, market insights and commentary

In total I spent about six hours reading and processing the report. The hardest part was cross-referencing the symbols to the legend, which is useful but frustrating initially if you don’t know what they mean.

Morningstar Stock Investor Pros

- Commentary on alternative data metrics such as ESG scores.

- Highly detailed reports, which increase investor confidence.

- Covers both high-risk and safer stocks.

- Relatively cheap for the value you get.

Morningstar Stock Investor Cons

- There is no explicit direction for which stocks to buy. Investors will need to do additional research and due diligence.

- The reports are too long to read in one sitting.

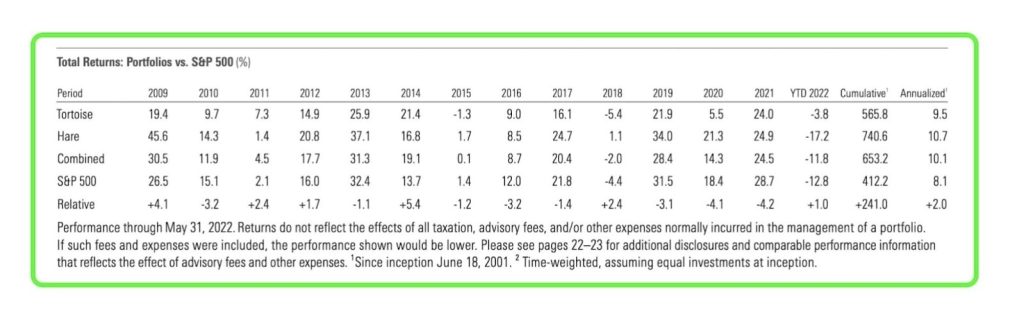

Morningstar Stock Investor Track Record

According to the annualized performance from 2009 to May 31, 2022, the Tortoise and Hare portfolios combined have outperformed the S&P 500 by 2%. Since Morningstar covers so many various stocks, it’s not useful to show the performance of their total portfolio holdings since investors will unlikely replicate the exact holdings.

Price: $145 per year for digital and $165 for print.

Free trial: No trial, but you get one free report.

Sign up for Morning Stock Investor here.

