Trying to find your next investment isn’t easy.

There are hundreds (if not thousands) of websites and tools you could use to find information about which stocks to invest in.

However, not all of them are accurate, or even helpful.

Some of them might only cover one data point, others might be missing data points, and some cost thousands of dollars to access.

So in this article, I’m going to share the best stock research websites and tools to help you find hidden gems worth investing in. Including the ones that are free!

Best Stock Research Websites & Tools Summary

Here's the TL;DR

- TradingView is best for charts and advanced metrics.

- Investopedia is best for educational content and simulated trading.

- Ticker Nerd is best for detailed stock reports.

- Simply Wall St is the best visual analysis research platform.

- Quiver Quantitative is best for alternative data points.

- Stock Analysis is best for IPO data and stock forecasts.

- Seeking Alpha is best for investors who want a one-stop shop.

- Yahoo Finance is best for updated company information and news.

- Google Finance is best for tracking your portfolio performance.

- Stock Circle is best for staying on top of hedge fund trading data.

- MarketWatch is best for news and opinions.

- The Motley Fool is best for reports and opinions.

- Stock Market Guides is best for software-based stock and options

What to look out for when using a stock research website or tool

It’s almost impossible to get an accurate picture of the performance of a stock without using a reliable, complete, and accurate tool. When searching for a website to lean on keep an eye out for these specific factors:

- Data accuracy and reliability: Ensure the platform sources its data from reputable providers (e.g. SEC data and not a third party that gets their data from another third party)

- User interface: Make sure the platform is user-friendly and easy to navigate. You might miss important details or information if it is not.

- Depth and breadth of data: Does the platform only share a few data points or does it share the whole picture? Ensure you have access to multiple data points.

- Historical data: This refers to the ability to access and analyzes historical performance, without this, it’s hard to see the full picture.

- Real-time updates: This is most important for active traders (i.e. day traders) but it’s still important to know that the information presented is updated as frequently as possible.

- Analytical tools: If the platform is technical in nature it should offer a range of analytical tools, such as valuation models, technical analysis charts, and predictive algorithms, to aid in your research.

- Sources: Any credible website or research tool will tell you where the information came from and have no issue linking out so you can validate their claims.

- Alternative data sources: For your research to be complete you might want access to alternative data sources like social media mentions, hedge fund trading data, etc. Ticker Nerd is a great example of combining alternative data sources to give an accurate picture of a company.

- Educational resources: This is especially important for newer investors, platforms that offer tutorials, webinars, articles, and other educational resources can be beneficial.

- Reviews and testimonials: Check reviews and testimonials from other users to gauge the platform's reliability, usability, and overall reputation.

13 best stock research websites and tools based on our first-hand experience

Here are the best stock research websites and tools based on our first-hand experience with them. We use these tools daily to produce our premium reports and provide our members access to the highest quality data and sources.

1. TradingView

TradingView is a popular platform that provides advanced financial visualization tools, including interactive charts for stocks, cryptocurrencies, forex, and other assets. It even offers a social network for traders and investors to share and discuss their insights, strategies, and technical analyses. Additionally, TradingView provides a range of tools for technical analysis, backtesting, and scripting, making it popular among novice traders, experienced traders, and other websites that want to leverage their data.

This is a stock research tool that any investor can find value in. When it comes to getting accurate, up-to-date data I rely on TradingView. Since I prefer to use websites with clean and easy-to-navigate interfaces I rely on TradingView.

Price

- Free version with limited features.

- Pro: $14.95 per month.

- Pro+: $29.95 per month.

- Premium: $59.95 per month.

- All memberships have a free 30-day trial and are cheaper on an annual plan.

🤓 Pro tip: You can customize your graphs to include data points, date ranges, and chart types that best suit your needs. On top of this, you can create detailed alerts with specific triggers and messages.

2. Investopedia

Investopedia is one of the most popular financial education websites on the internet and one of the first investing sites I ever came across. They offer a tonne of articles, tutorials, and resources on finance, investing, and economics. It serves as a comprehensive reference for terms, concepts, and strategies, catering to both beginners and experienced professionals.

Most of their articles are comprehensive, peer-reviewed, and packed with visuals to help you grasp concepts quickly. I would recommend every investor use Investopedia to improve their baseline investing knowledge.

Price

- Free.