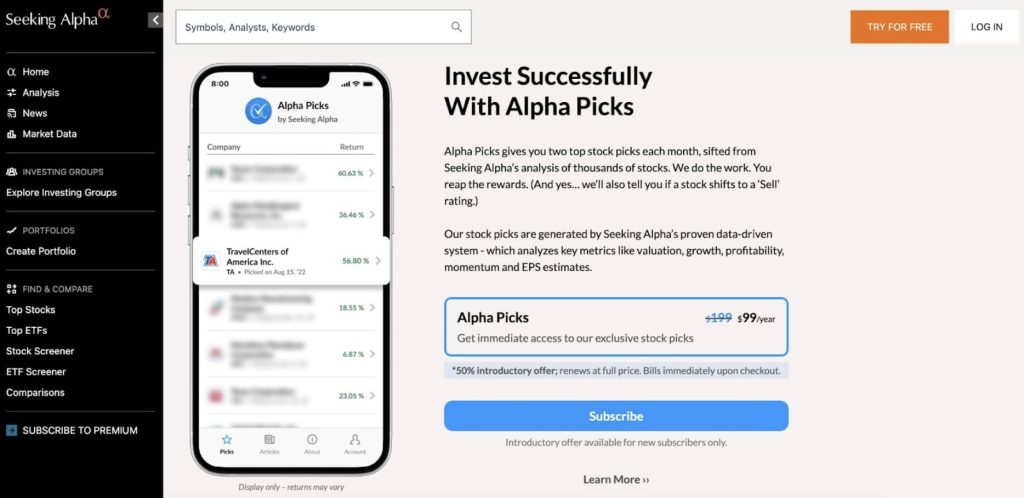

5. Seeking Alpha Alpha Picks

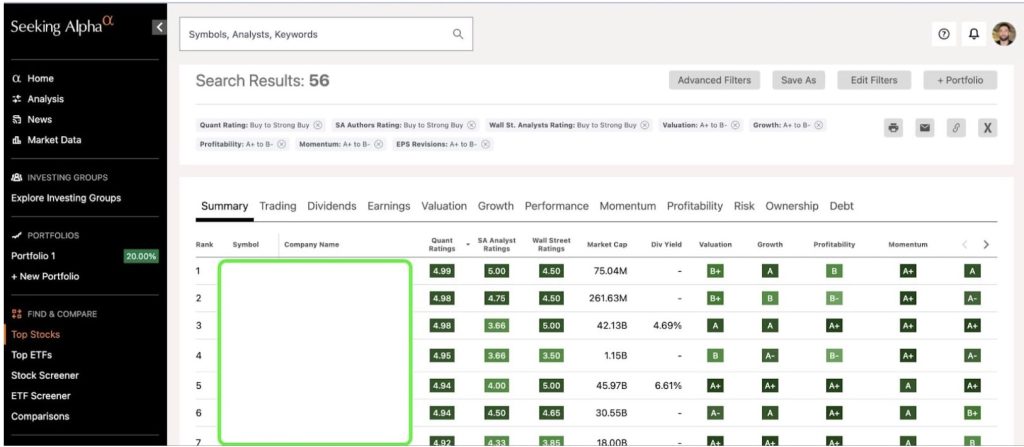

Another fan favorite is Seeking Alpha. They boast one of the most comprehensive, accurate, and enjoyable investing platforms. While most stock research platforms seem outdated (no offense, Morningstar or Zacks), Seeking Alpha does a great job at making their site user-friendly. On top of their advanced research platform, they have a monthly service that shortlists the best stocks from three sources, including the Seeking Alpha Quant Model, Seeking Alpha independent contributors, and Wall Street analysts.

You can expect to receive two stock picks each month as a member. However, you’ll gain access to the database of top stocks anyway, making the service a little bit redundant. Investors can easily just click on the top-rated stocks and read the analysis to judge whether or not to add them to their portfolio. I would recommend Alpha Picks to the lazy investor who might want to dig a bit deeper occasionally. In saying that, I see slightly more value in subscribing to a Seeking Alpha premium subscription than the Alpha Picks service.

Read our Seeking Alpha Premium review here.

Seeking Alpha Alpha Picks Pros

- Three different sources are used to weight and shortlist the top stocks.

- You get unlimited access to the whole platform to conduct deeper research.

- Factor Grades allow you to see the previous three and six months' ratings so you know if it’s time to sell.

- Ability to connect your brokerage account to make it easier to trade.

Seeking Alpha Alpha Picks Cons

- It was initially unclear where I could access the reports and the two Alpha Picks. It seems the two stocks are part of the “Top Stocks” list.

- When you navigate to an individual stock, you don’t get a detailed report but rather a list of data and news. You might be able to find an analysis of the individual stock, but this requires additional digging.

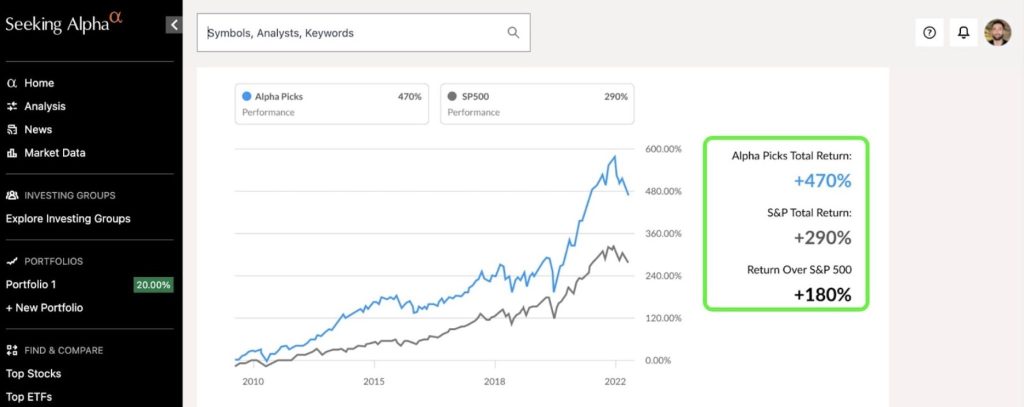

Seeking Alpha Alpha Picks Track Record

Seeking Alpha said their Alpha Picks had returned 470% since 2010 compared to 290% from the S&P 500. This is impressive, but it’s essential to understand their investment process and philosophy. Unless you’re disciplined enough to buy, sell and hold each stock following their strategy, you will unlikely experience the same results. These returns are also based on backtesting versus real trading results.

Price: $99 for the first year and $199 per year after that.

Free trial: Paid trial.

Signup for Seeking Alpha – Alpha Picks here.