🤓 Pro tip: Investors can use their tools like simulators, quizzes, and courses to further enhance financial literacy and investment skills.

3. Ticker Nerd

Ticker Nerd is our very own stock research website and newsletter space that is growing rapidly. Our reports are transparent, unbiased, trustworthy, packed with hard-to-find data and sources, and easily skimmable. Our team of experts keeps a three to five-year horizon when covering any stock to ensure a long-term upside for members.

Each monthly report shows two undervalued growth stocks that cover hedge fund trading data, Wall St analyst ratings, social media sentiment, and fundamental and technical analysis. So if you’re an investor who appreciates objective, transparent, accurate, and well-rounded information, Ticker Nerd is for you.

Price

- Free newsletter packed with value.

- Premium stocks newsletter: $39.95 per month or $199 per year.

4. Simply Wall St

Simply Wall St is one of the best stock research websites on the internet. The comprehensive visual analysis platform covers almost every data point on any business you can think of. What I like most about Simply Wall St is how intuitive the visualizations are. It's very easy to get a birds-eye view of a company's performance, along with its relative performance to other similar stocks.

For investors who want to spend time researching the fundamentals of a company and can appreciate in-depth visual reports I highly recommend starting a free trial. With a 4.5 star rating on Trust Pilot and over 6,000,000 investors signed up you trust the platform will provide value.

Price

- Free plan: $0 with access to 5 company reports per month, 1 portfolio, and 1 watchlist.

- Premium: $14 per month for 30 company reports, 3 portfolios with 30 holdings, a stock screener, and 3 watchlists.

- Unlimited: $28 per month for unlimited company reports, 5 portfolios with unlimited holdings, a stock screener, and 5 watchlists.

- All plans are billed yearly.

🤓 Pro tip: Use the snowflake filter to visually create your own personal stock screener.

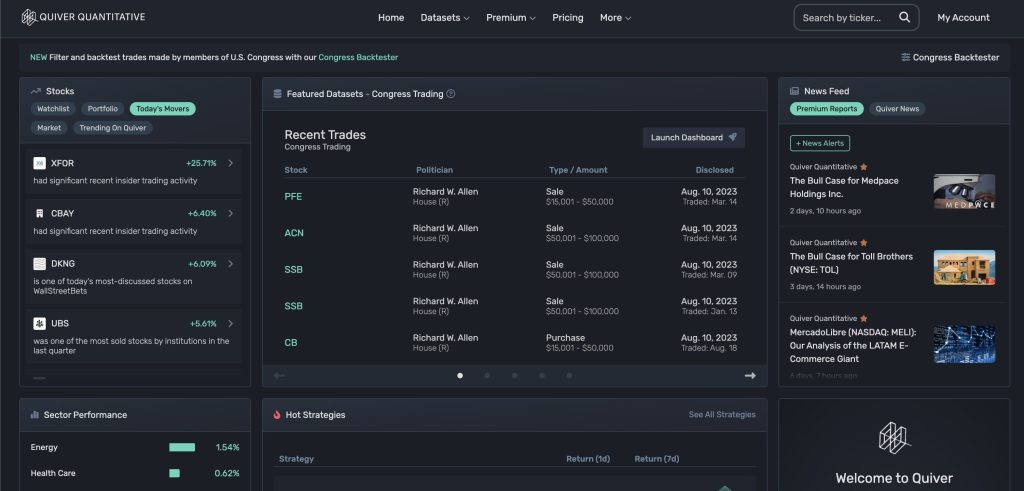

5. Quiver Quantitative

If you like alternative data points then you’ll like Quiver Quantitative. The platform aggregates and visualizes alternative financial data to provide unique insights into the stock market. It sources data from non-traditional datasets, such as political contributions, satellite imagery, and Reddit mentions, to offer a different perspective on market movements and trends. The platform aims to democratize access to alternative data, allowing both retail and institutional investors to make more informed investment decisions.

While I wouldn’t rely solely on this website for your research it’s a great place to come to find additional data points that Google Finance or Trading View simply won’t supply.

Price

- Free forever membership.

- Hobbyist: $20 per month.

- Trader: $30 per month.

- Enterprise: Contact for a quote.

- Annual plans are cheaper.

🤓 Pro tip: If you navigate to an individual stock page you can see whether any new patents have been submitted. This can often be a signal that the company is actively investing in new initiatives and protecting its IP.

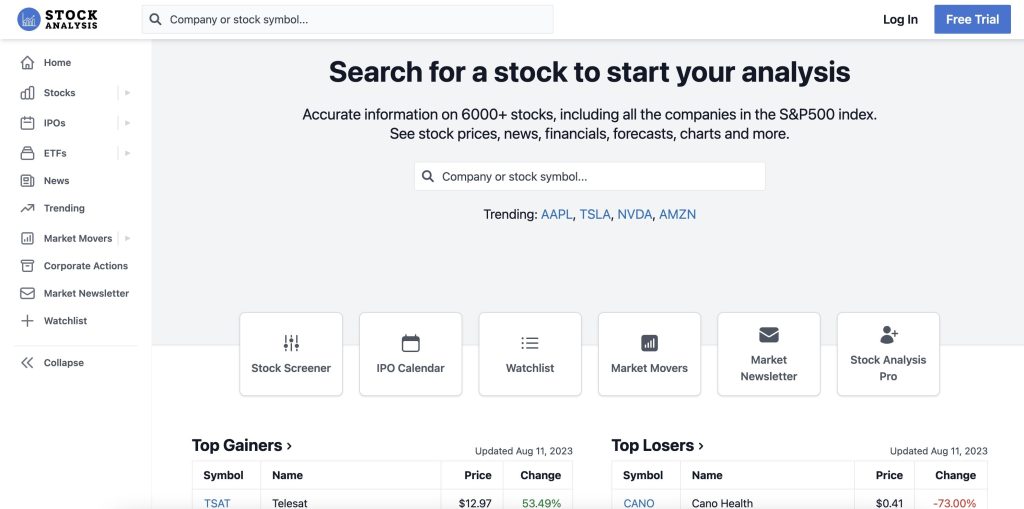

6. Stock Analysis

Stock Analysis is another fantastic site for researching the market. You can find detailed and accurate information on Stocks, IPOs, and ETFs. My favorite feature is the stock price prediction pages which leverage high-quality data sources to identify where a stock price is headed. Their revenue and EPS forecast data are provided by Finnhub which is a reputable data source.

Whilst Stock Analysis is packed with information I find their free daily newsletter to be particularly helpful. It gets me up to speed on what’s happening in the market along with any breaking news or IPOs to keep an eye on.

Price:

- Free plan with limited historical data and exports.

- Pro plan for $9.99 per month with access to all tools, data, and 30yrs of historical data.

🤓 Pro tip: Check out the IPO statistics page to find clear macroeconomic trends.

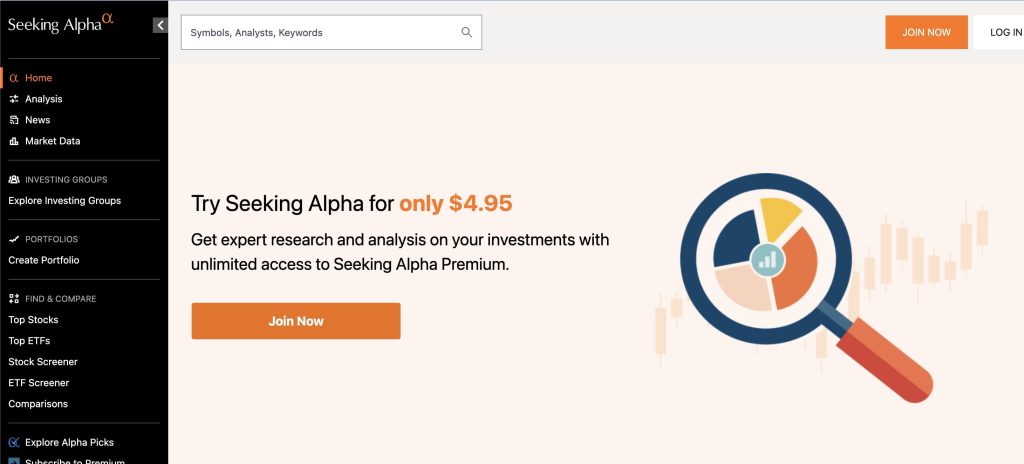

7. Seeking Alpha

Seeking Alpha is one of the most popular and reputable crowd-sourced content platforms for financial markets. Both professionals and amateur analysts share research, opinions, and insights on stocks, sectors, and economic trends. Whilst they offer a newsletter called “Alpha Picks” you can expect a robust investing platform with analyst ratings, quant ratings, news, stock screeners, and additional features to help you stay on top of your portfolio.