6. Motley Fool Rule Breakers

I wasn’t joking when I said Motley Fool has loads of different products and services. This is why they can get featured twice in one article, which is a little unfair, but I’ll let it slide since investors need to know their options. The core difference between Stock Advisor and Rule Breakers is that Rule Breaker covers high-risk, high-reward stocks. This doesn’t necessarily mean they take moonshots on junk companies but are looking for disrupters like Tesla.

You need to know that Motley Fool expects you to invest in at least 25 stocks and hold them for at least 5 years. I can’t even think of 25 companies that fall into this category, perhaps Netflix, Tesla, Shopify, and Hubspot. But most of these companies have had huge bull runs already, not to mention it’s unrealistic for regular retail investors like you and me to invest in 25 different “Rule Breaker” companies over the next five years. As much as I want an aggressive portfolio, I still find this unrealistic unless you’re an institutional investor.

Motley Fool Rule Breakers Pros

- It gives you exposure to companies that could 1000x.

- You still get access to the top recommendations.

Motley Fool Rule Breakers Cons

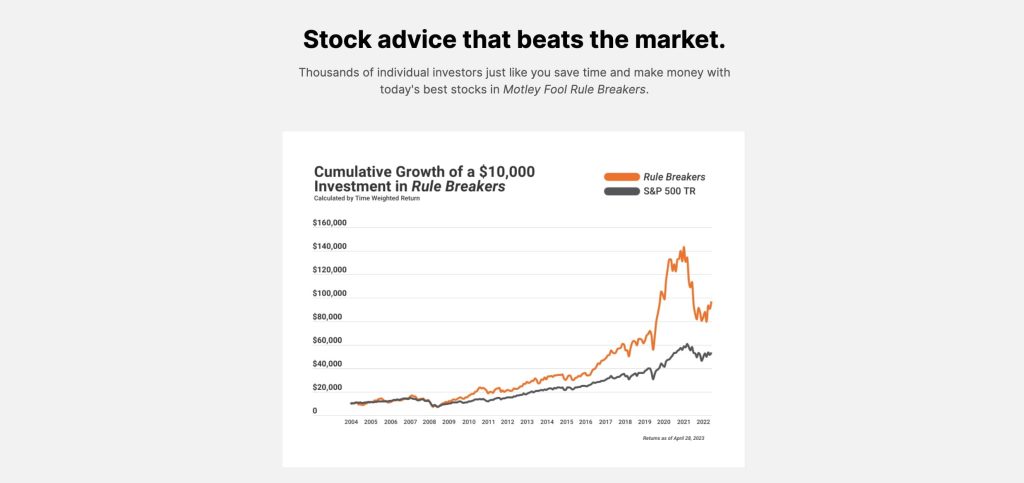

- Has only doubled the S&P 500 despite being a high-risk high, reward service.

- They often hold positions in the stocks they mention.

- Not super transparent with the research and reports.

- Expects you to invest in 25 Rule Breaker companies.

Motley Fool Rule Breakers Track Record

According to Motley Fool, their Rule Breaker picks have outperformed the S&P 500 in the last 17 years. A handful of stocks have likely driven most of this impressive performance (think Tesla, Under Armour, and Baidu). Motley Fool has claimed to beat the market consistently over the last 20 years, so I don’t want to underplay their performance.

Price: $99 per year for the first year, then $299 each year after that.

Free trial: No trial but a 30-day money-back guarantee.

Get started with Motley Fool Rule Breakers.

7. The Oxford Communique

The Oxford Cumminquē is The Oxford Clubs' flagship financial publication run by their Chief Investment Strategies Alexander Green. The company runs multiple newsletters, including The Oxford Income Letter and The Oxford Cumminquē Pro, but the regular Oxford Cumminquē is the best value for money. On their sales page, they call out three reasons you can expect to see a stock:

- It could be a company that Alex believes is likely to increase profits dramatically in the weeks and months ahead. No matter what the economy does.

- It could be a special insider play.

- It could be a smaller microcap play.

This makes The Oxford Cumminquē stand out from the likes of Motley Fool and Seeking Alpha. You’re getting more guidance on what to do and why. Many other newsletters leave me overwhelmed and confused about what to do next. I like being clear on the next steps, and I felt The Oxford Communique did this perfectly.

The Oxford Communique Pros

- Each month, you receive specific instructions on what to buy or sell

- Access to all of the current portfolios and future ones (many are added)

- Alexander Green has over 20 years of experience on Wall Street

The Oxford Communique Cons

- Many upsells and hard to differentiate products.

- The performance tracker only shows the last 12 months.