Similar to Trading View, you can create your own custom dashboards and alerts to help you stay on top of the market.

Pricing:

- Limited free membership.

- Seeking Alpha Premium: $239 per year with a $4.95 1-month trial.

- Seeking Alpha Alpha Picks: $99 for the first year then $199 per year.

- Seeking Alpha Pro: $2,400 per year.

🤓 Pro tip: If you want to take your investing to the next level consider subscribing to a Premium Investing Group. You’ll be able to access stock picks from Wall St Analysts, economists, and general enthusiasts with good track records.

Read our full Seeking Alpha Review here.

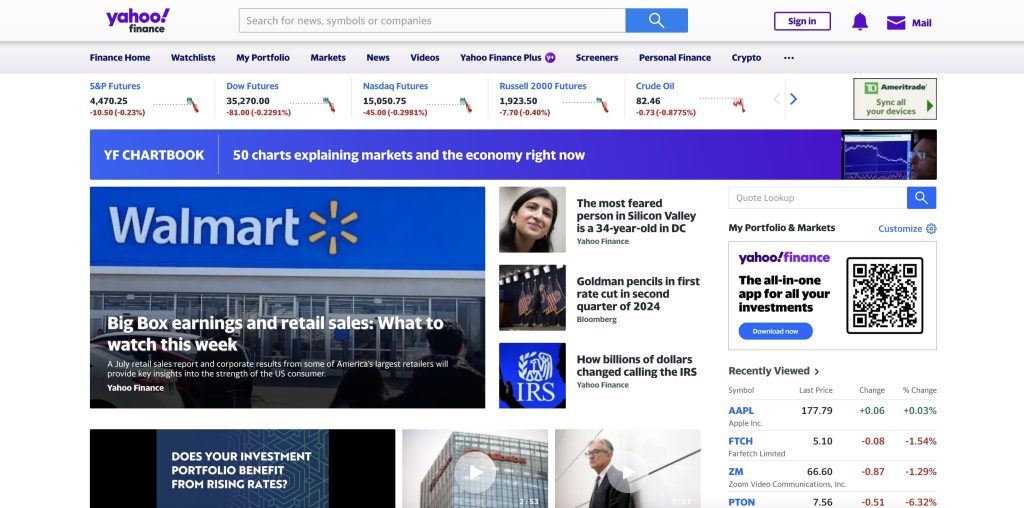

8. Yahoo Finance

Yahoo Finance is a staple in my investment research. I find it to be one of the most reliable and easy-to-navigate platforms. The website provides financial news, data, and commentary on stocks, bonds, commodities, cryptocurrency, and fiat currencies. It offers tools such as stock quotes, historical data, and portfolio management resources, making it a go-to source for both individual and professional investors.

There really isn’t any reason not to use Yahoo Finance in your research since it’s completely free and mostly accurate. Some of the news articles are opinion pieces so I wouldn’t take every single article as gospel.

Price

- Free

🤓 Pro tip: Navigate to a company profile (e.g. AAPL – Apple) and click on Profile to see which executives are running the company. From here you can take the name and plug it into Guru Focus to find out whether they’re trading the stock or not.