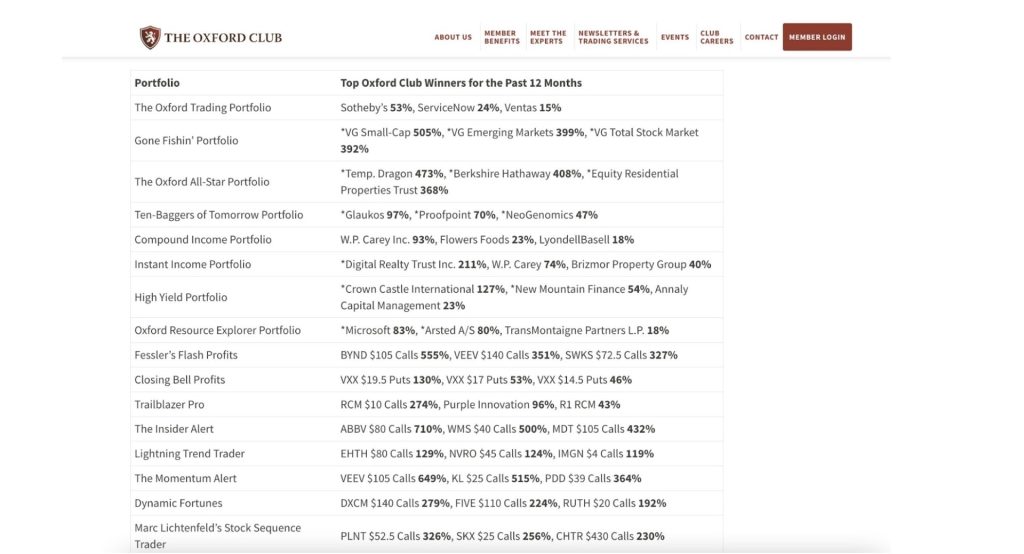

The Oxford Communique Track Record

Getting an accurate idea of how successful The Oxford Club is is not a small task. Their website boasts the portfolio's performance over the last twelve months. However, none were negative, which I find hard to believe. The website also mentions that The Hulbert Financial Digest consistently ranked Alex Green’s Oxford Communique as one of the top-performing for over a decade. Regardless, I still think seeing these track records is useless since very few investors will replicate their exact portfolios.

Price: $249 per year (sometimes discounted).

Free trial: No trial but 365-day money-back guarantee.

Sign up for The Oxford Cumminuqe.

8. Finimize

Finimize is an investment platform and daily newsletter in one. They’re one of the more trustworthy and helpful websites with actional investing resources on this list. You can expect to learn about the stock market and investing and get exposure to data and insights to help navigate your investment decisions.

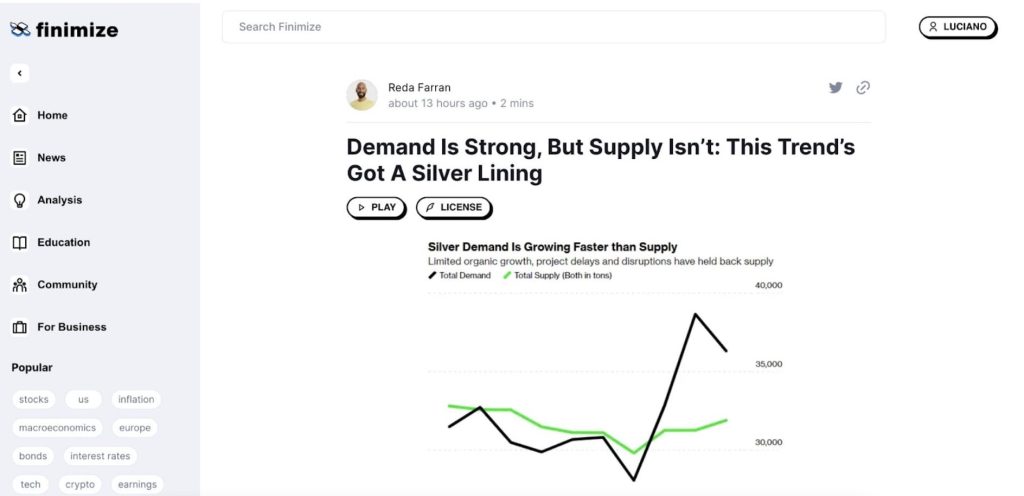

Even if you get access to Finimize Premium, it’s not a typical stock picking service where you can expect to receive monthly investment ideas. This is why I think the free newsletter is more than enough for most investors. You will, however, receive a deeper analysis market analysis of macroeconomic trends such as Silver's current demand and supply.