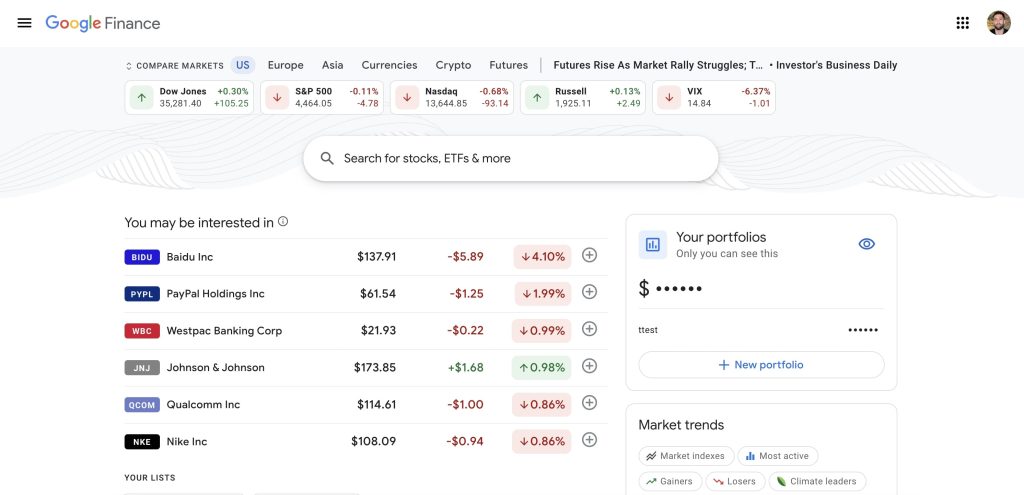

9. Google Finance

Google Finance is a website and tool offered by Google that provides real-time stock quotes, financial news, and market data. It allows users to track their portfolios, view interactive charts, and access company-specific details and key financial metrics. While it offers a streamlined interface for tracking and analyzing stocks, it's often used in conjunction with other more comprehensive financial platforms.

I like how clean Google Finance is however, they do not have an opinion piece so you will need to look elsewhere to find things like analyst ratings.

Price:

- Free

🤓 Pro tip: Create a portfolio within Google Finance and add all of your holdings and the purchase date. Google will visually show you the performance of your portfolio with additional metrics to keep you informed.

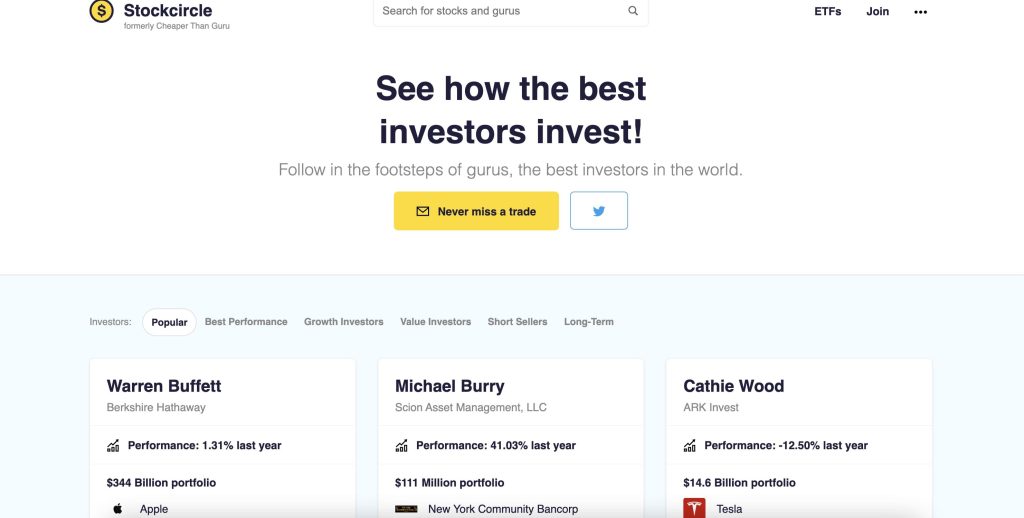

10. Stock Circle

Stock Circle, formerly known as Cheaper Than Guru, is a website that analyses and presents Hedge Fund and Institutional Investor holdings. You can see exactly which stocks investors like Waren Buffet, Michael Burry, Cathie Wood, and Ray Dalio are bullish on. Stock Circle sources most of its data from IEX Cloud which is another reputable provider of accurate and timely stock data.

On top of the institutional investor holdings, Stock Circle has other interesting data points and metrics. One of my favorite pages is the “Buffett Indicator”, which is a ratio that compares the total market value of all publicly traded stocks (Wilshire 5000) to the gross domestic product (GDP) of the US.

Price:

- Free

🤓 Pro tip: Use the stock screener to find interesting stocks and then click through to see which institutional investors have positions in the company.

11. MarketWatch

MarketWatch is a major financial news website that provides real-time market data, analysis, and news on stocks, bonds, commodities, and currencies. It offers tools and features such as a stock screener, watchlist, and market trend insights to help investors make informed decisions.