Finimize Pros

- Nice and easy platform to use.

- Covers key themes in financial markets.

- Easy to read and understand the articles. It feels like I learn something each time I read an article.

Finimize Cons

- You won’t receive any specific stock picks.

- The premium plan isn’t the best value for money.

Finimize Track Record

Since Finimize doesn’t recommend assets, there is no track record to measure.

Price: Free and paid service ($69.99 per year).

Free trial: Finimize Premium has a 7-day free trial.

Read our Finimize Review here.

9. Trade Ideas Free Trade of The Week

This one is for the day traders out there looking for an edge. Trade Ideas sends investors free trade ideas each week, showcasing the charts, analysis, and rationale behind why it’s being covered. There is a premium version you can subscribe to called Trade Ideas Pro, but since I’m not a day trader, I didn’t opt for this service. Investors should note that Trade Ideas use its software to generate these trades and, in most cases, try to upsell you. Below is an example.

Most companies will thank you and welcome you to their service. But not Trade Ideas. They want you to know all about how great their software is. This instantly made me question whether I should be reading the newsletters. I’ll let you decide, but I wasn’t a massive fan of this and I don’t think I’ll rely on their investment advice.

Trade Ideas Trade of The Week Pros

- The free newsletter offers specific trade advice, which is helpful.

- The trades generally offer explainers making it easier to learn.

- It’s a free newsletter.

Trade Ideas Trade of The Week Cons

- They try to upsell you on their software.

- It's not that useful for regular retail investors looking for a stock pick.

Trade Ideas Trade of The Week Track Record

Unfortunately, I could not validate the track record for Trade Ideas. The only data I could locate boasted a 75% win rate from January 2022 to April 2022. As you can imagine, this doesn’t carry much weight, nor is it very trustworthy.

Price: Free newsletter or $228 per month for the software.

Free trial: N/A.

Join Trade Ideas Trade of The Week here.