One thing I particularly like is their podcast “Best New Ideas in Money” which is a great educational resource. Most of the investing and stock websites on his list except Investopedia have a lot of market information but lack educational content.

Price:

- Free basic membership.

- MarketWatch Digital: $4 for 4 weeks then $19.99 per month.

- Barron’s & MarketWatch Duo: $5 for 4 weeks then $22.99 per month.

🤓 Pro tip: Create an account and start trading using the virtual trading account feature. This will help you become a better investor by simulating various trades.

12. The Motley Fool

Most stock investors have probably heard of the Motley Fool. They’ve been around for over 25 years and have covered every aspect of the stock market. As far as a stock research website goes they’ve got a lot of experience and are mostly trustworthy.

The only pitfall is that they have over 20 different membership plans which can become overwhelming and difficult to choose from. On top of this, their investment philosophy is quite specific. If you’re looking for a stock picking service then I would recommend Motley Fool, but as a stock research platform, I think there are better options such as Seeking Alpha or Stock Analysis.

Related article: Morningstar vs Motley Fool

Price:

- Free to access news stories.

- Motley Fool Stock Advisor: $199 per year.

- Over 25 other membership plans range from $149 per year to $4,999 per year.

🤓 Pro tip: Before signing up for the Motley Fool, I suggest reading their investment philosophy and adhering to the principles so you can get the most out of your membership.

13. Stock Market Guides

Stock Market Guides is a stock-picking service that leverages an algorithm and a back-tested model to make recommendations. Unlike some services, Stock Market Guides is purely a software play.

Most stock and option advisory services that offer trade recommendations don’t tell you exactly how the trade setup has performed historically. This is what distinguished Stock Market Guides from other services. The service is best suited for active traders who want to enter and exit positions daily.

Related article: Best investing newsletters.

Price:

- Pre-market stock picks: $49 per month.

- Market hours stock picks: $49 per month.

- Pre-market options picks: $49 per month.

- Market hours options picks: $49 per month.

- Note: you can combine packages.

🤓 Pro tip: Use Stock Market Guides to educate yourself on options trading by watching their videos and then analyzing the positions they recommend.

Other stock research websites that are worth exploring

The websites I mentioned above are a lot more popular, complete, and easy to use. However, there are some other gems I would personally check out if you’re not afraid to dig a bit deeper. These include:

- Finimize (see our review here)

- SEC Website for 13F trading data

- Whale Wisdom for hedge fund trading data

- Morningstar and Bloomberg (for advanced investors)

- Subreddits like r/stocks or r/WallStreetBets for opinions

- ChatGPT with the Boolio Plugin (see the stock prompts here)

Where to from here

Now that you’re equipped with the resources to get started, I suggest taking a look at each website to see which works best for you. Some of the stock research websites and tools will be more advanced than others while some will be free and others will cost thousands of dollars to access.

So it’s important to know what your end goal is and only sign up for a tool (or suite of tools) that aligns.

If this is too overwhelming and time-consuming then consider signing up for a premium service such as Ticker Nerd which does all of the hard work for you.

Frequently Asked Questions (FAQs)

Each website will have different data points and features so it will depend on your use case. TradingView is great for technical analysis, charts, and alters whereas Seeking Alpha is best for getting opinions from Wall Street Analysts and the broader community of investors. No one website is “the best” for stock research. Instead, it is likely going to be a combination of sites and tools that best fit your use case and needs.

I believe Yahoo Finance is the best free stock research website since you can conduct all of your research from the spot. Everything from investing news to financial information on a particular company. It can all be done within Yahoo Finance. Even though there aren’t Wall St Analyst ratings there it still offers real-time stock quotes, financial news, portfolio management resources, and international market data.

Whilst it is almost impossible to accurately predict the stock market you can find stock price prediction on sites like Stock Analysis. If you’re looking for specific stock picks then Ticker Nerd, Motley Fool, and Seeking Alpha Picks are also great options. Note that these sites charge a monthly or yearly fee to access.

When it comes to stock advice be sure to find a service that is reputable, accurate, unbiased, complete, and timely. This is why I highly recommend using Ticker Nerd. I understand this is our very own Investing Newsletter, however, we’ve spent a lot of time and resources creating the most valuable reports on the market. Each report contains two growth stocks and combines data sources from almost every single resource on this list. Not to mention, we’re the only resource on this list that accurately cover the risks of each business.