10. MarketWatch

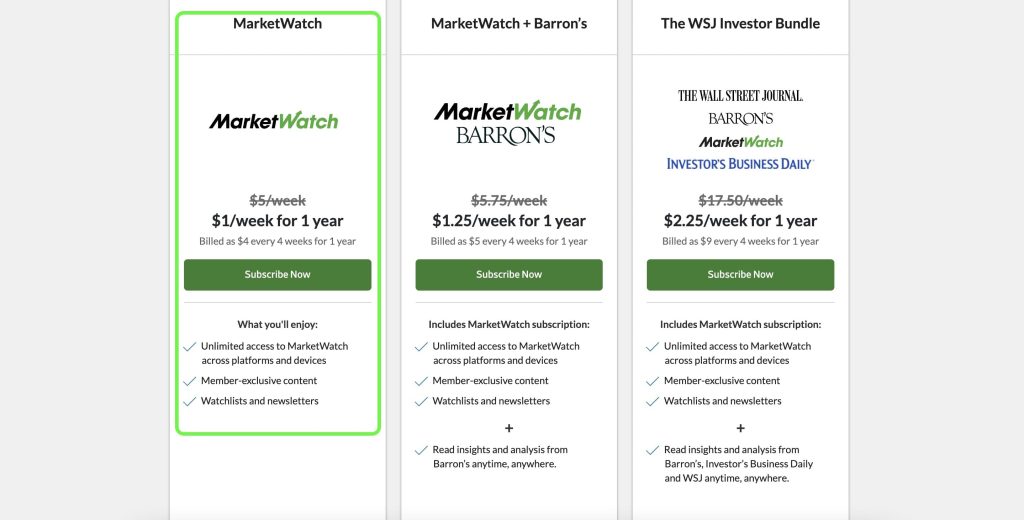

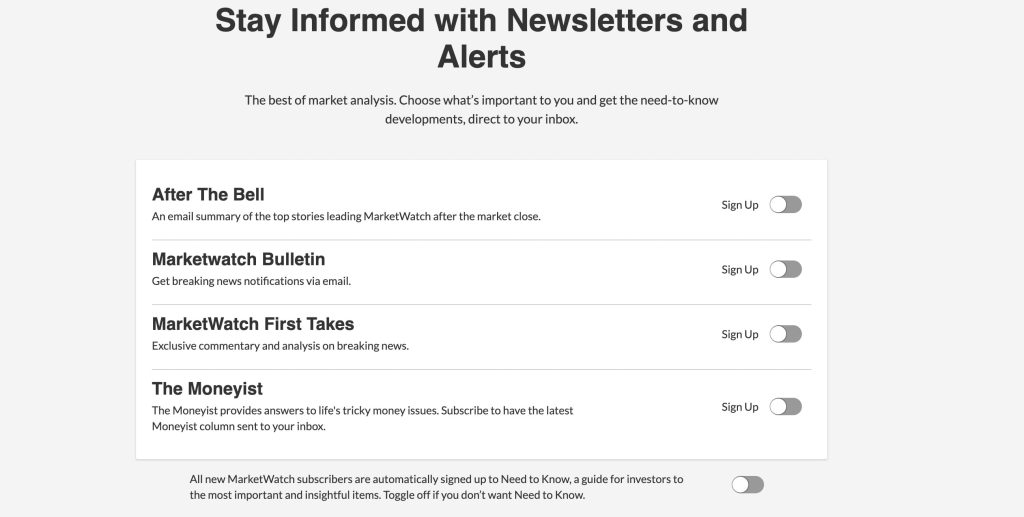

MarketWatch is one of the larger investing and stock websites. You can find stock market news, commentary, and insights on almost any asset. They even have partnerships with Barrons, The Wall Street Journal, and Investors Business Daily. I’ve included them on this list because they offer premium subscribers exclusive newsletters (and content) you won't be able to access on a free plan.

Once you’re a member, you can download the app, stay on top of market news and keep a watchlist of stocks that interest you most. On top of this, you can choose which premium newsletter you want to subscribe to as well.

MarketWatch Pros

- Great value for money.

- Special pricing for students (verification required).

- The mobile app is pretty advanced and makes it convenient to stay on top of the news.

MarketWatch Cons

- You won’t receive any specific stock picks.

- You’re paying for free information you could find on different sources if you looked hard enough.

- Most of the content is gated unless you have a premium membership.

MarketWatch Track Record

Since the newsletters do not contain specific stock picks, there is no track record to measure.

Price: $1 per week or $4 per month for the first year.

Free trial: N/A.

My final thoughts

You might be overwhelmed trying to choose between the various newsletters. However, the TL;DR should help you make an accurate decision if you get stuck. Some investing newsletters are best for long-term investors, while others are suited for advanced traders. If you’re still stuck, re-read the section on choosing the best investing newsletter at the beginning of this guide.

I noticed by reviewing each service that a lot of the stock and investing newsletters are classified as newsletters but are actually investing platforms that host reports. Seeking Alpha and Zaks Premium are perfect examples of this; investors are under the impression it will give them clear guidance and direction but usually require more research before making a decision. If you’re interested in this, consider checking our guide on the best stock-picking services.

Compared to options like Ticker Nerd and The Oxford Communique, investors can sit back and read the reports as they come in. They’re more focused and detailed, giving investors more trust and guidance.

Frequently asked questions (FAQs)

Investment newsletters are regular emails or reports that contain advice, information, or recommendations about a particular investment. They’re designed to help investors save time and make accurate decisions. Once you sign up, you can expect to receive frequent communication and detailed information about a particular investment (such as stock or commodities). But remember, it’s essential to research and never blindly follow a recommendation in any investment newsletter.

This will depend on your investment strategy and the investing newsletter you have subscribed to. However, it is best to consult a financial advisor who can give accurate, tailored financial advice. On top of this, we always recommend doing your research even if you pay for one of these services.

The simple answer is no. You should never blindly follow any advice, especially investing advice related to your hard-earned money. Always check for credible sources and do your research to cross-reference the research. Even if one of these services has a “strong-buy” rating, it’s highly encouraged that you still do your own research.

Since most of the investment newsletters on this list have market-beating returns, it’s safe to say they are worth it. Not to mention they will save you hours of research each month. This doesn’t mean every investing newsletter is worth subscribing to, but generally, they benefit investors regardless of their investing style. In saying this, they are not worth it if you only plan on buying one stock and continue to pay a monthly or yearly fee which can eat into your returns.

This will depend on your goals, investment strategy, and budget. And this article does a great job of covering the best stock newsletters for all types of investors. However, I believe Ticker Nerd is the best stock newsletter for just about every type of investor. This is because the reports are transparent, accurate, timely, easy to read, and curate data investors will struggle to find elsewhere. But at the end of the day, the best stock newsletter will depend on your unique needs and preference.